Surface Mining Equipment Market Analysis by Region, Population, Commodity and Forecast to 2030

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Explore the following trends and analysis from our ‘Surface Mining Equipment’ market report:

- Understand the breakdown of equipment counts by region (Asia Pacific, Australasia, Europe, Former Soviet Union, Middle East & Africa, North America, and South & Central America).

- Analyze the major mining countries such as Australia, Canada, Chile, China, India, Indonesia, Peru, Russia, South Africa, and the US.

- Assess the total population by commodity to set smart business goals.

- Learn the market shares of the leading OEMs by type of machine and region.

How is our ‘Surface Mining Equipment’ report unique from other reports in the market?

- Assess the current population of each major type of equipment by country, region, and key commodity (coal, iron ore, gold, and copper) to get a better understanding of the market.

- Predict counts of each machine through to 2030.

- Analyze the key OEMs in each segment and region.

- View counts of trucks by payload, as well as by numbers of autonomous and electric vehicles.

We recommend this valuable source of information to anyone involved in:

- Mining Companies

- Heavy Industry /Automobiles Companies and Manufacturers

- Primes/OEMs/Mining Technology Enterprises

- Technology Leaders and Startups

- Business Development and Market Intelligence

- Investment Analysts and Portfolio Managers

- Professional Services – Investment Banks, PE/VC firms

- M&A/Investment, Management Consultants, and Consulting Firms

To Get a Snapshot of the Surface Mining Equipment Market Report

Surface Mining Equipment Market Report Overview

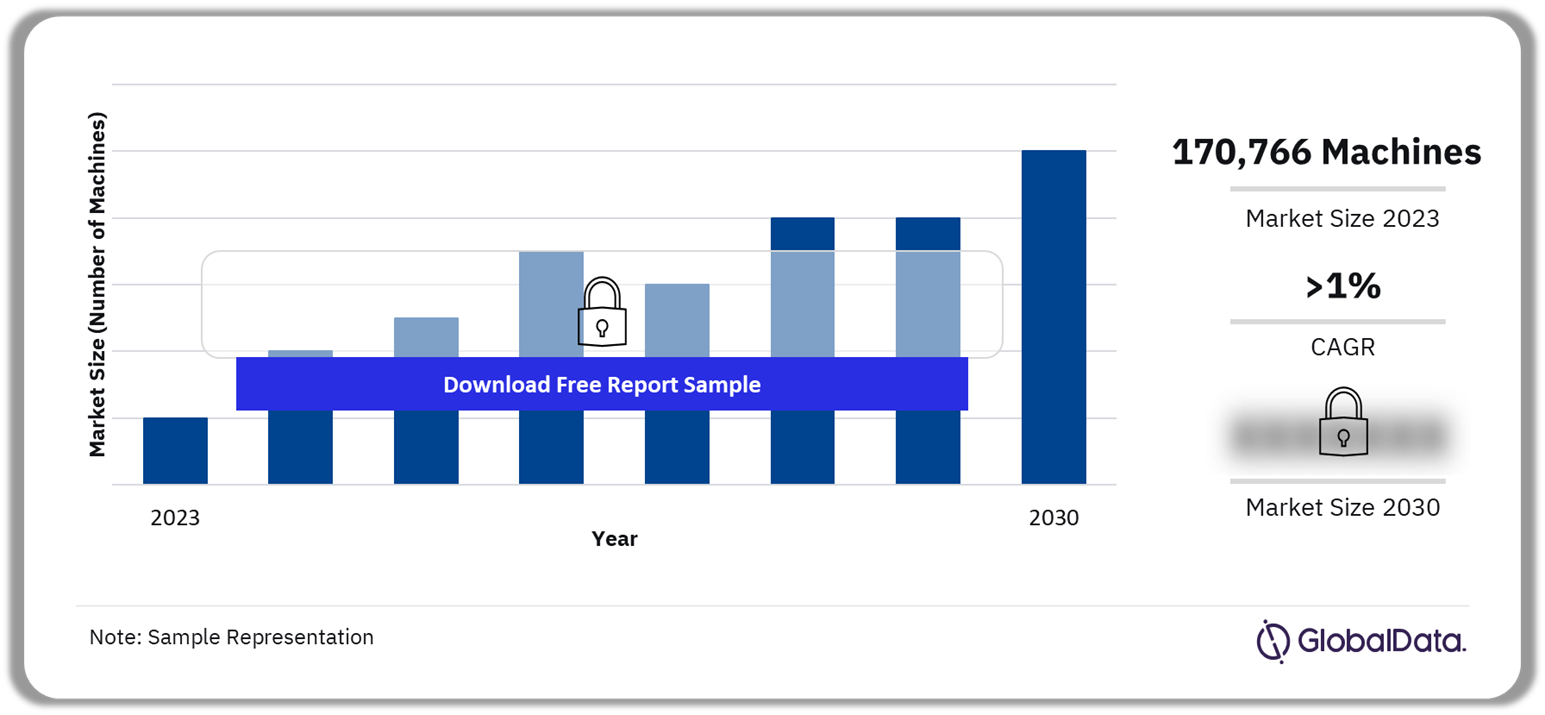

The total number of surface mining equipment was estimated at 170,766 in 2023. The surface mining equipment market is expected to grow at a CAGR of more than 1% from 2023 to 2030. Miners are seeking improved productivity and minimized emissions, which has increased the number of autonomous haul trucks. Also, the electrification of surface equipment is expected to gain traction in the upcoming years.

Surface Mining Equipment Market Outlook 2023-2030 (Number of Surface Mining Machines)

Buy the Full Report to Know More About the Surface Mining Equipment Market Forecast, Download a Free Sample Report

The surface mining equipment market research report provides detailed data and forecasts for different types of major surface mining equipment. The report uses our extensive mine-site research data and equipment models to generate a complete view of equipment counts globally. Furthermore, the report covers the number-wise breakdown of surface mining equipment by major regions, prominent mining countries, and key commodities.

| Market Size (2023) | 170,766 machines |

| CAGR (2023-2030) | >1% |

| Key Regions | · Asia-Pacific

· Europe & FSU · Africa & ME · South & Central America · North America · Oceania |

| Key Machines | · Mining Trucks

· Hydraulic Excavators/Shovels · Electric Rope Shovels · Wheel Loaders · Dozers · Motor Graders |

| Leading OEMs | · Caterpillar

· Komatsu · Volvo · BEML · Hitachi |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

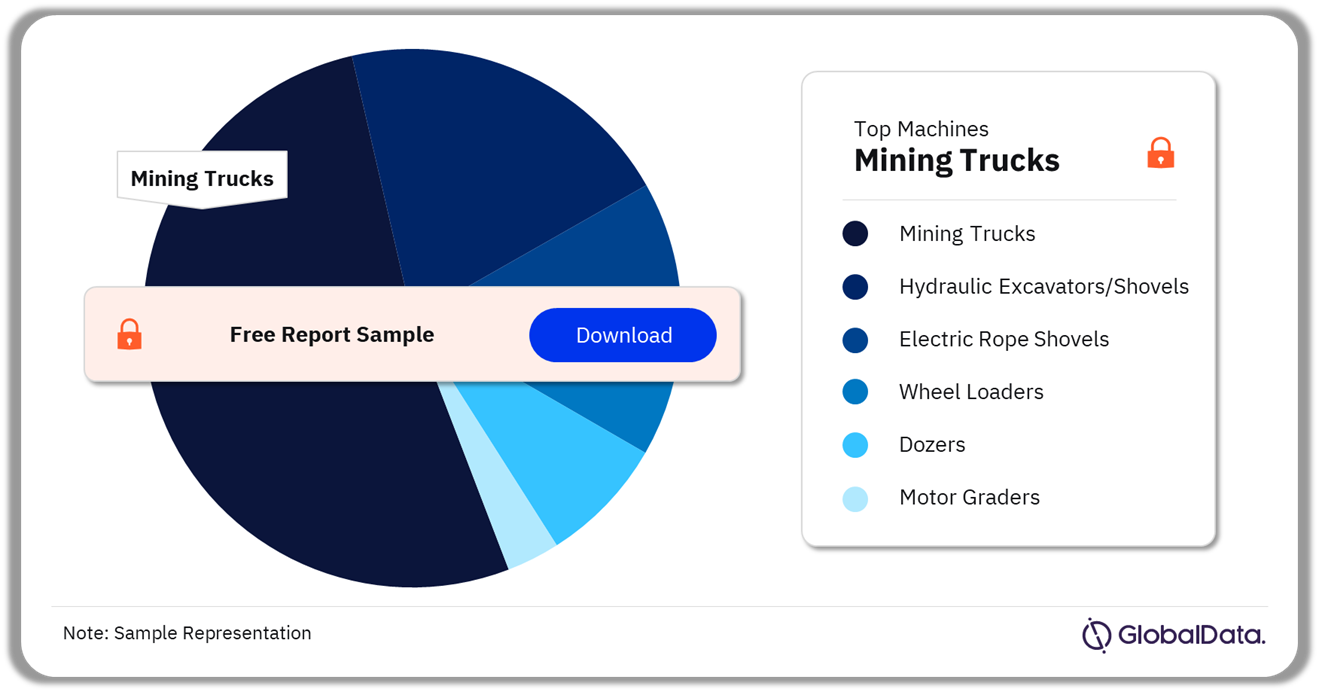

Surface Mining Equipment Market Segmentation by Machines

The key machines in the surface mining equipment market are mining trucks, hydraulic excavators/shovels, electric rope shovels, wheel loaders, dozers, and motor graders. In 2023, mining trucks accounted for the largest surface mining equipment market share, followed by dozers, and hydraulic excavators/shovels. The growth of the mining trucks segment can be attributed to the rising popularity of smaller-sized trucks with shorter lifespans. Mining trucks hold the largest share at coal mines, and by country, the largest number of trucks are in India.

Surface Mining Equipment Market Analysis by Machines, 2023 (%)

Buy the Full Report for More Machine-Wise Insights in the Surface Mining Equipment Market,

Download the Free Sample Report

Surface Mining Equipment Market Segmentation by Regions

The key regions in the surface mining equipment market are Asia-Pacific, Europe & FSU, Africa & ME, South & Central America, North America, and Oceania. In 2023, Asia-Pacific accounted for the highest number of surface mining equipment, followed by the Middle East & Africa.

Surface Mining Equipment Market Analysis by Regions, 2023 (%)

Buy the Full Report for More Region-Wise Insights in the Surface Mining Equipment Market,

Download the Free Sample Report

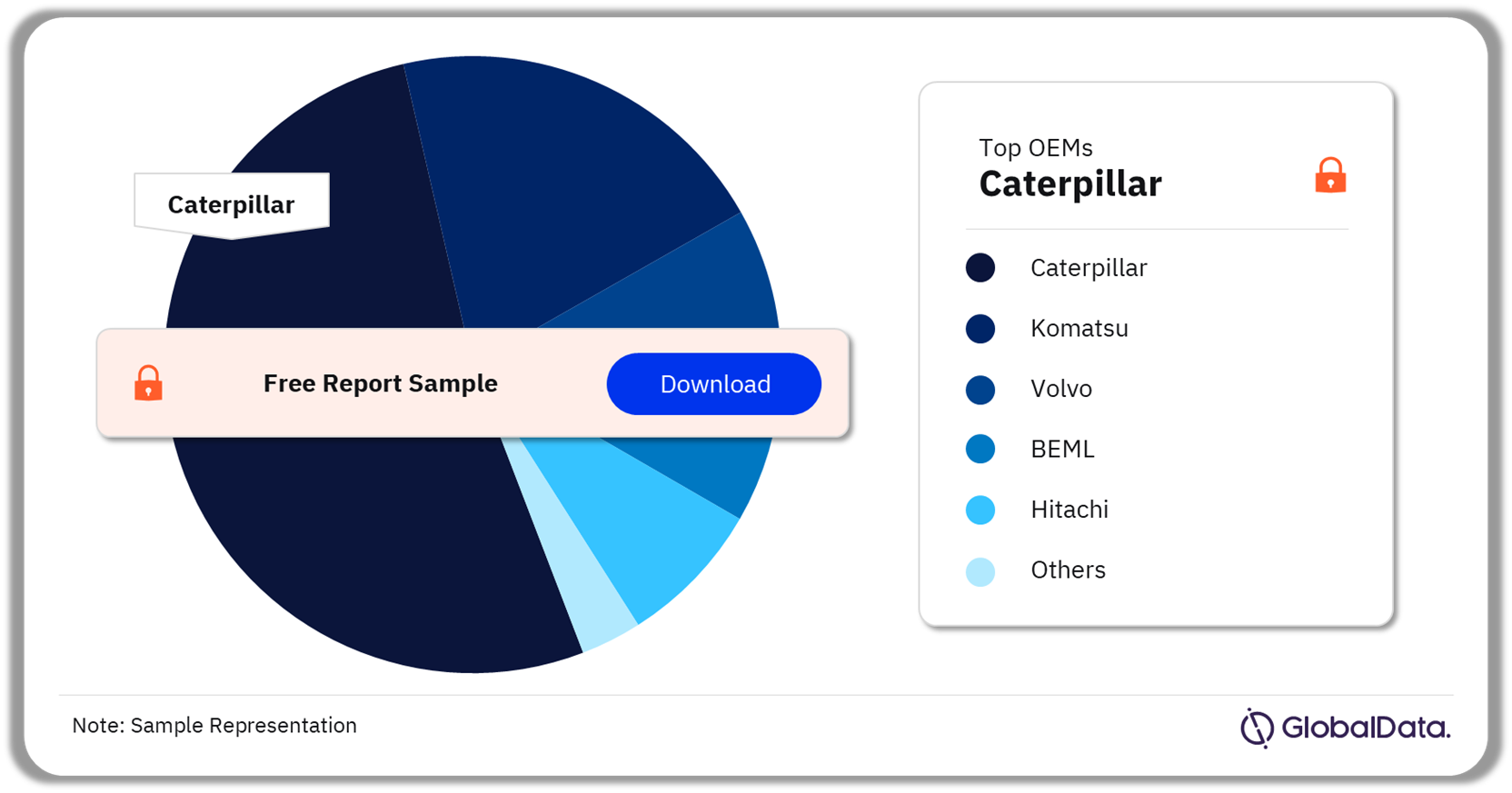

Surface Mining Equipment Market – Competitive Landscape

The leading OEMs in the surface mining equipment market are Caterpillar, Komatsu, Volvo, BEML, Hitachi, Belaz, Tata Motors, Scania, Liebherr, and Larsen & Toubro among others. In 2023, Caterpillar was the market leader in most segments. However, Komatsu was the leading provider of electric rope shovels.

Surface Mining Equipment Market Analysis by Leading OEMs, 2023 (%)

Buy the Full Report for More Company-Wise Insights in the Surface Mining Equipment Market,

Download the Free Sample Report

Segments Covered in this Report

Surface Mining Equipment Type Outlook (Number of Machines, 2023)

- Mining Trucks

- Hydraulic Excavators/Shovels

- Electric Rope Shovels

- Wheel Loaders

- Dozers

- Motor Graders

Surface Mining Equipment Regional Outlook (Number of Machines, 2023)

- Asia-Pacific

- Europe & FSU

- Africa & ME

- South & Central America

- North America

- Oceania

Key Highlights

• The total number of trucks, hydraulic excavators, rope shovels, wheel loaders, motor graders and dozers across all operating mines (including those in care and maintenance), excluding quarries, at the end of 2023 was estimated at 170,766. The largest share of machines is in Asia Pacific, at 44%, followed by the Middle East & Africa at 12%. Including only active fleet, this figure was 153,277.

• With steady growth in output, as more mines ramp up and come on stream, the total number of active machines is forecast to rise to 176,543 by 2030, a CAGR of 2.0% from 2023 to 2030. The largest contributor to this growth will be trucks, and particularly the smaller-sized trucks with shorter lifespans.

•Of the total, the largest share is accounted for by trucks at 61%. Of these the most popular payload sizes are in the range of 50-99 metric tonne trucks (36%), with 35% below 50t. Next most numerous are dozers accounting for 14% of machines, ahead of hydraulic excavators/shovels at 11%.

Komatsu

Liebherr

Volvo

Hitachi

BEML

Table of Contents

Table

Figures

Frequently asked questions

-

What was the total count of surface mining equipment in 2023?

The total number of surface mining equipment was estimated at 170,766 in 2023.

-

What will the CAGR of the surface mining equipment market be during 2023-2030?

The surface mining equipment market is anticipated to grow at a CAGR of more than 1% from 2023 to 2030.

-

Which was the leading machine in the surface mining equipment market in 2023?

In 2023, mining trucks accounted for the largest surface mining equipment market share.

-

Which region accounted for the largest surface mining equipment market share in 2023?

In 2023, Asia-Pacific had the largest number of surface mining equipment.

-

Which are the leading OEMs in the surface mining equipment market?

The leading OEMs in the surface mining equipment market are Caterpillar, Komatsu, Volvo, BEML, Hitachi, Belaz, Tata Motors, Scania, Liebherr, and Larsen & Toubro among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.