United Kingdom (UK) Health and Beauty Market Size, Trends, Consumer Attitudes and Key Players to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

United Kingdom Health and Beauty Market Report Overview

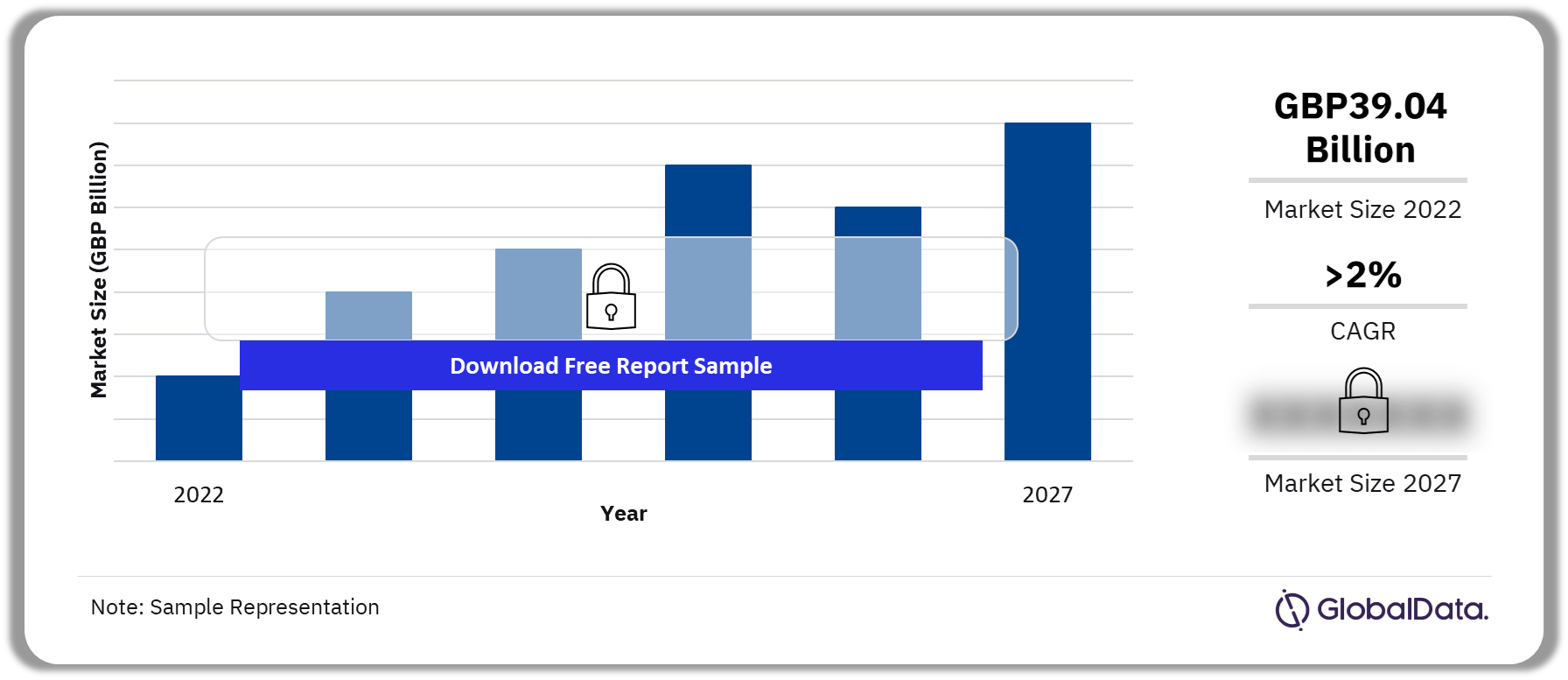

The United Kingdom health and beauty market size was GBP39.04 billion in 2022. The market is expected to record a CAGR of more than 2% during 2022-2027. As consumer confidence and spending recover in the forecast period, an upturn is anticipated in the non-essential categories, as consumers can invest once again in makeup and skincare that they forewent when under financial pressure.

United Kingdom Health and Beauty Market Outlook, 2022-2027 (GBP Billion)

Buy Full Report for More Insights on the United Kingdom Health and Beauty Market Forecast

The United Kingdom Health & Beauty report offers a comprehensive insight into the health and beauty market in the United Kingdom (UK), analyzing the sector, the major players, the main trends, and consumer attitudes, as well as providing market forecasts till 2027.

| Market Size (2022) | GBP39.04 billion |

| CAGR (2022-2027) | >2% |

| Historical Period | 2017-2022 |

| Forecast Period | 2023-2027 |

| Key Categories | · Health

· Beauty |

| Key Distribution Channels | · Drug Stores and Health & Beauty Stores

· Hypermarkets & Supermarkets, and Hard Discounters · Other Online Retail · Online Specialists · Convenience Stores and Gas Stations · Value, Discount, and Variety Stores and General Merchandise Retail · Others |

| Leading Companies | · Boots

· Tesco · ASDA · Aldi · Superdrug |

| Enquiry & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

United Kingdom Health and Beauty Market Drivers

Inflation gives retailers an opportunity to expand their brand ranges and get an edge in the UK health and beauty market. As the cost-of-living crisis continues, consumers are trading down to cheaper alternatives. The essential nature of over-the-counter (OTC) medicine and feminine hygiene products provides retailers with opportunities to expand their brand ranges to limit the need for shoppers to visit competitors for substitutes. Additionally, retailers should expand their brand ranges to include a wider variety of highest-growth categories such as cosmetics and skincare.

United Kingdom Health and Beauty Market Segmentation by Categories

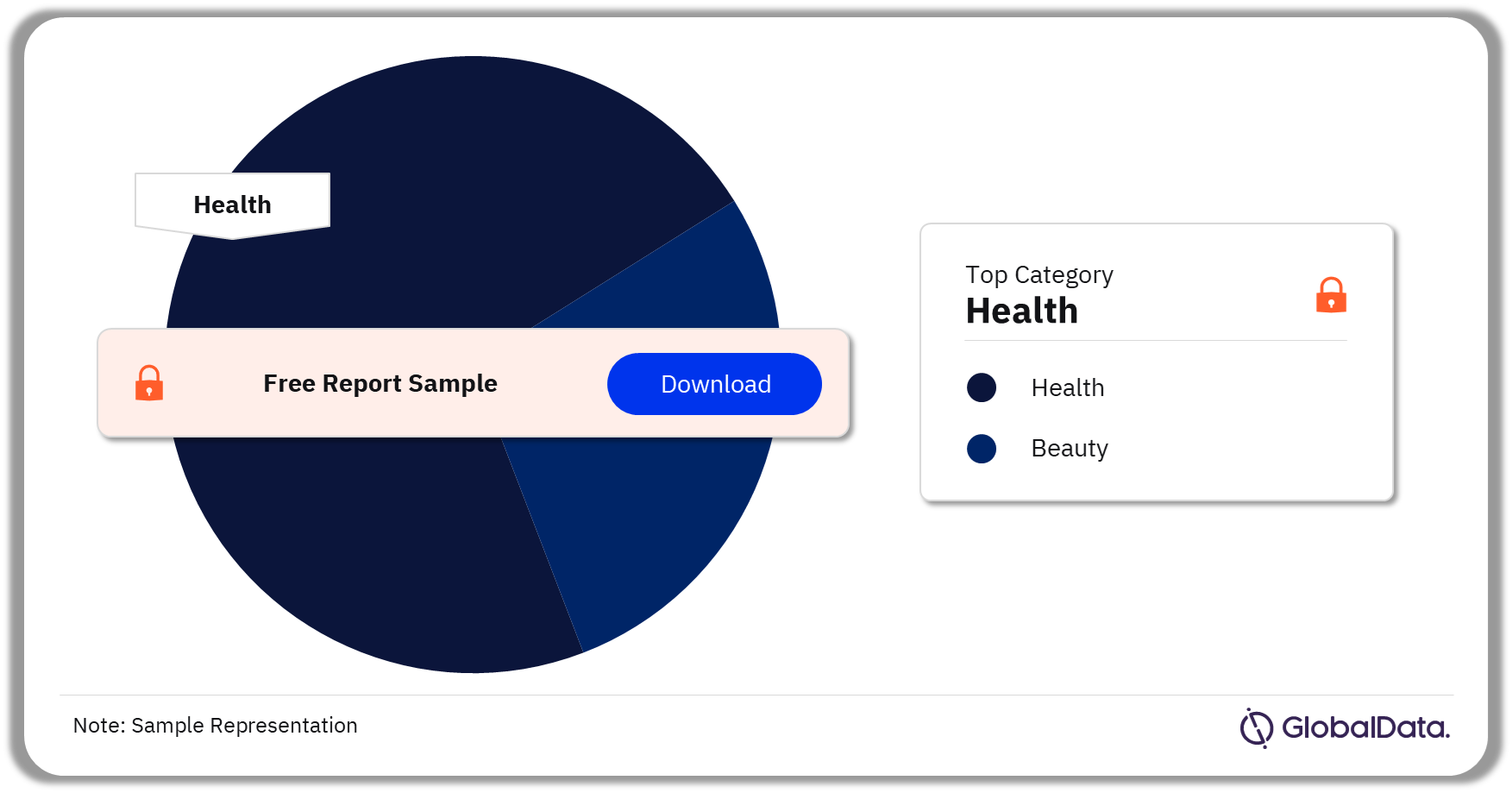

The key categories in the United Kingdom’s health and beauty market are health and beauty. In 2022, the health category dominated the United Kingdom’s health and beauty market.

Prescriptions & optical was the leading sub-category in the health market, while the beauty category was led by the skincare sub-category in the UK market in 2022.

United Kingdom Health and Beauty Market Analysis by Categories, 2022 (%)

Buy Full Report for More Sector Insights on the United Kingdom Health and Beauty Market

United Kingdom Health and Beauty Market Segmentation by Distribution Channels

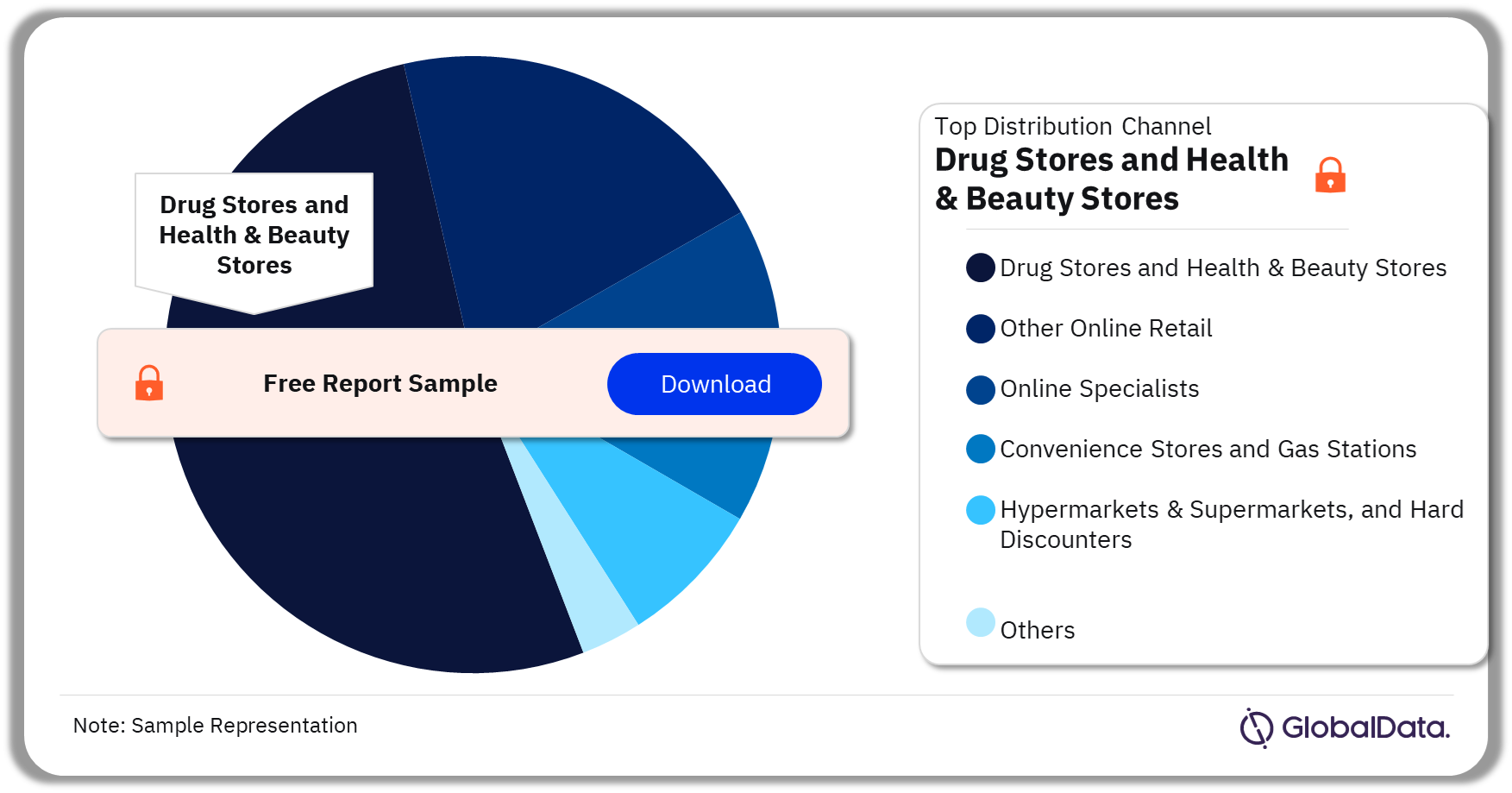

The key distribution channels in the United Kingdom health and beauty market are drug stores and health & beauty stores, hypermarkets & supermarkets, and hard discounters, other online retail, online specialists, convenience stores and gas stations, value, discount, and variety stores, and general merchandise retail, and others. In 2022, drug stores and health & beauty stores was the leading distribution channel.

United Kingdom Health and Beauty Market Analysis by Distribution Channels, 2022 (%)

Buy Full Report for More Distribution Channel Insights on the United Kingdom Health and Beauty Market

United Kingdom Health and Beauty Market – Competitive Landscape

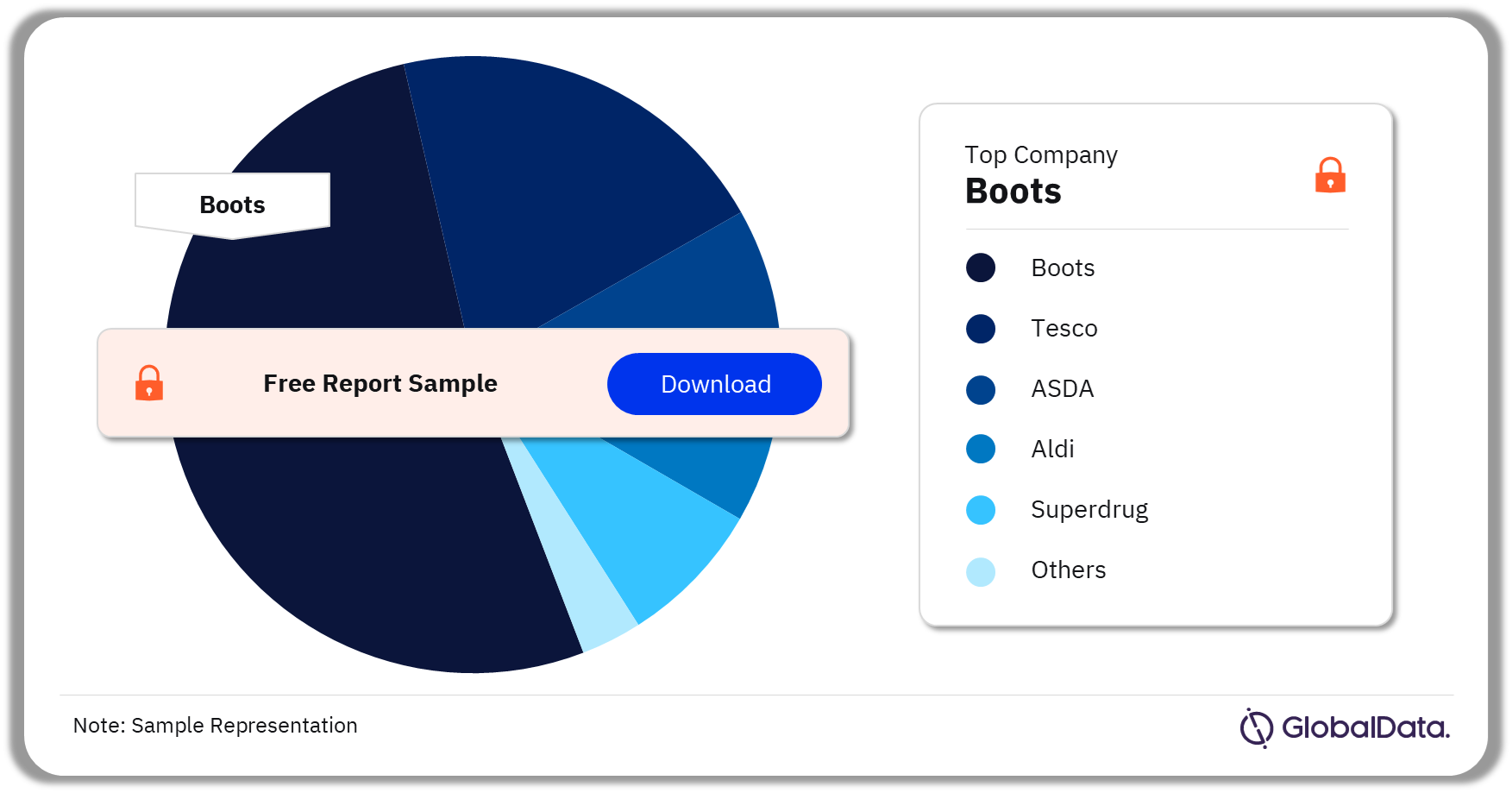

Some of the leading companies in the United Kingdom health and beauty market are Boots, Tesco, ASDA, Aldi, and Superdrug among others. In 2022, Boots dominated the United Kingdom health and beauty market in terms of value share. Boots achieved stronger growth than the market.

United Kingdom Health and Beauty Market Analysis by Companies, 2022 (%)

Buy Full Report for More Company Insights into the United Kingdom Health and Beauty Market

Segments Covered in the Report

United Kingdom Health and Beauty Categories Outlook (Value, GBP Billion, 2017-2027)

- Health

- Beauty

United Kingdom Health and Beauty Distribution Channels Outlook (Value, GBP Billion, 2017-2027)

- Drug Stores and Health & Beauty Stores

- Hypermarkets & Supermarkets, and Hard Discounters

- Other Online Retail

- Online Specialists

- Convenience Stores and Gas Stations

- Value, Discount and Variety Stores and General Merchandise Retail

- Others

Scope

The UK Health & Beauty report offers a comprehensive insight into the health and beauty market in the UK, analyzing the sector, the major players, the main trends, and consumer attitudes, as well as providing market forecasts out to 2027.

Key Highlights

- The UK health & beauty market is forecast to maintain momentum as inflation drives growth.

- Boots extends its lead over rivals as it outperforms the market.

- Value for money and quality are the most important purchase drivers, with sustainability also an important consideration for young consumers.

Reasons to Buy

- Using our five-year forecasts to 2027, learn which areas of the health and beauty market will be the fastest performing to enable focus and investment in these winning product areas.

- Understand how drivers of health and beauty purchases, such as range, price, and quality, vary in importance among different demographics to maximize sales potential.

- Use our in-depth analysis and forecasts to understand current trends in health & beauty subcategories, such as over-the-counter medicine.

Amazon

ASDA

B&M

Beauty Bay

Benefit

Boots

Charlotte Tilbury

Clinique

Cult Beauty

Estee Lauder

Feelunique

Fenty

Harrods

Holland & Barrett

Home Bargains

Huel

Liberty

John Lewis & Partners

Lidl

Lloyds Pharmacy

Lookfantastic

Lush

Marks & Spencer

Morrisons

Oh My Cream

Poundland

Primark

Sainsbury's

Savers

Sephora

Specsavers

Superdrug

Tesco

The Body Shop

TK Maxx

Well Pharmacy

Wilko

Table of Contents

Table

Figures

Frequently asked questions

-

What was the size of the United Kingdom health and beauty market in 2022?

The health and beauty market in the United Kingdom was valued at GBP39.04 billion in 2022.

-

What is the growth rate of the United Kingdom health and beauty market?

The United Kingdom health and beauty market is expected to record a CAGR of more than 2% during 2022-2027.

-

Which was the leading distribution channel in the United Kingdom health and beauty market?

In 2022, drug stores and health & beauty stores was the leading distribution channel.

-

Who are the leading companies in the United Kingdom's health and beauty market?

Some of the leading companies in the United Kingdom’s health and beauty market are Boots, Tesco, ASDA, Aldi, and Superdrug among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.