Online Travel Market Trends and Analysis by Region, Transportation, Accommodation, Travel Intermediation and Segment Forecast to 2030

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insight from the ‘Online Travel’ report can help you:

- Make informed decisions about investments, partnerships, and product development

- Identify your competitors positioning to stay ahead in the market

- Identify promising areas, growth trends, segments, and markets to expand your product portfolio or successful investment

- Anticipate expected changes in demand and adjust your business development strategies

- Identify potential areas of disruption

How is our ‘Online Travel’ report different from other reports in the market?

- The report presents in-depth market sizing and forecast at a segment level for more than 15 countries including historical and forecast analysis for the period 2019-2030 for market assessment

- Detailed segmentation by type – Transportation (Airlines, Car Rental, Others), Travel Accommodation, Travel Intermediation (Online Travel Agencies, Tour Operator Websites, Other Travel Intermediaries)

- Detailed value chain analysis helping businesses identify areas where they can improve their efficiency and effectiveness, reduce costs, and enhance their competitive advantage

- The report offers consumer, industry, and enterprise trends, along with challenging factors impacting the online travel market.

- The growth innovation matrix included in the report, divides the market players in to four categories i.e., flagbearers, contenders, specialists, and experimenters, which will help value chain participants in understanding how competition is performing based on their revenue growth and their R&D efforts

- Competitive profiling and benchmarking of key players in the market to provide deeper understanding of industry competition

We recommend this valuable source of information to anyone involved in:

- Online Travel Agents

- Tour Operators

- Direct Suppliers

- Hotel Groups

- Car Rental Companies

- Technology Companies

- Ancillary Suppliers

- Venture Capital Firms

To Get a Snapshot of the Online Travel Market Report, Download a Free Report Sample

Online Travel Market Overview

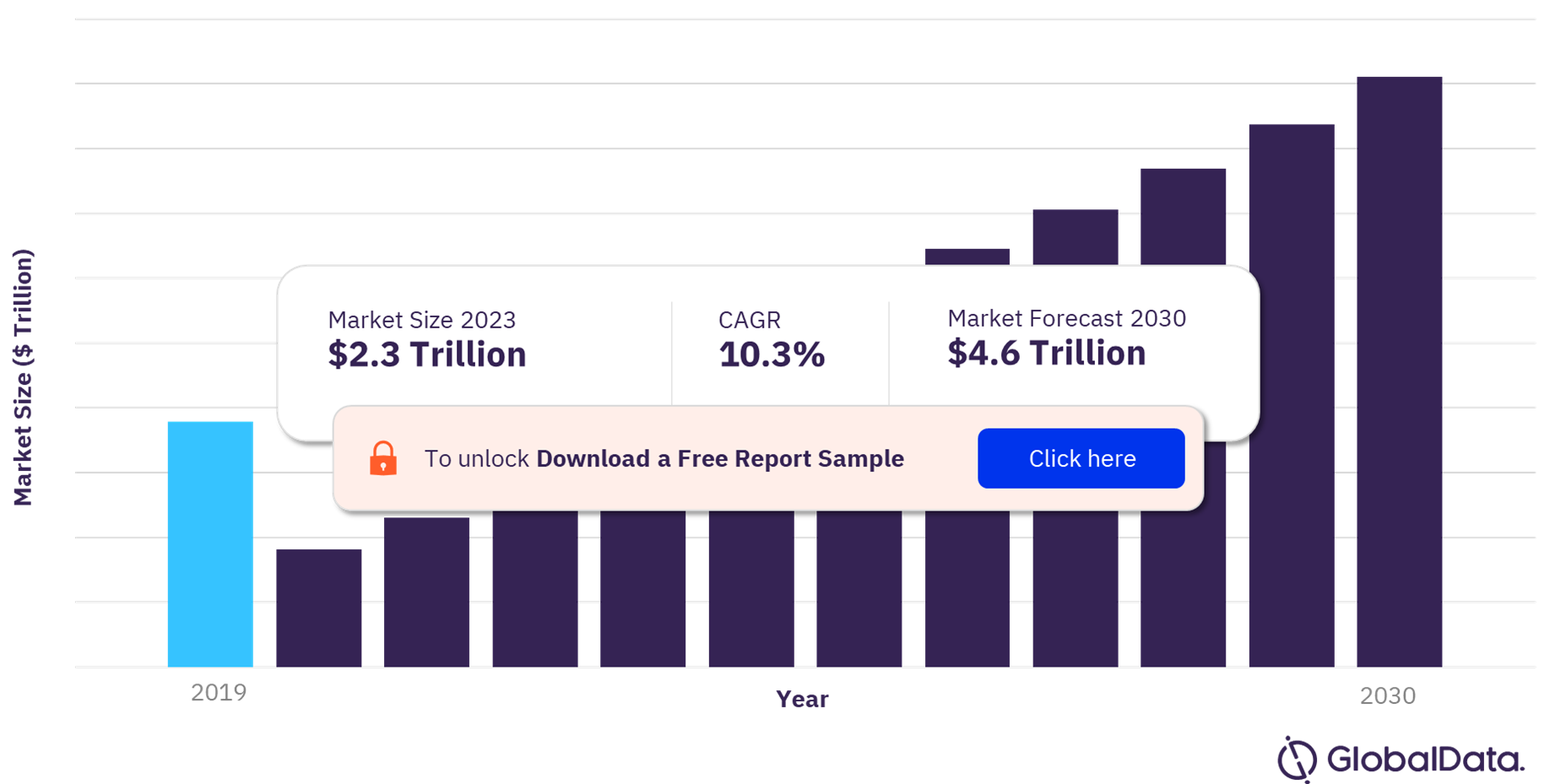

The online travel market will be valued at $2.3 trillion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 10.3% over the forecast period. The proliferation of mobile devices, improved network connectivity, and rising disposable income are some of the prime factors responsible for the growth of this market. Furthermore, the growing interest of individuals in frequent travel coupled with the emergence of vlogging culture is anticipated to contribute to market growth.

The travel and tourism industry experienced a significant drop in revenue during the pandemic outbreak owing to travel restriction imposed by governments worldwide. This impacted the sales across the online as well as offline channels with the market value of online travel intermediaries and in-store travel intermediaries declining by 60.1% and 63.8% YoY respectively. However, the impact of COVID-19 compelled several consumers to use online services, which is anticipated to benefit and accelerate the uptake of online travel in the future.

Online Travel Market Outlook, 2019-2030 ($ Trillion)

View Sample Report for Additional Insights on Online Travel Market Forecast, Download a Free Report Sample

Online travel booking enables travel and tourism companies to better engage with their customers, which ensures improved customer satisfaction. Furthermore, it helped travel companies and consumers in managing travel bookings while facing uncertainties in terms of travel dates and cancellations during COVID-19 outbreak. This coupled with changing customer demands, compelled travel companies to invest in updating their websites and building travel apps through which travel brands can expand their digital presence and offer various features and discounts, thereby enhancing customer booking experience.

Online travel booking is gaining immense popularity with the younger generation. Millennials and Gen Z are influenced by digitally smart products, owing to which they are expected to look out for advanced booking systems that offer them a personalized experience. As such travel companies are investing in integrating technologies such as artificial intelligence, machine learning, and Big Data to help automate the online travel booking process, which is anticipated to attract young consumers. Travel companies can leverage the traveler analytics generated by Big Data and offer tailored packages, which is expected to help attract more website and app traffic, subsequently contributing to market growth.

Several travel companies are introducing online platforms and applications for travel booking to capitalize on the expansion and automation capabilities it provides to travel companies. However, online platforms are also vulnerable to data breaches, which may pose a challenge to market growth. As reported in 2019 by American Airlines and United Airlines, both companies were compromised with data breachers stealing miles from the 10,000 reward accounts. With a large amount of personal consumer data on the websites, online travel companies are one of the common targets for cyber-attackers. As such, travel companies are investing in integrating advanced cybersecurity solutions in order to mitigate the threat of cyber-attacks and reassure travelers about the safety of their data.

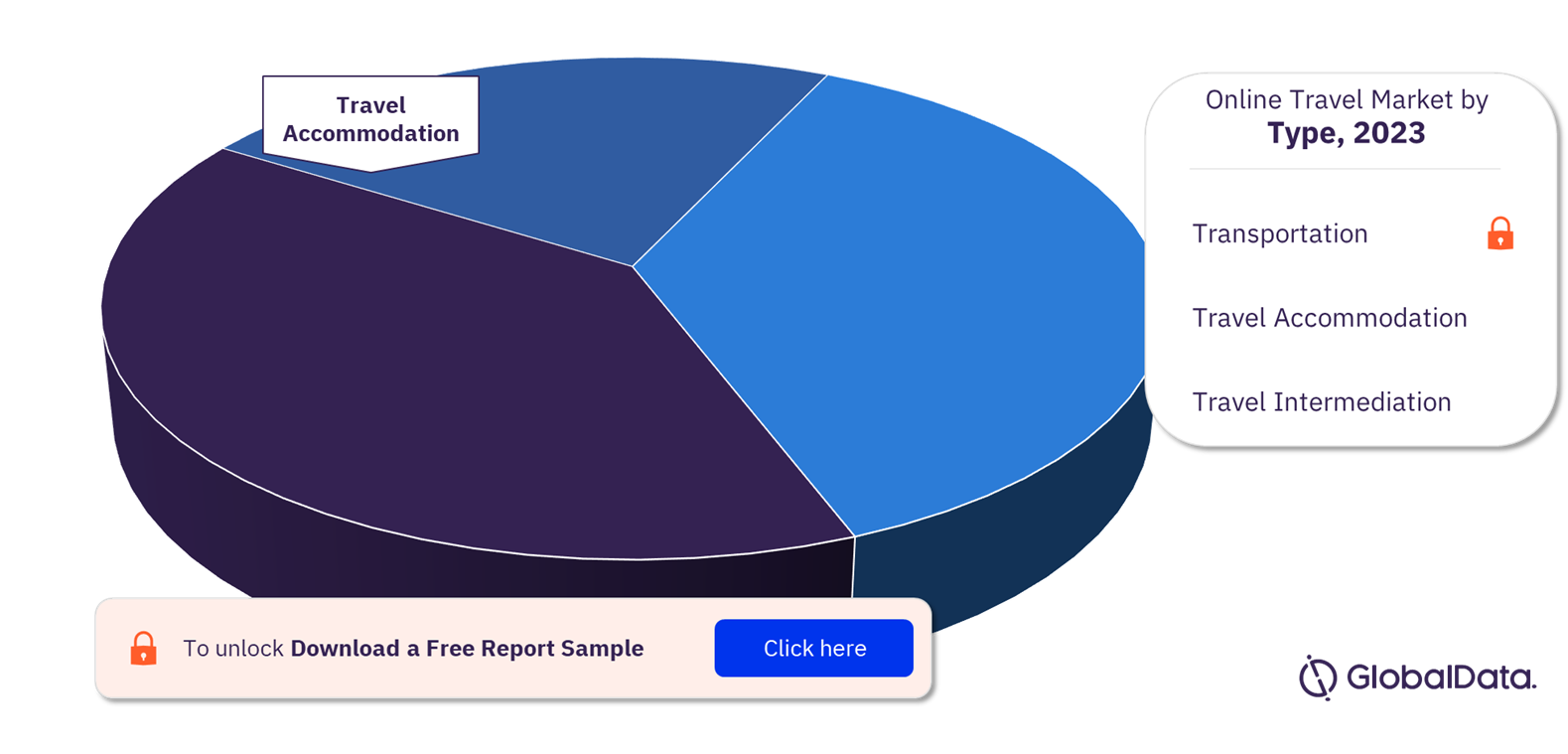

Online Travel Market Segmentation by Type

The online travel type category is broken down into three segments, including transportation, travel accommodation, and travel intermediation. The transportation segment is anticipated to dominate the online travel market in 2023. The increasing amount of online booking for trains, airlines, buses, and cars coupled with rapid urbanization has contributed to the growth of this segment.

Online Travel Market Share by Type, 2023 (%)

Online Travel Market Outlook Report with Detailed Segment Analysis is Available with GlobalData Now! Download a Free Report Sample

The travel accommodation segment is expected to exhibit the fastest growth of more than 10% during the forecast period. Travel companies provide a variety of accommodations nowadays such as homestays, hotel rooms, villas, and more, which enables a consumer to book their preferred options based on the requirements. Additionally, travel companies offer these accommodations in different packages such as honeymoon suites, with meal options, group stays, and others, in order to attract various consumer groups, which is contributing to market growth.

The transportation segment is expected to be followed by travel intermediation segment with second highest market share in 2023. This segment is bifurcated in to three sub-segments, namely, online travel agencies (OTAs), tour operator websites, and other travel intermediaries. OTAs held the significant market share of the travel intermediation segment in the past few years and is expected to retain its dominance over the forecast period. The high market share is attributed to the broad range of services that these agencies provide access to the customer. Travelers can research and book variety of products and services, including flights, hotels, cars, activities, and cruises, among others with the travel suppliers though OTAs, which has fueled the demand for this segment.

Online Travel Market Analysis by Region

The North America region is expected to hold the highest market share in 2023 and is anticipated to continue its strong growth over the forecast period. US is the leading market in the region owing to the high technology penetration across the country. Additionally, early technology adoption and enhanced network connectivity are the factors responsible for market growth in North America. Europe held the second highest market share in the online travel market owing to government initiatives in promoting travel & tourism and favorable business environment across the European countries.

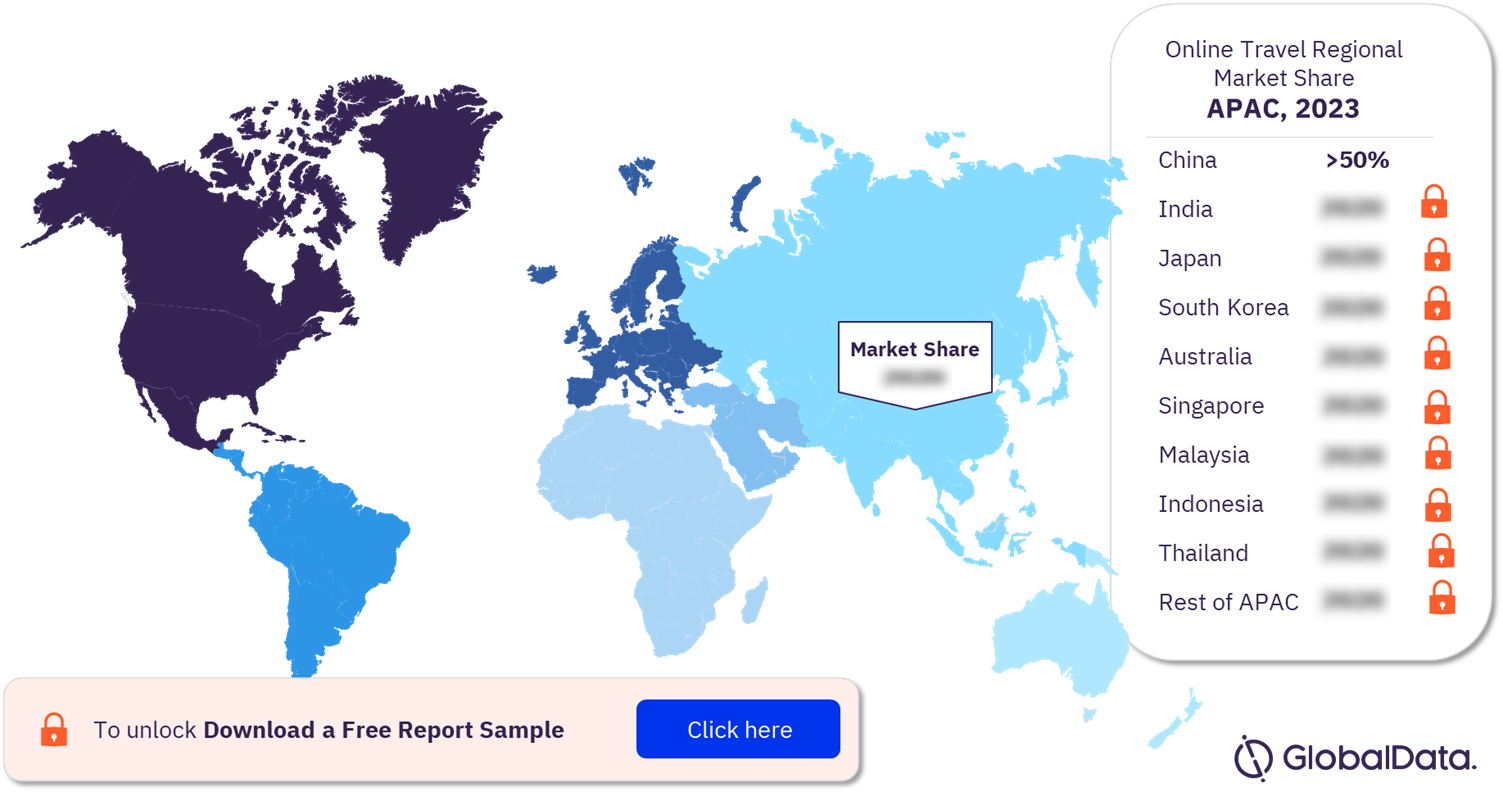

Asia-Pacific Online Travel Market Share by Country, 2023 (%)

View Sample Report for Additional Online Travel Market Insights, Download a Free Report Sample

The Asia Pacific online travel market is expected to register the fastest growth of more than 10% over the forecast period. This growth is attributed to the enhanced network connectivity and rising disposable income across the region. Additionally, the region has significant amount of young tech-savvy population, responsible for the emerging trend of making travel vlogs, which is further anticipated to boost domestic and international travel across the region, thereby fueling market growth.

The South and Central America and the MEA are anticipated to exhibit strong growth over the future owing to government initiatives to promote tourism across the regions. The South and Central American countries offer tourists with natural attractions such as deserts, jungles, and mountains along with different activities in national parks, thereby attracting wildlife enthusiasts, adventure seekers, and hikers.

Furthermore, the countries in this region also offer various culinary experiences from street food to fine dining restaurants. Although, the region has lot to offer to the travel and tourism industry, lack of technological infrastructure may pose a challenge to market growth. Enhancement in technological capabilities such as data centers and telecommunication networks may help travel vendors in expanding online travel booking network across the region, in turn contributing to market growth.

The Middle East has been experiencing a solid growth with the resumption of tourism activities post pandemic. The frequency of online booking has paced up with the emerging trend of escapism travel, which allows people to work from anywhere they want. The last-minute travel bookings are expected to gain momentum with an increased desire to travel among the domestic travelers.

Additionally, with the increasing demand of luxury hotels, total number of 32,621 hotel rooms were under construction in Saudi Arabia in 2022, which bodes well for market growth. This coupled with the robust technological and tourism infrastructure in the region is expected to fuel the market growth.

Online Travel Market – Competitive Landscape

The online travel market is highly competitive market with the presence of several established and small regional players operating in the market. The established companies in the market are focused on merging and acquiring smaller firms in order to expand their business to new regions as well as utilize their technology to enhance online travel booking platforms and enhance user experience.

The market has three types of suppliers, including online travel agencies (OTAs), direct suppliers, and ancillary suppliers. OTAs are currently dominating the market while facing competition from direct suppliers who are indulging in developing their own online travel booking platforms in order to better engage with the customers.

Key players in the online travel market include:

- Airbnb Inc

- Booking Holdings Inc

- com Corp

- eDreams ODIGEO SA

- Expedia Group Inc

- Flight Centre Travel Group Ltd

- MakeMyTrip Ltd

- Singapore Airlines Ltd

- The Emirates Group

- Tongcheng Travel Holdings Ltd

- Trainline plc

- com Group Ltd

- Trivago NV

Other Online Travel Market Vendors Mentioned

TripAdvisor, Uber Technologies Inc, Marriott International, Hilton Worldwide Holdings Inc, Thomas Cook (India) Limited, lastminute.com N.V., Adventure Inc., Tuniu Corporation, Easy Trip Planners Ltd, Yatra Online Inc, and Hostelworld Group PLC, among others.

To Know More About Leading Online Travel Market Players, Download a Free Report Sample

Online Travel Market Research Scope

| Market Size in 2023 | $2.3 trillion |

| Market Size in 2030 | $4.6 trillion |

| CAGR (2023-2030) | 10.3% |

| Forecast Period | 2023-2030 |

| Historic Data | 2019-2022 |

| Report Scope & Coverage | Industry Overview, Revenue Forecast, Regional Analysis, Competitive Landscape, Company Profiles, Growth Trends |

| Type Segment | Transportation (Airlines, Car Rental, Others), Travel Accommodation, Travel Intermediation (Online Travel Agencies, Tour Operator Websites, Other Travel Intermediaries) |

| Regional Segment | North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa |

| Country Segment | US, Canada, Mexico, UK, Germany, France, Netherlands, Italy, Spain, Belgium, Switzerland, Sweden, China, India, Japan, South Korea, Australia, Singapore, Malaysia, Indonesia, Thailand, Brazil, Argentina, Saudi Arabia, South Africa, UAE |

| Key Companies | Airbnb, American Airlines Group Inc, Booking Holdings Inc, Despegar.com Corp, eDreams ODIGEO SA, Expedia Group Inc, Flight Centre Travel Group Ltd, MakeMyTrip Ltd, Singapore Airlines Ltd, The Emirates Group, Tongcheng Travel Holdings Ltd, Trainline plc, Trip.com Group Ltd, Trivago NV |

Online Travel Market Segments and Scope

GlobalData Plc has segmented the online travel market report by type and region:

Online Travel Type Outlook (Revenue, $ Billion 2019-2030)

- Transportation

- Airlines

- Car Rental

- Other

- Travel Accommodation

- Travel Intermediation

- Online Travel Agencies

- Tour Operator Websites

- Other Online Travel Intermediaries

Online Travel Regional Outlook (Revenue, $ Billion 2019-2030)

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Netherlands

- Italy

- Spain

- Belgium

- Switzerland

- Sweden

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Singapore

- Malaysia

- Indonesia

- Thailand

- Rest of Asia Pacific

- South and Central America

- Brazil

- Argentina

- Rest of South and Central America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Key Players

Airbnb IncBooking Holdings Inc

Despegar.com Corp

eDreams ODIGEO SA

Expedia Group Inc

Flight Centre Travel Group Ltd

MakeMyTrip Ltd

Singapore Airlines Ltd

The Emirates Group

Tongcheng Travel Holdings Ltd

Trainline plc

Trip.com Group Ltd

Trivago NV

Table of Contents

Figures

Frequently asked questions

-

What will be the online travel market size in 2023?

The online travel market size globally will be valued at $2.3 trillion in 2023.

-

What is the online travel market growth rate?

The online travel market is expected to grow at a CAGR of 10.3% over the forecast period (2023-2030).

-

What are the key online travel market drivers?

The increasing population coupled with the rising disposable income and proliferation of mobile devices are expected to drive the online travel market growth.

-

What are the key online travel market segments?

Type Segments: Transportation (Airlines, Car Rental, Others), Travel Accommodation, Travel Intermediation (Online Travel Agencies, Tour Operator Websites, Other Travel Intermediaries)

-

Which are the leading online travel companies?

The leading online travel companies are Airbnb, American Airlines Group Inc, Booking Holdings Inc, Despegar.com Corp, eDreams ODIGEO SA, Expedia Group Inc, Flight Centre Travel Group Ltd, MakeMyTrip Ltd, Singapore Airlines Ltd, The Emirates Group, Tongcheng Travel Holdings Ltd, Trainline plc, Trip.com Group Ltd, Trivago NV

-

Is there a breakdown of segments in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.