Robotics – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Robotics Theme Analysis Report Overview

Robotics is an industry with a long history that is only now experiencing growth due to technological, economic, and demographic conditions prevalent in the industry. AI and cloud computing are unlocking the potential of robotics by enabling robots to collaborate and access huge amounts of data uninterruptedly. Societies are also using robots to care for older people and address shortages in the workforce. Automation is key to improving productivity across various sectors, including healthcare, manufacturing, and logistics.

The robotics thematic intelligence report provides an overview of the current landscape, including technology, macroeconomic, and regulatory trends, as well as key players. The report provides an industry-specific analysis based on GlobalData databases and surveys.

| Report Pages | 65 |

| Regions Covered | Global |

| Market Size (2022) | $62.7 Billion |

| CAGR (2022-2030) | >16% |

| Value Chain | · Hardware Components

· Robot Manufacturing · Software Components · Robotics as a Service |

| Leading Companies | · Cognex

· Cyberdyne · Estun Automation |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Robotics – Key Trends

The main trends shaping the robotics theme over the next 12 to 24 months are technology, macroeconomic, and regulatory trends.

- Technology trends: Some of the key technology trends impacting the theme are AI, edge computing, cybersecurity, industrial internet, cloud robotics, robotics centers of excellence (CoEs), and others.

- Macroeconomic trends: Some of the macroeconomic trends impacting the theme are China’s global economic and industrial impact, the robotics industry in Japan and Europe, and the Russia-Ukraine war.

- Regulatory trends: The usage of drones, China’s regulatory landscape, and ethical issues are the regulatory trends impacting the robotics theme.

Robotics – Industry Analysis

The robotics industry was worth $62.7 billion in 2022 and is expected to achieve a CAGR of more than 16% during 2022-2030. The robotics industry can be split into two main areas which are industrial robots and service robots. They can be further subdivided into additional categories, with service robots being a particularly fragmented category.

The Robotics industry analysis also covers:

- Timeline

Service and Industrial Robot Revenue 2020-2030 ($ Billion)

Buy Full Report for More Insights into the Robotics Revenue Forecast

Robotics - Value Chain Analysis

The robotics value chain consists of four segments: hardware components, software components, robot manufacturing, and robotics as a service. Depending on the application, level of sophistication, and reliability requirements, robotics generally involves several levels of control and processing, including onboard hardware and software and, increasingly, cloud processing and the pooling of knowledge from multiple robots.

Robot manufacturing: Robot manufacturing can be further divided into industrial robots and service robots. Industrial robots are typically housed in safety cages as they lack sensory intelligence, making them too dangerous to be placed near workers for fear of injury. China is the key growth driver for the industrial robot sector due to the accelerating automation in the Chinese manufacturing sector and the retooling of its automotive factories. Growth in the market is also driven by increasing demand for automation in industries other than automotive.

Robotics Value Chain Analysis

Buy Full Report for More Insights into the Robotics Value Chain

Robotics – Competitive Analysis

Some of the leading companies making their mark within the robotics theme are:

- Cognex

- Cyberdyne

- Estun Automation

Buy the Full Report to Learn More About the Leading Robotics Companies

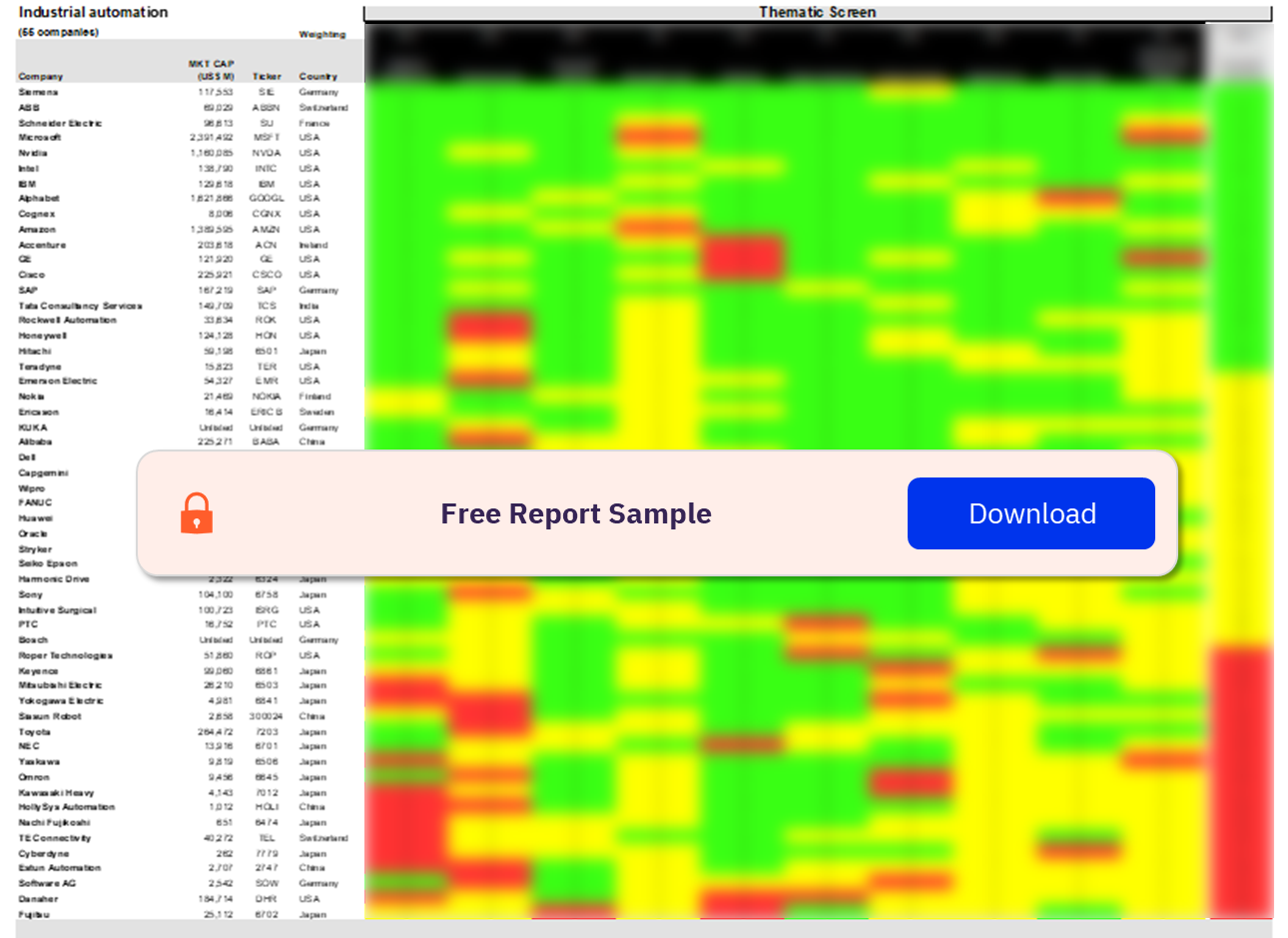

Industrial Automation Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our sector scorecard has three screens: a thematic screen, a valuation screen, and a risk screen.

- The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

- The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

- The risk screen ranks companies within a particular sector based on overall investment risk.

Industrial Automation Sector Scorecard – Thematic Screen

Buy Full Report to Know More About the Sector Scorecards

The Robotics sector scorecard also covers:

- Consumer electronics sector scorecard

Scope

This report provides:

- An overview of the robotics theme.

- The key trends impacting the growth of the theme over the next 12 to 24 months are split into three categories: technology trends, macroeconomic trends, and regulatory trends.

- Comprehensive industry analysis, including forecasts for robotics revenues to 2030. These forecasts are split by robot type (industrial and service).

- Details of M&A deals driven by the robotics theme, and a timeline highlighting milestones in the development of robotics.

- Detailed value chain comprising four core segments: hardware components, software components, robot manufacturing, and robotics as a service. Leading and challenging vendors are identified for sub-categories across all four segments.

Key Highlights

Science fiction often speculates about robots that are virtually indistinguishable from humans. Yet, the most popular consumer robot is still a vacuum cleaner shaped like a disc. In factories and warehouses, human staff work alongside robots that are incredibly good at performing repetitive and dangerous tasks but do not look or behave like humans. In the future, AI will allow robots to identify human emotions, and the field of soft robotics is developing robots from materials similar to those found in living organisms. There is a chance that one day life will imitate art, and robots will look like people. If and when that happens, societies will face an ethical conundrum: what rights do we give non-human creatures that look like us?

Reasons to Buy

Robotics has a long history, but only relatively recently have conditions aligned to unlock its full potential. This report provides a clear and comprehensive overview of the robotics theme and explains the conditions driving its growth. It also includes details of leading vendors across all aspects of the robotics market, from caged industrial robots and industrial co-bots to consumer robots and drones.

6 River Systems

ABB

Aeronvironment

Aethon

Agrobot

Air Hogs

Airbus

AIST

Alibaba

Alphabet

Amazon

Ambarella

AMD

American Robotics

AMS

Anduril

ANYbotics

Apple

Arxium

Aselsan

AUBO Robotics

Autel Robotics

AVIC

Avidbots

BAE Systems

Baidu

Baker Hughes (Waygate)

Barrett Technology

Baykar

Bear Robotics

BigML

Bionik Laboratories

Blue Frog Robotics

Boeing

Broadcom

C2RO

Cambricon

CASC

Cerebras

Cisco

Clearpath

Cognex

Coherent Corp

Corin Group

Cyberdyne

Daihen

Delair

Denso

Diligent Robotics

DJI

Dyson

EcoRobotix

Ecovacs

Ehang

Ekso Bionics

Elbit Systems

Electrolux

Emax

Embodied

Estun Automation

ExRobotics

FANUC

Festo

First Sensor

Five Elements Robotics

Flyability

Flytrex

Focal Medtech

Franka Emika

Freefly

Fujitsu

GE

GE Digital

Gecko Robotics

General Atomics

General Dynamics

Genrobotic

GestureTek

Globus Medical

Graphcore

Grey Orange

GSK CNC

Hahn Group (Rethink Robotics)

Haier

Halo

Harmonic Drive

Hasbro

Hindustan Aeronautics

Hitachi

HollySys

Hon Hai (Foxconn)

Honda Robotics

Honeywell

Horizon Robotics

Huawei (HiSilicon)

Hubsan

Huntington Ingalls

Hyundai Motor

IAI

IAM Robotics

IBM

iFlytek

Indie Semiconductor

Infineon

Intel

Intuition Robotics

Intuitive Surgical

InVia Robotics

iRobot

Jabil Circuit

John Deere

Johnson & Johnson

Kawasaki

Keyence

KOKS

Kompaï Robotics

Kongsberg Maritime

Kore.ai

Korea Aerospace Ind.

Kratos Defense

Krauss-Maffei Wegmann

Lego

LG Electronics

Lockheed Martin

Locus Robotics

Marvell

Maxon

MediaTek

Medtronic

Microchip

Microport MedBot

Microsoft

Midea (Kuka)

Milrem Robotics

Mitsubishi Motors

Myomo

Nabtesco

Nachi-Fukikoshi

Naval Group

Neurala

Nexter

Nippon Ceramic

Noos

Northrop Grumman

Nvidia

NXP

Omnicell

Omron

Ottobock

Ouster

Parker Hannifin

Parrot

PickNik Robotics

PredicSis

Procept Biorobotics

Q-BOT

Qinetiq

Qorvo

Qualcomm

Quanergy

Rabbit Tractors

Rapyuta

Raytheon Technologies

RDA Microelectronics

Revolve Robotics

ReWalk Robotics

Rheinmetall

Robert Bosch

Robotiq

Rockwell Automation

Rokid

Rokoko

Rowbot

Saab

Samsung Electronics

SAP

Schneider Electric

Seegrid

Seiko Epson

Sensata

Sentient Tech

SharkNinja

Siasun Robotics

Siemens Healthineers

Skydio

Skyworks

Small Robot Company

Soft Robotics

Softbank

Sony

Spin Master

Stellantis (Comau)

Stihl

STMicroelectronics

Stryker

SuitX

TDK

TE Connectivity

Teledyne Technologies

Tend.AI

Teradyne (Universal Robots)

Texas Instruments

Textron

Thales

Tharsus

Toyota

Trimble

TSMC

Turkish Aerospace Ind.

UBtech

Ultraleap

UNISOC

Uvify

Vecna

Venus Concept

Vicarious Surgical

Walkera

Wingcopter

Xiaomi

Yaskawa

Yuneec

Zimmer Biomet

Zipline

Zora Robotics

Table of Contents

Frequently asked questions

-

What was the size of the robotics market in 2022?

The robotics market was worth $62.7 billion in 2022.

-

What is the growth rate of the robotics market?

The robotics market is expected to achieve a CAGR of more than 16% during 2022-2030.

-

What are the components of the robotics value chain?

The robotics value chain consists of four segments which are hardware components, software components, robot manufacturing, and robotics as a service.

-

Who are the leading companies in the robotics industry?

Some of the leading companies in the robotics industry are Cognex, Cyberdyne, and Estun Automation.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.