Rabobank – Enterprise Tech Ecosystem Series

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Rabobank Enterprise Tech Ecosystem Report Overview

Rabobank has been focusing on using artificial intelligence, cloud, big data, mobile payments and blockchain to digitally transform its operations. The annual ICT spending of Rabobank was estimated at $1.2 billion for 2022. A major share of this spending is earmarked for acquiring software, ICT services and hardware from vendors. Rabobank offers global banking and other related financial solutions to commodity traders, large corporates, startups, financial institutions, and private equity firms. It provides a wide range of accounts, deposits, cards, loans, term deposits, managed funds, agriculture and rural advisory, and leasing.

The Rabobank Digital Transformation Strategies report will act as a reference point to understand a company/competitor’s digital strategy. It will also help in understanding the digital preparedness of the company against its peers. Information included in these reports are sourced from a mix of our very own internal database and authentic secondary research links such as company’s annual report, presentations, press releases etc. The report covers overview of the company, its digital transformation strategies, technology focus areas, accelerators, incubators, and other innovation programs, technology partnerships, technology introductions, venture arm, investments, acquisitions and ICT spending among others.

Digital Transformation Strategies

Rabobank invests in innovative technologies including artificial intelligence and robotics, while strengthening its capabilities to reduce the risk of cybercrime through cloud and data analysis technologies. Rabobank has around 450 virtual employees who collect and check data from internal and external sources. This helps the bank be more efficient, more consistent, and less error prone.

To gain more insights on digital transformation strategies and initiatives of Rabobank, download a free report sample.

Rabobank Technology Theme Focus

Rabobank is utilizing a number of emerging technologies including artificial intelligence, cloud, big data, mobile payments and blockchain among others to enhance its operational and service capabilities.

Robobank Technology Focus

To know about other technology themes under focus for the company, download a free report sample

Rabobank Technology Initiatives

Rabobank has been involved in several strategic technology partnerships and collaborations, technology developments and roll outs, and technology investments and acquisitions over the last few years. For instance, in 2021, Rabobank launched video calling for business loans, enabling B2B clients to apply for loans via video call through the Rabobank website by leveraging video conferencing service provider 24sessions’ solutions. To apply for a loan, clients need to schedule a video call with a Rabobank SME account manager. This initiative forms part of the bank’s efforts to digitize and centralize loan application processes by eliminating the need for physical appointments.

For more insights on other technology initiatives of Rabobank, download a free report sample

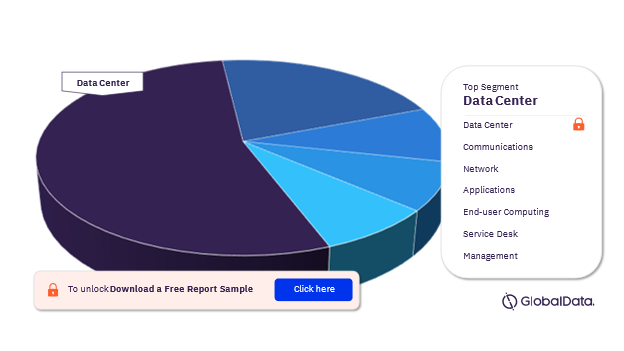

Rabobank ICT Spend by Function

- Data center

- Communications

- Network

- Applications

- End-user computing

- Management

- ICT Service desk

Rabobank ICT Spend by Function, 2022

For more insights on ICT spending by function, download a free report sample

For more insights on ICT spending by function, download a free report sample

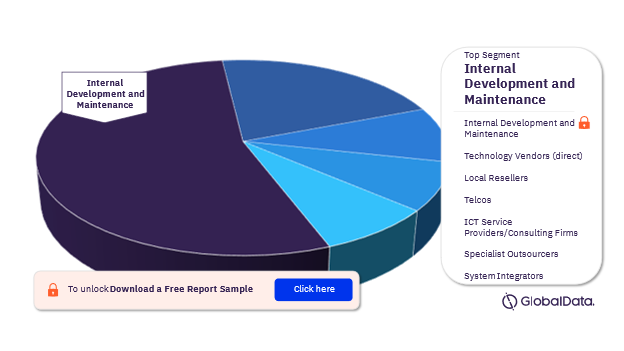

Rabobank ICT Spend by Channel

- Internal development and maintenance

- Technology vendors (direct)

- Local resellers

- Telcos

- ICT services providers/consulting firms

- Specialist outsourcers

- Systems integrators

Rabobank ICT Spend by Channel, 2022

For more insights on ICT spending by channel, download a free report sample

For more insights on ICT spending by channel, download a free report sample

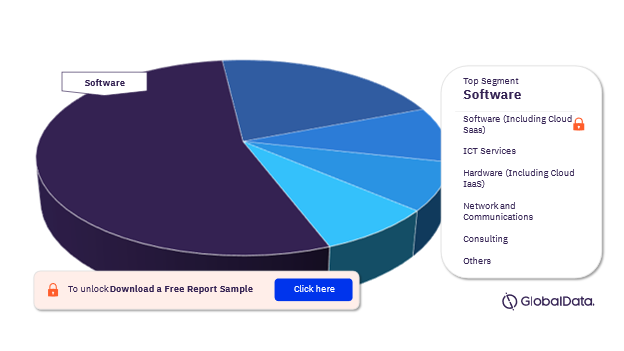

Rabobank External ICT Spend by Segment

- Software (including Cloud SaaS)

- Hardware (including Cloud Iaas)

- ICT services

- Consulting

- Network and communications

- Others

Rabobank External ICT Spend by Segment, 2022

For more insights on external ICT spending by segment, download a free report sample

For more insights on external ICT spending by segment, download a free report sample

Rabobank Digital Transformation Strategies Overview

| Total ICT Spending 2022 | $1.2 billion |

| ICT Spend by Function | Data center, Communications, Network, Application, End-User computing, Management, and Service desk |

| ICT Spend by Channel | Internal development and maintenance, Technology vendors (direct), Local resellers, Telcos, ICT services providers/consulting firms, Specialist outsourcers, and Systems integrators |

| External ICT Spend by Segment | Software (including cloud SaaS), Hardware (including cloud Iaas), ICT services, Consulting, Network and communications, and Others |

| Technology Theme Focus | Artificial intelligence, cloud, big data, mobile payments and blockchain. |

This report provides:

- Insight into Rabobank’s technology activities.

- Insights of its accelerators, incubators, & innovation programs, and venture arm.

- Overview of technology initiatives covering partnerships, technology introductions, acquisitions, and investments.

- Insights on each technology initiative including technology theme, objective, and benefits.

- Details of estimated ICT budgets.

Reasons to Buy

- Gain insights into Rabobank’s technology operations.

- Gain insights into its technology strategies and innovation initiatives.

- Gain insights into its technology themes under focus.

- Gain insights into its various partnerships.

Digital Agricultural Services

Expert System

Mastercard

Sparkholder

Euroclear

IBM

Innovalor

iProov

Signicat

nCino

Identitii

TIE Kinetix

Veeam Software

Hitachi Vantara

Cloudian

Finastra

ACI Worldwide

equensWorldline

GoCredible

Mendix

Surecomp

HPD Lendscape

Bol.com

Brilliance Financial Technology

InvestCloud

Dynatrace

Telstra

Table of Contents

Frequently asked questions

-

What was the total ICT spending of Rabobank in 2022?

The annual ICT spending of Rabobank was estimated at $1.2 billion in 2022.

-

What are the key ICT spending categories by function for Rabobank?

The key ICT spending categories by function for Rabobank are communications, data center, network, applications, end-user computing, ICT service desk, and management.

-

What are the key ICT spending categories by channel for Rabobank?

The key ICT spending categories by channel for Rabobank are internal development and maintenance, technology vendors (direct), local resellers, telcos, ICT services providers/consulting firms, specialist outsourcers, and systems integrators.

-

What are the key external ICT spending categories by segment for Rabobank?

The key external ICT spending categories by segment for Rabobank are ICT services, software (including cloud SaaS), hardware (including cloud IaaS), ICT services, network and communications, consulting, and others.

-

What are the key technology themes in focus for Rabobank?

The key technological theme in focus for Rabobank are artificial intelligence, cloud, big data, mobile payments and blockchain.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Retail Banking and Lending reports