Wealth Management Competitive Dynamics – Review of Wealth Managers by AUM, Financial Performance and Competitive Trends

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Wealth Management Competitive Dynamics Report Overview

After 2021 saw double-digit growth in client assets and record profits, the private wealth management industry looks set for its toughest year since the global financial crisis. A combination of expansionary monetary policy and pandemic support created fertile market conditions for private wealth managers in 2021, but 2022 is set to be the polar opposite – saddling competitors with significant challenges and headwinds.

The wealth management competitive dynamics research report benchmarks the AUM and financial performance of the largest private wealth managers in the industry. The report will help you understand the challenges facing wealth managers and how the top banks are addressing them.

Wealth Management Competitive Dynamics - Wealth Managers by AUM

After a year of the COVID-19 pandemic, the world’s leading wealth managers had more than recovered from the stock market panic that wiped out trillions of dollars of wealth by the end of 2021. Client assets were up almost across the board, with many wealth managers smashing records for net inflows and total AUM by year-end 2021. All indicators were positive, but these rosy conditions proved to be short-lived. 2021 was likely a high point for the wealth management industry, which is looking at generally negative conditions for 2022-2023.

The total client AUM accounted for by our top wealth managers came in at $18.8 trillion in 2021. Continued industry consolidation is likely to force this figure even higher (after the effects of the COVID-19 crisis fall out of the stats).

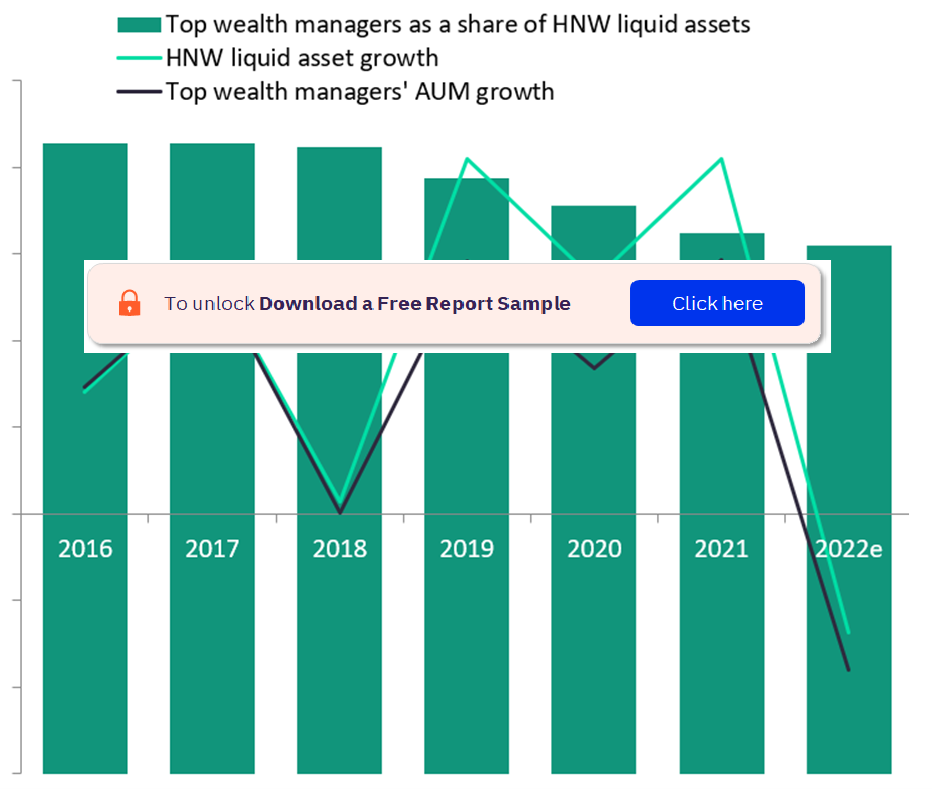

Wealth Management Analysis by Growth in AUM and Share of HNW assets

For more insights on wealth managers by AUM in the wealth management market, download a free report sample

Wealth Management Competitive Dynamics - Financial Performance

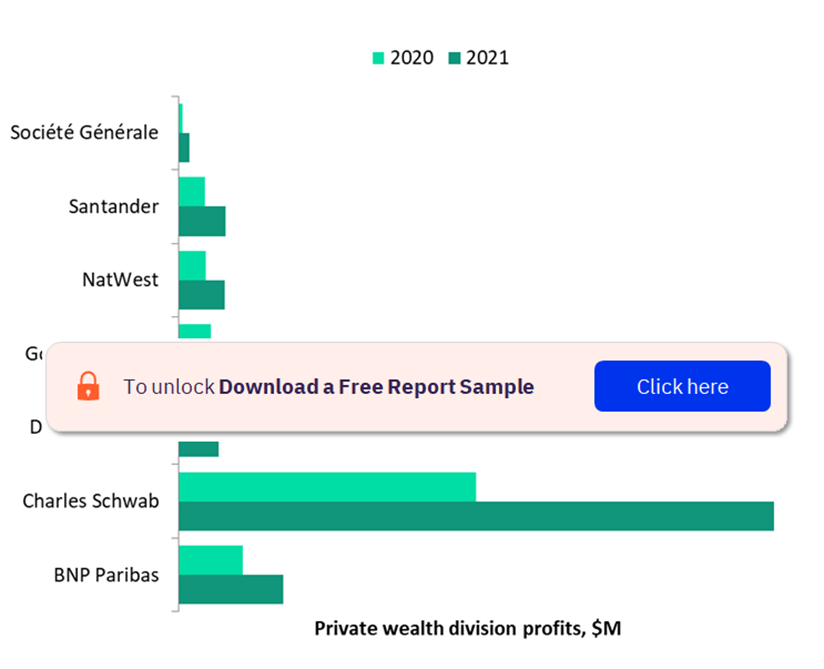

More than 90% of wealth managers increased profitability in 2021 as economic conditions were particularly favorable in that year. The vaccine rollouts ramped up across parts of the world and sharply higher client AUM generated a bumper crop of fees. This was the primary driver in higher profitability; the natural cycle of financial markets always has the ability to boost wealth managers’ profit as it swings from a year of the crash to a year of recovery. Higher net inflows – typical in an improving economy – also contributed to the strong year.

Growth in profit was widespread across regions and types of private wealth managers. Some of the key players in the industry are Charles Schwab, Societe Generale, Santander, and Natwest, Goldman Sachs, among others.

Wealth Management Analysis by Profitability

For more insights on financial performance in the wealth management market, download a free report sample

For more insights on financial performance in the wealth management market, download a free report sample

Wealth Management Competitive Dynamics - Competitive Trends

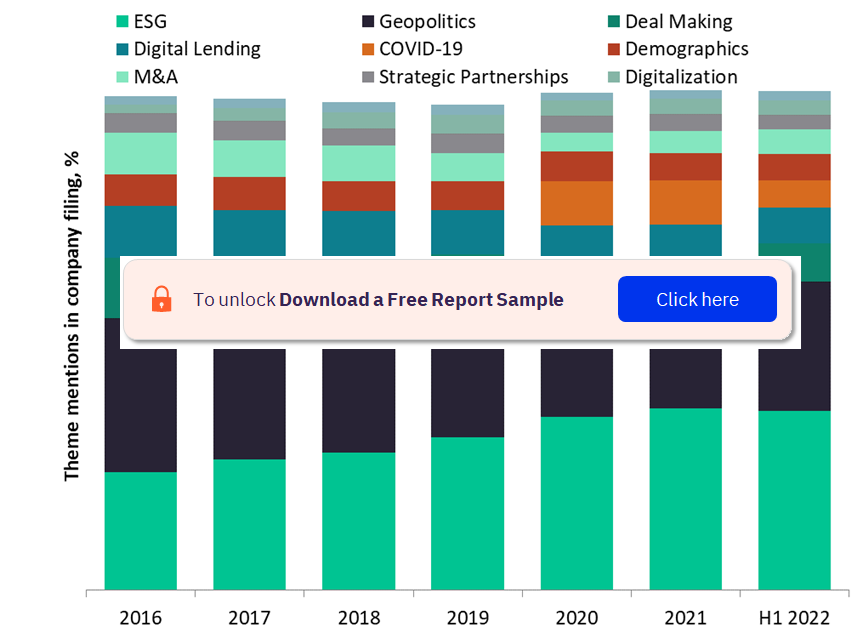

COVID-19 remains a strategic concern, but ESG is the long-term priority for the market. For most banks, this would be simply a matter of ensuring lending is not going to problematic companies and that the bank’s carbon footprint, governance, and policies are in line with common corporate standards.

Sustained high inflation is also sparking a repricing of investment assets and a shift in the strategy of the key players. Several factors, not least the Russia/Ukraine conflict, are pushing inflation measures up across the world. Wealth managers need to ensure their communications and strategies account for an era of prolonged elevated inflation.

Wealth Management Analysis by Top Theme in Focus

For more insights on competitive trends in the wealth management market, download a free report sample

Wealth Management Competitive Dynamics Overview

| Outlook Year | 2022 |

| Total Client AUM (in 2021) | $18.8 Trillion |

| Leading Companies | Charles Schwab, Societe Generale, Santander, Natwest, Goldman Sachs, and Others |

Key Highlights

- Inflows to the largest wealth managers outpaced growth in overall HNW wealth in 2021.

- Digitalization of private wealth management is continuing to reduce headcount at leading banks, even as assets under management and clients reach all-time highs.

- COVID-19 has already faded from the strategies of the top wealth managers, with geopolitics and environmental, social, and governance rising as concerns.

For more wealth management competitive dynamics insights, download a free report sample

Reasons to Buy

- Benchmark the AUM and financial performance of the largest private wealth managers in the industry.

- Understand the challenges facing wealth managers and how the top banks are addressing them.

- Learn about the strategies driving growth at leading wealth management groups.

- Analyze wealth profitability trends and discover the strategies that leading banks are using to improve performance.

- Identify the industry’s best practices in managing operating costs and boosting revenues.

- Gain insight into the major issues preoccupying wealth managers.

Bank of America Merrill Lynch

Barclays

BNP Paribas

BNY Mellon

Bank of China

Bank of Montreal

Charles Schwab

China Merchants Bank

Citigroup

Citi Private Bank

Crédit Agricole

Credit Suisse

Deutsche Bank

DBS

EFG International

Goldman Sachs

HSBC

HSBC Private Bank

J.P. Morgan

Julius Baer

Morgan Stanley

Northern Trust

Pictet

Royal Bank of Canada

Royal Bank of Scotland/NatWest

Santander

Société Générale

Standard Chartered

UBS

U.S. Trust

Vontobel

Wells Fargo

OCBC

Bank of Singapore

DBS

UBP

Raymond James

St. James’s Place

Investec

Bank Cantonale Vaudoise

Rothschild & Co

Nordea

Table of Contents

Table

Figures

Frequently asked questions

-

What was the total client AUM by top wealth managers in 2021?

The total client AUM accounted for by our top wealth managers came in at $18.8 trillion in 2021.

-

What percentage of wealth managers have increased their profits in the wealth management industry?

More than 90% of wealth managers increased profitability in 2021 as economic conditions were particularly favorable in that year.

-

Which are the key competitive trends in the wealth management industry?

Strategic planning for COVID-19, inflation, and ESG are the key trends in the wealth management market.

-

Which are the key players in the wealth management industry?

Some of the key players in the wealth management industry are Charles Schwab, Societe Generale, Santander, Natwest, Goldman Sachs, and others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Wealth Management reports