Taiwan Construction Market Size, Trend Analysis by Sector, Competitive Landscape and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Taiwan Construction Market Report Overview

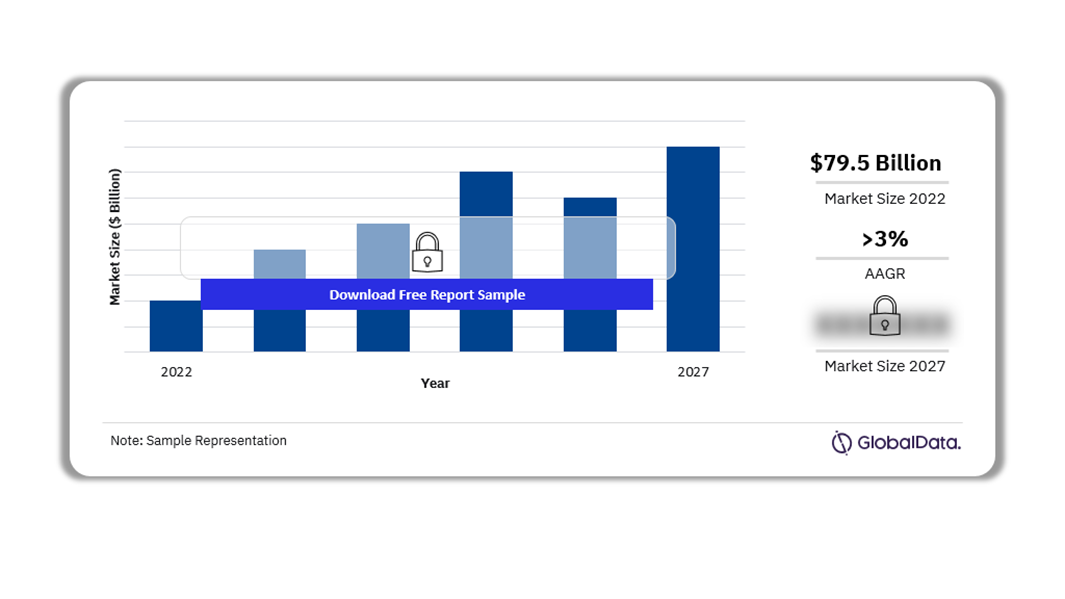

The Taiwan construction market size was $79.5 billion in 2022. The market is projected to achieve an AAGR of more than 3% during 2024-2027. The growth is attributed to the rise in investment in renewable energy, rail and road infrastructure, and water infrastructure projects.

Taiwan Construction Market Outlook, 2022-2027 ($ Billion)

Buy the Full Report to Know More about the Taiwan Construction Market Forecast

The Taiwan construction market research report offers a comprehensive understanding of project types and construction activities in the country. It analyzes the mega-project pipeline, focusing on development stages, participants, and listings of major projects in the pipeline. The market report further discusses the key sectors in the construction market and their growth drivers. Along with reviewing the details of the construction projects, our analysts have elaborated on emerging trends and assessed key risks and opportunities that will influence the Taiwan construction market growth in the coming years.

| Market Size (2022) | $79.5 billion |

| AAGR (2024-2027) | >3% |

| Forecast Period | 2023-2027 |

| Historical Period | 2018-2022 |

| Key Sectors | · Commercial Construction

· Industrial Construction · Infrastructure Construction · Energy and Utilities Construction · Institutional Construction · Residential Construction |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

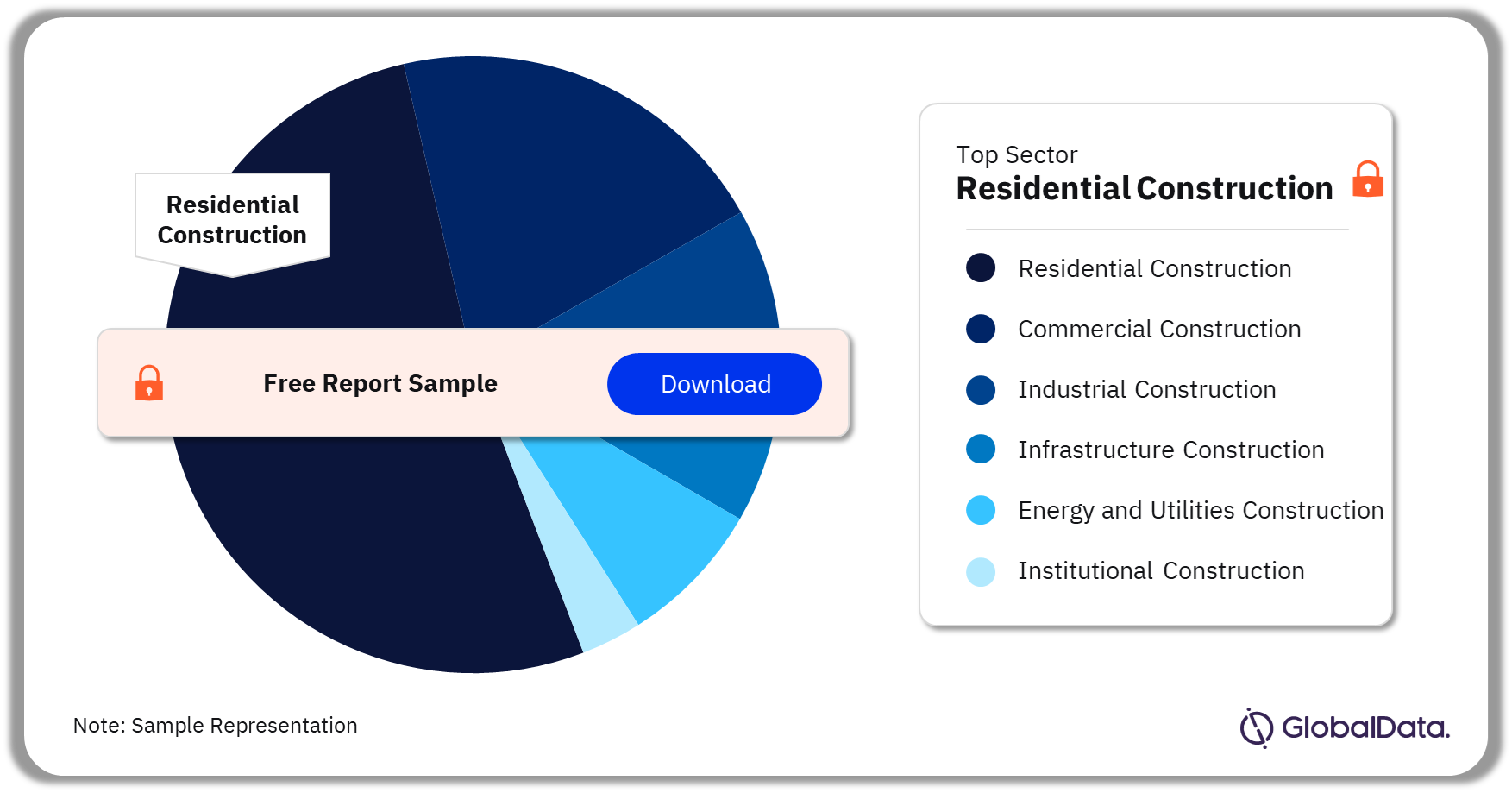

Taiwan Construction Market Segmentation by Sectors

Residential construction was the leading sector in the Taiwan construction market in 2022

The key sectors in the Taiwan construction market are commercial construction, industrial construction, infrastructure construction, energy and utilities construction, institutional construction, and residential construction. In 2022, the residential construction sector was followed by infrastructure construction.

Infrastructure construction: The project types in this sector include rail infrastructure, road infrastructure, and other infrastructure projects. The government investment in the development of road, rail, and other transport infrastructure during the forecast period will support the sector’s growth.

Residential construction: The project types in this sector include single-family housing and multi-family housing. The residential construction industry will recover over the forecast period owing to the government’s investments in providing affordable housing. For instance, the government of New Taipei plans to provide more than 11,000 units of affordable housing by the end of 2024, to benefit low and middle-income households.

Energy and utilities construction: The project types in this sector include electricity and power, oil and gas, telecommunications, sewage infrastructure, and water infrastructure. The government’s focus on the development of the renewable energy sector, water infrastructure, and electricity projects will drive the sector growth between 2024 and 2027.

Commercial construction: The project types in this sector include leisure and hospitality buildings, office buildings, outdoor leisure facilities, retail buildings, and other commercial construction. Factors such as increased investment in tourism, leisure, and hospitality projects will drive the commercial sector’s growth over the forecast period.

Industrial construction: The project types in this sector include chemical and pharmaceutical plants, manufacturing plants, metal and material production and processing plants, and waste processing plants. A rise in investments by the private players will revive the sector’s growth during the forecast period. For instance, in June 2023, RecycLiCo Battery Materials Inc., a Canadian battery recycling company, announced an investment of more than $24 million in a joint venture with Taiwanese chemical company Zenith Chemical Corporation to build a lithium-ion battery recycling plant, in Taiwan.

Institutional construction: The project types in this sector include educational buildings, healthcare buildings, institutional buildings, research facilities, and religious buildings. Factors such as the increase in investment in educational and healthcare infrastructure will fuel the growth of this sector in the coming years.

Taiwan Construction Market Analysis by Sectors, 2022 (%)

Buy the Full Report for more Sector Insights into the Taiwan Construction Market

Taiwan Construction Market - Latest Developments

- In August 2023, the Government’s budget plan of more than $98 billion for 2024 was approved by the Cabinet.

- Among the recent developments, the Hai Long offshore wind project received all environmental approvals and major construction permits in September 2023. It is Taiwan’s longest offshore wind project finance contract to date.

Segments Covered in the Report

Taiwan Construction Sectors Outlook (Value, $ Billion, 2018-2027)

- Commercial Construction

- Industrial Construction

- Infrastructure Construction

- Energy and Utilities Construction

- Institutional Construction

- Residential Construction

Scope

This report provides:

- A comprehensive analysis of the construction industry in Taiwan.

- Historical and forecast valuations of the construction industry in Taiwan, featuring details of key growth drivers.

- Segmentation by sector and by sub-sector.

- Analysis of the mega-project pipeline, including breakdowns by development stage across all sectors and projected spending on projects in the existing pipeline.

Reasons to Buy

- Identify and evaluate market opportunities using GlobalData’s standardized valuation and forecasting methodologies.

- Assess market growth potential at a micro-level with over 600 time-series data forecasts.

- Understand the latest industry and market trends.

- Formulate and validate strategy using GlobalData’s critical and actionable insight.

- Assess business risks, including cost, regulatory, and competitive pressures.

- Evaluate competitive risk and success factors.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Taiwan construction market size in 2022?

The construction market size in Taiwan was $79.5 billion in 2022.

-

What will the Taiwan construction market growth rate be during the forecast period?

The construction market in Taiwan is projected to achieve an AAGR of more than 3% during 2024-2027.

-

Which was the leading sector in the Taiwan construction market in 2022?

Residential construction was the leading sector in the Taiwan construction market in 2022.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Construction reports