India Fuel Cards Market Size, Share, Key Players, Competitor Card Analysis and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

How will the ‘India Fuel Cards Market’ report help you achieve your business goals? The report’s in-depth analysis and market insights will help you:

- Understand the key market dynamics and growth opportunities in the India fuel cards market.

- Assess the competitive dynamics in the India fuel cards market.

- Analyze the current and future value and volume of the India fuel card market.

- Assess the network acceptance of your card and identify potential merchants be it an issuer, a processor, a leasing company, or a fuel retailer, and make informed business decisions.

How is the ‘India Fuel Cards Market report different from other reports in the market?

Businesses need to have a deeper understanding of the market dynamics to gain a competitive edge in the coming decade. Anticipate market changes and develop risk management strategies with the following data:

- Macroeconomic landscape: Detailed analysis of current macroeconomic factors and their impact on the Indian fuel cards market.

- Market dynamics: In-depth historical and forecast data of key channels (fleet cards and CRT cards) within the India fuel cards market.

- Trends: Identify the market trends and their impact in the coming years.

- Key players: Overview of market leaders including Operator Rankings in 2022 vs. 2021.

- Competitor card analysis: Detailed analysis of fees, discounts, credit days, station acceptance partners, free services, and the target region for the various cards available in the market.

We recommend this valuable source of information to anyone involved in:

- Issuers of Fleet Cards and Fuel Retailers

- Fleet Leasing Companies and Other Suppliers

- Technology Leaders and Startups

- Business Development and Market Intelligence

- Investment Analysts and Portfolio Managers

- Professional Services – Investment Banks, PE/VC firms

- M&A/Investment, Management Consultants, and Consulting Firms

To Get a Snapshot of the India Fuel Cards Market Report

India Fuel Cards Market Report Overview

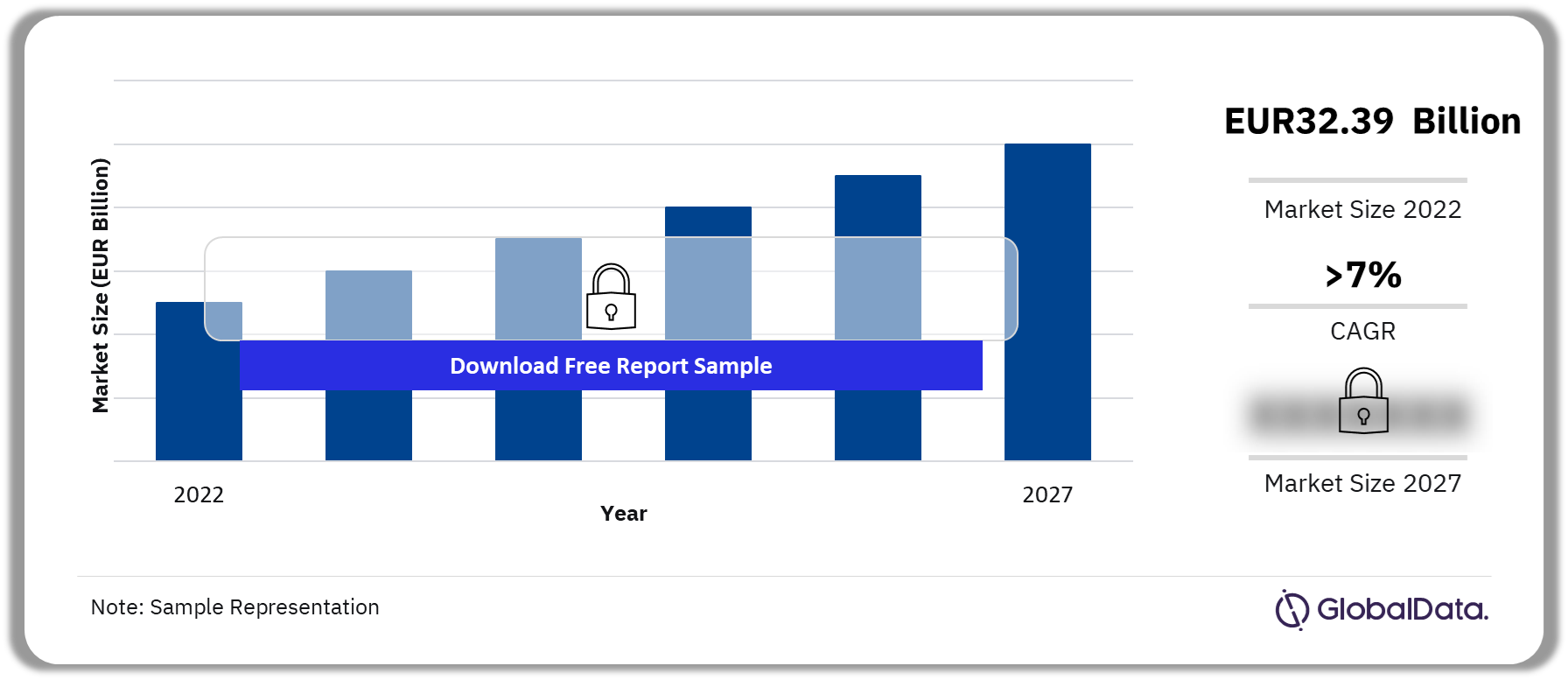

The India fuel cards market value was EUR32.39 billion in 2022. India has recorded growth in fuel card uptake since 2015. Rising fuel prices and greater volumes of fuel sold through fuel cards will drive the growth of fuel card value registering a CAGR of more than 7% during the period 2023-2027.

India Fuel Cards Market Outlook 2022-2027 (EUR Billion)

Buy the Full Report for More Insights into the India Fuel Cards Market Forecast

The India fuel cards market research report provides invaluable comprehensive data insights for issuers of fleet cards, fuel retailers, fleet leasing companies, and other suppliers to the sector. The report also provides commercial (B2B) fuel card volume (split by fleet and CRT), value and market share forecasts for 2027, and key data on independent and oil company card issuers. It also analyses fuel card competition in India.

| Market Size (2022) | EUR32.39 Billion |

| CAGR (2023-2027) | >7% |

| Historical Period | 2015-2022 |

| Forecast Period | 2023-2027 |

| Key Channels | · CRT Cards

· Fleet Cards |

| Leading Fuel Card Operators | · Indian Oil Corporation

· Bharat Petroleum · Hindustan Petroleum · Shell · Reliance Industries Limited |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

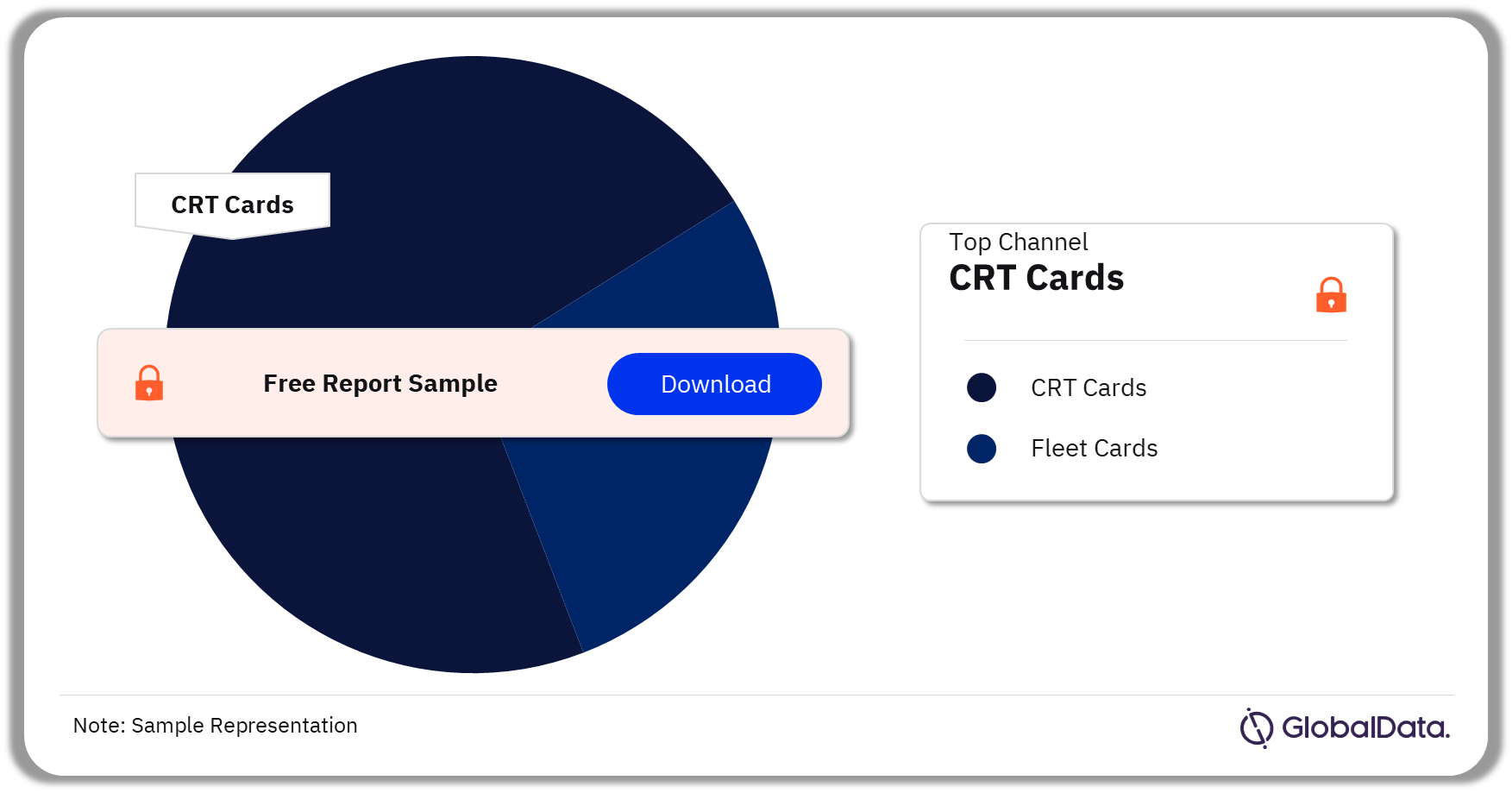

India Fuel Cards Market Segmentation by Channels

The key channels in the Indian fuel cards market are fleet cards and CRT cards. CRT card channels led the market in 2022. In India, a higher proportion of CRT vehicles have fuel cards, as companies ensure their drivers have maximum service station network coverage along their varied transport routes. However, during the forecast period, a large proportion of new fuel cards in India will be issued to small domestic fleets as they take on new business in the market. Card operators should ensure that they create new partnerships in India to expand their acceptance networks in urban and remote locations, as well as to meet fleet needs and increase the appeal of their fuel cards among fleet vehicles.

India Fuel Cards Market Analysis by Channels, 2022 (%)

Buy the Full Report for More Insights on Channels in the India Fuel Cards Market

India Fuel Cards Market – Competitive Landscape

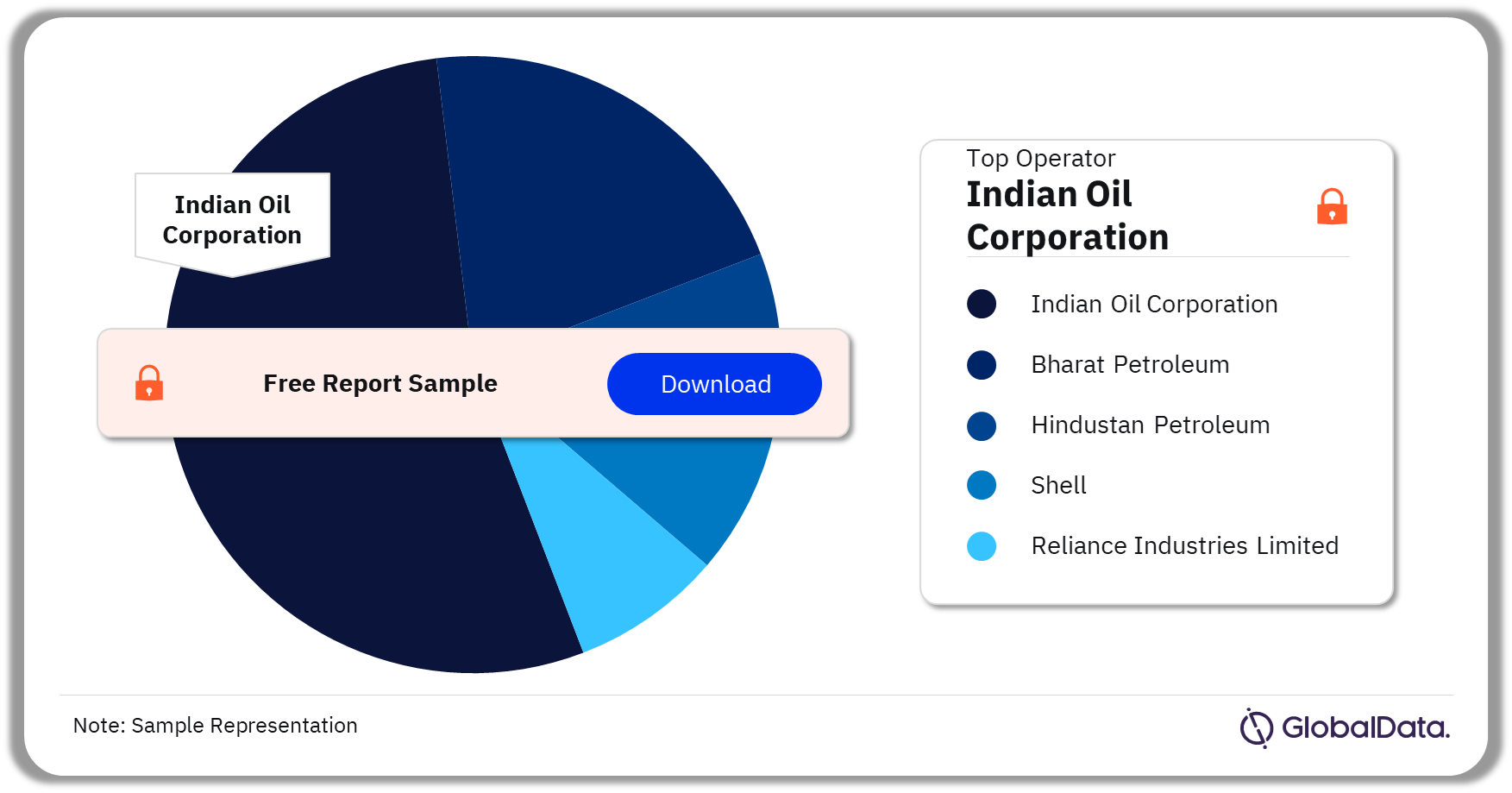

Some of the leading fuel card operators in India are:

- Indian Oil Corporation

- Bharat Petroleum

- Hindustan Petroleum

- Shell

- Reliance Industries Limited

In 2022, Indian Oil Corporation remained the fuel card market leader in 2022 due to its large acceptance network and fuel card offerings.

India Fuel Cards Market Analysis by Fuel Card Operators, 2022 (%)

Buy the Full Report for More Insights on Companies in the India Fuel Cards Market

Segments Covered in the Report

India Fuel Cards Channels Outlook (Value, EUR Billion, 2015-2027)

- Fleet card

- CRT card

Key Highlights

The total number of service stations in India increased by 5.9%, from 78,607 in 2021 to 83,222 in 2022. Around 2.8 million new fuel cards will be issued during 2023-27, resulting in a total of 16.1 million cards in the market. Out of the total active cards in the market, 50.7% will be held by fleet vehicles and 49.3% by CRT vehicles. Fuel card volumes will rise by a CAGR of 5.1% from 2023 to 2027, reaching 40.5 billion liters in 2027.

Bharat Petroleum

Hindustan Petroleum

Reliance Industries Limited

Shell

Table of Contents

Frequently asked questions

-

What was the India fuel cards market size in 2022?

The fuel card market size in India was valued at EUR32.39 billion in 2022.

-

What is the market growth rate of the Indian fuel card market?

The India fuel cards market is expected to register a CAGR of more than 7% during the period 2023-2027.

-

Which channel led the India fuel cards market?

CRT cards channel led the India fuel cards market.

-

Which are the leading fuel card operators in the Indian fuel cards market?

Some of the leading fuel card operators in India are Indian Oil Corporation, Bharat Petroleum, Hindustan Petroleum, Shell, and Reliance Industries Limited among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.