ICICI Bank – Digital Transformation Strategies

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

ICICI Bank has been focusing on digital technologies as a part of its digital transformation strategies. The annual ICT spending of ICICI Bank was estimated at $760.7 million in 2021. A major share of this spending is earmarked for acquiring Network and communications, ICT services, and software from vendors. ICICI Bank offers personal and corporate banking, investment banking, private banking, venture capital, life and non-life insurance, securities broking, and asset management services to corporate and retail clients, high net worth individuals, and SMEs.

The ICICI Bank digital transformation strategies report will act as a reference point to understand a company/competitor’s digital strategy. It will also help in understanding the digital preparedness of the company against its peers. Information included in these reports are sourced from a mix of our very own internal database and authentic secondary research links such as company’s annual report, presentations, press releases etc. The report covers overview of the company, its digital transformation strategies, technology focus areas, technology initiatives, technology introductions, investments, acquisitions, ICT spending among others.

Digital Transformation Strategies

ICICI introduced digital and technology solutions to strengthen its services while ensuring the safety of its customers and workforce amid the pandemic. It has digitized account opening, Know Your Customer, cash withdrawal, and customer service processes for retail and business customers. It has introduced various digital banking platforms and services for retailers and businesses. It is growing its internal capabilities while building the technology expertise of its employees. It launched the 12 x 12 Ignite series to keep its employees up to date on emerging technologies.

To gain more insights on digital transformation strategies and initiatives of ICICI Bank, download a free report sample

ICICI Bank Technology Theme Focus

ICICI Bank is utilizing number of emerging technologies including big data, blockchain, and cloud to enhance its operational and service capabilities.

ICICI Bank Technology Theme Focus

To know about other technology themes under focus for the company, download a free report sample

ICICI Bank Technology Initiatives

ICICI collaborated with Shivaami Cloud Services to build cloud-based solutions for Indian SMEs and help them optimize their accounting transactions. This partnership combines ICICI’s API banking solutions with Shivaami Cloud Services to offer SaaS applications including Google Cloud Platform, Google Suite for efficient communication between team members, FreshSales for effective customer relationship management, FreshMarketer, and FreshDesk for customer service.

For more insights on other technology initiatives of ICICI Bank, download a free report sample

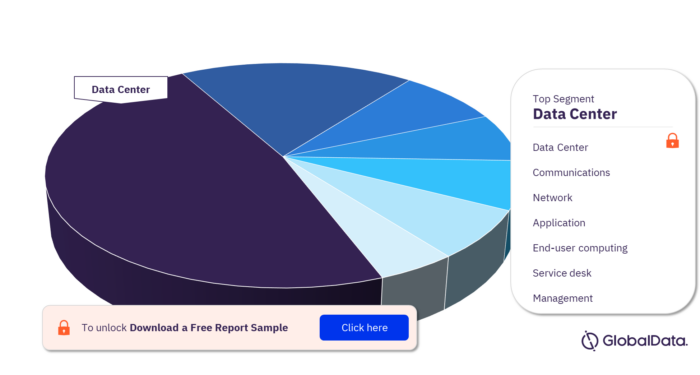

ICICI Bank ICT Spend by Function

- Communications

- Data center

- Network

- Application

- End-user computing

- Service desk

- Management

ICICI Bank ICT Spend by Function

For more insights on ICT spending by function, download a free report sample

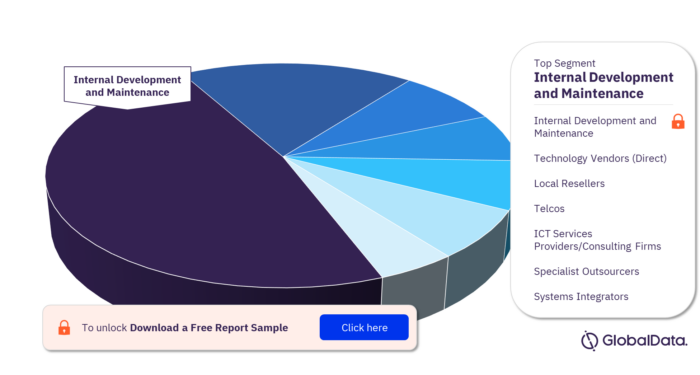

ICICI Bank ICT Spend by Channel

- Internal development and maintenance

- Technology vendors (direct)

- Local resellers

- Telcos

- ICT services providers/Consulting firms

- Specialist outsourcers

- Systems integrators

ICICI Bank ICT Spend by Channel

For more insights on ICT spending by channel, download a free report sample

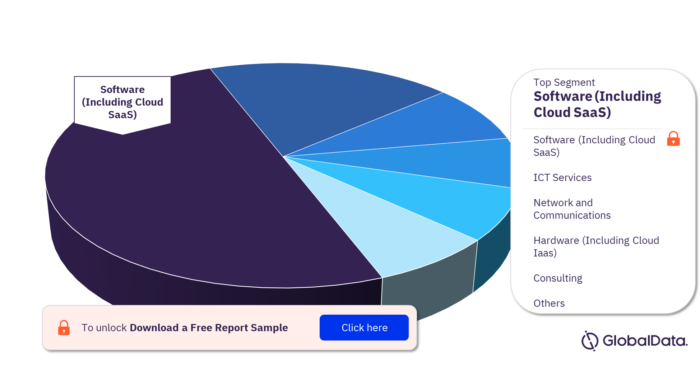

ICICI Bank External ICT Spend by Segment

- ICT services

- Software (including Cloud SaaS)

- Hardware (including Cloud Iaas)

- Network and communications

- Consulting

- Others

ICICI Bank External ICT Spend by Segment

For more insights on external ICT spending by segment, download a free report sample

ICICI Bank Digital Transformation Strategies Overview

| Total ICT Spending 2021 | $760.7 million |

| ICT Spend by Function | Communications, Data Center, Network, Application, End-User Computing, Service Desk, and Management |

| ICT Spend by Channel | Internal Development and Maintenance, Technology Vendors (Direct), Local Resellers, Telcos, ICT Services Providers/Consulting Firms, Specialist Outsourcers, and Systems integrators |

| External ICT Spend by Segment | ICT services, Software (including Cloud SaaS), Hardware (including Cloud Iaas), Network and communications, Consulting, and Others |

| Technology Theme Focus | Big Data, Blockchain, and Cloud |

This report provides:

- Insight into ICICI Bank’s technology activities.

- Insights of its digital transformation strategies and technology center & innovation program.

- Overview of technology initiatives covering partnerships, investments, and acquisitions.

- Insights on each technology initiative including technology theme, objective, and benefits.

- Details of estimated ICT budgets and major ICT contracts.

Reasons to Buy

- Gain insights into ICICI Bank’s technology operations.

- Gain insights into its technology strategies and innovation initiatives.

- Gain insights into its technology themes under focus.

- Gain insights into its various partnerships, investments, and acquisitions.

Experian

TCS

Moneythor

Fingpay

Incremint

GyanDhan

TAQBit

Nanobi

Heckyl Technologies

iProov

Algofox

Idos

Credochain

Hylo Challenger Private Limited

Jarvis Invest

Gimbooks

Wealth Easy

Paymatrix

Zimyo

Phi Commerce Pvt Ltd

Paytm

HDFC

Kotak Mahindra

Axis Bank

JP Morgan

Infosys Finacle

Stellar

Westpac

Pine Labs

Open Financial Technologies

Marg ERP

Truecaller

Signzy

Apple

Shivaami Cloud Services

Terainium

Zoho

ODRways

First Hive

ePayLater

BTI Payments

Fino Paytech

True Balance

SLO Technologies

Tapits Technologies

Avenues Payments

Arteria Technologies

MyClassboard Educational Solutions

CityCash

Thillais Analytical Solutions

IBBIC

Wipro

Table of Contents

Frequently asked questions

-

What was the total ICT spending of ICICI Bank in 2021?

The annual ICT spending of ICICI Bank was estimated at $760.7 million in 2021.

-

What are the key ICT spending categories by function for ICICI Bank?

The key ICT spending categories by function for ICICI Bank are communications, data center, network, application, end-user computing, service desk, and management.

-

What are the key ICT spending categories by channel for ICICI Bank?

The key ICT spending categories by channel for ICICI Bank are internal development and maintenance, technology vendors (direct), local resellers, telcos, ICT services providers/consulting firms, specialist outsourcers, and systems integrators.

-

What are the key external ICT spending categories by segment for ICICI Bank?

The key external ICT spending categories by segment for ICICI Bank are ICT services, software (including cloud SaaS), hardware (including cloud IaaS), network and communications, consulting, and others.

-

What are the key technology themes in focus for ICICI Bank?

The key technological theme in focus for ICICI Bank are big data, blockchain, and cloud.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Financial Services reports