South Africa Healthcare (Pharma and Medical Devices) Market Analysis, Regulatory, Reimbursement and Competitive Landscape

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

South Africa Healthcare Market Overview

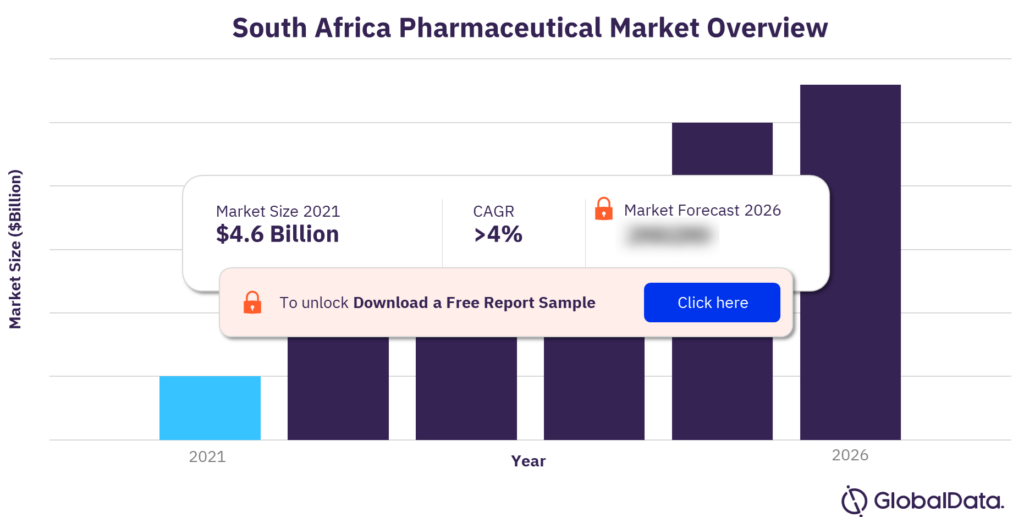

The South Africa pharmaceutical market size was valued at $4.6 billion in 2021. The market is projected to grow at a CAGR of more than 4% during the forecast period (2022-2026). The key factors driving the pharmaceutical market growth in South Africa are the growing and aging population, larger prevalence of chronic diseases, expanding private health insurance coverage, and increased patient volumes for general practitioners and specialist medical practitioners. The pharmaceutical market of the country is extensively reliant on imported products, accounting for more than two-third of pharmaceutical sales.

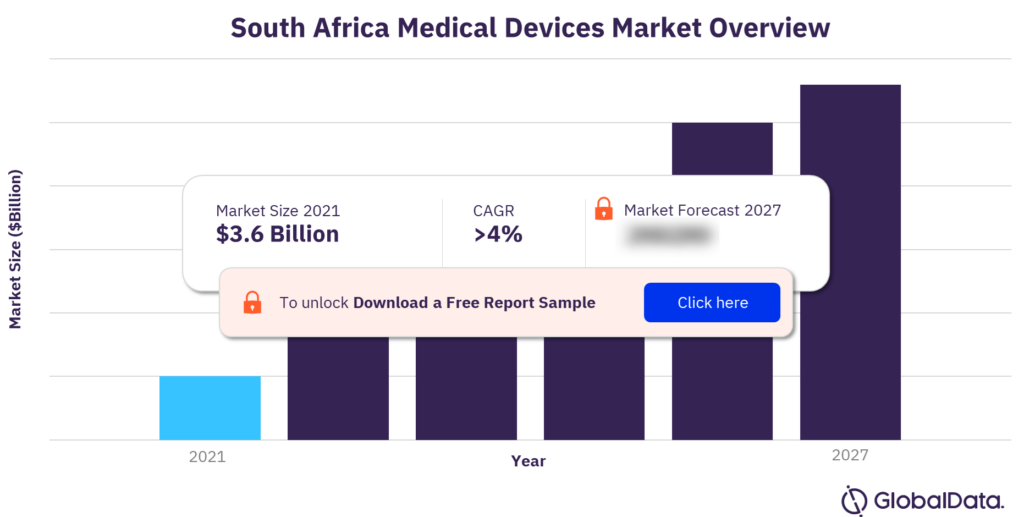

The South Africa medical devices market size was valued at $3.6 billion in 2021. The market is expected to grow at a CAGR of more than 4% during the forecast period (2022-2027). In South Africa, increased government spending to upgrade public health facilities and systems as part of their NHI implementation program may catalyze some growth in this sector, though recent significant budgetary shortfalls and pandemic fallout might have a negative impact on government spending.

South Africa Healthcare (Pharma) Market Outlook

For more insights, download a free sample report

South Africa Healthcare (Medical Devices) Market Outlook

For more insights, download a free sample report

What are the market dynamics in the South Africa pharmaceutical market?

In December 2021, South Africa’s Biovac Institute, a bio-pharmaceutical company based in Cape Town, announced plans to manufacture Pfizer-BioNTech’s COVID-19 vaccine for distribution within the African region. As per the agreement between the two, Biovac will perform manufacturing and distribution activities within Pfizer’s and BioNTech’s global COVID-19 vaccine supply chain and manufacturing network. Manufacturing is expected to commence from 2022.

In November 2021, Novelty Technology Care (NTC), an R&D-driven pharmaceutical company headquartered in Italy, and Aspen, headquartered in South Africa, announced SAHPRA’s approval for the first fixed combination of an ophthalmic quinolone antibiotic (levofloxacin) with an anti-inflammatory steroid (dexamethasone) eye drop solution.

What are the key segments in the South Africa pharmaceutical market?

The key segments in the South Africa pharmaceutical market are generics, biologics, biosimilars, and over-the-counter (OTC).

In November 2021, Pfizer signed a licensing agreement allowing generic drug manufacturers to produce inexpensive versions of its COVID-19 pill. South Africa is on the list of 95 countries standing to benefit from the agreement.

Who are the key players in the South Africa pharmaceutical market?

The key players in the South Africa pharmaceutical market are Pfizer, F. Hoffmann-La Roche Ltd. (Roche), Novartis, Sanofi, and Aspen Pharmacare Holdings Ltd (Aspen).

Pfizer

Pfizer is a research-based global biopharmaceutical company that discovers, develops, manufactures, and commercializes drugs for various conditions, consumer healthcare products, generics, and active pharmaceutical ingredients (APIs). Pfizer is headquartered in the US. In South Africa, it operates from Johannesburg.

Hoffmann-La Roche Ltd

Hoffmann-La Roche Ltd. (Roche) is a biotechnology company that develops drugs and diagnostics to treat major diseases including autoimmune diseases, central nervous system disorders, ophthalmological disorders, infectious diseases, and respiratory diseases. The company also offers in vitro diagnostics, tissue-based cancer diagnostics, and diabetes management solutions. Roche is headquartered in Basel, Switzerland; in South Africa, it operates from Midrand.

Novartis

Novartis is a healthcare company that focuses on the discovery, development, manufacture, and marketing of prescription and generic pharmaceutical products, as well as eye care products. It provides drugs for the treatment of cancer and other diseases. Novartis is headquartered in Basel, Switzerland. In South Africa, it operates from Gauteng.

Which are the key segments in the South Africa medical devices market?

The key segments in the South Africa medical devices market are hospital supplies, general energy, orthopedic devices, cardiovascular devices, dental devices, and others. Hospital supplies has the highest revenue in the medical devices market in South Africa in the year 2021.

Who are the key players in the South Africa medical devices market?

The key players in the South Africa medical devices market are Abbott, Medtronic, Kimberly-Clark, GE Healthcare, Getinge AB (Getinge).

Kimberly-Clark

Kimberly-Clark is a global hygiene company, involved in the manufacturing and marketing of personal care and household products. The company operates in North America, Europe, Middle East and Africa, Asia, and Latin America. Kimberly-Clark is headquartered in Irving, Texas, US. The company operates in Johannesburg, South Africa.

Getinge AB (Getinge)

Getinge AB (Getinge) is a medical technology company that designs, develops, and markets equipment and instruments in the areas of surgery, infection control, intensive care, care ergonomics, and wound care. Its major products include heart-lung machines and hospital beds, among others. Getinge is headquartered in Gothenburg, Sweden, and in South Africa, it operates from Sandton.

Medtronic

Medtronic is a medical technology company. It provides a wide range of medical devices for the treatment of heart disease, spinal conditions, neurological disorders, vascular disease, orthopedic disorders, and diabetes. Medtronic is headquartered in Dublin, Ireland. Medtronic’s footprint is in the Central and Eastern Europe, Middle East and Africa (CEMA) region. In South Africa, Medtronic is in Midrand, Gauteng.

Market report overview of pharmaceutical market in South Africa

| Market size 2021 | $4.6 billion |

| CAGR | >4% (2022-2026) |

| Forecast period | 2022-2026 |

| Key segments | Generics, Biologics, Biosimilars, and Over-The-Counter (OTC) |

| Major players | Pfizer, F. Hoffmann-La Roche Ltd. (Roche), Novartis, Sanofi, and Aspen Pharmacare Holdings Ltd (Aspen) |

Market report overview of medical devices market in South Africa

| Market size 2021 | $3.6 billion |

| CAGR | >4% (2022-2027) |

| Forecast period | 2022-2027 |

| Key segments | Hospital Supplies, General Energy, Orthopedic Devices, Cardiovascular Devices, Dental Devices, and Others |

| Major players | Abbott, Medtronic, Kimberly-Clark, GE Healthcare, and Getinge AB (Getinge) |

Scope

The report provides information on the healthcare, regulatory, and reimbursement landscape in South Africa, and includes:

- An overview of the pharmaceutical and medical device markets, comprising market size, segmentation, and key drivers and barriers.

- Profiles and SWOT analyses of the major players in the pharmaceutical market: Pfizer, Roche, Novartis, Sanofi, and Aspen

- Profiles and SWOT analyses of the major players in the medical device market: Abbott, Medtronic, Kimberly Clark, GE healthcare, and Getinge.

- An insightful review of the COVID-19 epidemiology, COVID-19 impact and developments in healthcare market, Healthtech landscape, reimbursement and regulatory landscape, with analysis covering details of the country’s healthcare reimbursement process, regulatory agencies and the approval processes for new drugs and medical devices.

- Detailed analysis of the country’s healthcare policy highlights, demographics, healthcare infrastructure, and healthcare expenditure.

- An overview of the opportunities for and challenges to growth in the South Africa’s healthcare market.

Reasons to Buy

- This report will enhance your decision-making capability by allowing you to:

- Develop business strategies by understanding the trends shaping and driving the South Africa healthcare market

- Drive revenues by understanding the key trends, reimbursement and regulatory policies, pharmaceutical market segments, and companies likely to impact the South Africa healthcare market in the future

- Formulate effective sales and marketing strategies by understanding the competitive landscape and analyzing competitors’ performance

- Organize your sales and marketing efforts by identifying the market categories and segments that present the most opportunities for consolidation, investment and strategic partnership

Table of Contents

Table

Figures

Frequently asked questions

-

What was the South Africa pharmaceutical market size in the year 2021?

The pharmaceutical market size in South Africa was $4.6 billion in the year 2021.

-

What is the South Africa pharmaceutical market growth rate?

The pharmaceutical market in South Africa is expected to increase at a CAGR of more than 4% during the forecast period.

-

What are the key segments in the South Africa pharmaceutical market?

The key segments in the South Africa pharmaceutical market are generics, biologics, biosimilars, and over-the-counter (OTC).

-

Who are the key players in the South Africa pharmaceutical market?

The key players in the South Africa pharmaceutical market are Pfizer, F. Hoffmann-La Roche Ltd. (Roche), Novartis, Sanofi, and Aspen Pharmacare Holdings Ltd (Aspen).

-

What was the South Africa medical devices market size in the year 2021?

The medical devices market size in South Africa was $3.6 billion in the year 2021.

-

What is the South Africa medical devices market growth rate?

The medical devices market in South Africa is expected to increase at a CAGR of more than 4% during the forecast period.

-

Which are the key segments in the South Africa medical devices market?

The key segments in the South Africa medical devices market are hospital supplies, general energy, orthopedic devices, cardiovascular devices, dental devices, and others.

-

Which are the major players in the South Africa medical devices market?

The major players in the South African medical devices market are Abbott, Medtronic, Kimberly-Clark, GE Healthcare, Getinge AB (Getinge)

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Pharmaceuticals reports