Iran Cards and Payments – Opportunities and Risks to 2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Iran Cards and Payments Market Report Overview

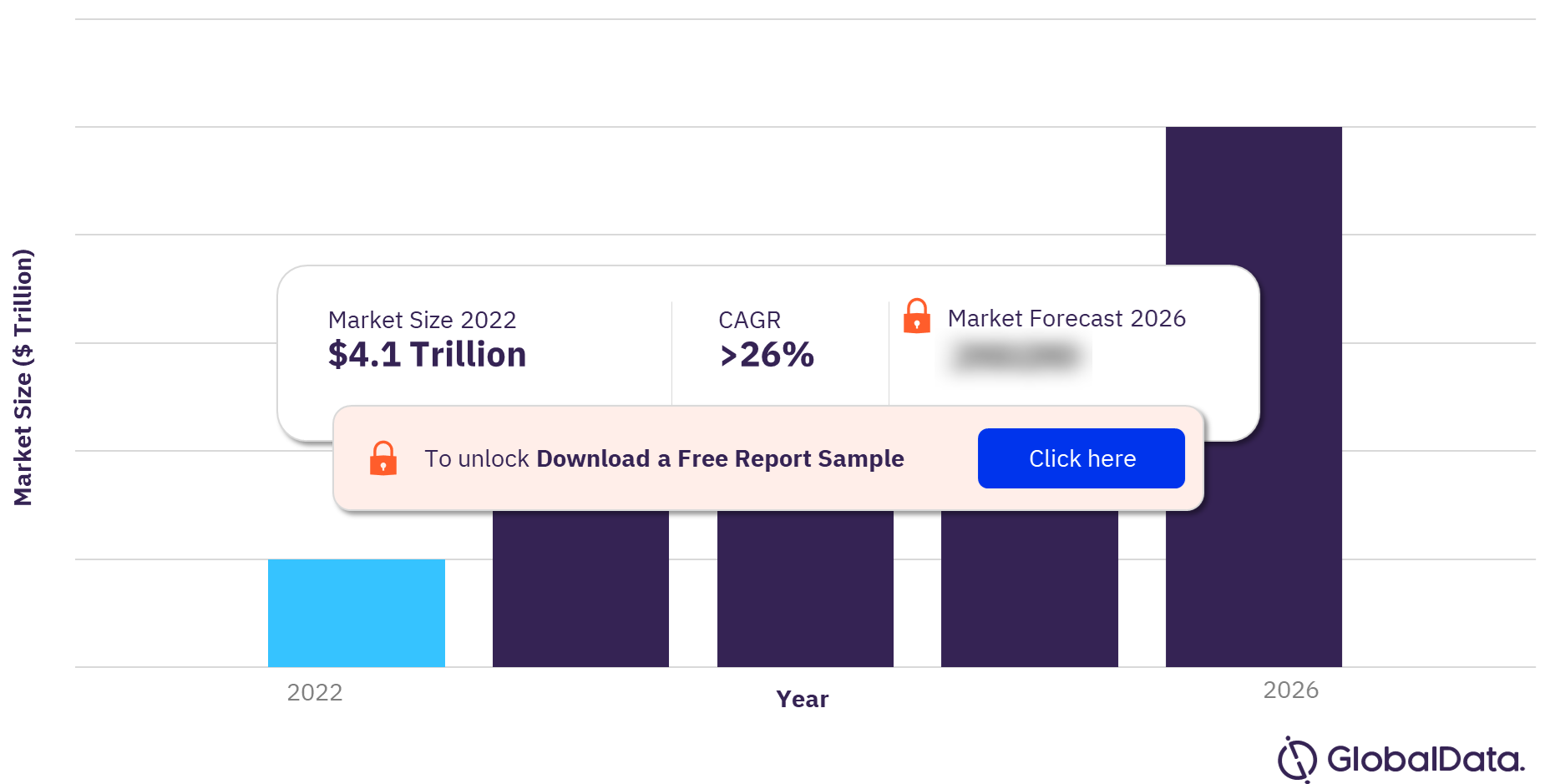

The Iran cards and payments market size was valued at $4.1 trillion in 2022 and is expected to achieve a CAGR of more than 26% during 2022-2026. Iran’s payment card market is relatively well-developed. The high penetration rate can be attributed to the country’s large banking population, as well as the implementation of various government initiatives to encourage electronic payments.

The Iran cards and payments market research report provides a detailed analysis of market trends in the Iran cards and payments market. The report provides values and volumes for several key performance indicators in the industry, including cards, credit transfers, and cheques during the review-period. It also analyzes various payment card markets operating in the industry and provides detailed information on the number of cards in circulation, transaction values, and volumes during the review period and over the forecast period. Moreover, it offers information on the country’s competitive landscape, including market shares of issuers and schemes.

Iran Cards and Payments Market Outlook, 2022-2026 ($ Trillion)

To gain more information on the Iran cards and payments market forecast, download a free report sample

Iran Cards and Payments Market Dynamics

The central bank of Iran is focusing on boosting contactless mobile payments. In February 2021, it launched an EMV-based mobile payment system, which allows users to make NFC-based contactless mobile payments by adding their payment cards to supported mobile apps. As of September 2021, three banks and one payment service provider had enabled this contactless payment functionality at over 20,000 POS terminals.

Owing to the US sanctions and rising inflation, the Iranian rial (IRR) has been declining in value. Its value further deteriorated following the outbreak of COVID-19. To address this situation, in May 2020, the Iranian government passed a bill to replace the rial with the toman and in September 2022, the central bank began a trial of its digital currency, the digital rial.

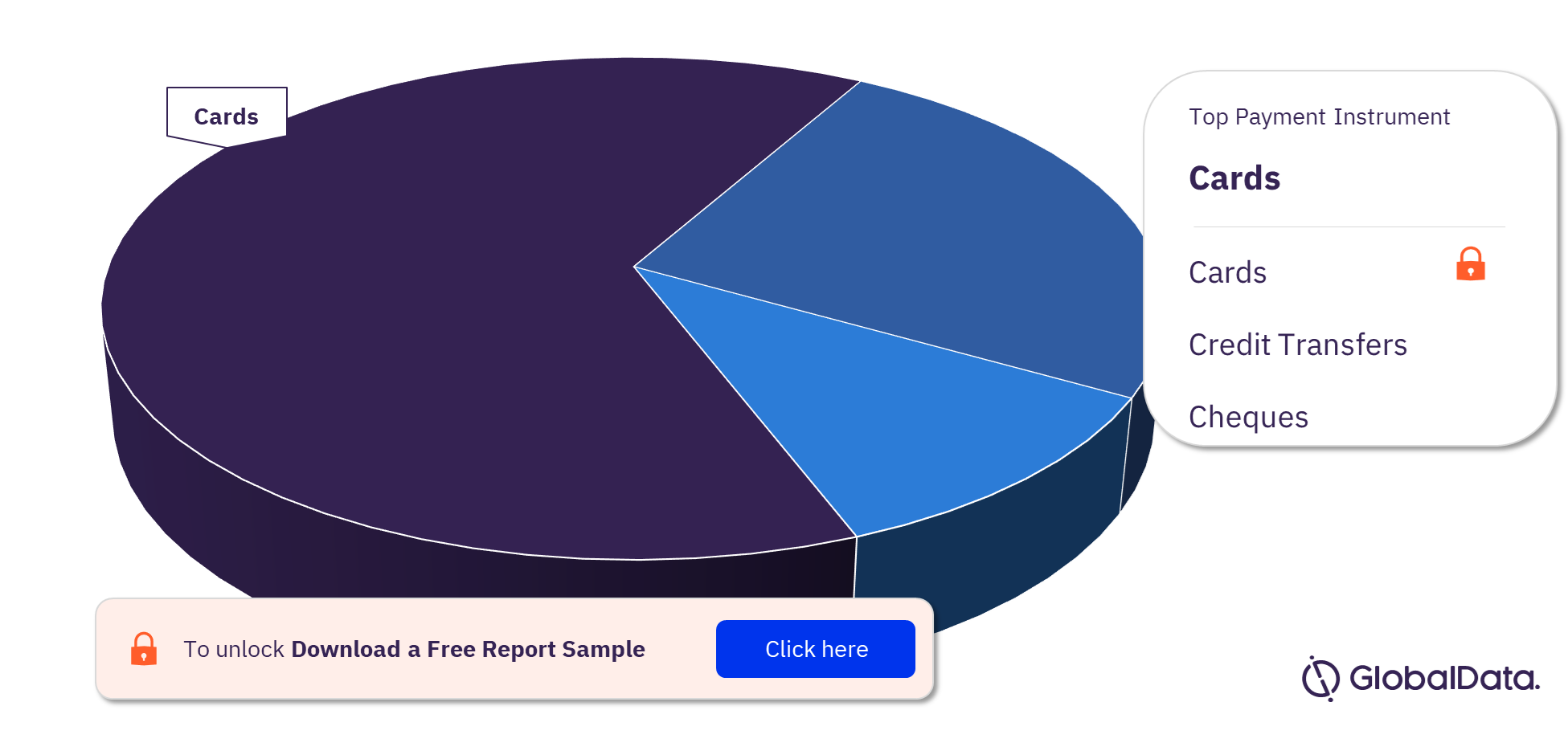

Iran Cards and Payments Market Segmentation by Payment Instruments

The key payment instruments in the Iran cards and payments market are cards, credit transfers, and cheques. In 2022, cards were the major payment instrument. Technologies such as quick-response (QR) codes and near-field communication (NFC) will further promote the growth of payment cards in the coming years.

Iran Cards and Payments Market Analysis by Payment Instruments, 2022 (%)

For more payment instrument insights into the Iran cards and payments market, download a free report sample

Iran Cards and Payments Market Segments

The key segments in the Iran cards and payments market are card-based payments and alternative payments.

Iran Cards and Payments Market - Competitive Landscape

Some of the leading players in the Iran cards and payments market are Bank Melli Iran, Bank Saderat Iran, Bank Mellat, Bank Sepah, Tejarat Bank, Bank Keshavarzi, Bank Maskan, Refah Bank, Parsian Bank, and Post Bank of Iran.

Iran Cards and Payments Market Report Overview

| Market Size (2022) | $4.1 trillion |

| CAGR | >26% |

| Forecast Period | 2022-2026 |

| Historical Period | 2018-2021 |

| Key Payment Instruments | Cards, Credit Transfers, and Cheques |

| Key Segments | Card-Based Payments and Alternative Payments |

| Leading Players | Bank Melli Iran, Bank Saderat Iran, Bank Mellat, Bank Sepah, Tejarat Bank, Bank Keshavarzi, Bank Maskan, Refah Bank, Parsian Bank, and Post Bank of Iran |

Segments Covered in the Report

Iran Cards and Payments Instruments Outlook (Value, $ Trillion, 2018-2026)

- Cards

- Credit Transfers

- Cheques

Iran Cards and Payments Market Segments Outlook (Value, $ Trillion, 2018-2026)

- Card-Based Payments

- Alternative Payments

Scope

This report provides:

- Current and forecast values for each market in the Iranian cards and payments industry, including debit and credit cards.

- Detailed insights into payment instruments including cards and cheques. It also includes an overview of the country’s key alternative payment instruments.

- E-commerce market analysis.

- Analysis of various market drivers and regulations governing the Iranian cards and payments industry.

- Detailed analysis of strategies adopted by banks and other institutions to market debit and credit cards.

Reasons to Buy

This report provides:

- Current and forecast values for each market in the Iranian cards and payments industry, including debit and credit cards.

- Detailed insights into payment instruments including cards and cheques. It also includes an overview of the country’s key alternative payment instruments.

- E-commerce market analysis.

- Analysis of various market drivers and regulations governing the Iranian cards and payments industry.

- Detailed analysis of strategies adopted by banks and other institutions to market debit and credit cards.

Bank Saderat Iran

Bank Mellat

Bank Sepah

Tejarat Bank

Bank Keshavarzi

Bank Maskan

Refah Bank

Parsian Bank

Post Bank of Iran

TT Bank

Qarz Al-Hasaneh Mehr Iran Bank

Ansar Bank

Pasargad Bank

TAT Bank

Saman Bank

EN Bank

Sarmayeh Bank

Sina Bank

Table of Contents

Frequently asked questions

-

What was the Iran cards and payments market size in 2022?

The cards and payments market size in Iran was valued at $4.1 trillion in 2022.

-

What is the Iran cards and payments market growth rate?

The cards and payments market in Iran is expected to achieve a CAGR of more than 26% during 2022-2026.

-

What are the key payment instruments in the Iran cards and payments market?

The key payment instruments in the Iran cards and payments market are cards, credit transfers, and cheques.

-

What are the key segments in the Iran cards and payments market?

The key segments in the Iran cards and payments market are card-based payments and alternative payments.

-

Who are the leading players in the Iran cards and payments market?

Some of the leading players in the Iran cards and payments market are Bank Melli Iran, Bank Saderat Iran, Bank Mellat, Bank Sepah, Tejarat Bank, Bank Keshavarzi, Bank Maskan, Refah Bank, Parsian Bank, and Post Bank of Iran.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports