Internet of Things (IoT) in Mining – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

IoT in Mining Theme Analysis Report Overview

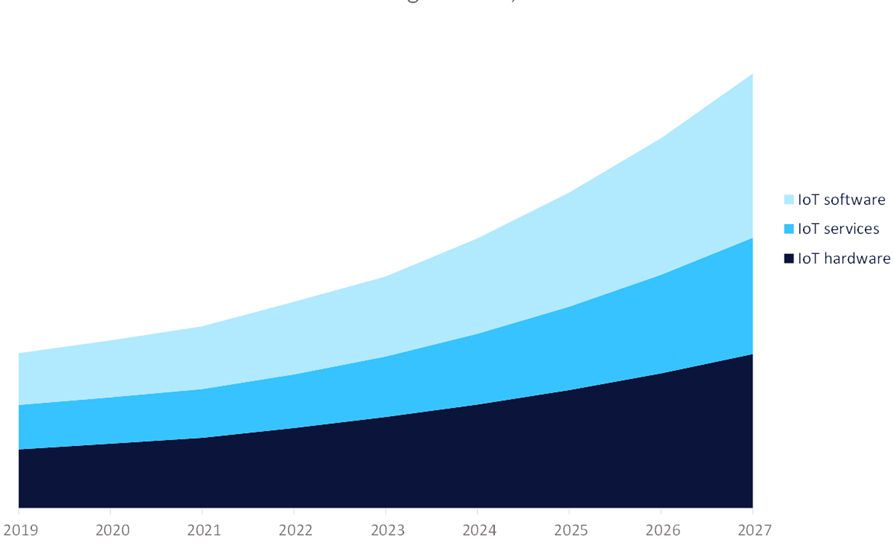

The mining IoT market was valued at $3.7 billion in 2022 and is expected to grow at a CAGR of more than 16% between 2022 and 2027. In an industry known for its complex and hazardous operations, IoT solutions enable mining companies to automate workflows, improve efficiency while reducing costs, and improve safety and environmental, social, and governance (ESG) credentials across the whole value chain. IoT supports mining operations such as autonomous drilling, driverless haul trucks, health and safety monitoring, energy management, and environmental monitoring. IoT technologies enabling these mining operations include drones, wearable tech, proximity detection sensors, and autonomous trucks.

The IoT in mining report will help you to understand IoT and its potential impact on the mining sector. The report will also help you benchmark your company against your competitors and assess how mining companies are utilizing IoT to drive revenues.

| Market Size (2022) | $3.7 billion |

| CAGR (2022-2027) | >16% |

| Key Value Chain Components | Physical Layer

Connectivity Layer Data Layer App Layer Services Layer |

| Key Leading IoT Adopters in Mining | Anglo American

BHP Boliden |

| Key Specialist IoT Vendors in Mining | ABB

Caterpillar Cisco |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Buy the Full Report for Additional Insights on the IoT in Mining Thematic Report

IoT Impact on Mining

IoT technology is deployed across the whole mining value chain, from prospecting to reclamation. Its spread has been encouraged by reduced latency, increased computing power, and the falling price of sensors, which have led to a faster ROI. IoT solutions enable mining companies to automate workflows, improve efficiency while reducing costs, and improve safety and ESG credentials. IoT technologies enabling mining operations include drones, wearable tech, proximity detection sensors, and autonomous trucks. Also, AI has increased relevance across all IoT layers, and a growing number of products and services incorporate this disruptive technology into their capabilities, especially for predictive maintenance and digital twin modeling.

Buy the Full Report for Impact Analysis of the IoT in Mining Report

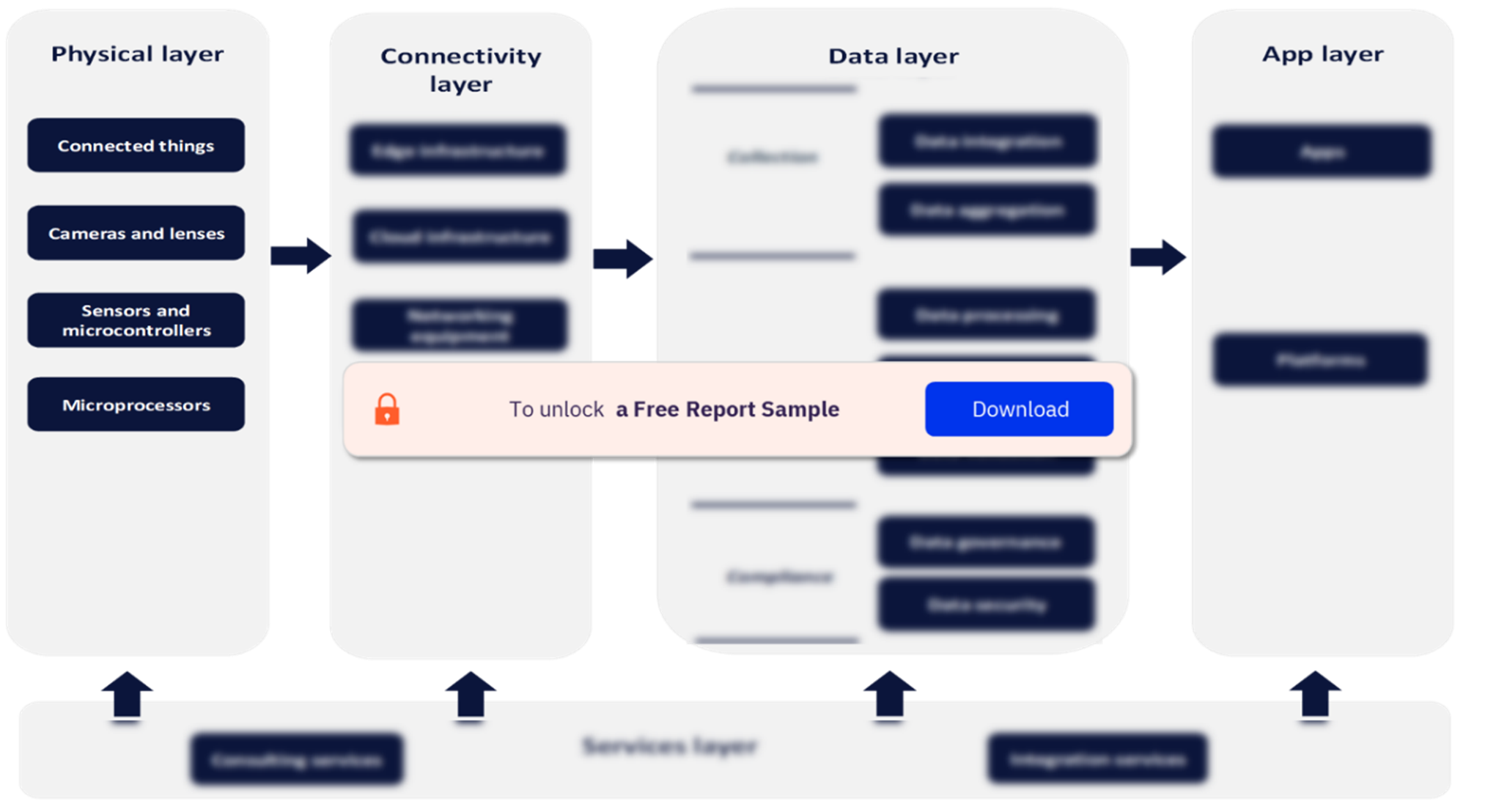

IoT Value Chain Analysis

The key layers in the IoT value chain are physical, connectivity, data, apps, and services. While these layers are logically discrete, large-scale IoT solutions are seeing considerable blurring of these logical boundaries. For example, while there will continue to be an identifiable data layer towards the top of the stack, a growing proportion of the data processing occurs within and at the edge of the network. The accelerated development of generative AI, particularly ChatGPT, has increased the relevance of AI across all IoT layers. Therefore, a growing number of IoT products and services incorporate AI into their capabilities, especially across customer-driven interfaces.

Physical Layer: The makers of connected things, including sensors, embedded chips, and their components comprise this layer. Connected things can include connected cars, smart thermostats, fitness bands, smart light bulbs, or a parcel in a delivery truck. The essential electronic components include microcontroller units (MCUs), central processing units (CPUs), AI chips, communications chips, and sensors. Despite the geopolitical issues impacting the production and delivery of advanced chips, leaders in this space include Amazon, Apple, and Huawei.

IoT Value Chain Analysis

Buy the Full Report for Value Chain Analysis of the IoT in Mining Report

IoT in Mining Industry Analysis

The mining IoT market was valued at $3.7 billion in 2022 and is expected to grow at a CAGR of more than 16% between 2022 and 2027. IoT enables real-time monitoring and control of mining operations. Therefore, it has become a vital technology for the mining industry. In an industry known for its complex and hazardous operations, IoT provides data on equipment status, safety hazards, and environmental factors, thus improving operational efficiency, safety, and sustainability.

The IoT in mining industry analysis also covers signals including –

- Mergers and acquisitions

- Patent trends

- Company filing trends

- Hiring trends

IoT in Mining Revenue, 2019-2027

Buy the Full Report for IoT in Mining Industry Forecasts

IoT in Mining – Competitive Landscape

Leading IoT Adopters in Mining: Some of the leading IoT adopters in mining are Anglo American, BHP, and Boliden among others.

Specialist IoT Vendors in Mining: ABB, Caterpillar, and Cisco are some of the specialist IoT vendors in the mining sector.

Buy the Full Report for More Information about the IoT in Mining Industry Players

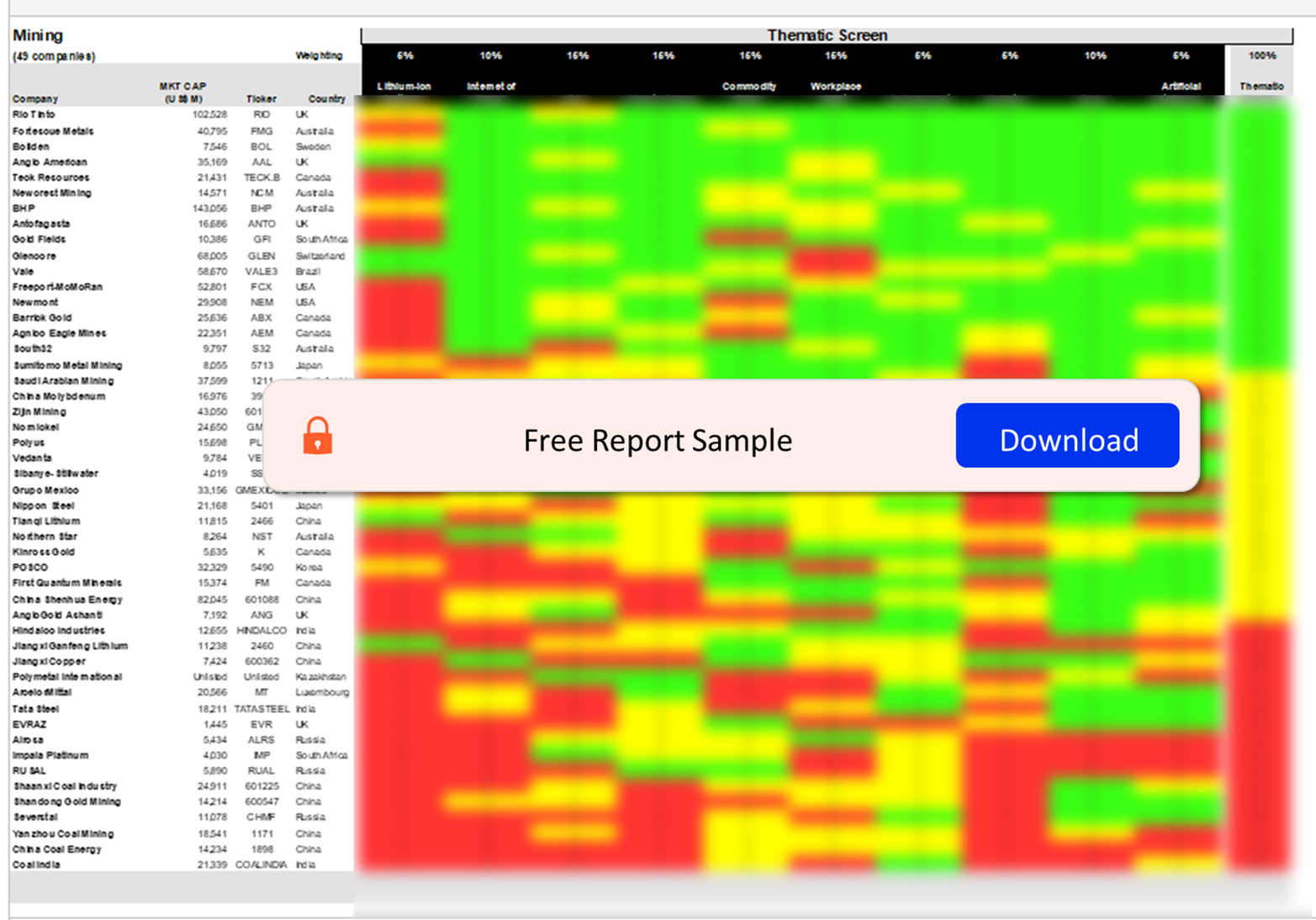

Mining Sector Scorecard

The mining sector scorecard approach predicts tomorrow’s leading companies within each sector using three screens including a thematic screen, a valuation screen, and a risk screen.

The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance. The valuation screen ranks our universe of companies within a sector based on selected valuation metrics. The risk screen ranks companies within a particular sector based on overall investment risks.

Mining Sector Scorecard

Buy the Full Report for More Information about the Mining Sector Scorecard

Scope

- This report provides an overview of the IoT theme. The detailed value chain comprises five layers: physical, connectivity, data, apps, and services. Leading and challenging vendors are identified across both segments.

- It identifies mining challenges, such as ESG, safety, productivity, and resource development, and an impact assessment of IoT on the mining industry, addressing these challenges.

- Several case studies are included to analyze the multiple ways countries and companies have responded to the impact of this theme’s growth and what they are doing to grow with this theme.

Key Highlights

IoT technology is deployed across the whole mining value chain, from prospecting to reclamation. Its spread has been encouraged by reduced latency, increased computing power, and the falling price of sensors, which have led to a faster ROI.

IoT solutions enable mining companies to automate workflows, improve efficiency while reducing costs, and improve safety and ESG credentials. IoT supports mining operations such as autonomous drilling, driverless haul trucks, health and safety monitoring, energy management, and environmental monitoring. IoT technologies enabling mining operations include drones, wearable tech, proximity detection sensors, and autonomous trucks.

Also, AI has increased relevance across all IoT layers, and a growing number of products and services incorporate this disruptive technology into their capabilities, especially for predictive maintenance and digital twin modeling.

Autonomous mining represents the future, with mining companies of all tiers investing in it. However, it will likely remain primarily accessible to larger players due to the financial commitments involved.

Reasons to Buy

- This report will help you to understand IoT and its potential impact on the mining sector.

- Benchmark your company against your competitors and assess how mining companies are utilizing IoT to drive revenues.

- Identify attractive investment targets by understanding which companies are most advanced in the themes that will determine future success in the mining industry.

- Understand key industry challenges and where IoT use cases are most useful.

- Develop and design your corporate strategies through an in-house expert analysis of IoT by understanding the primary ways in which this theme is impacting the mining industry.

- Position yourself for future success by investing in the right IoT technologies.

Anglo American

Antofagasta

Barrick Gold

BHP

Boliden

Freeport-McMoRan

Fortescue Metals

Glencore

Gold Fields

Jiangxi Copper

Newcrest Mining

Newmont

Northern Star

Rio Tinto

South32

Teck Resources

Vale

Vedanta

Zijin Mining

ABB

Caterpillar

Emesent

Epiroc

Fatigue Science

Guardhat

Hexagon

Howden

Komatsu

Latium Technologies

Maptek

Rockwell Automation

Sandvik (Newtrax)

SymboticWare

Trimble

Table of Contents

Frequently asked questions

-

What was the IoT market size in mining in 2022?

The mining IoT market was valued at $3.7 billion in 2022.

-

What will be the growth rate of mining spending on IoT products between 2022 and 2027?

The mining IoT market is expected to grow at a CAGR of more than 16% between 2022 and 2027.

-

Which are the key value chain components of the IoT market?

The key layers in the IoT value chain are physical, connectivity, data, apps, and services.

-

Who are the leading IoT adopters in mining?

Some of the leading IoT adopters in mining are Anglo American, BHP, and Boliden among others.

-

Who are the leading IoT adopters in mining?

ABB, Caterpillar, and Cisco are some of the specialist IoT vendors in the mining sector.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.