Malaysia Defense Market Size, Trends, Budget Allocation, Regulations, Acquisitions, Competitive Landscape and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Malaysia Defense Market Report Overview

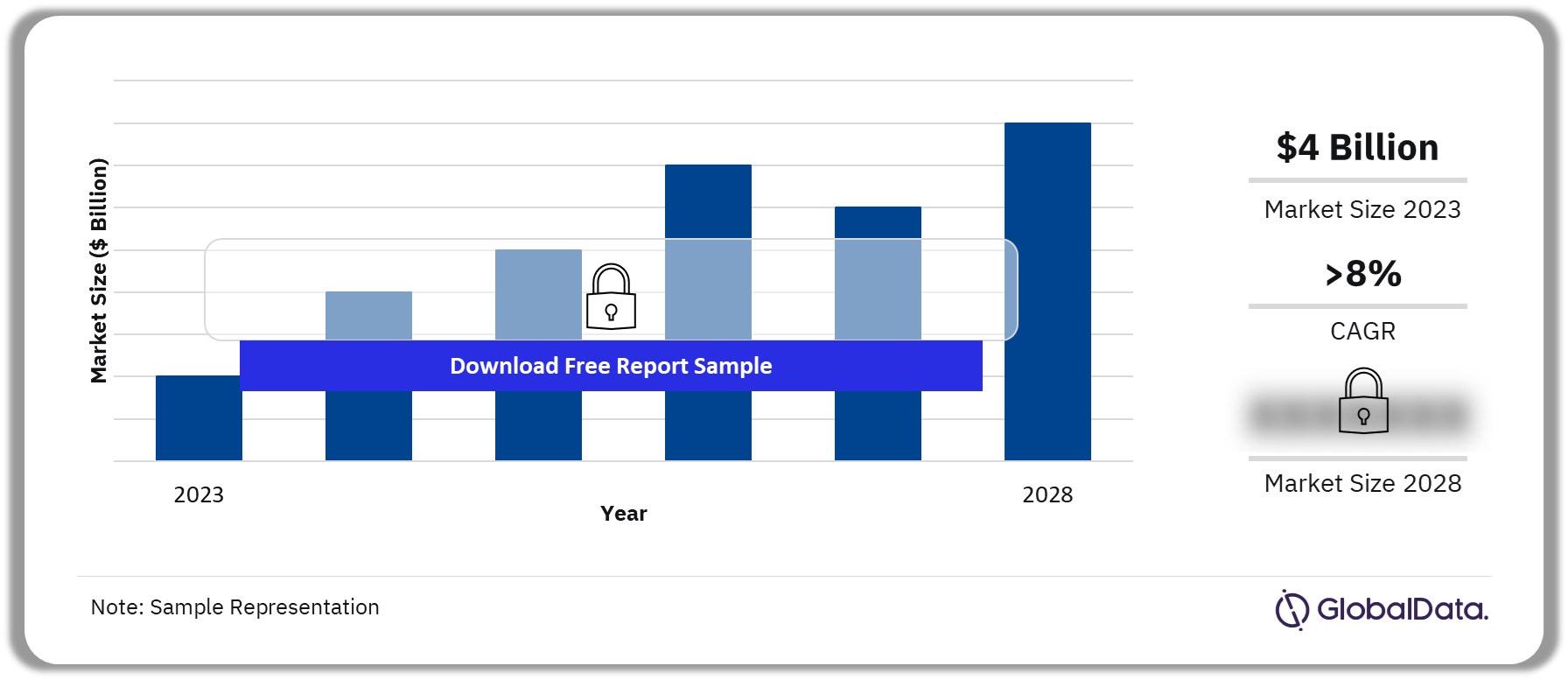

The Malaysia defense budget is worth $4 billion in 2023. The country’s defense budget is expected to grow at a CAGR of more than 8% from 2024 to 2028. The Malaysian defense budget is driven by efforts to modernize its armed forces, its participation in peacekeeping programs, and ongoing territorial disputes with neighboring countries.

Malaysia Defense Market Outlook, 2023-2028 ($ Billion)

Buy Full Report to Gain More Information about the Malaysia Defense Market Forecast

The Malaysia defense market research report provides the market size forecast and the projected growth rate for the next five years. It also covers industry analysis including the key market drivers, emerging technology trends, segments, and major challenges faced by market participants. It offers insights regarding military strategies as well as key factors and government programs that are expected to influence the demand for military platforms over the forecast period.

| Market Size (2023) | $4 billion |

| CAGR (2024-2028) | >8% |

| Forecast Period | 2024-2028 |

| Historical Period | 2019-2023 |

| Key Sectors | · Naval Vessels and Surface Combatants

· Tactical Communications Systems · Military Fixed-Wing · Missiles and Missile Defense Systems · Military Unmanned Aerial Vehicles · Military Radar · Underwater Warfare Systems |

| Leading Companies | · ACME Holdings Berhad

· Aerospace Composites Malaysia Sdn. Bhd. · AMP Corporation (M) Sdn Bhd · AppAsia Berhad · Aviation Design Centre Sdn.Bhd. · Boustead Heavy Industries Corp Bhd · Boustead Holdings Bhd · Composites Technology Research Malaysia Sdn Bhd · DRB-HICOM Defense Technologies Sdn Bhd · Fotronics Corporation Berhad |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Malaysia Defense Market Drivers

- Malaysia’s 2023 defense budget aims to modernize the armed forces and make the domestic defense industry increasingly self-sufficient, with minimal reliance on external assistance. The country’s integrated, agile, and focused approach is expected to enable it to build a defensive-postured, technologically advanced armed force that can respond to the threats that Malaysia may face.

- An uncertain security environment and the emergence of nontraditional security threats will drive defense expenditure over 2024-2028.

Malaysia Military Doctrines and Defense Strategies

Defense diplomacy is an important element of Malaysia’s conflict prevention strategy.

Malaysia has evolved a comprehensive security doctrine that leverages a broad array of security assets including robust socio-economic policies and diplomacy. The Malaysian defense policy is a demonstration of its commitment to securing its national interests and defending itself against external aggression. Some of the core principles of the Malaysian defense doctrine are total defense (HANRUH), defense diplomacy, and self-reliance.

As any escalation in conflict could jeopardize stability and peace within the region, the proactive prevention of any prospective conflicts remains the best option. The country prefers to adopt measures such as confidence-building, drafting progressive rules of engagement, adopting a transparent policy, and laying down foundations for dedicated channels of communication.

Malaysia Defense Market Segmentation by Sectors

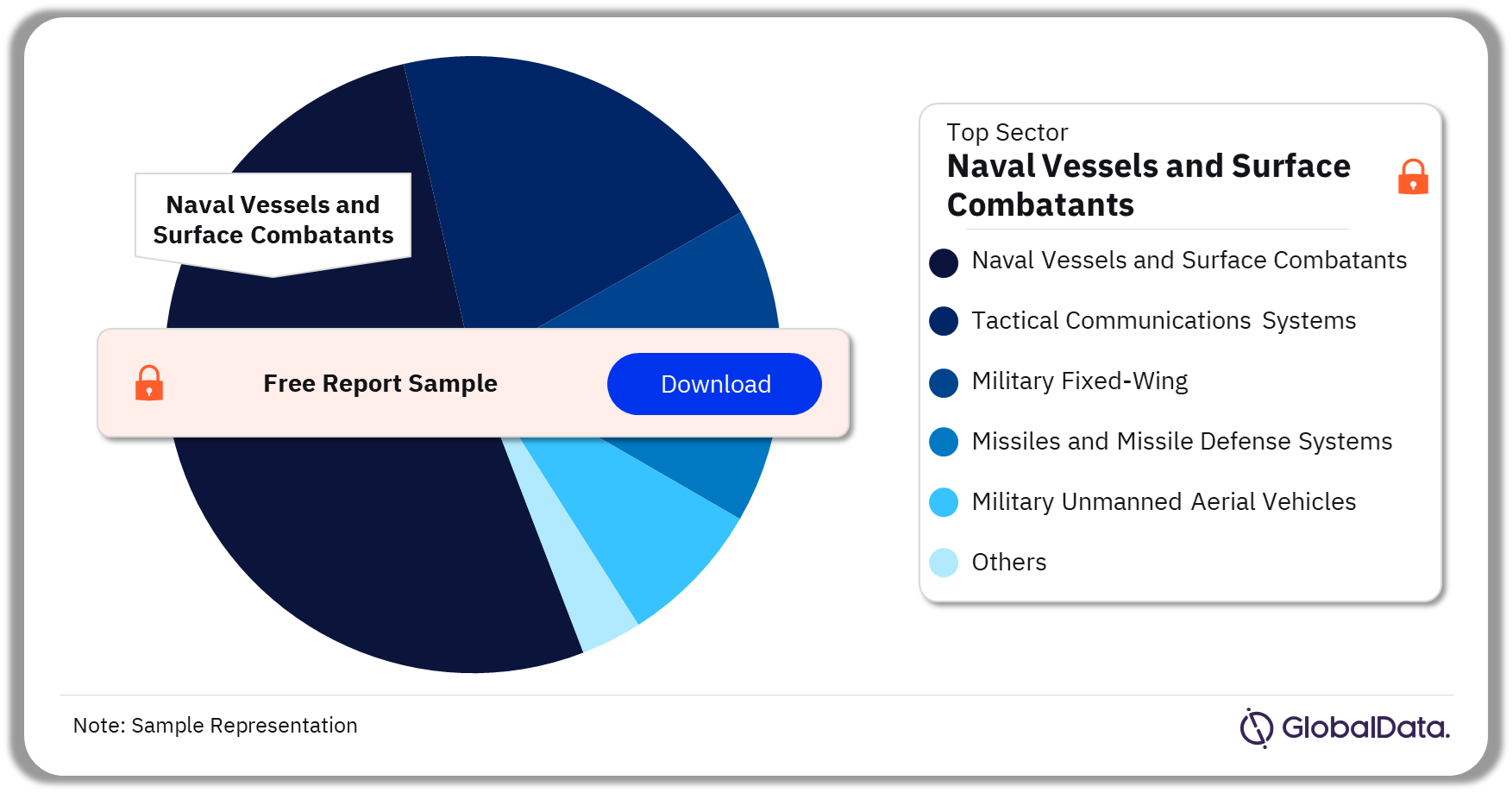

The top sector in the Malaysian defense market is naval vessels and surface combatants, followed by tactical communications systems and military fixed-wing.

The key sectors in the Malaysian defense market are naval vessels and surface combatants, tactical communications systems, military fixed-wing, missiles and missile defense systems, military unmanned aerial vehicles, military radar, and underwater warfare systems, among others. Attractive sectors with the fastest growth rates in Malaysia’s defense market are military fixed-wing aircraft, military unmanned aerial vehicles UGVs, and missile and missile defense systems.

Malaysia Defense Market Analysis by Sectors, 2023 (%)

Buy Full Report for more Sector Insights into the Malaysia Defense Market

Malaysia Defense Market - Competitive Landscape

Some of the leading defense companies operating in Malaysia are:

- ACME Holdings Berhad

- Aerospace Composites Malaysia Sdn. Bhd.

- AMP Corporation (M) Sdn Bhd

- AppAsia Berhad

- Aviation Design Centre Sdn.Bhd.

- Boustead Heavy Industries Corp Bhd

- Boustead Holdings Bhd

- Composites Technology Research Malaysia Sdn Bhd

- DRB-HICOM Defense Technologies Sdn Bhd

- Fotronics Corporation Berhad

Malaysia Defense Market Analysis by Companies

Buy Full Report for more Company Insights into the Malaysia Defense Market

Segments Covered in the Report

Malaysia Defense Market Sectors Outlook (Value, $ Billion, 2019-2028)

- Naval Vessels and Surface Combatants

- Tactical Communications Systems

- Military Fixed-Wing

- Missiles and Missile Defense Systems

- Military Unmanned Aerial Vehicles

- Military Radar

- Underwater Warfare Systems

Scope

The report provides:

- Detailed analysis of Malaysia defense market with market size forecasts covering the next five years. The report will also analyze factors that influence demand for the industry, key market trends, and challenges faced by industry participants.

- Malaysia defense budget: detailed analysis of the Malaysia 2023 defense budget broken down into market size and market share. This is coupled with an examination of key current and future acquisitions.

- Regulation: the procurement policy and process is explained. This is coupled with an analysis of Malaysian military doctrine and strategy to provide a comprehensive overview of the Malaysia military procurement regulation.

- Security Environment: political alliances and perceived security threats to Malaysia are examined to explain trends in spending and modernization.

- Competitive landscape and strategic insights: analysis of the competitive landscape of Malaysia’s defense industry.

Reasons to Buy

- Determine prospective investment areas based on a detailed trend analysis of the French defense market over the next five years.

- Gain an in-depth understanding of the underlying factors driving demand for different defense and internal security segments in the French market and identify the opportunities offered.

- Strengthen your understanding of the market in terms of demand drivers, market trends, and the latest technological developments, among others.

- Identify the major threats that are driving the Malaysia defense market providing a clear picture of future opportunities that can be tapped, resulting in revenue expansion.

- Channel resources by focusing on the ongoing programs that are being undertaken by the Malaysian government.

- Make correct business decisions based on an in-depth analysis of the competitive landscape consisting of detailed profiles of the top defense equipment providers in the country. The company profiles also include information about the key products, alliances, recent contracts awarded, and financial analysis, wherever available.

Table of Contents

Frequently asked questions

-

What is the Malaysia defense market size in 2023?

The defense market size in Malaysia is $4 billion in 2023.

-

What is the Malaysia defense market growth rate?

The defense market in Malaysia is expected to achieve a CAGR of more than 8% during 2024-2028.

-

Which is the leading sector in the Malaysia defense market in 2023?

Naval vessels and surface combatants is the leading sector in the Malaysia defense market in 2023.

-

Who are the key companies operating in the Malaysia defense market?

Some of the leading defense companies operating in Malaysia are ACME Holdings Berhad, Aerospace Composites Malaysia Sdn. Bhd., AMP Corporation (M) Sdn Bhd, AppAsia Berhad, Aviation Design Centre Sdn.Bhd., Boustead Heavy Industries Corp Bhd, Boustead Holdings Bhd, Composites Technology Research Malaysia Sdn Bhd, DRB-HICOM Defense Technologies Sdn Bhd, and Fotronics Corporation Berhad.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Homeland Security reports