Military Rotorcraft Market Size and Trend Analysis including Segments, Programs, Competitive Landscape and Forecast to 2033

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Military Rotorcraft Market Overview

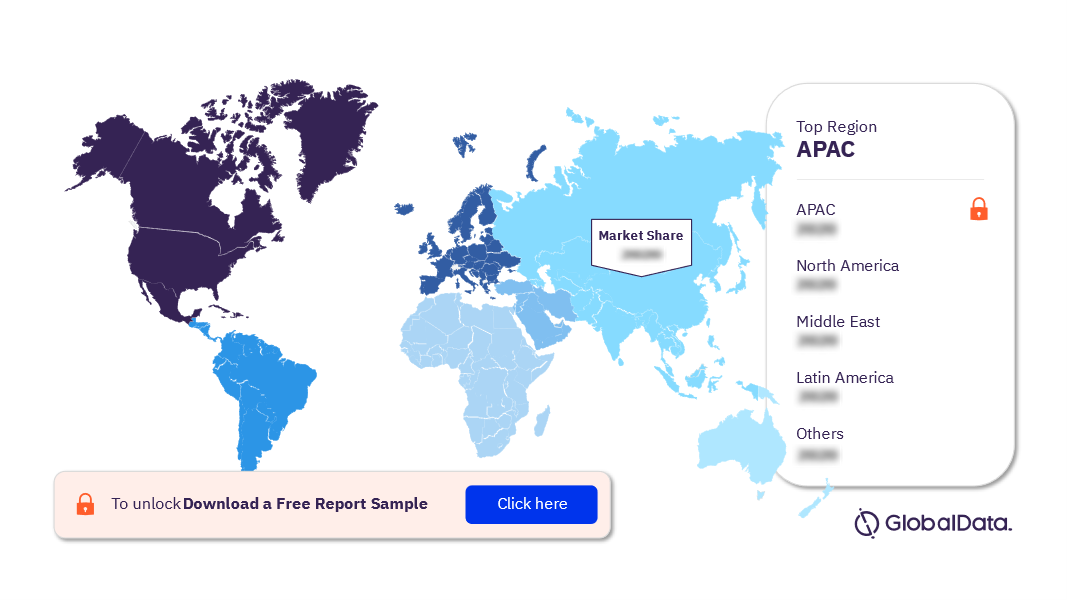

The military rotorcraft market size is valued at $19.4 billion in 2023 and is expected to grow at a CAGR of more than 3% during 2023-2033. The Asia-Pacific region, supported by China, India, South Korea, and Australia’s multi-year procurement programs, is expected to maintain its leading position globally, exhibiting a steady pace of growth over the forecast period. The modernization drives initiated by leading countries in the region to replace aging fleets and develop domestic rotorcraft R&D and manufacturing capabilities are anticipated to drive the regional growth over the next decade.

Military Rotorcraft Market Outlook, 2023-2033 ($ billion)

To gain more information on the military rotorcraft market forecast, download a free report sample

The military rotorcraft market research report covers industry analysis, including the key market drivers, trends, emerging technologies, and major challenges faced by industry participants. It also offers insights regarding key factors and government programs that are expected to influence the demand for the military rotorcraft market over the forecast period.

| Market Size (2023) | $19.4 billion |

| CAGR | >3% |

| Forecast Period | 2023-2033 |

| Key Segments | · Transport and Utility Helicopter

· Maritime Helicopter · Attack Helicopter |

| Key Regions | · Asia-Pacific

· North America · Europe · Middle East · Africa · Latin America |

| Leading Companies | · Lockheed Martin Corp

· The Boeing Co · Airbus SE · Rostec Corp · Aviation Industry Corporation of China Ltd |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Military Rotorcraft Market Dynamics

Rapid advancements in the fields of stealth, speed, load capacity, and design have rendered most of the legacy, erstwhile state-of-the-art rotorcraft fleets, obsolete and, in several cases, unsuitable for modern combat, thus necessitating the procurement of new helicopter variants. The need to operate in a network-centric combat environment with advanced electronic warfare and communication systems is another major influencer anticipated to drive investment in advanced rotorcraft programs worldwide. Countries such as the US, Russia, China, and India have initiated major procurement programs to replenish their legacy fleets with new helicopters, replete with the latest avionics and flight features.

The increasing complexity and cost of military rotorcraft development are necessitating international cooperation as countries seek to share the costs and risks of developing and acquiring new rotorcraft. This trend of collaboration brings forth numerous benefits in helicopter development. Firstly, international cooperation can help countries pool their resources and expertise, which can lead to the development of more capable and affordable rotorcraft. Additionally, collaborations foster faster development timelines while also allowing the countries to customize the helicopters to align with their unique requirements. In addition to developmental efforts, governments are also collaborating to locally manufacture foreign rotorcraft to reduce manufacturing costs and develop their indigenous industrial base.

Military Rotorcraft Market Segments

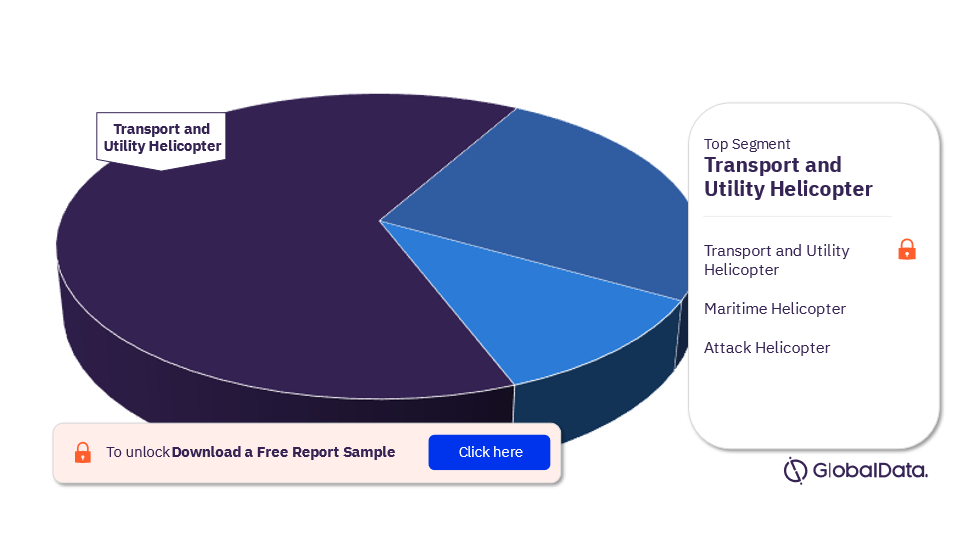

The key segments in the military rotorcraft market are transport and utility helicopter, maritime helicopter, and attack helicopter. Over 2023-33, the military rotorcraft market is expected to be dominated by the transport and utility helicopter segment. North America ranks first in the transport and utility helicopter segment. The North American military transport and utility helicopter segment is expected to experience significant growth, primarily driven by prominent US programs such as the UH-60M Black Hawk Program and the CH-47F Chinook Helicopter Procurement.

Military Rotorcraft Market Analysis by Segments, 2023-2033 (%)

For more segment insights into the military rotorcraft market, download a free report sample

Military Rotorcraft Market Segmentation by Regions

The key regions in the military rotorcraft market are Asia-Pacific, North America, Europe, the Middle East, Africa, and Latin America. The market is expected to be led by APAC over the forecast period. China is the largest market in the Asia-Pacific region. China’s involvement in all flashpoint zones in the region, right from its borders with India to the South China Sea, involving Indonesia, Malaysia, the Philippines, Taiwan, and Vietnam, as well as traditional conflicts with South Korea and Japan, ensures the necessity for a large fleet capacity and continuous technology enhancements.

North America is anticipated to be the next largest market for military rotorcraft. Investment in the rotorcraft domain in the region is primarily driven by forward-looking development programs such as the Future Attack Reconnaissance Aircraft and the Future Long Range Assault Aircraft (FLRAA).

Military Rotorcraft Market Analysis by Regions, 2023-2023 (%)

For more regional insights into the military rotorcraft market, download a free report sample

Military Rotorcraft Market - Competitive Landscape

Some of the leading companies in the military rotorcraft market are Lockheed Martin Corp, Boeing Co, Airbus SE, Rostec Corp, and Aviation Industry Corporation of China Ltd among others.

Segments Covered in the Report

Military Rotorcraft Segments Outlook (Value, $ Billion, 2023-2033)

- Transport and Utility Helicopter

- Maritime Helicopter

- Attack Helicopter

Military Rotorcraft Regional Outlook (Value, $ Billion, 2023-2033)

- Asia-Pacific

- North America

- Europe

- Middle East

- Africa

- Latin America

Scope

In particular, the report provides an in-depth analysis of the following –

- Market Size and Drivers: Detailed analysis during 2023-2033, including the demand drivers and growth stimulators. It also provides a snapshot of the spending and modernization patterns of different regions around the world.

- Recent Developments and Industry Challenges: Insights into technological developments and a detailed analysis of the existing military rotorcraft programs being executed and planned worldwide. It also provides trends of the changing industry structure and the challenges faced by industry participants.

- Regional Highlights: The study of the key markets in each region, providing an analysis of the key segments of the market that are expected to be in demand.

- Major Programs: Details of the key programs in each segment, which are expected to be executed during 2023-2033.

- Competitive landscape and strategic insights: analysis of the competitive landscape of the global military rotorcraft market. It provides an overview of key players, their strategic initiatives, and financial analysis.

Key Highlights

• The global Military Rotorcraft market is expected to grow at a CAGR of 3.8% over the forecast period.

• The global Military Rotorcraft market is classified into three categories: Transport and Utility Helicopter, Attack Helicopter and Maritime Helicopter.

• Asia-Pacific is expected to dominate the global military rotorcraft market over the forecast period with a market share of 31.7%, followed by North America and European regions.

• Transport and Utility Helicopter is expected to be the largest segment among other military rotorcraft categories over the forecast period.

Reasons to Buy

- Determine prospective investment areas based on a detailed trend analysis of the global military rotorcraft over the next ten years.

- Gain an in-depth understanding of the underlying factors driving demand for different military rotorcraft segments in the top spending countries across the world and identify the opportunities offered by each of them.

- Strengthen your understanding of the market in terms of demand drivers, industry trends, and the latest technological developments, among others.

- Identify the major channels that are driving the global military rotorcraft market, providing a clear picture of future opportunities that can be tapped, resulting in revenue expansion.

- Channelize resources by focusing on the ongoing programs that are being undertaken by the defense ministries of different countries within the global military rotorcraft market.

- Make correct business decisions based on in-depth analysis of the competitive landscape consisting of detailed profiles of the top military rotorcraft solution providers around the world. The company profiles also include information about the key products, alliances, recent contracts awarded, and financial analysis, wherever available.

The Boeing Co

Hindustan Aeronautics Limited

Rostec Corp

Aviation Industry Corporation of China

Airbus SE

NHIndustries

Korea Aerospace Industries Ltd

Textron Inc.

Leonardo SpA

Turkish Aerospace Industries

Mitsubishi Heavy Industries Ltd.

Table of Contents

Frequently asked questions

-

What is the size of the military rotorcraft market in 2023?

The military rotorcraft market size is valued at $19.4 billion in 2023.

-

What is the growth rate of the military rotorcraft market?

The military rotorcraft market is expected to grow at a CAGR of more than 3% during 2023-2033.

-

Which segment will account for the highest share of the military rotorcraft market?

Over 2023-33, the military rotorcraft market is expected to be dominated by the transport and utility helicopter segment.

-

Which region will lead the military rotorcraft market?

The global military rotorcraft market over the forecast period is expected to be led by APAC.

-

Which are the leading companies in the military rotorcraft market?

Some of the leading companies in the military rotorcraft market are Lockheed Martin Corp, Boeing Co, Airbus SE, Rostec Corp, and Aviation Industry Corporation of China Ltd.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Military Rotorcraft reports