Motor Insurance Market Trends and Analysis by Region, Line of Business, Competitive Landscape and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Motor Insurance Market Report Overview

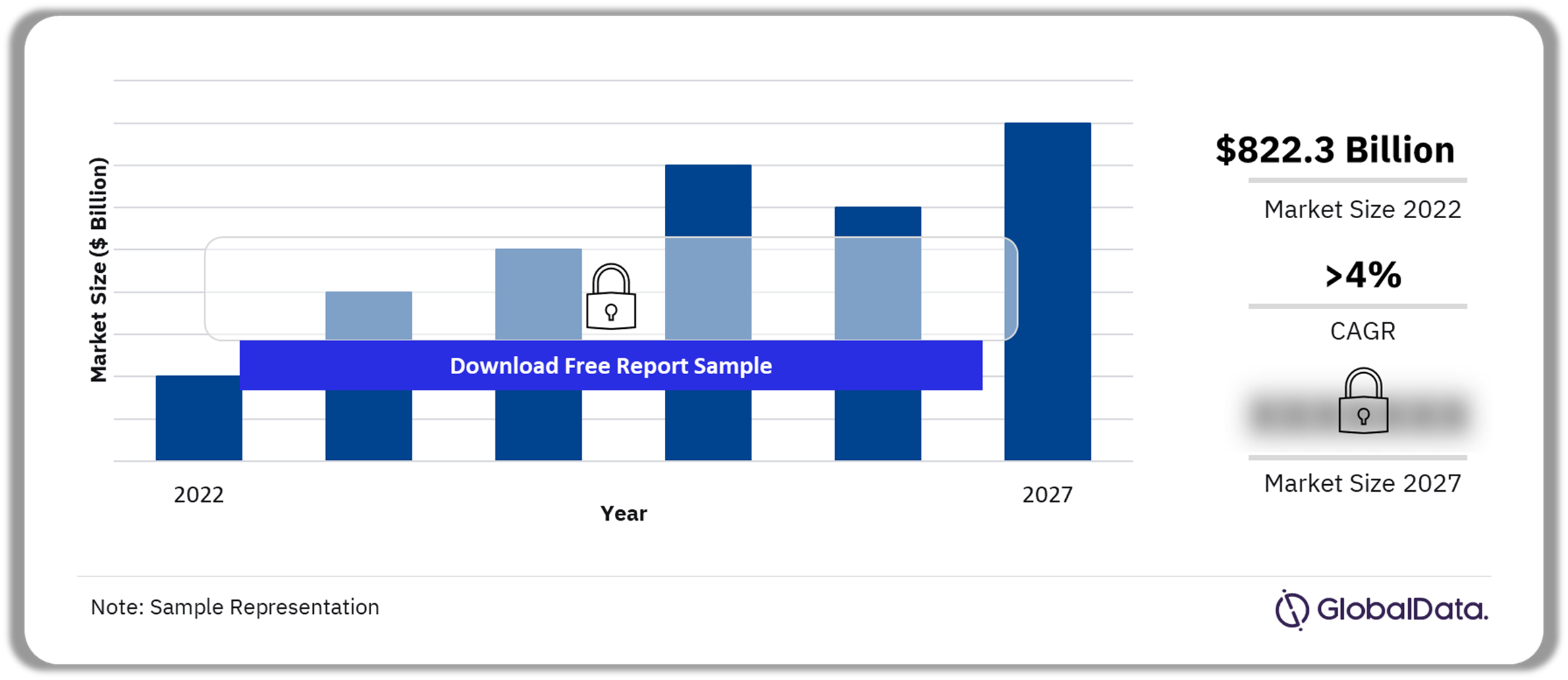

The motor insurance industry’s written premium was $822.3 billion in 2022. The market is expected to gain pace from 2024 and achieve a CAGR of more than 4% during 2023-2027. The motor insurance market research report provides in-depth market analysis, information, and insights into the global and regional motor insurance industry. It provides a detailed outlook and values for key performance indicators such as written premiums and claims during the review and forecast period.

Motor Insurance Market Outlook, 2022-2027 ($ Billion)

Buy Full Report for More Insights into the Motor Insurance Market Forecast

The report gives a comprehensive overview of the global and regional motor insurance industry, key lines of business, key trends, drivers, challenges, regulatory overview, developments in the industry, and insights into key technological developments impacting the market. The report provides a detailed analysis of the competitive landscape, overview, and comparative analysis of leading companies and top insurance markets’ premium and profitability trends for every region. It also gives insurers access to information on motor insurance dynamics in the country.

| Market Size (2022) | $822.3 billion |

| CAGR (2023-2027) | >4% |

| Forecast Period | 2023-2027 |

| Historical Period | 2018-2022 |

| Key Lines of Business | · Motor Hull

· Motor Third-Party Liability (MTPL) · Others |

| Key Regions | · North America

· Asia-Pacific · Europe · Middle East and Africa · South and Central America |

| Leading Insurers | · Progressive

· State Farm · PICC · Berkshire Hathaway · Ping An |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Motor Insurance Market Trends

- Falling EV prices, longer battery ranges, and more global charging infrastructure will drive the demand for EVs. Moreover, governments across the world are implementing policies and incentives to encourage people to use EVs, as well as investing in the infrastructure required for their success. This represents an opportunity for the automotive and insurance industries.

- Likewise, in many markets, regulatory frameworks are being developed regarding insurance related to autonomous vehicles and automated driving.

- Recently, telematics-oriented policies have become increasingly popular among both consumers and businesses.

Motor Insurance Market Segmentation by Lines of Business

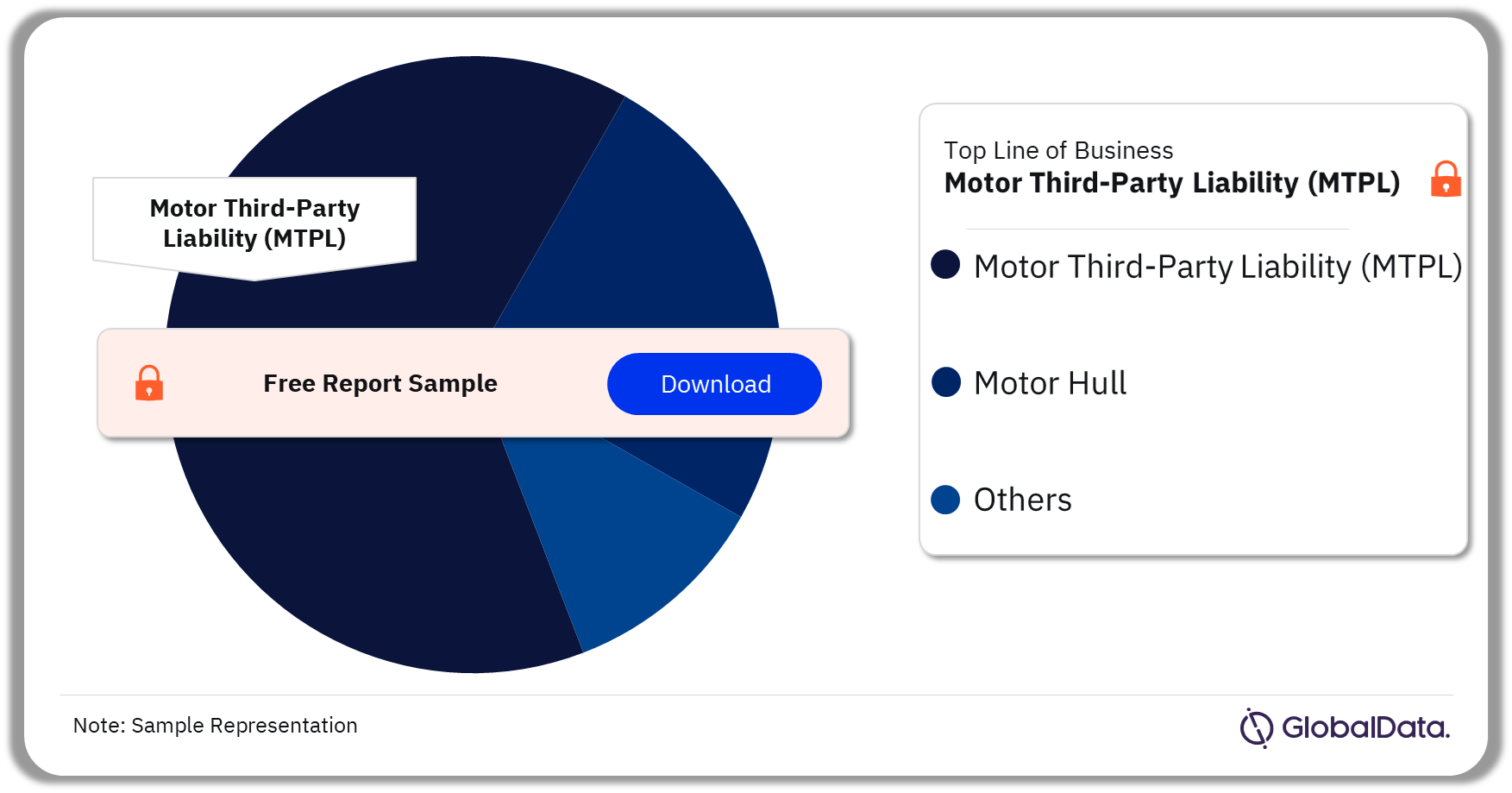

Motor third-party liability (MTPL) insurance was the leading motor insurance LOB in 2022

The lines of business included in the motor insurance market are motor hull and motor third-party liability (MTPL), among others. MTPL insurance accounts for around 40% of motor insurance written premiums. Conducive regulatory policies to enhance the scope of compulsory insurance will aid the market’s growth, especially in developing markets. Additionally, vehicle repair/replacement cost inflation, theft cases, and damage from natural disasters will continue to add pricing pressures over the forecast period driving the motor hull insurance market.

Motor Insurance Market Analysis by Lines of Business, 2022 (%)

Buy the Full Report for More Line of Business Insights into the Motor Insurance Market

Motor Insurance Market Segmentation by Regions

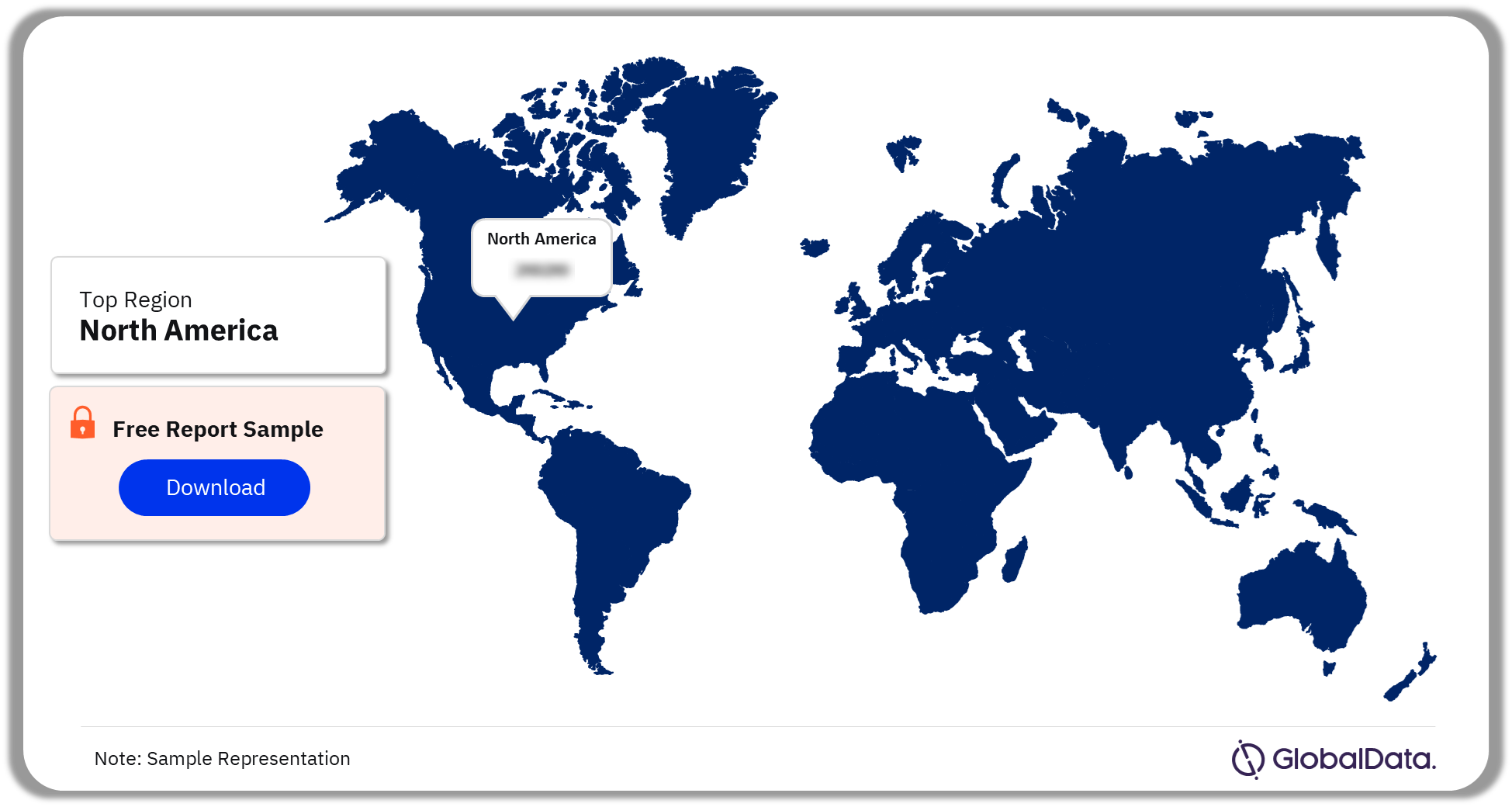

North America is the leading region in the motor insurance market in 2023

The key regions where motor insurance is available are North America, Asia-Pacific, Europe, the Middle East and Africa, and South and Central America. Meanwhile, Asia-Pacific and Europe (the second- and third-largest regional markets respectively) are expected to contract. Even though the written premium share of APAC declined during 2018-2023, the region is expected to record the highest growth among all regions during the forecast period.

Furthermore, the US is the leading motor insurance market in 2023 and Australia is expected to record the highest growth among the top 10 markets during 2023-2027.

Motor Insurance Market Analysis by Regions, 2023 (%)

Buy Full Report for More Region Insights into the Motor Insurance Market

Motor Insurance Market - Competitive Landscape

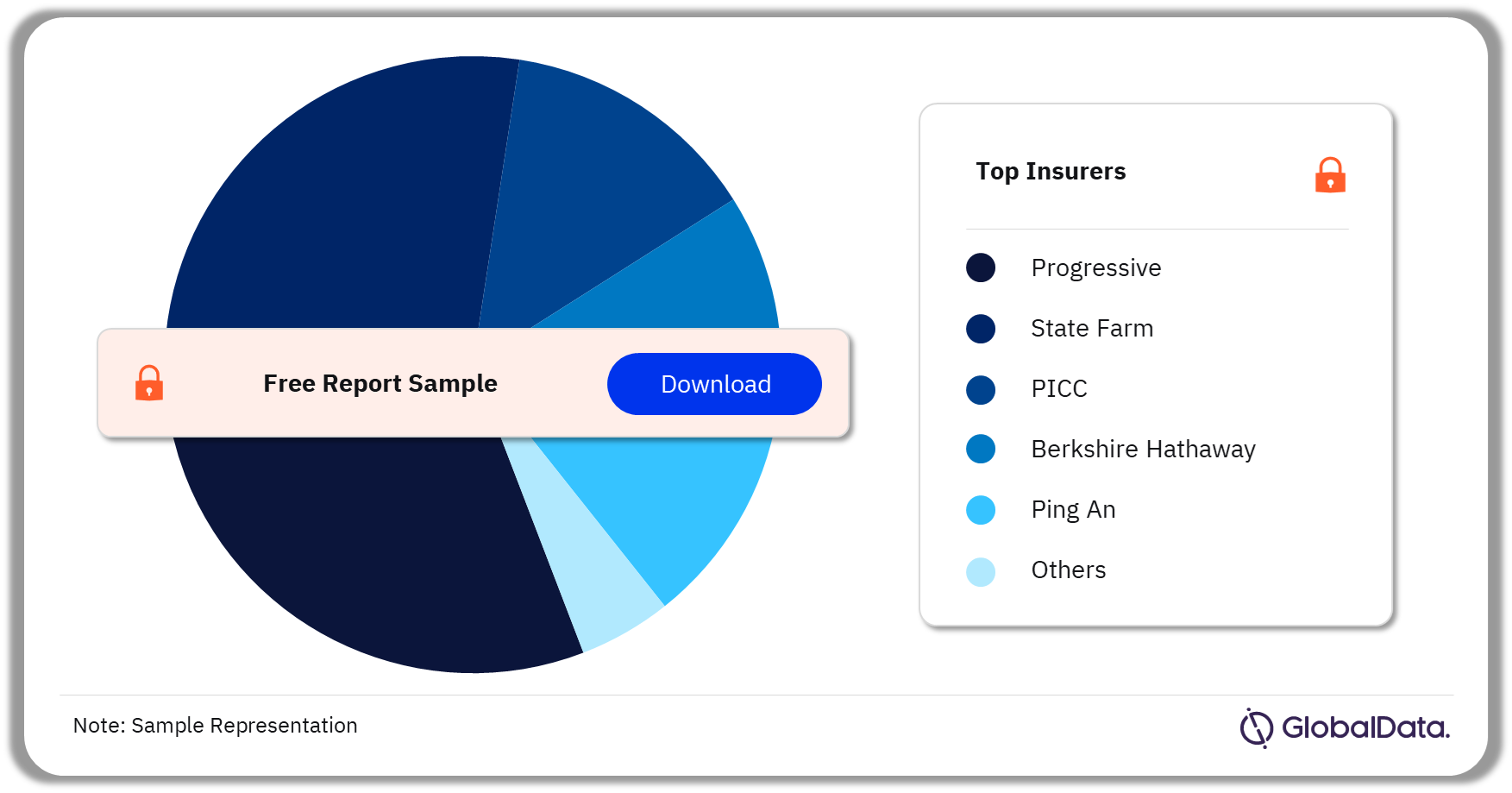

Progressive and State Farm had the highest written premiums in 2022

Some of the key insurers in the motor insurance market are:

- Progressive

- State Farm

- PICC

- Berkshire Hathaway

- Ping An

In August 2023, Progressive granted a budget to 10 Black American entrepreneurs to purchase commercial vehicles for their business operations. Furthermore, in May 2023, the company started offering optional heavy truck roadside assistance coverage for its commercial auto customers in partnership with TTN Fleet Solutions. This service covers labor and towing costs for heavy vehicles including trailers, tractors, straight trucks, and dump trucks. Policyholders can submit motor claims via Progressive’s client login portal and through its mobile app by uploading photos and documents.

Motor Insurance Market Analysis by Insurers, 2022 (%)

Buy Full Report for More Insurer Insights into the Motor Insurance Market

Motor Insurance Market – Latest Developments

- In April 2023, Qualitas Compania de Seguros started utilizing Octo’s driving behavior analytics for commercial fleet insurance. This enables fleet owners to track vehicles, supply customers with accurate and intelligent logistics, and improve driver safety. Fleet owners can use real-time telematics data to reduce their insurance premiums and thus their operating expenses.

- In January 2023, State Farm appointed HCLTech to enhance its IT operations. HCLTech will speed up State Farm’s hybrid cloud infrastructure through automation and will help to improve IT support experiences for its agents, customers, and employees.

Segments Covered in the Report

Motor Insurance Lines of Business Outlook (Value, $ Billion, 2018-2027)

- Motor Hull

- Motor Third-Party Liability (MTPL)

Motor Insurance Regional Outlook (Value, $ Billion, 2018-2027)

- Asia-Pacific

- Europe

- Middle East and Africa

- North America

- South and Central America

Scope

This report provides:

- A comprehensive analysis of the global motor insurance industry.

- Historical values for the global and regional motor insurance industry for the report’s review period and projected figures for the forecast period.

- A detailed analysis of the regional motor insurance industry and market forecasts to 2027.

- Key market trends in the global motor insurance industry.

- Rankings, premiums, and market share of top global and regional motor insurers and analyzes the competitive landscape.

Key Highlights

- Key insights and dynamics of the motor insurance industry.

- Insights on key market trends in the motor insurance industry.

- Insights on key growth and profitability challenges in the motor insurance industry.

- Comparative analysis of leading motor insurance providers.

- In-depth analysis of regional markets.

- Insight on the future growth trend and market outlook.

Reasons to Buy

- Make strategic business decisions using in-depth historic and forecast market data related to the global and regional motor insurance industry.

- In-depth market analysis, information, and insights into the global motor insurance industry.

- In-depth analysis of the competitive landscape and top 20 regional markets.

- Understand the key dynamics, trends, and growth opportunities in the global and regional motor insurance industry.

- Identify key regulatory developments impacting market growth.

- Identify growth opportunities in key regional markets.

Progressive

PICC

Berkshire Hathaway

Ping An

Tokio Marine

China Pacific

Sompo

China Life

Samsung Fire & Marine

Hyundai Marine & Fire

DB Insurance

AXA

Table of Contents

Frequently asked questions

-

What was the motor insurance market written premium in 2022?

The written premium of the motor insurance market was $822.3 billion in 2022.

-

What is the growth rate of the motor insurance market?

The motor insurance market is expected to achieve a CAGR of more than 4% during 2023-2027.

-

Which line of business dominated the motor insurance market in 2022?

Motor third-party liability (MTPL) insurance was the leading motor insurance line of business in 2022.

-

Which is the leading region in the motor insurance market in 2023?

North America is the leading region in the motor insurance market in 2023.

-

Who are the major insurers operating in the motor insurance market?

Some of the key insurers in the motor insurance market are Progressive, State Farm, PICC, Berkshire Hathaway, and Ping An.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Motor reports