Royal Bank of Canada – Digital Transformation Strategies

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

RBC Digital Transformation Strategies Report Overview

Royal Bank of Canada (RBC) has been focusing on using artificial intelligence, machine learning, cloud, big data, and blockchain to digitally transform its operations. The annual ICT spending of RBC was estimated at $725.1 million for 2023. A major share of this spending is earmarked for acquiring software, consulting, and hardware from vendors. RBC is a multinational financial institution providing personal and business banking, wealth management, and institutional banking services. The personal and business banking divisions offer deposit services, loans, credit cards, mortgages, investments, bancassurance, payments, international trade, and business advisory services. The wealth management division offers investment management, wealth management, banking and custody, and credit and financing services. The institutional banking division offers global asset management and investor services. The bank operates through a network of branch offices, ATMs, and online portals and serves individuals, businesses, and high-net-worth clients.

| Total ICT Spending 2023 | $2 billion |

| ICT Spend by Function | Data center, Communications, Network, Application, End-User computing, Management, and Service Desk |

| ICT Spend by Channel | Internal development and maintenance, Technology vendors (direct), Local resellers, Telcos, ICT services providers/consulting firms, Specialist outsourcers, and Systems integrators |

| External ICT Spend by Segment | Software (including cloud SaaS), Hardware (including cloud Iaas), ICT services, Consulting, Network and communications, and Others |

| Technology Theme Focus | AI, Cloud, Blockchain and Fintech |

The RBC Digital Transformation Strategies report will act as a reference point to understand a company/competitor’s digital strategy. It will also help in understanding the digital preparedness of the company against its peers. The information included in these reports is sourced from a mix of our very own internal database and authentic secondary research links such as the company’s annual report, presentations, press releases, etc. The report covers an overview of the company, its digital transformation strategies, technology focus areas, accelerator, incubators, and other innovation programs, technology partnerships, technology introductions, venture arm, investments, acquisitions, and ICT spending among others.

Digital Transformation Strategies

RBC invests in AI solutions to improve customer experience and enhance its operational efficiency. The bank rolled out AI-powered digital platforms for both retail and institutional clients that have saved their time and offered them valuable insights. For instance, NOMI, the AI-based digital assistant for retail customers, analyzes a customer’s cash flow and provides insights on spending patterns as well as budget recommendations and suitable savings plans. It also functions as a chatbot.

Buy The Full Report To Gain More Insights On Digital Transformation Strategies And Initiatives Of RBC, Download A Free Report Sample

RBC Technology Theme Focus

RBC is utilizing several emerging technologies including AI, cloud, blockchain, and fintech among others to enhance its digital banking capabilities.

RBC Technology Theme Focus

Buy The Full Report to Know About Other Technology Themes Under Focus For The Company, Download A Free Report Sample

RBC Technology Initiatives

RBC has been involved in several strategic technology partnerships and collaborations, technology developments and rollouts, and technology investments and acquisitions over the last few years. For instance, in 2020, RBC and Borealis AI launched an AI-powered electronic stock-trading platform called Aiden. The platform uses an advanced AI technology called deep reinforcement learning to learn about stock trading in real-time and automatically execute buy and sell transactions in the best interest of clients. It also anticipates changes in the stock market and adjusts trade executions accordingly, as well as helping RBC’s customers make smart stock investments.

Buy The Full Report for More Insights on Other Technology Initiatives Of RBC, Download A Free Report Sample

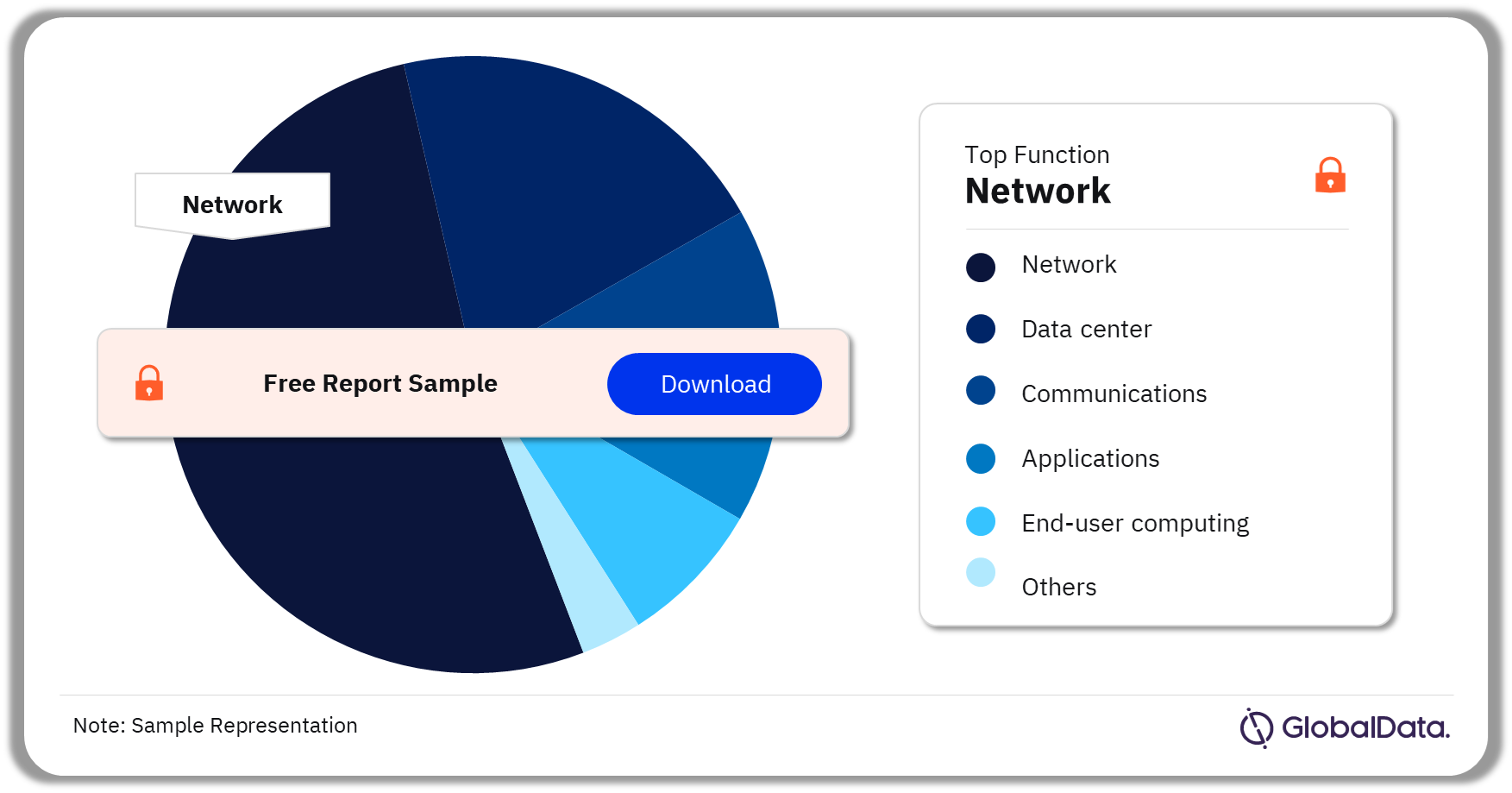

RBC ICT Spend by Function

- Datacenter

- Communications

- Network

- Applications

- End-user computing

- Management

- ICT Service desk.

RBC ICT Spend by Function, 2023 (%)

Buy The Full Report for More Insights On ICT Spending By Function, Download A Free Report Sample

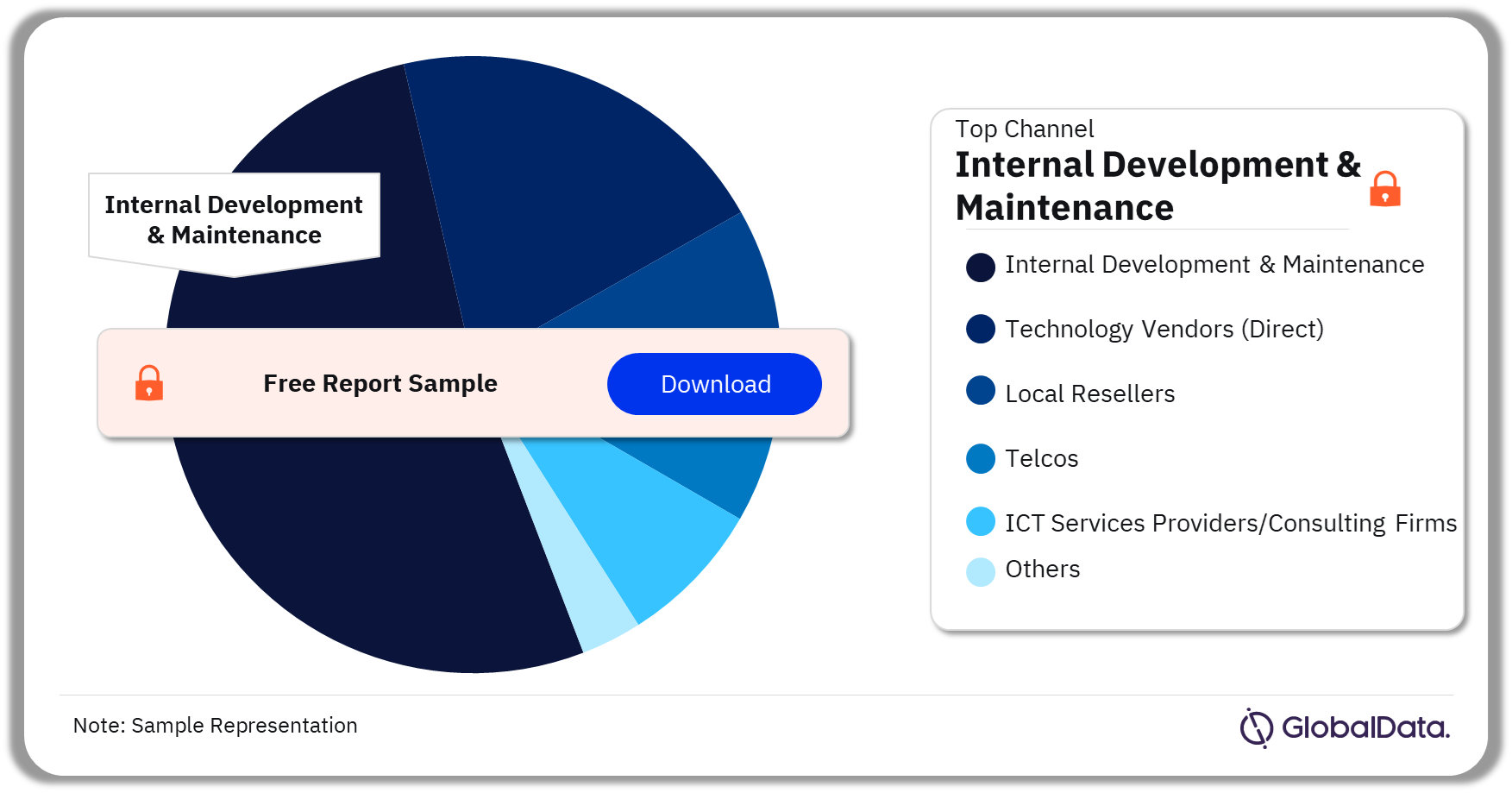

RBC ICT Spend by Channel

- Internal development and maintenance

- Technology vendors (direct)

- Local resellers

- Telcos

- ICT services providers/consulting firms

- Specialist outsourcers

- Systems integrators

RBC ICT Spend by Channel, 2023 (%)

Buy The Full Report for More Insights On ICT Spending By Channel, Download A Free Report Sample

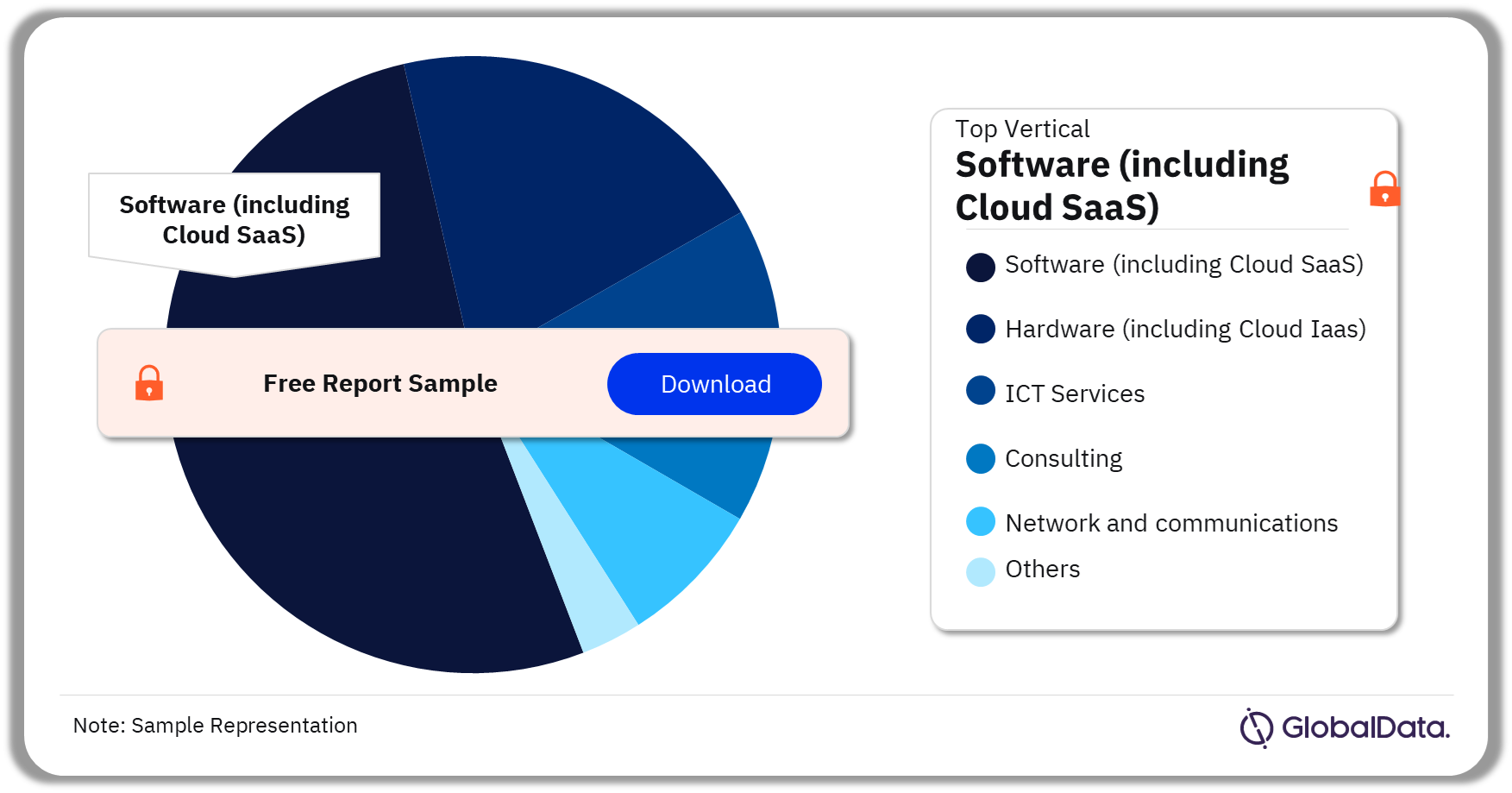

RBC External ICT Spend by Segment

- Software (including Cloud SaaS)

- Hardware (including Cloud Iaas)

- ICT services

- Consulting

- Network and communications

- Others

RBC External ICT Spend by Segment, 2023 (%)

Buy The Full Report for More Insights on External ICT Spending by Segment, Download A Free Report Sample

Scope

This report provides:

- Insight into RBC’s technology activities.

- Insights of its accelerators, incubators & innovation programs, and venture arm.

- Overview of technology initiatives covering partnerships, technology introductions, acquisitions, and investments.

- Insights on each technology initiative including technology theme, objective, and benefits.

- Details of estimated ICT budgets.

Reasons to Buy

- Gain insights into RBC’s technology operations.

- Gain insights into its technology strategies and innovation initiatives.

- Gain insights into its technology themes under focus.

- Gain insights into its various partnerships.

AI4Good Lab

CanDeal

Bread

WestJet

Microsoft

Borealis AI

DMZ

BGN Technologies

Kobalt.io

Avaloq

Sherweb

Plaid

Envestnet | Yodlee

OJO Labs

Drop Technologies

Fidel

Visible Alpha

Maple

League

TouchBistro

R3

Ryerson University

Rogers Cybersecure Catalyst

Western University

WayPay

MDBilling.ca

IBM

NEC Corp.

Table of Contents

Frequently asked questions

-

What was the total ICT spending of RBC in 2023?

The annual ICT spending of RBC was estimated at $725.1 million in 2023.

-

Which is the leading ICT spending category by function for RBC?

Network is the leading ICT spending category by function for RBC in 2023.

-

Which is the leading ICT spending category by channel for RBC?

Internal development and maintenance is the leading ICT spending category by channel for RBC in 2023.

-

Which is the leading ICT spending category by segment for RBC?

Software (including cloud SaaS) is the leading ICT spending category by segment for RBC in 2023.

-

What are the key technology themes in focus for RBC?

The key technological themes in focus for RBC are AI, cloud, blockchain, and fintech.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Financial Services reports