Hydrogen in Oil and Gas – Thematic Research

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Explore actionable market insights from the following data in our ‘Hydrogen in Oil and Gas’ report:

- Explores the opportunities for oil and gas companies in the hydrogen economy.

- Analyses the scope of hydrogen for the oil and gas industry and identifies key players across the value chain.

- Provides an overview of the competitive positions held by oil and gas companies, and contractor companies in the hydrogen theme.

- Includes sector scorecards for integrated oil companies ranking them with respect to thematic exposure, market valuation, and overall investment risk.

How is the ‘Hydrogen in Oil and Gas’ report different from other reports in the market?

- Explore recent industry, technology, regulatory, and macroeconomic trends in the hydrogen theme.

- Discover growth opportunities for oil and gas industry players in the hydrogen economy.

- Recognize and benchmark key oil and gas companies and their role in the hydrogen theme.

- Identify and benchmark key contractor companies participating in the hydrogen market.

We recommend this valuable source of information to anyone involved in:

- Oil & Gas/Hydrogen Project Owners and Developers

- EPC Contractors Focused on Hydrogen in Oil & Gas Projects

- Technology Leaders and Startups

- Business Development and Market Intelligence

- Investment Analysts and Portfolio Managers

- Professional Services – Investment Banks, PE/VC firms

- M&A/Investment, Management Consultants, and Consulting Firms

To get a snapshot of the hydrogen in oil and gas thematic report, download a free report sample

Hydrogen in Oil and Gas Report Overview

Oil companies are looking for avenues to move towards operations with net-zero emissions. Among various options to choose from, such as renewable energy, biofuels, and hydrogen, low-carbon hydrogen presents a suitable alternative for oil and gas industry players. Green and blue hydrogen are the main types of low-carbon hydrogen alternatives available to the market. Of the 1,716 active and upcoming low-carbon hydrogen plants around the world, only 208 are fully dedicated to the requirements of the oil and gas industry as of June 2023.

This report explores the opportunities for oil and gas companies in hydrogen economy. It analyses the scope of hydrogen for the oil and gas industry and identifies key players across the value chain. The report provides an overview of the competitive positions held by oil and gas companies, and contractor companies in the hydrogen theme. The report includes sector scorecards for integrated oil companies ranking them with respect to thematic exposure, market valuation, and overall investment risk.

| Key Trends | Oil and Gas Trends, Technology Trends, and Regulatory Trends |

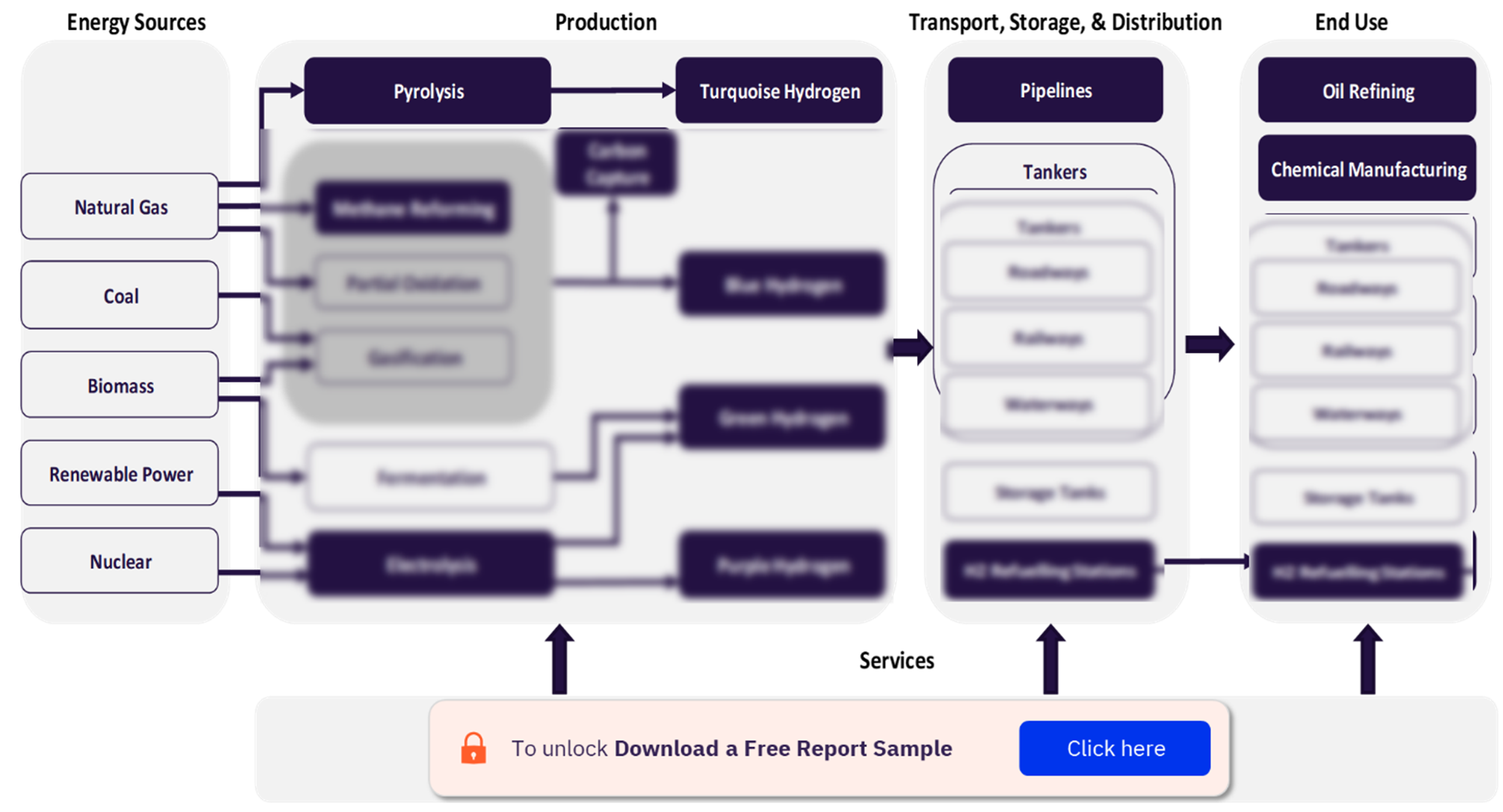

| Key Value Chain Components | Energy Sources, Production, Transport, Storage & Distribution, and End Use |

| Oil and Gas Companies | BP, China Petrochemical Corp, Eni, Equinor, ExxonMobil, Reliance Industries, Repsol, Saudi Arabian Oil Co, Shell, and TotalEnergies |

| Contractors | Air Liquide, Air Products and Chemicals, Baker Hughes, Ballard Power, Green Hydrogen Systems, Hexagon Composites, Honeywell, Linde, Nel ASA, and Siemens Energy |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

For more insights on the Hydrogen in oil and gas theme, download a free sample report

Hydrogen in Oil and Gas Industry Trends

The main trends shaping the hydrogen theme over the next 12 to 24 months are oil and gas trends, technology trends, and regulatory trends.

Oil and Gas Trends: Hydrogen as a component of energy transition strategies, high costs, government funding, potential of hydrogen in energy storage, growth in the transportation sector, and challenges concerning the hydrogen economy are the key oil and gas trends influencing the hydrogen market.

Technology Trends: Technological advancements could make electrolyzers affordable, issues with hydrogen transportation technologies, hydrogen fuel cell applications in transportation and power generation, CCS deployment can transform blue hydrogen utilization, and prospects of waste to hydrogen production are some of the technology trends gaining traction in the oil and gas industry.

Regulatory Trends: The regulatory scenario in the Middle East and Africa, major APAC countries building the groundwork for the hydrogen economy, EU hydrogen plan aimed at decarbonization, and US DOE pursuing hydrogen through multiple initiatives are the latest regulatory trends impacting the hydrogen theme over the next few months.

For more insights on the key hydrogen in oil and gas trends, download a free sample report

Hydrogen in Oil and Gas Industry Analysis

Hydrogen has gained traction in recent years as an alternative form of energy. Hydrogen can help in achieving imperative global decarbonization targets in the energy sector as well as other difficult-to-decarbonize industrial sectors. As a result, low-carbon hydrogen is gaining popularity as an energy transition technology. Several major economies such as the US and European Union have laid out their hydrogen plans as the energy transition gains precedence in the global polity as well as the corporate boardrooms of energy companies.

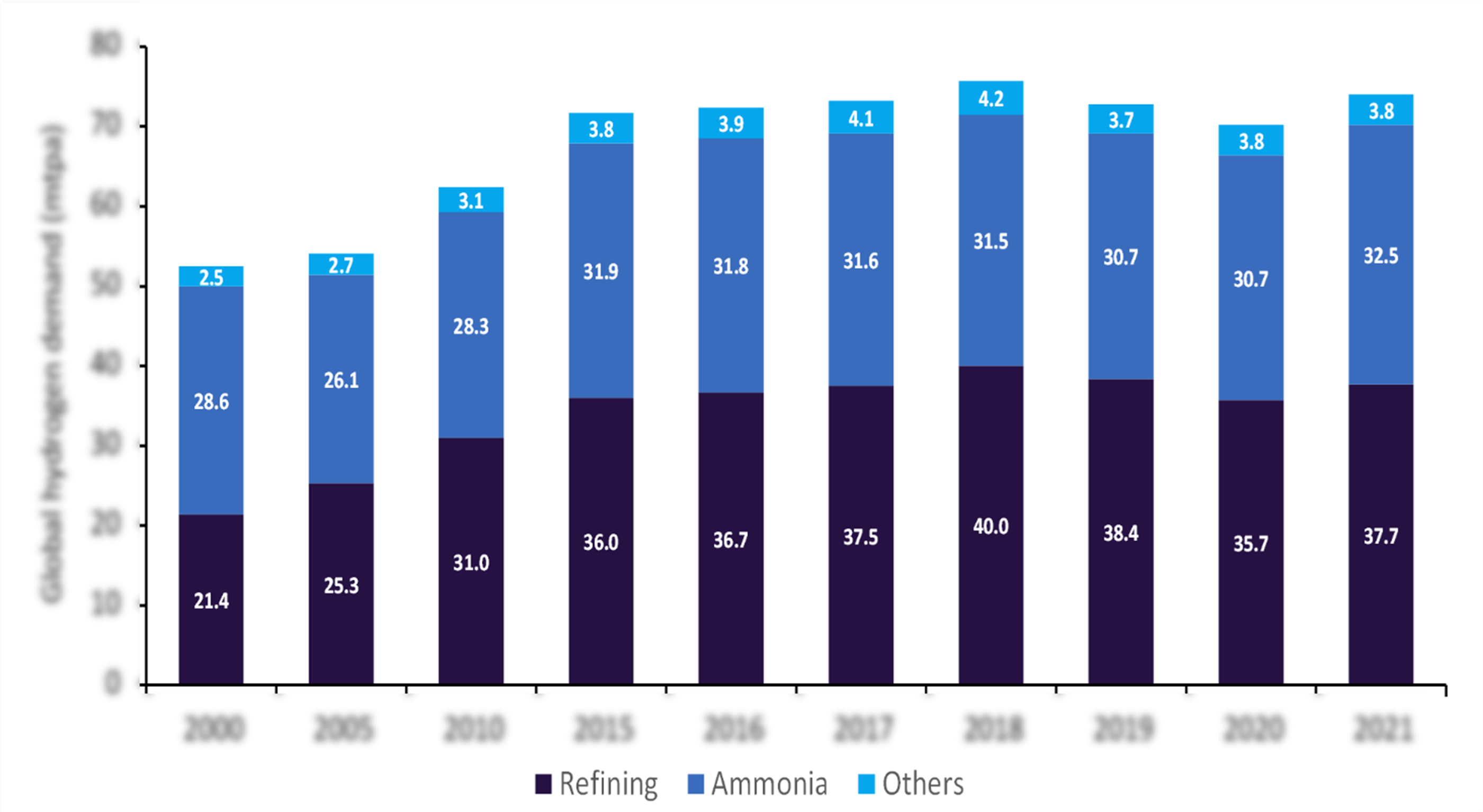

The demand for hydrogen applications other than refining and petrochemical sectors accounted for more than 5% in 2021. The growing trend of decarbonization is expected to impact the demand for refined fuels in transportation as well as other industrial verticals. On the other hand, demand for hydrogen fuel used in transportation, combustion, and as an energy storage medium will increase by 2030.

Hydrogen in Oil and Gas Industry Analysis

The Hydrogen in oil and gas industry analysis also covers:

- Hydrogen adoption by sector

- Low-carbon hydrogen capacity outlook

- Hydrogen pipelines

- Competitive landscape

- Timeline

- M&A trends

- Venture financing trends

- Patent trends

- Company filings trends

- Hiring trends

For more insights on the Hydrogen in oil and gas industry, download a free sample report

Hydrogen in Oil and Gas Industry Value Chain Insights

The hydrogen value chain encompasses hydrogen production channels from various energy sources, along with its transportation, storage, and distribution aspects, and finishing with its end uses in various industrial verticals. Energy sources, production, transport, storage & distribution, and end use are the key value chain components in the Hydrogen in the oil and gas industry.

Energy Source: Materials available for sourcing hydrogen include natural gas via reforming, coal via gasification, water via electrolysis, and biomass, through varied processes. Conventionally natural gas has been the most dominant source for hydrogen production followed by cheaply available coal. Although they are still the cheapest sources to derive hydrogen gas, they discharge a high amount of carbon emissions during their processing. To curb the emissions, carbon capture technologies are being employed, resulting in blue hydrogen. The incorporation of carbon capture technologies in hydrogen production further increases the cost of production. Pyrolysis is another method of extracting hydrogen from natural gas which results in turquoise hydrogen.

Hydrogen in Oil and Gas Industry Value Chain Analysis

For more insights on the Hydrogen in oil and gas industry value chain components, download a free sample report

Hydrogen in Oil and Gas Industry – Competitive Landscape

The Hydrogen in oil and gas industry report highlights companies making their mark within the hydrogen theme.

Oil and Gas Companies: BP, China Petrochemical Corp, Equinor, ExxonMobil, Reliance Industries, Saudi Arabian Oil Co, Shell, TotalEnergies are the oil and gas companies in the Hydrogen theme. BP plans on producing 0.5–0.7 mtpa of low-carbon hydrogen by 2030, with green hydrogen being the primary path. The company is also involved in developing H2Teesside, the UK’s largest blue hydrogen project, which aims to produce 500MW of green hydrogen by 2030. BP is working with EPC vendors to incorporate green hydrogen capacities at its refineries in Germany and the Netherlands. It is also involved in low-carbon hydrogen projects in Australia and the US. Furthermore, it has plans to build up its green hydrogen capacity in Spain. BP is among the leading five global companies with active and upcoming green hydrogen capacity by 2030.

Contractors: Air Liquide, Air Products and Chemicals, Baker Hughes, Green Hydrogen Systems, Honeywell, Linde, Nel ASA, and Siemens Energy are some of the leading contractors in the Hydrogen in oil and gas industry companies. Air Products is an industrial gas supplier that owns and operates over 100 hydrogen plants. It also maintains a large hydrogen distribution network. The company has over 250 hydrogen-fueling projects in over 20 countries. It holds an extensive patent portfolio in hydrogen dispensing technology and supplies hydrogen to its clients in the form of cylinders, cryogenic tanks, and a pipeline. It also sets up on-site hydrogen gas generation units wherever feasible. Air Products plans to invest $4.5 billion to build a blue hydrogen production facility in Louisiana, US, which is expected to be operational in 2026. It also has upcoming green hydrogen projects in North America and the Middle East.

For more insights on the key Hydrogen in oil and gas industry companies, download a free sample report

Integrated oil and gas sector scorecard

The scorecard approach is used for predicting tomorrow’s leading companies within each sector have four screens: a company screen, a thematic screen, a valuation screen, and a risk screen.

Integrated Oil and Gas Sector Scorecard Analysis

For more insights on the Hydrogen in oil and gas industry scorecard, download a free sample report

Table of Contents

Frequently asked questions

-

What are the key trends in the Hydrogen in oil and gas industry?

Oil and gas trends, technology trends, and regulatory trends are the key trends in the Hydrogen in oil and gas industry.

-

What are the key value chain components in the Hydrogen in oil and gas industry?

Energy sources, production, transport, storage & distribution, and end use are the key value chain components in the Hydrogen in the oil and gas industry.

-

Which are the main oil and gas companies in the Hydrogen in oil and gas industry?

BP, China Petrochemical Corp, Equinor, ExxonMobil, Reliance Industries, Saudi Arabian Oil Co, Shell, TotalEnergies are the oil and gas companies in the Hydrogen theme.

-

Which are the key Hydrogen in oil and gas industry contractors?

Air Liquide, Air Products and Chemicals, Baker Hughes, Green Hydrogen Systems, Honeywell, Linde, Nel ASA, and Siemens Energy are some of the leading contractors in the Hydrogen in oil and gas industry companies.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Oil and Gas reports