Philippines Defense Market Size, Trends, Budget Allocation, Regulations, Acquisitions, Competitive Landscape and Forecast to 2029

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Philippines Defense Market Report Overview

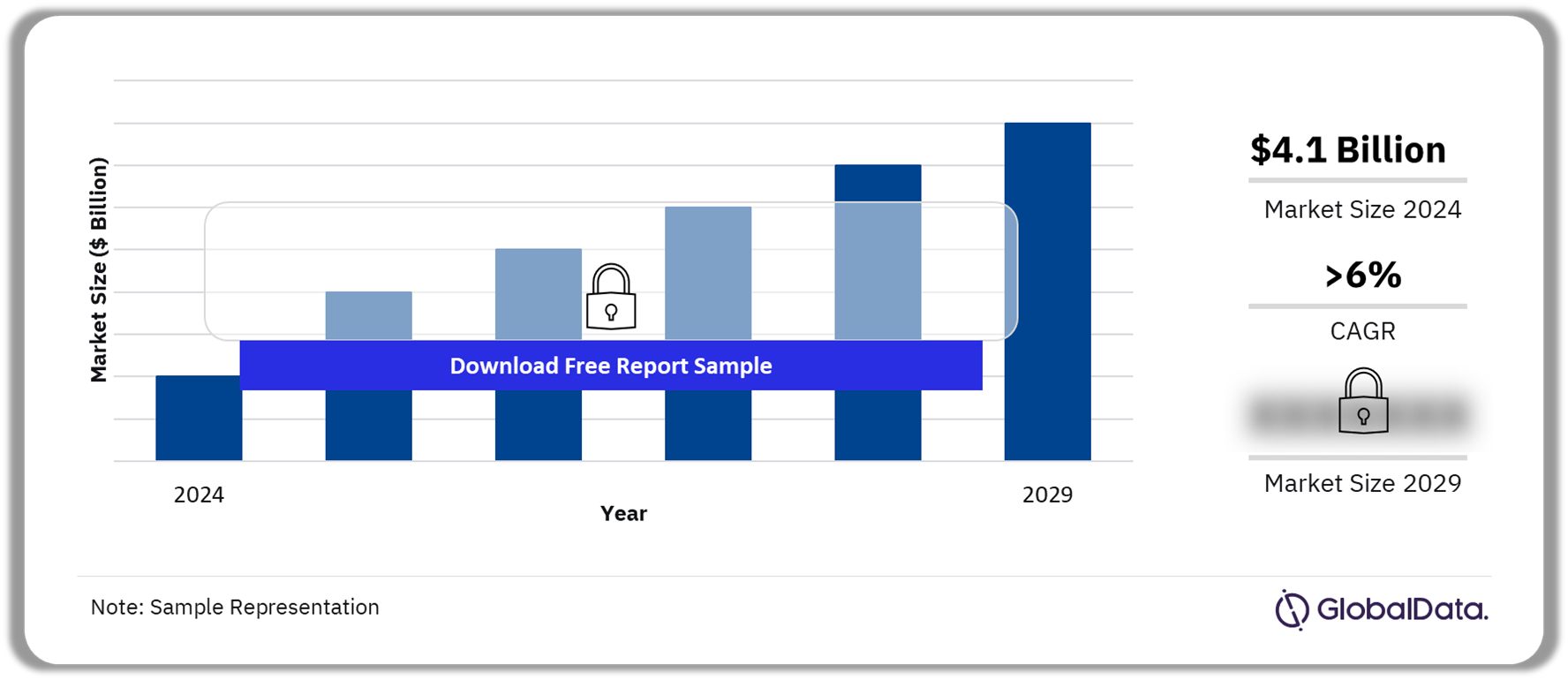

The Philippines defense budget is worth $4.1 billion in 2024 and is expected to register a robust CAGR of more than 6% during 2025-2029. Territorial claims in the South China Sea and the increasing strength and assertiveness of the Chinese armed forces have spurred the Philippines government to enhance its military capabilities, driving the Philippines’s defense expenditure. Additionally, the Philippines is planning to replace its obsolete equipment to combat the modern threat scenario. The country is expected to procure fighter and multirole aircraft, armored vehicles, naval vessels, patrol ships, maritime patrol aircraft, and surveillance equipment over the forecast period.

Philippines Defense Market Outlook, 2024-2029 ($ Billion)

Buy the Full Report for More Insights into the Philippines Defense Market Forecast

The Philippines defense market research report provides the market size forecast and the projected growth rate for the next five years. Furthermore, our analysts have carried out a comprehensive industry analysis to determine key market drivers, emerging technology trends, key sectors, and major challenges faced by market participants, in this report. The Philippines defense market study has also assessed key factors and government programs that are expected to influence the demand for military platforms over the forecast period.

| Market Size (2024) | $4.1 billion |

| CAGR (2025-2029) | >6% |

| Forecast Period | 2025-2029 |

| Historical Period | 2020-2024 |

| Key Drivers | · Rise of Terrorism

· Tensions in the South China Sea |

| Key Sectors | · Military Fixed-wing Aircraft

· Naval Vessels and Surface Combatants · Missiles and Missile Defense Systems · Submarines · Military Rotorcraft |

| Leading Companies | · Lockheed Martin

· HD Hyundai Co Ltd · Israel Shipyards · Boeing · Elbit Systems |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Philippines Defense Market Drivers

The defense budget is currently being driven by threats from terrorist organizations, tensions in the South China Sea, and efforts to modernize the armed forces.

Tension in the South China Sea is expected to augment naval procurement by the Philippines: China’s sovereignty claims over territory in the South China Sea, and the estimated 190 trillion cubic feet of natural gas and 11 billion barrels of untapped oil, have antagonized competing claimants such as the Philippines, Malaysia, Indonesia, Brunei, Vietnam, and Taiwan. These territorial disputes in the South China Sea have fueled military expenditure by Association of South East Asian Nations (ASEAN) members. Furthermore, illegal incursions have alarmed the Philippines government, which is therefore spending to strengthen its navy and air force by purchasing missile-guided frigates, gunboats, and two anti-submarine attack helicopters. The Philippines is prepared to deploy more coast guard ships to protect its fishermen from harassment by Chinese vessels within Manila’s exclusive economic zone in the South China Sea.

Buy the Full Report for Additional Information on the Philippines Defense Market Drivers

Philippines Military Doctrines and Defense Strategies

The Philippines’ comprehensive security doctrine is focused on the acquisition of a wide range of security assets, to establish diplomatic and geographic advantages. The Philippines is also aiming to develop robust military capabilities through its ambitious Horizon I, II, and III programs to ensure tranquility, peace, and stability. The AFP Modernization Act aims to develop a self-reliant and credible strategic armed force, professionalize the AFP, and acquire and upgrade appropriate technology and equipment.

Furthermore, the country has been forming strategic alliances and partnerships with the US, Croatia, South Korea, and Indonesia. The United States and the Philippines have a long-standing strategic relationship in terms of defense. The US is a key partner in the Philippines’ Horizon II modernization program, providing military assistance and facilitating defense acquisitions. Similarly, the Philippines and South Korea have a strong and growing defense relationship. Both countries have been working to strengthen their partnership in the areas of defense, security, and counterterrorism. The military alliance between South Korea and the Philippines is considered one of the key military alliances in Asia.

Buy the Full Report for More Insights on the Military Doctrines and Defense Strategies in the Philippines Defense Market

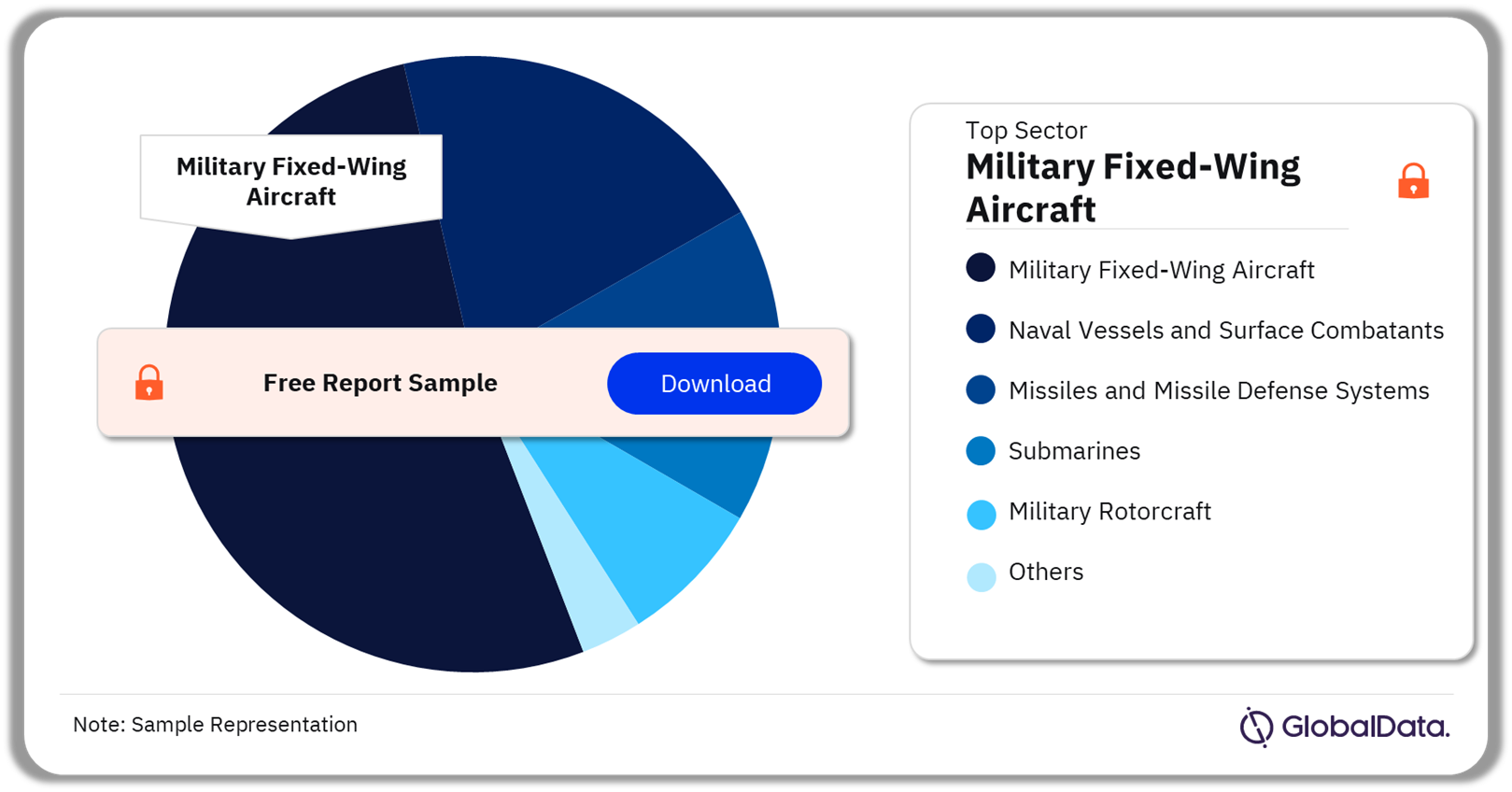

Philippines Defense Market Segmentation by Sectors

The key sectors in the Philippines defense market are military fixed-wing aircraft, naval vessels and surface combatants, missiles and missile defense systems, submarines, and military rotorcraft among others. The military fixed-wing aircraft sector was the largest sector within the Philippines defense market in 2024. The sector ranks first within the Philippines defense market with a cumulative investment of $3.5 billion during 2023-2028, with the highest contribution from multirole aircraft and transport aircraft.

Philippines Defense Market Analysis by Sectors, 2024 (%)

Buy the Full Report for More Sector Insights into the Philippines Defense Market

Philippines Defense Market - Competitive Landscape

A few of the leading defense companies operating in Philippines are:

- Lockheed Martin

- HD Hyundai Co Ltd

- Israel Shipyards

- Boeing

- Elbit Systems

Lockheed Martin is headquartered in Bethesda, Maryland, the US. The company manufacturers security and aerospace products. The company is involved in research, design, development, manufacture, and integration of advanced technology systems, products, and services. It also offers management, technical, engineering, scientific, logistics, system integration, and cybersecurity services.

Philippines Defense Market Analysis by Companies

Buy the Full Report for More Company Insights into the Philippines Defense Market

Segments Covered in the Report

Philippines Defense Market Sectors Outlook (Value, $ Million, 2020-2029)

- Military Fixed-wing Aircraft

- Naval Vessels and Surface Combatants

- Missiles and Missile Defense Systems

- Submarines

- Military Rotorcraft

Scope

The report provides:

- Detailed analysis of the Philippines 2024 defense budget broken down into market size and market share.

- Overview of key current and future acquisitions.

- Explanation of the procurement policy and process.

- Analysis of Philippines’s military doctrine and strategy to provide a comprehensive overview of Philippines’s military procurement regulation.

- Outline of political alliances and perceived security threats to Philippines and trends in spending and modernization.

- Analysis of the competitive landscape and strategic insights of Philippines’s defense industry.

Key Highlights

• Drivers of Defense expenditure include military modernization, national security concerns, internal security challenges

• Major ongoing procurement programs include procurement of Wonhae-class Offshore Patrol Vessels, Fast Attack Interdiction Boats, S-70

Reasons to Buy

- Determine prospective investment areas based on a detailed trend analysis of the Philippines defense market over the next five years.

- Understand the underlying factors driving demand for different defense and internal security segments in the Philippines market and identify the opportunities offered.

- Strengthen your understanding of the market in terms of demand drivers, market trends, and the latest technological developments, among others.

- Identify the major threats that are driving the Philippines defense market providing a clear picture of future opportunities that can be tapped, resulting in revenue expansion.

- Channel resources by focusing on the ongoing programs that are being undertaken by the Philippines government.

- Make correct business decisions based on an in-depth analysis of the competitive landscape consisting of detailed profiles of the top defense equipment providers in the country. The company profiles also include information about the key products, alliances, recent contracts awarded, and financial analysis, wherever available.

Table of Contents

Frequently asked questions

-

What was the Philippines defense market size in 2024?

The defense market size in Philippines is estimated to be $4.1 billion in 2024.

-

What will the Philippines defense market growth rate be during the forecast period?

The defense market in Philippines is expected to achieve a CAGR of more than 6% during 2025-2029.

-

Which sector accounted for the highest market attractiveness in the Philippines defense market in 2024?

The military fixed-wing aircraft sector accounted for the highest market attractiveness in the Philippines defense market in 2024.

-

Which are the key companies operating in the Philippines defense market?

A few of the leading defense companies operating in the Philippines are Lockheed Martin, HD Hyundai Co Ltd, Israel Shipyards, Boeing, Elbit Systems, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Homeland Security reports