Switzerland Baby Food Market Size and Share by Categories, Distribution and Forecast to 2029

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Switzerland Baby Food Market Report Overview

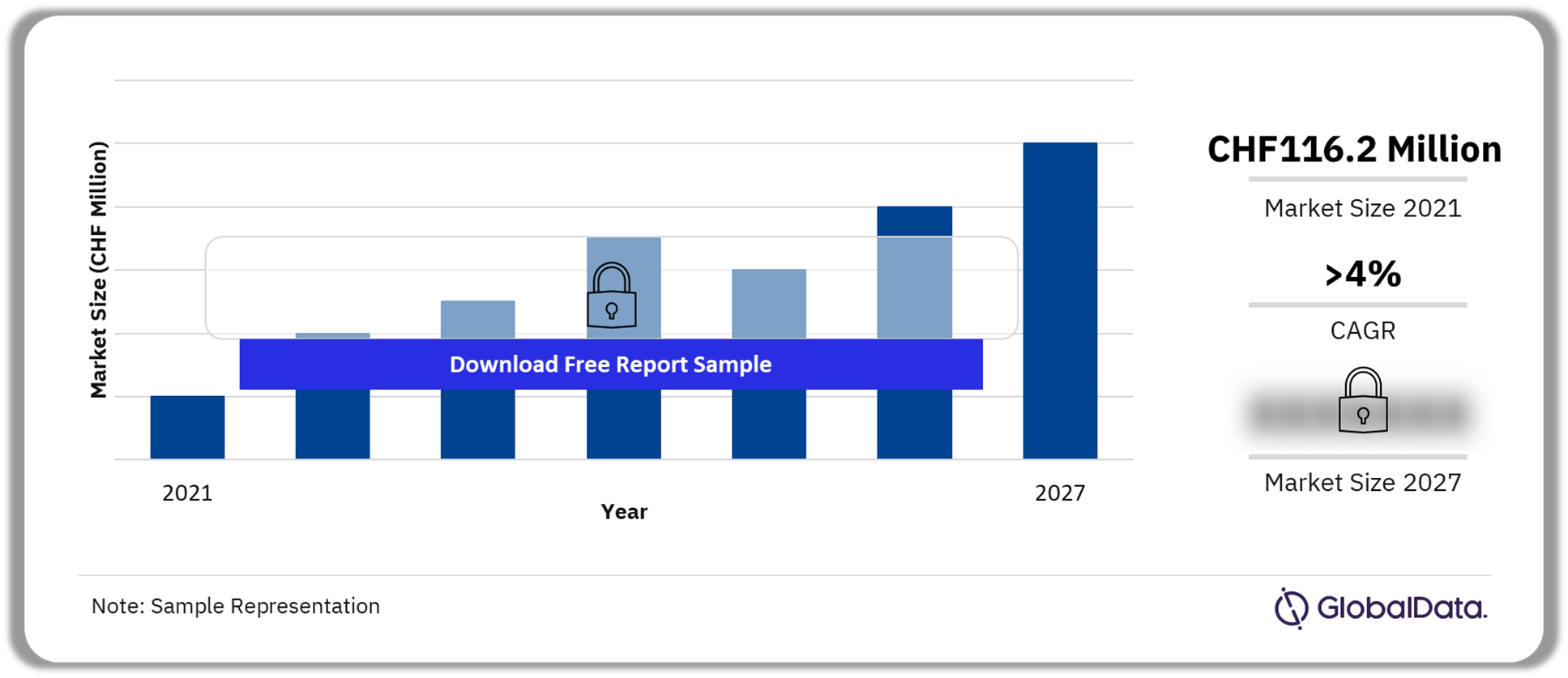

The Swiss baby food market size was valued at CHF116.2 million in 2021. The market will garner a CAGR of more than 4% during 2021-2027. The Swiss baby food market outlook includes demographic and socio-economic trends to aid clients in effective decision-making.

Switzerland Baby Food Market Outlook 2021-2027, (CHF Million)

Buy the Full Report for Switzerland’s Baby Food Market Revenue, Download a Free Report Sample

The Switzerland baby food market insights cover current and future trends that will influence the baby food industry. This report collates multiple data sources to offer a comprehensive baby food sector overview in Switzerland.

| Market Size 2021 | CHF116.2 million |

| CAGR (2021-2027) | >4% |

| Historical Period | 2015-2021 |

| Forecast Period | 2021-2027 |

| Key Categories | · Baby Milks

· Baby Cereals & Dry Meals · Baby Wet Meals & Other · Baby Finger Food · Baby Drinks |

| Key Distribution Channels | · Hypermarkets & Supermarkets

· Drugstores & Pharmacies · Convenience Stores · E-Retailers |

| Leading Manufacturers | · Nestlé

· Danone Group · Hero Group · HiPP · Alnatura |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Switzerland Baby Food Market Trends

The number of working women in Switzerland has witnessed a considerable rise in recent years. Furthermore, favorable maternity policies are encouraging women to re-join services as quickly as possible. In Switzerland, nursing mothers have the right to breastfeeding breaks in the workplace. Furthermore, Switzerland has a strong tradition of promoting breastfeeding. Several government and voluntary organizations regularly conduct promotional campaigns to educate people about the benefits of breastfeeding. The country has a dedicated code regarding the promotion of breastmilk substitutes and baby food. These factors are further expected to drive Swiss baby food market growth during the projected years.

Buy the Full Report for a Detailed Switzerland Baby Food Trends Analysis, and Download PDF

Switzerland Baby Food Market Segmentation by Category

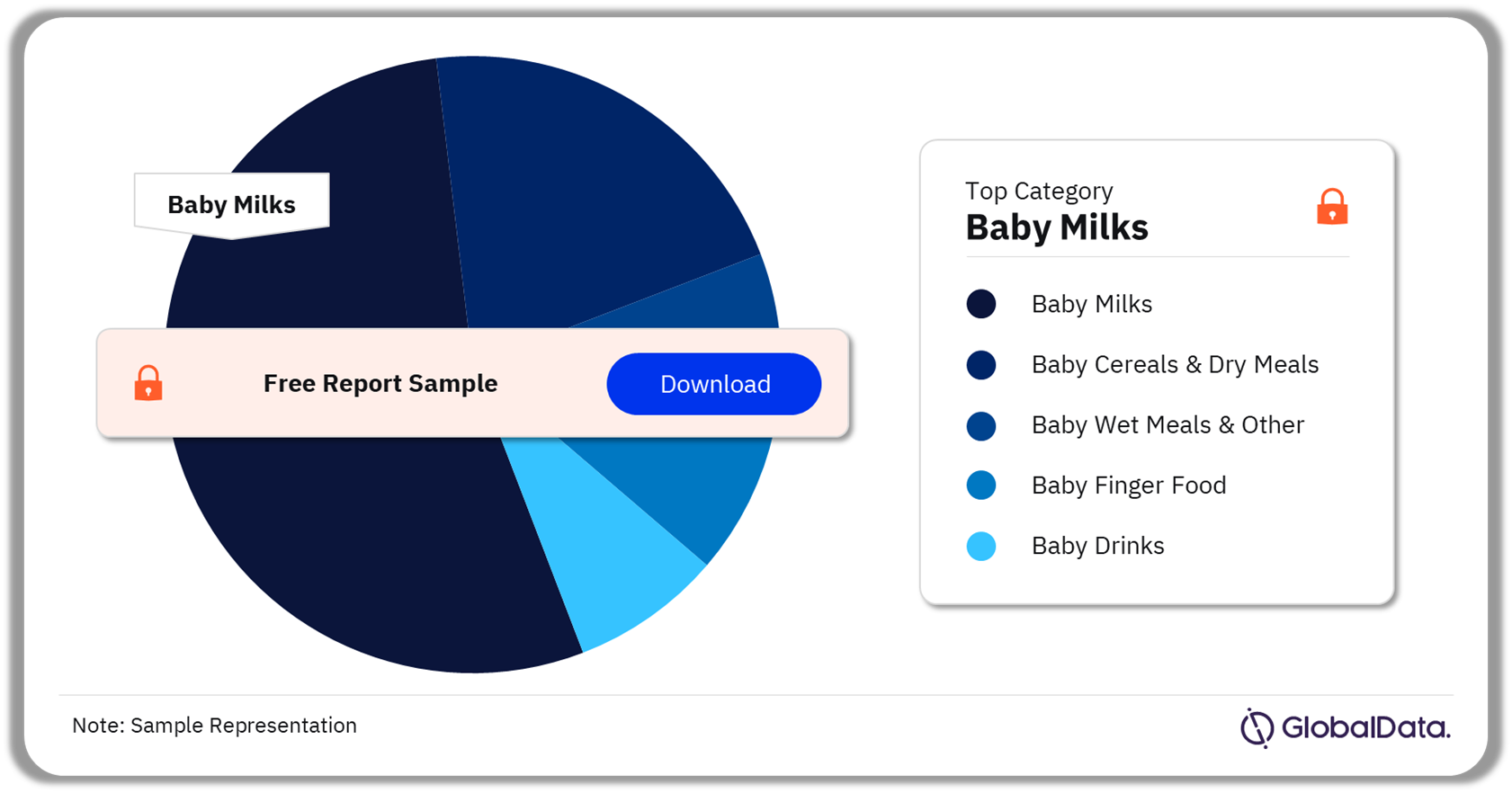

Baby milk category held the largest Swiss baby food market share in 2021

The key categories in the Switzerland baby food market are:

- Baby Milks

- Baby Cereals & Dry Meals

- Baby Wet Meals & Other

- Baby Finger Food

- Baby Drinks

The baby milk category accounted for the highest baby food value in 2021. In terms of volume, this category dominated Switzerland’s baby food market growth. The baby milk category comprises breast milk substitutes for infants aged from birth to three years old. Products include first-stage milk, and growing-up milk, among others. Growing-up milk was the largest segment in 2021.

Buy the Full Report for Categorical Swiss Baby Food Market Outlook, Download a Free Report Sample

Segments Covered in Switzerland Baby Food Market Report

Switzerland Baby Food Categories Outlook (Value, CHF Million, 2015-2027)

- Baby Milks

- Baby Wet Meals & Other

- Baby Cereals & Dry Meals

- Baby Drinks

- Baby Finger Food

Switzerland Baby Food Distribution Channel Outlook (Value, CHF Million, 2015-2027)

- Hypermarkets and Supermarkets

- Drugstores & Pharmacies

- Convenience Stores

- E-Retailers

- Others

Switzerland Baby Food Market Segmentation by Distribution Channel

Hypermarkets & supermarkets was the dominant distribution channel with the highest baby food sales in 2021

The key distribution channels in the Switzerland baby food market are:

- Hypermarkets & Supermarkets

- Drugstores & Pharmacies

- Convenience Stores

- E-Retailers

- Others

Hypermarkets & supermarkets were the leading distribution channel for baby food in 2021. Drugstores & pharmacies and convenience stores followed the lead among the other distribution channels.

Buy the Full Report for Switzerland Baby Food Market Insights by Distribution Channels, Download PDF Sample

Switzerland Baby Food Market - Competitive Landscape

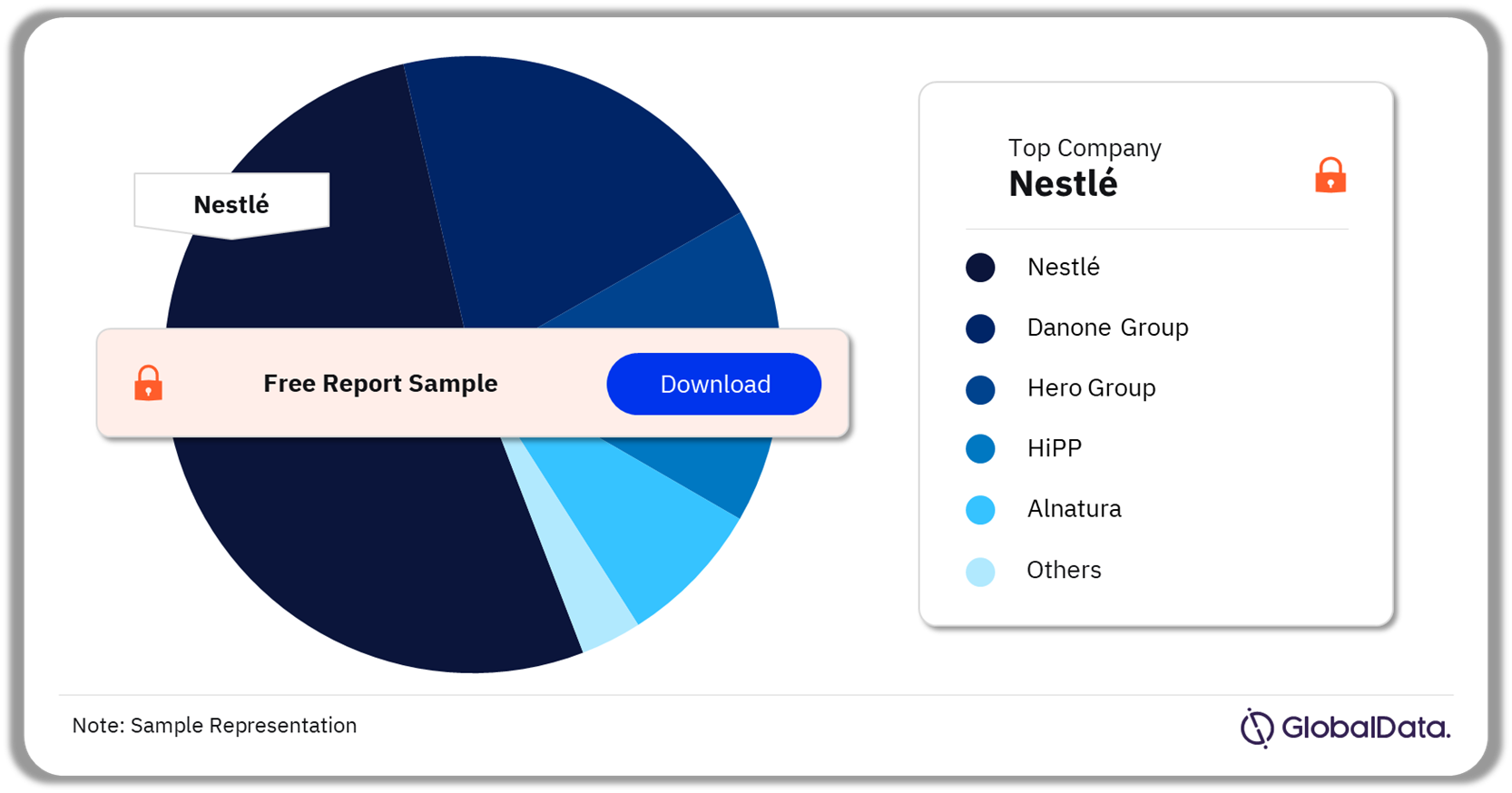

Nestlé was the leading Swiss baby food manufacturer in 2021

The leading Swiss baby food companies are:

- Nestlé

- Danone Group

- Hero Group

- HiPP

- Alnatura

Nestlé garnered the highest Swiss baby food market share in value and volume terms during 2021. Danone Group and Hero Group followed the lead among other baby food companies operating in Switzerland. Nestlé offers baby food products across its key brands including Nestlé Junior and Beba. Other leading brands include Nestlé Baby Cereals, Cerelac, and NaturNes.

Buy the Full Report for the Swiss Baby Food Manufacturers, Download PDF

Latest News and Developments

- In 2018, HOCHDROF Group took over Bimbosan to expand its business in the Swiss baby milks market. The company also offers premium goat’s milk under the Bimbosan brand. The powdered milk range is available in various pack formats, including box, pouch, and can.

Scope

This report provides:

- Consumption data based upon a unique combination of industry research, fieldwork, market sizing work. In-house expertise to offer extensive trends and dynamics data affecting the industry.

- Detailed company profiles considering their entry in the baby food industry with key product sectors.

- Market profile of the various product sectors with their key features & developments. Extensive insights about product segmentation, per capita trends, and the various manufacturers & brands.

- Baby food industry retailing overview with company revenues along with the distribution channel insights.

- Future projections considering various baby food market trends that are likely to affect the industry.

Reasons to Buy

- Evaluate important changes in consumer behavior and identify profitable markets and areas for product innovation.

- Analyse current and forecast behavior trends in each category to identify the best opportunities to exploit.

- Understand individual product category consumption to align your sales and marketing efforts with the latest trends in the market.

- Investigate which categories are performing the best and how this is changing market dynamics.

Danone

Hero

HiPP

Alnatura

Holle

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Switzerland baby food market size in 2021?

The baby food market size in Switzerland was valued at CHF116.2 million ($127.1 million) in 2021.

-

What is the Switzerland baby food market growth rate from 2021 to 2027?

The baby food market in Switzerland will achieve a CAGR of more than 4% during 2021-2027.

-

What category accounted for the highest Switzerland baby food market in 2021?

Baby milk was the leading category in the Switzerland baby food market in 2021.

-

What was the leading distribution channel of the Switzerland baby food market in 2021?

Hypermarkets and supermarkets were the leading distribution channel of Switzerland’s baby food market in 2021.

-

Which are the leading baby food manufacturers in Switzerland?

The leading baby food manufacturers in the Switzerland are Nestlé, Danone Group, Hero Group, HiPP, Alnatura, and Others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.