Philippines Packaging Market Size, Analyzing Material Type, Innovations and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Philippines Packaging Market Report Overview

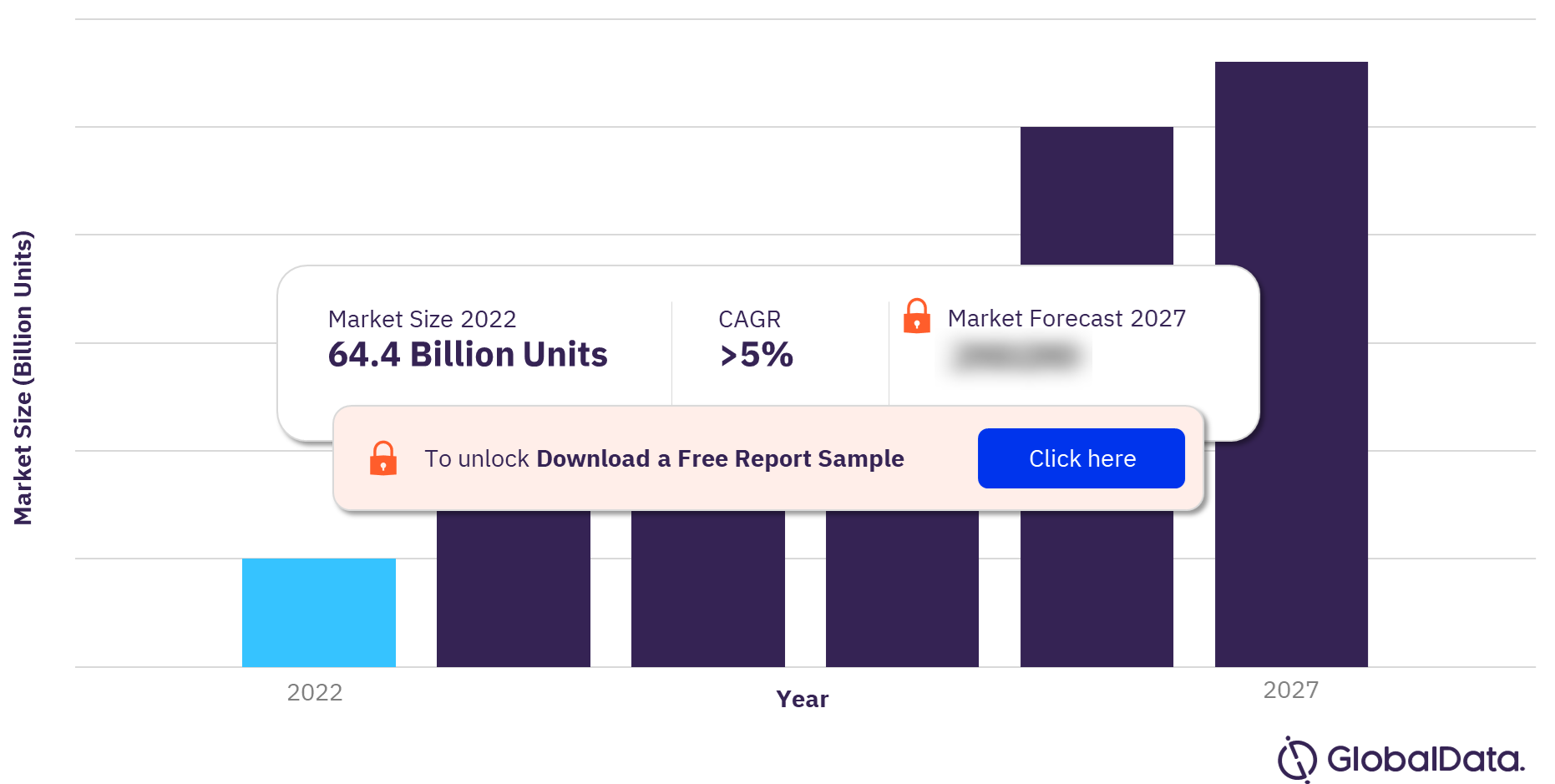

The Philippines packaging market size was valued at 64.4 billion units in 2022. The market is anticipated to register a CAGR of more than 5% during 2022-2027.

Philippines Packaging Market Overview, 2022-2027 (Billion Units)

For more insights on the Philippines packaging market forecasts, download a free sample report

The Philippines packaging market report brings together multiple data sources to provide a comprehensive overview of the packaging industry in Philippines, as part of our coverage of the industry across 50 countries. Furthermore, the Philippines packaging market research report provides an overview of the usage of different packaging materials across different industries in terms of the number of units, packaging share and growth rates during 2017–27, in addition to key packaging innovations for key industries in each of the categories analyzed. The report also includes data and analysis for five-pack materials across several sectors.

| Market Size (2022) | 64.4 billion units |

| CAGR (2022-2027) | >5% |

| Key Pack Materials | Rigid Plastics, Rigid Metal, Paper & Board, Flexible Packaging, and Glass |

| Key Industries | Food, Alcoholic Beverages, Non-Alcoholic Beverages, Cosmetics & Toiletries, and Other Industries |

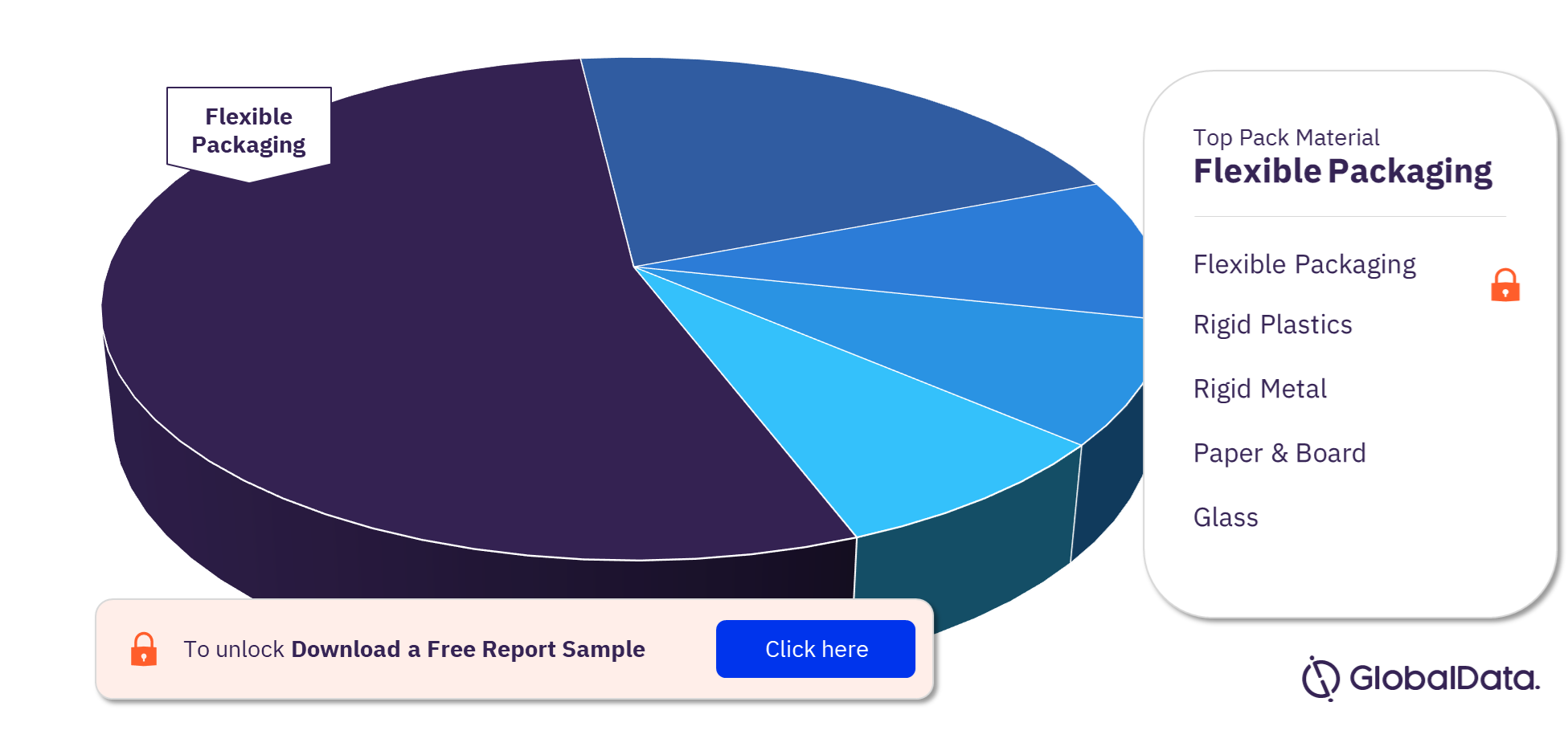

Philippines Packaging Market Segmentation by Pack Material

The key pack materials in the Philippines packaging market are rigid plastics, rigid metal, paper & board, flexible packaging, and glass. In 2022, the flexible packaging segment dominated the Philippines packaging market share and will continue to dominate through 2027. This was followed by rigid plastics and glass. Flexible packaging’s low cost and multiple shapes and sizes contribute to its significant usage in packaging. The packaging material offers easy and convenient storage. However, rigid metal is anticipated to record the fastest growth during the period 2022-2027, followed by glass and flexible packaging.

Philippines Packaging Market Analysis by Pack Material, 2022 (%)

For more pack material insights in the Philippines packaging market, download a free sample report

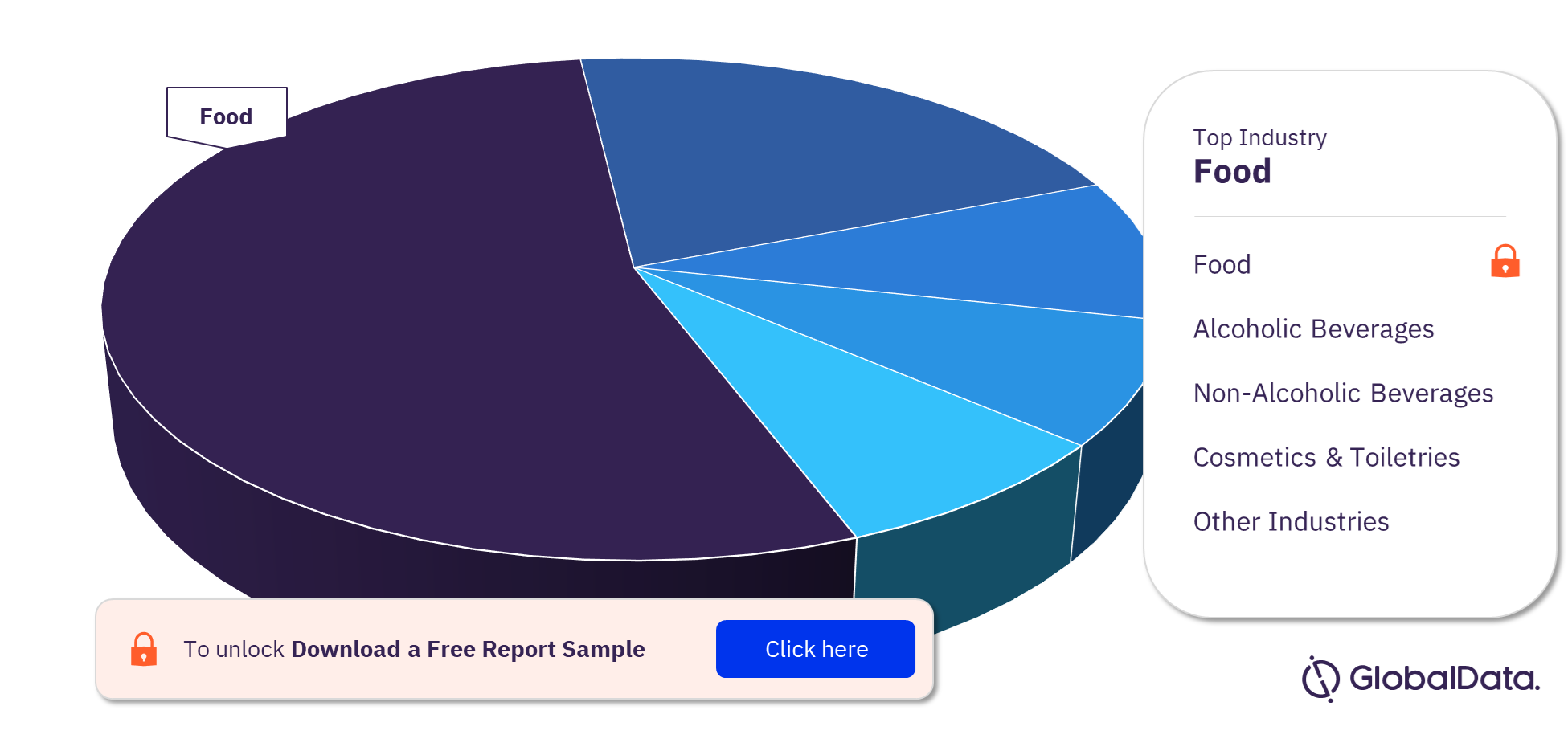

Philippines Packaging Market Segmentation by Industry

The key industries using pack materials in the Philippines packaging market are food, alcoholic beverages, non-alcoholic beverages, cosmetics & toiletries, and other industries. The packaging industry in Philippines is characterized by its strong use in the food industry, accounting for a more than 47% share in terms of size, in 2022. In the food industry, flexible packaging is the most widely used pack material, followed by rigid plastics. The demand for flexible packaging in food products is mostly attributed to its high consumption in dairy & soy food, meat, and bakery and cereals wherein consumers prefer products that provide the benefits of safe delivery and ease of transportation.

Philippines Packaging Market Analysis by Industry, 2022 (%)

For more industry insights in the Philippines packaging market, download a free sample report

Key Segments Covered in this Report

Philippines Packaging Market by Pack Material Outlook (2017-2027)

- Rigid plastics

- Rigid metal

- Paper & board

- Flexible packaging

- Glass

Philippines Packaging Market by Industry Outlook (2022-2027)

- Food

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Cosmetics & Toiletries

- Other industries

Scope

This report provides:

- Multiple data sources to provide a comprehensive overview of the Packaging industry in Philippines.

- Overview of the usage of different packaging materials across different industries in terms of the number of units, packaging share and growth rates during 2017–27, in addition to key packaging innovations for key industries in each of the categories analyzed.

- Overview of the shift in the utilization of various pack materials across sectors.

- Data and analysis including the number of units (millions) and growth rates for five pack materials viz. rigid plastics, rigid metal, glass, paper & board, flexible packaging, and others.

- Pack sub-type, pack type, closure material, closure type, primary outer material, and primary outer type.

Reasons to Buy

- Manufacturers and retailers seek the latest information on how the market is evolving to formulate their sales and marketing strategies. There is also a demand for authentic market data with a high level of detail.

- This report has been created to provide its readers with up-to-date information and analysis to uncover emerging opportunities for growth within the sector in the region.

- The report provides a detailed analysis of the countries in the region, covering the key challenges, competitive landscape, and demographic analysis, that can help companies gain insight into the country-specific nuances.

- The analysts have also placed a significant emphasis on the key trends that drive consumer choice and the future opportunities that can be explored in the region, which can help companies in revenue expansion.

- To gain competitive intelligence about leading brands in the sector in the region with information about their market share and growth rates.

Table of Contents

Frequently asked questions

-

What was the Philippines packaging market size in 2022?

The Philippines packaging market size was valued at 64.4 billion units in 2022.

-

What is the Philippines packaging market growth rate during 2022-2027?

The Philippines packaging market will register a CAGR of more than 5% during 2022-2027.

-

Which segment accounted for the largest Philippines packaging market share in 2022?

In 2022, the flexible packaging segment dominated the Philippines packaging market share.

-

Which industry dominated the Philippines packaging market in 2022?

The food industry dominated the Philippines packaging market in 2022.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.