Top Themes in Tech, Media and Telecom (TMT) in 2024 – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Viewing the world’s data by themes makes it easier to make important decisions. GlobalData’s Top Themes in Tech, Media, and Telecom (TMT) in 2024, report offers the following in-depth trends and insights:

- TMT SECTORS: Analysis of 17 TMT sectors, broadly divided into four categories: Hardware, Software and Services, Internet and Media, and Telecom.

- THEMATIC SCORECARDS: For each sector, we provide thematic scorecards comprising four screens: the company screen, the thematic screen, the valuation screen, and the risk screen.

- HOLISTIC VIEW: An easy-to-use framework tracking all themes across all companies in all sectors, with a unique thematic research ecosystem designed to give a holistic view of the big themes that are impacting companies in the TMT industry.

- The report features what’s happening, what are our predictions, who are the leaders and who are the laggers?

How is the ‘Top Themes in Tech, Media, and Telecom (TMT) in 2024’ thematic report different from other reports in the market?

- If you are worried about the pace of innovation in your industry, this report will help you identify which tech vendors can help you.

- It provides a top-down, comprehensive outlook for the leading players in the TMT industry based on the key themes set to transform their industry landscape over the next two years.

- Written by some of the world’s leading tech experts, GlobalData’s TMT Themes 2024 will help you look credible when discussing tech in your industry.

- It tells you everything you need to know about disruptive tech themes and which companies are best placed to help you digitally transform your business.

Investing in our Thematic Intelligence reports’ will enable you to invest in your future. We recommend this valuable source of information to anyone involved in:

- C-Suite

- Strategy

- Market Intelligence

- Competitor Intelligence

- Sales Enablement

- Digital Transformation

- IT

- Professional Services

To Get a Snapshot of the Top Themes in Tech, Media and Telecom (TMT) in 2024 Report

TMT Thematic Intelligence Report Overview

The TMT themes 2024 report provides readers an insight about disruptive tech themes and the companies that are best placed to help governments, and individuals adapt to upcoming digital transformations.

The biggest themes that are expected to drive growth in the TMT industry in 2024 are broadly categorized into four segments- hardware, software and services, internet and media, and telecom. The key themes in the hardware segment include semiconductors, component makers, consumer electronics, IT infrastructure, telecom infrastructure, and industrial automation.

Application software, gaming, enterprise security software, IT services, and cloud services are some of the themes driving growth in the software and services segment. Additionally, e-commerce, social media, advertising, music, film, and TV, and publishing themes come under the internet and media category. The report also discusses the telecom services theme and its impact on the TMT industry.

Top Themes Driving Growth in the TMT Industry

Buy the Full Report to Know More About the Top Themes Driving Growth in The TMT Industry

Download a Free Report Sample

The tech, media, and telecom (TMT) themes in the 2024 report provide a top-down, comprehensive outlook for the leading players in the tech, media, and telecom (TMT) industry. The report is based on the key themes set to transform the industry landscape over the next two years.

| Hardware Themes | · Semiconductors

· Component Makers · Consumer Electronics · IT Infrastructure · Telecom Infrastructure · Industrial Automation |

| Software and Services Themes | · Application Software

· Gaming · Enterprise Security Software · IT Services · Cloud Services |

| Internet and Media Themes | · E-commerce

· Social Media · Advertising · Music, Film, and TV · Publishing |

| Telecom Theme | · Telecom Services |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Industrial Automation

Technology and automation play a crucial role in building resilient businesses. Hence, industries are looking more seriously at emerging technology. Automation is especially needed to combat labor shortages, cut costs, and ease the negative consequences of supply chain disruption. This includes cybersecurity and technologies that replace human labor, such as robotics, or help workers collaborate remotely, such as digital twins, wearable tech, and virtual and augmented reality (VR and AR). In this context, technologies such as AI and the Industrial Internet will function as the backbone of industrial automation.

The top themes driving industrial automation are artificial intelligence, cybersecurity, industrial internet, wearable tech, and robotics among others.

Industrial Automation Thematic Screen

Buy the Full Report to Know How Industrial Automation Will Impact the TMT Industry

Download a Free Report Sample

Cloud Services

The cloud services sector is dominated by four major players, Amazon, Microsoft, Alibaba, Google, and Kyndryl. There will be no new entrant in 2024 that will significantly disrupt the status quo of these tech-giants owing to the capital cost involved in building the necessary infrastructure.

Few of the key themes driving cloud services are artificial intelligence, software defined networks (SDNs), the Internet of Things, Enterprise Software as a Service (SaaS), and Cloud Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) among others.

Cloud Services Thematic Screen

Buy the Full Report to Know How Cloud Services will Impact the TMT Industry

E-Commerce

E-commerce gained significant momentum during the pandemic as physical stores temporarily closed for business worldwide. Technological innovations such as Artificial intelligence, social media, and robotics are helping e-commerce companies to stay afloat and retain their customers. While product quality is vital to customer satisfaction, vendors can harness the data insights, marketing opportunities, and delivery options these technologies provide to improve their operations.

Few of the key themes driving e-commerce are the metaverse, artificial intelligence, data privacy, supply chain management, and social media among others.

E-Commerce Thematic Screen

Buy the Full Report to Know How E-Commerce will Impact the TMT Industry

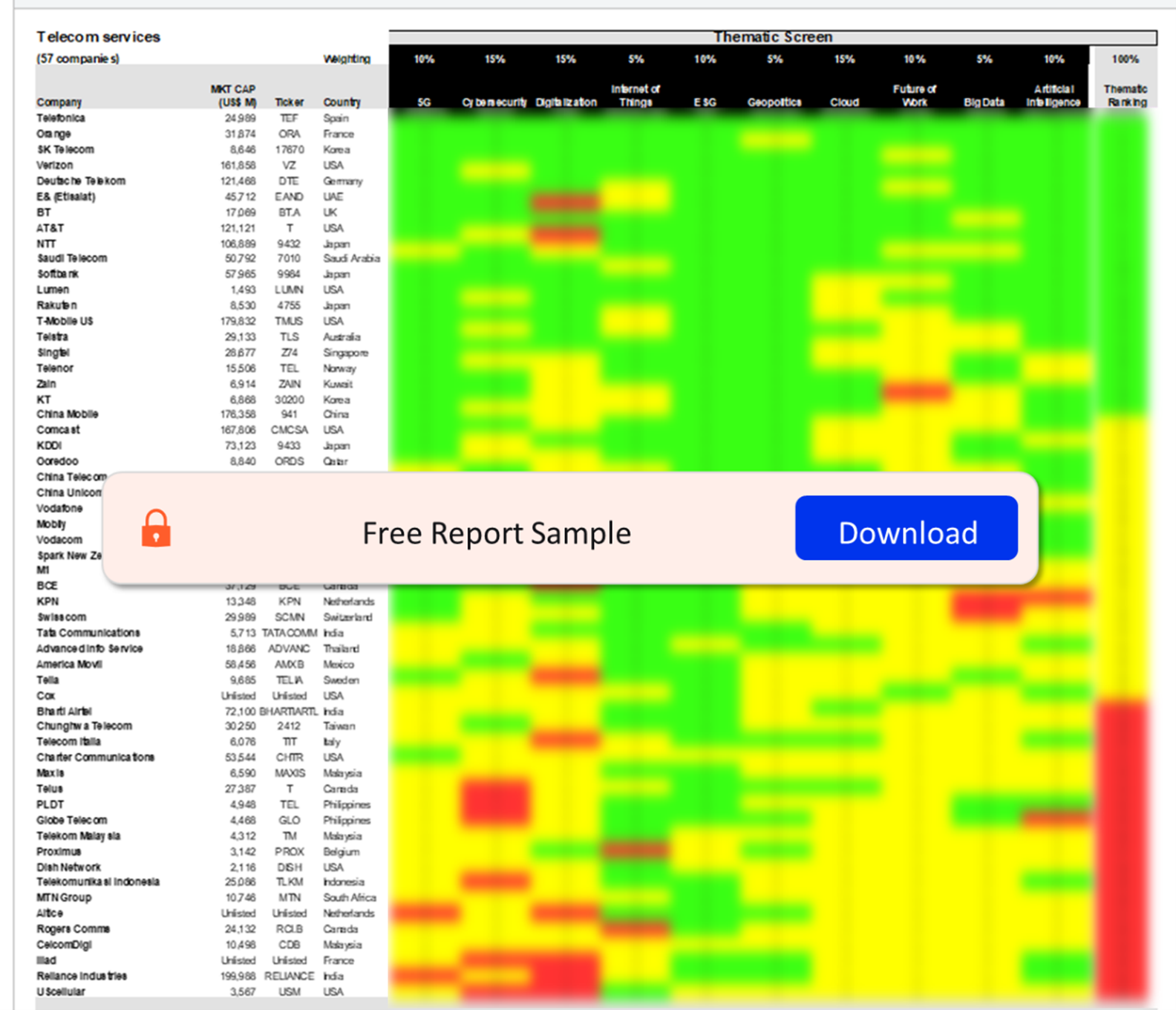

Telecom Services

Telecom carriers are facing global challenges owing to the global geopolitical situation and issues with supply chains caused by the COVID-19 pandemic. However, carriers continue to rationalize their offerings, influenced by advances in cloud, enterprise digitalization, and virtualization. To meet the needs of enterprises and consumers, telcos continue to become operationally agile in the way they connect in the digital ecosystem, bundle services, focus on customer experience, and introduce new business models in new segments.

The leading themes driving telecom services are 5G, cybersecurity, digitalization, the Internet of Things, and the future of work among others.

Telecom Services Thematic Screen

Buy the Full Report to Know How Telecom Services Will Impact the TMT Industry

Download a Free Report Sample

Key Highlights

As we enter 2024, the outlook is volatile and uncertain, primarily due to geopolitical turmoil and macroeconomic uncertainty. Technology can help businesses, governments, and individuals adapt to profound shifts in an uncertain world.

Artificial intelligence (AI) was the most talked about technology theme in 2023 and will remain at the top of agendas. From a business perspective, AI represents both an opportunity and a threat, and the companies that succeed will approach it as such rather than seeing it as a cure for all ills.

ABB

Accenture

Accton

Acer

Adobe

Adtran

Advance

Advanced Info Service

Airbnb

Aixtron

Akamai

Alarm.com

Alcatel-Lucent Enterprise

Alibaba

Alibaba Pictures

Alphabet

Alteryx

Altice

Amazon

Ambarella

AMC Entertainment

AMC Networks

AMD

Amdocs

America Movil

Amphenol

AMS

Analog Devices

Ansys

AO.com

Apple

Applied Materials

Arista Networks

Arm

Asia Optical

ASML

ASOCS

ASOS

Asus

AT&T

Atos

Atresmedia

Autodesk

Automation Anywhere

Aviatrix

Axel Springer

BAE Systems

Baidu

Bandai Namco

Baozun

Barracuda Networks

BCE

Bentley Systems

Bertelsmann

Bharti Airtel

Bilibili

Bitmain

Bizlink

Blackbaud

Blackberry

Blackline

Bloomberg

Bonnier

Boohoo.com

Booking Holdings

Bosch

Box

Boyaa

BrainChip

Broadcom

BT

Bureau Veritas

BYD

ByteDance

Cadence Design Systems

Calix

Cambricon

Cambridge University Press

Canon

Canonical

Capcom

Capgemini

Casa Systems

Catcher Technology

CATL

Cato Networks

CelcomDigi

Cengage

Cerebras

CGI

Charter Communications

Check Point Software

Chegg

Cheil

China Literature

China Mobile

China Telecom

China Unicom

Chunghwa Telecom

Ciena

Cineworld

Cirrus Logic

Cisco

Clarivate

Clear Channel

Cloud Software Group

Cloudera

Cloudflare

Cognex

Cognizant

Cohesity

Colopl

Comcast

CommScope

CommVault

Compal

Compass

Computacenter

Comscore

Concentrix

Conduent

Constellation Software

Corning

Couchbase

Coupa

Cox

Criteo

CrowdStrike

CSG Systems

CyberArk Software

Cyberdyne

Cybereason

Daily Mail and General Trust

Danaher

Darktrace

Dassault Systemes

Databricks

Datadog

Dawning

Deliveroo

Delivery Hero

Dell Technologies

DeNA

Dentsu

Deutsche Telekom

Didi Chuxing

Digital Realty

Diodes

Discord

Dish Network

DJI

DocuSign

DoorDash

Dropbox

DXC Technology

Dynatrace

E& (Etisalat)

Ebay

Edgio

Electronic Arts

Embracer

Emerson Electric

EPAM Systems

Epic Games

Equifax

Equinix

Ericsson

Estun Automation

Etsy

Euromoney

Exabeam

Expedia

Experian

Extreme Networks

F5

FactSet

FANUC

FICO

Finastra

Forcepoint

Fortinet

Fuji Media

Fujitsu

Gakken

Gamevil

Gannett

Garmin

GE

Genpact

GlobalFoundries

Globe Telecom

GoDaddy

GoerTek

GoPro

Graphcore

Gree

Groq

Groupon

Grupo Planeta

Grupo Televisa

Guardian Media Group

GungHo Online

Haier Smart Home

Harmonic

Harmonic Drive

HashiCorp

HCLTech

Hearst

Hikvision

Himax

Hitachi

Hitotsubashi Group

HollySys Automation

Holtzbrinck Publishing

Hon Hai

Honeywell

Horizon Robotics

Houghton Mifflin Harcourt

HP

HPE

HTC

Huawei

HubSpot

IAC

IBM

iFlytek

IGG

Iliad

Indra Sistemas

Infineon

Infinera

Info Edge

Infor

Informa

Infosys

Inspur Electronic

Instacart

Intel

Interpublic

Intuit

Intuitive Surgical

Inventec

IonQ

iQiyi

iRobot

ITV

Jabil

Japan Display

JC Decaux

JD.com

Juniper Networks

Just Eat Takeaway

Justdial

Kadokawa

Kakao

Kawasaki Heavy

KDDI

Keyence

Kingsoft

Klarna

Kodansha

Konami

KPN

Krafton

KT

KUKA

Kyndryl

Kyocera

Lagardere

LAM Research

Lamar Advertising

Largan

Lenovo

LG Display

LG Electronics

LG Energy Solution

Lionsgate

Live Nation

LivePerson

Logitech

LTI

Lumen

Lumentum

Lyft

M&C Saatchi

M1

M6-Metropole TV

Magic Leap

Magnite

MakeMyTrip

Marchex

Marvell

Mastercard

Mavenir

Maxis

McGraw Hill

MediaForEurope

MediaTek

Meituan

Melexis

MercadoLibre

Meta

Microchip

Micron

Microsoft

Mimecast

Mirantis

Mitsubishi Electric

Mixi

Mobily

Momo

MoneySuperMarket

Monolithic Power Systems

Moody's

Morningstar

Motorola Solutions

Mphasis

MTN Group

Murata

Mythic

Nabtesco

Nachi Fujikoshi

Nanya Tech

Naspers

Naver

NavInfo

NCC

NCSoft

NEC

NetApp

NetEase

Netflix

Netmarble

Netskope

Network 18 Media

Neusoft

New Relic

New Work

New York Times

News Corp

Nexon

Nexstar

Nfon

Nielsen

Nikon

Ningbo Bird

Nintendo

Nippon Ceramic

Nippon TV

Nokia

NTT

NTT Data

Nutanix

Nvidia

NXP

Ocado

Okta

Omnicom

Omron

On Semiconductor

Ooredoo

OpenAI

OpenText

Oracle

Orange

Outfront Media

OVHcloud

Oxford University Press

Palantir

Palo Alto Networks

Panasonic

Parallel Wireless

Paramount Global

Parrot

PayPal

Paytm

Pearson

Pegatron

Perfect World

Philips

Phluido

Phoenix Publishing & Media

Pinduoduo

Platform9

Playtech

PLDT

Progress Software

Proofpoint

ProSiebenSat.1

Proximus

PTC

Publicis

Pure Storage

Qisda

Qorvo

Qualcomm

Qualys

Quanta Computer

Quantinuum

Quebecor

Rackspace Technology

Radisys

Radware

Rakuten

Rapid7

Razer

Rea Group

Reliance Industries

Relx

Renesas

Renren

Ribbon Comms

Ricoh

Rigetti Computing

RingCentral

Roblox

Rockwell Automation

Rogers Comms

Rohm

Roper Technologies

RTL

Rubrik

S&P Global

Sage

Sage Publishing

SAIC

SailPoint Technologies

Salesforce

SambaNova

Samsung Electronics

Samsung SDI

Sanoma

SAP

Saudi Telecom

Schibsted

Schneider Electric

Scholastic

Sea

Seagate

SecureWorks

Securonix

Sega Sammy

Seiko Epson

Sensata

SenseTime

SentinelOne

ServiceNow

Sharp

Shein

Shopify

Siasun Robot

Siemens

Silicon Labs

Silicon Motion

Sina

Singtel

Sirius XM Radio

SK Hynix

SK Telecom

Skyhigh Security

Skyworks

SMEE

SMIC

Snap

Snap One

Snowflake

Snyk

Softbank

Software AG

Sonos

Sony

Sophos

Sopra Steria

Spark New Zealand

Splunk

Spotify

Square Enix

SS&C

STMicroelectronics

Stryker

Sumo Logic

Sun TV Network

Suning.com

Sunny Optical

SUSE

Swisscom

Synaptics

Synopsys

SynSense

Take-Two Interactive

TAL Education

Tanium

Tata Communications

Tata Consultancy Services

TDK

TE Connectivity

TeamViewer

Tech Mahindra

Tegna

Telecom Italia

Telefonica

Telekom Malaysia

Telekomunikasi Indonesia

Telenor

Television Broadcasts

Telia

Telstra

Telus

Temenos

Tenable

Tencent

Teradata

Teradyne

Tesla

Texas Instruments

TF1

Thales

Thomson Reuters

TietoEVRY

T-Mobile US

Tokyo Electron

TomTom

Toshiba

Toyota

Trade Desk

TransUnion

Trellix

Trend Micro

Trip.com

TripAdvisor

TSMC

Twilio

Uber

Ubiquiti Networks

Ubisoft

UiPath

UMC

Umicore

United Internet

Unity Technologies

Universal Music

UScellular

Valve

Vantiva

Vecima

Verisk Analytics

Verizon

Viaplay

Vipshop

Visa

Vivendi

VK

Vodacom

Vodafone

Vuzix

Walmart

Walt Disney

Warner Bros. Discovery

Warner Music

Wayfair

Webzen

Wiley

Wipro

Wistron

Wolters Kluwer

Workday

Workiva

World Wide Technology

WPP

X (formerly Twitter)

Xero

Xiaomi

Yandex

Yaskawa

Yelp

Yokogawa Electric

Yuneec

YY

Z Holdings

Zain

Zalando

Zapata Computing

Zee Entertainment

Zendesk

Zillow

Zoom

Zscaler

ZTE

Table of Contents

Frequently asked questions

-

Which key themes will drive industrial automation in the TMT industry in 2024?

The key themes driving industrial automation in the TMT industry in 2024 are artificial intelligence, cybersecurity, industrial internet, wearable tech, and robotics

-

Which key themes will drive cloud services in the TMT industry in 2024?

The key themes driving cloud services in the TMT industry in 2024 are artificial intelligence, software defined networks (SDNs), Internet of Things, and Enterprise Software as a Service (SaaS) among others.

-

Which key themes will drive e-commerce in the TMT industry in 2024?

The leading themes driving e-commerce in the TMT industry in 2024 are the metaverse, artificial intelligence, and data privacy among others.

-

Which key themes will drive telecom services in the TMT industry in 2024?

The key themes driving telecom services in the TMT industry in 2024 are 5G, cybersecurity, digitalization, the Internet of Things, and the future of work.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Technology reports