Wind Power Market Trends and Analysis by Region, Technology, Installed Capacity, Key Players and Forecast to 2030

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Wind Power Market Report Overview

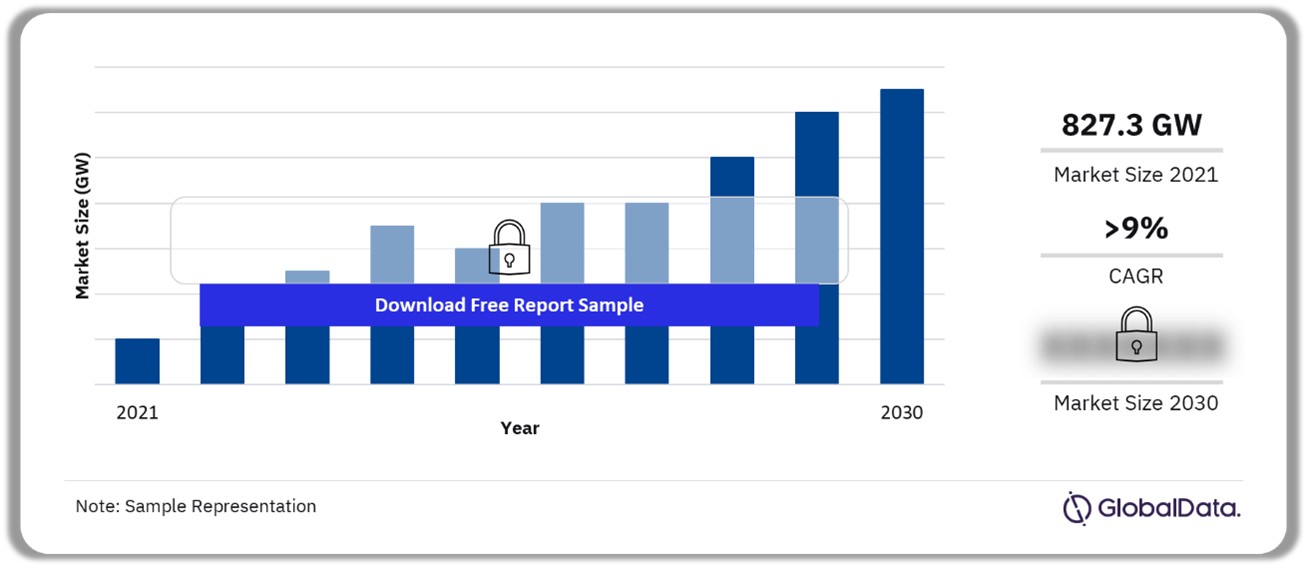

The installed wind power capacity was 827.3 GW in 2021 and is expected to achieve a CAGR of more than 9% during 2021–2030. The wind power market research report provides a clear overview and detailed insight into the global market.

Wind Power Market Outlook, 2021-2030 (GW)

Buy the Full Report to Gain More Information about the Wind Power Market Forecast, Download A Free Report Sample

The report provides data and analysis on the historical and forecast of wind power capacity and generation, the impact of the COVID-19 pandemic, geo-political scenario, major active and upcoming plants, market size, and market drivers and challenges for eleven key wind power market countries.

| Market Size (2021) | 827.3 GW |

| CAGR (2021-2030) | >9% |

| Forecast Period | 2022-2030 |

| Historical Period | 2011-2021 |

| Key Regions | · North America

· Middle East and Africa (MEA) · Europe · South and Central America · Asia-Pacific |

| Key Types | · Onshore

· Offshore |

| Leading Suppliers (Onshore) | · Vestas

· Xinjiang Goldwind · GE · Envision · Siemens Gamesa |

| Leading Suppliers (Offshore) | · Siemens Gamesa

· Shanghai Electric · Vestas Offshore · China Ming Yang · Envision · Xinjiang Goldwind |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

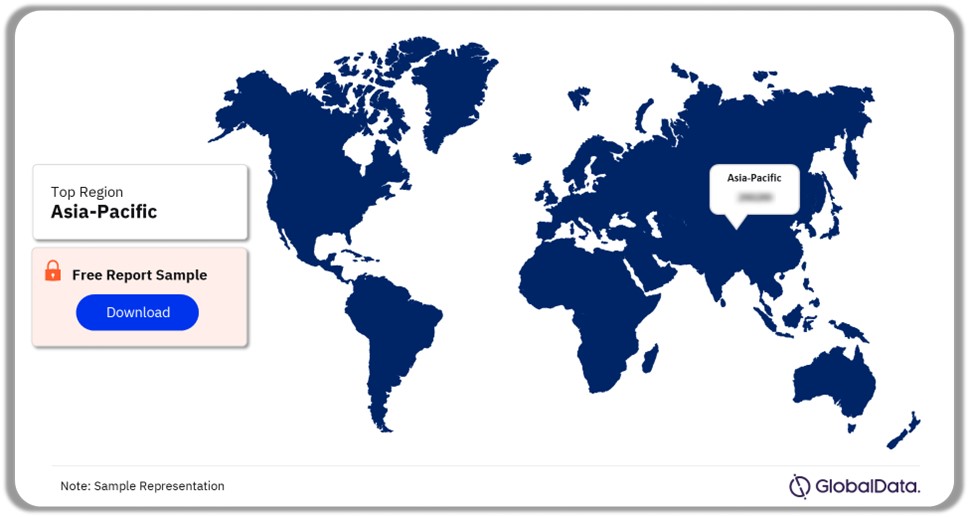

Wind Power Market Segmentation by Regions

The key regions in the wind power market are North America, the Middle East and Africa (MEA), Europe, South and Central America, and Asia-Pacific. Asia-Pacific is the largest market in terms of cumulative installed wind power capacity in 2021.

China accounted for more than one-third of the world’s wind power capacity. In 2021, it added the largest wind power capacity ever in the country and globally. The US and Germany reported large capacity since the early 2000s and both have excelled in terms of wind power technology and efficiency. Italy is a new wind power market that is set to add significant capacity during 2022–2030.

Wind Power Market Analysis by Regions, 2021 (%)

Buy the Full Report for More Regional Insights into the Wind Power Market, Download A Free Report Sample

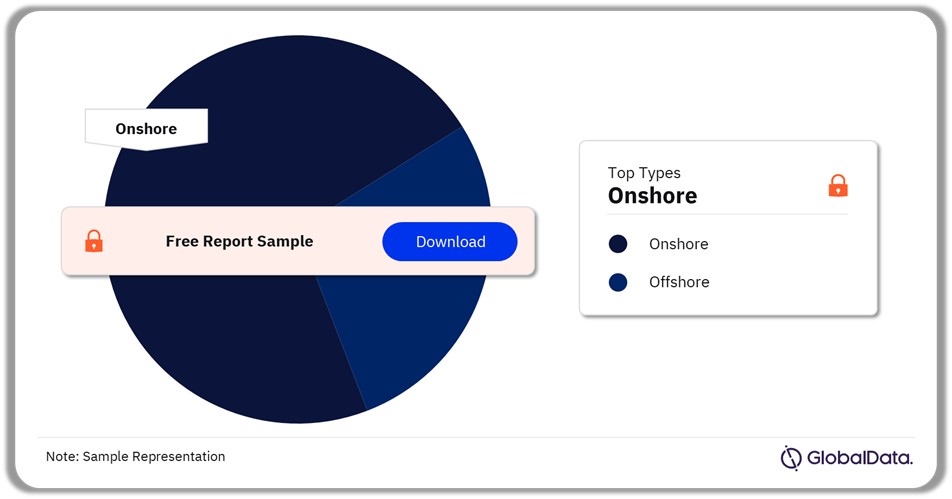

Wind Power Market Segmentation by Types

The key types in the wind power market are onshore and offshore. The wind power market is led by the onshore wind power segment as the offshore wind power segment is still in a nascent stage. However, dedicated R&D efforts will likely bring down the cost of installing offshore wind farms. This will result in an increase in the share of offshore wind power. Despite the growth expected in the offshore wind power market, it is not expected to surpass the onshore market.

Wind Power Market Analysis by Types, 2021 (%)

Buy the Full Report for More Type Insights into the Wind Power Market, Download A Free Report Sample

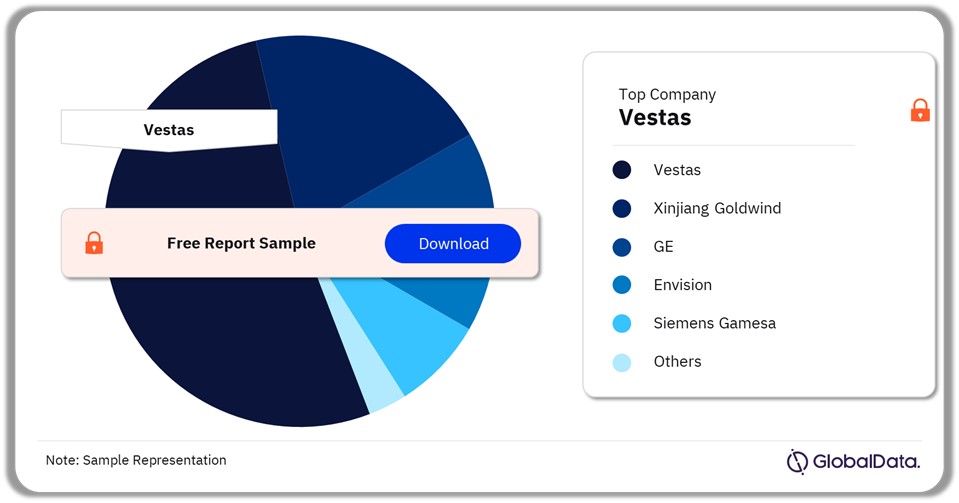

Wind Power Market – Competitive Landscape

Some of the suppliers in the onshore turbines market are Vestas, Xinjiang Goldwind, GE, Envision, Siemens Gamesa, Nordex, China Ming Yang, Dongfang, Zhejiang Windey, and Shanghai Electric Wind Power Equipment Co., Ltd.

Some of the suppliers in the offshore turbines market are Siemens Gamesa, Shanghai Electric, Vestas Offshore, China Ming Yang, Envision, and Xinjiang Goldwind.

Onshore Turbines Market Analysis by Suppliers, 2021 (%)

Buy the Full Report for More Supplier Insights into the Wind Power Market, Download A Free Report Sample

Scope

The report provides:

- Wind power market study at the global level, and at a key country level covering nine key countries in depth.

- Key growth drivers and challenges at a country level.

- The impact of the COVID-19 pandemic on the wind power market at a country level.

- Historic and forecast data for cumulative installed wind power capacity and generation globally, and for each of the key countries.

- Market size globally and in each of the key countries.

- Import and export values in each of the key countries.

Reasons to Buy

The report will allow you to:

- Facilitate decision-making by providing historical and forecast data in the wind power market

- Develop business strategies by understanding the drivers and challenges of the market

- Position yourself to gain the maximum advantage of the industry’s growth potential

- Maximize potential in the growth of the wind power market

- Identify key partners, geographies, and business-development avenues

- Respond to business structure, strategy, and prospects

GE

Siemens Gamesa

Envision

MHI Vestas

Shanghai Electric

Xinjiang Goldwind

WEG

Enercon

Nordex

Senvion

Suzlon

Inox Wind

NextEra

Iberdrola

EDF

Avangrid

Invenergy

Enel Green Power

EDP

RWE AG

Duke

Clearway

Apex Clean Energy

Table of Contents

Table

Figures

Frequently asked questions

-

What was the wind power market installed capacity in 2021?

The installed wind power capacity was 827.3 GW in 2021.

-

What is the wind power market growth rate?

The wind power market is expected to achieve a CAGR of more than 9% during 2021-2030.

-

What are the key regions in the wind power market?

The key regions in the wind power market are North America, the Middle East and Africa (MEA), Europe, South and Central America, and Asia-Pacific.

-

What are the key types in the wind power market?

The key types in the wind power market are onshore and offshore.

-

Which are the leading suppliers in the onshore turbines market?

Some of the suppliers in the onshore turbines market are Vestas, Xinjiang Goldwind, GE, Envision, Siemens Gamesa, Nordex, China Ming Yang, Dongfang, Zhejiang Windey, and Shanghai Electric Wind Power Equipment Co., Ltd.

-

Which are the leading suppliers in the offshore turbines market?

Some of the suppliers in the offshore turbines market are Siemens Gamesa, Shanghai Electric, Vestas Offshore, China Ming Yang, Envision, and Xinjiang Goldwind.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.