Platinum Mining Market Analysis by Reserves, Production, Assets, Demand Drivers and Forecast to 2030

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Platinum Mining Market Report Overview

Platinum production is expected to decline by 1.5% to 6.1 million ounces (moz) in 2024. The decline is primarily due to the decline in output from Russia and South Africa, which are expected to be partially offset by higher output from the US. However, global production is expected to recover gradually, registering a CAGR of more than 1% during the forecast period. This recovery can be due to ongoing expansion at the Two Rivers mine in South Africa and the commencement of the Mareesburg project in 2025.

Buy the Full Report for More Insights into the Global Platinum Market Forecast, Download A Free Report Sample

The platinum mining market research report provides detailed historical and forecast period data on the global platinum industry. It provides a complete view of the platinum reserves globally, with a breakdown of key platinum mining countries and the prevailing platinum prices in those countries. It also analyzes the competitive business landscape, highlighting company profiles of a few of the major market participants. Furthermore, the report sheds light on the major active mines, as well as upcoming development and exploration projects by region.

| Forecast Period | 2023-2030 |

| Historical Period | 2011-2022 |

| Key Countries | · South Africa

· Russia · Zimbabwe · Canada · US · Others |

| Active Mines | · Impala Mine

· Marikana Mine (Lonmin) · Mogalakwena Mine · Rustenburg Complex · Kola MMC Mine |

| Development Projects | · Garatau Project, South Africa

· Waterberg Project, South Africa · Platreef Project, South Africa · Marathon Project, Canada · Karo Platinum Project, Zimbabwe · Tjate Project, South Africa |

| Exploration Projects | · Booysendal Prospect Project

· Weld Range Complex Project · Julimar Project · Tamboti Project · River Valley Project |

| Leading Companies | · Anglo American Plc

· Impala Platinum Holdings Ltd · Sibanye Stillwater Ltd · MMC Norilsk Nickel |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

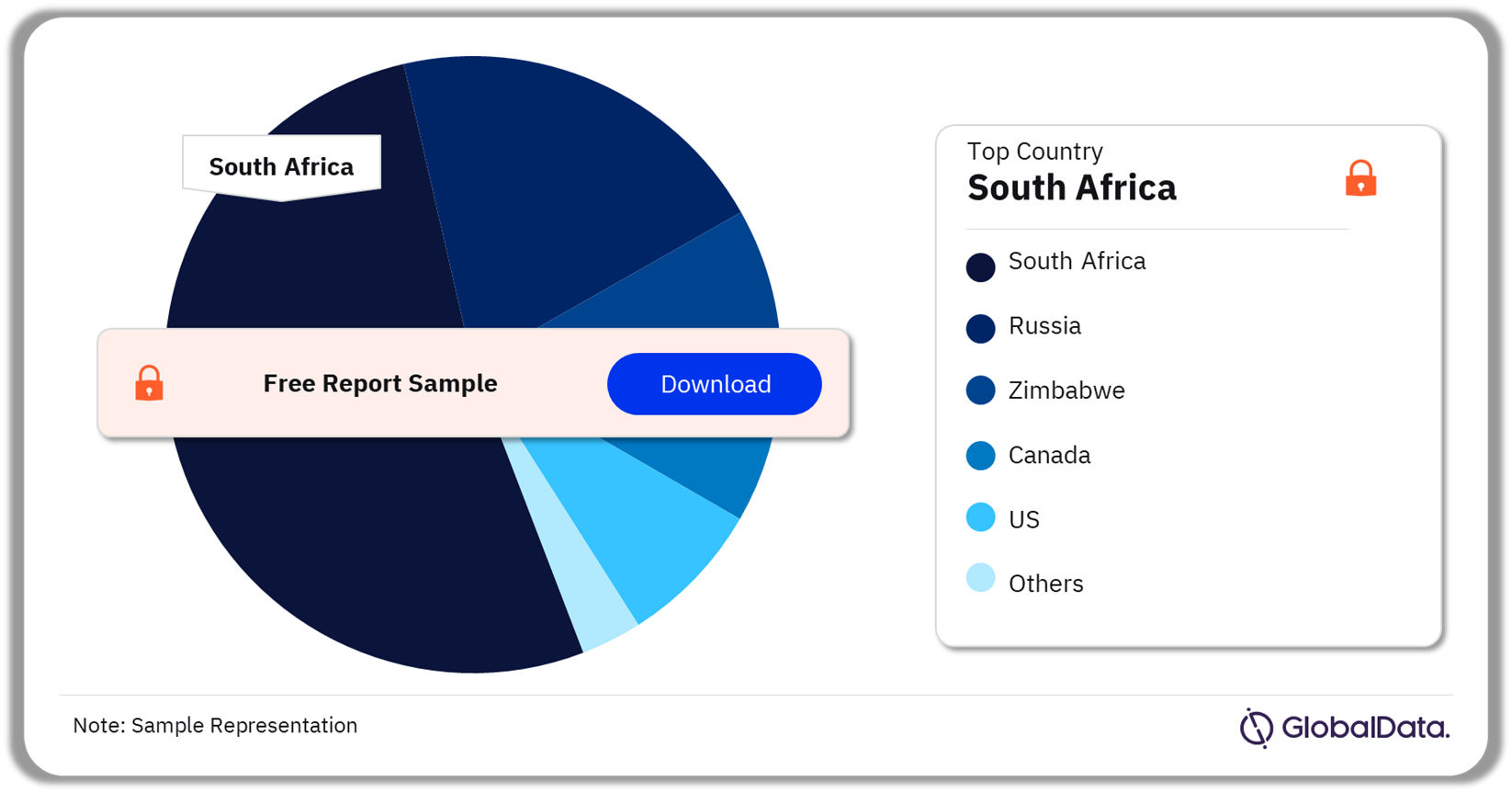

Platinum Mining Market Production by Country

South Africa, Russia, Zimbabwe, Canada, and the US are the world’s top five producers of platinum, accounting for majority of the global share in 2023. South Africa was the leading platinum producer in 2023. The top platinum mines operating in South Africa include Impala, Marikana, and Mogalakwena. However, the country’s platinum industry is currently experiencing operating challenges due to power shortages, rail constraints, and volatile prices, and several companies announced restructuring processes in response to falling prices.

Platinum Mining Production Analysis by Countries, 2023 (%)

Buy the Full Report for More Country Insights into the Platinum Mining Market, Download a Free Report Sample

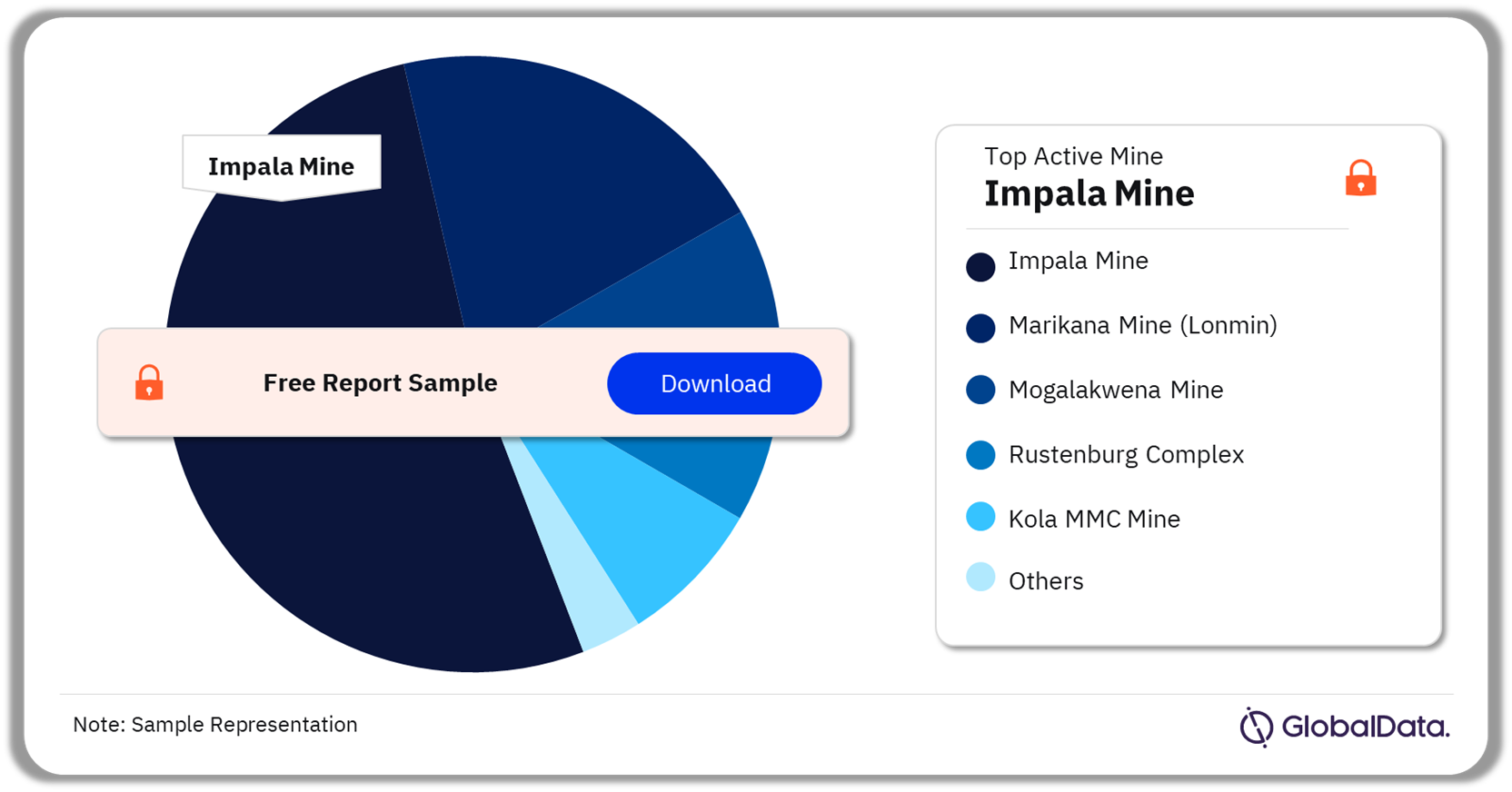

Platinum Mining Market - Active Mines

A few of the major active platinum mines are Impala Mine, Marikana Mine (Lonmin), Mogalakwena Mine, Rustenburg Complex, and Kola MMC Mine among others. The Impala Mine is the top platinum mine operating in South Africa.

Platinum Mining Market Analysis by Active Mine, 2024 (%)

Buy the Full Report for More Insights on Active Mines in the Platinum Mining Market, Download a Free Report Sample

Platinum Mining Market - Development Projects

A few of the major platinum mining projects that are in the development phase include the Garatau Project, South Africa; the Waterberg Project, South Africa; the Platreef Project, South Africa; the Marathon Project, Canada; Karo Platinum Project, Zimbabwe; and Tjate Project, South Africa among others.

Garatau Project, South Africa: The project is majority (74%) owned by Zijin Mining Group and is currently awaiting regulatory approvals and permitting. It has an annual saleable production capacity of 330koz of platinum and is set to commence operations in 2028.

Buy the Full Report for More Insights on Development Projects in the Platinum Mining Market, Download a Free Report Sample

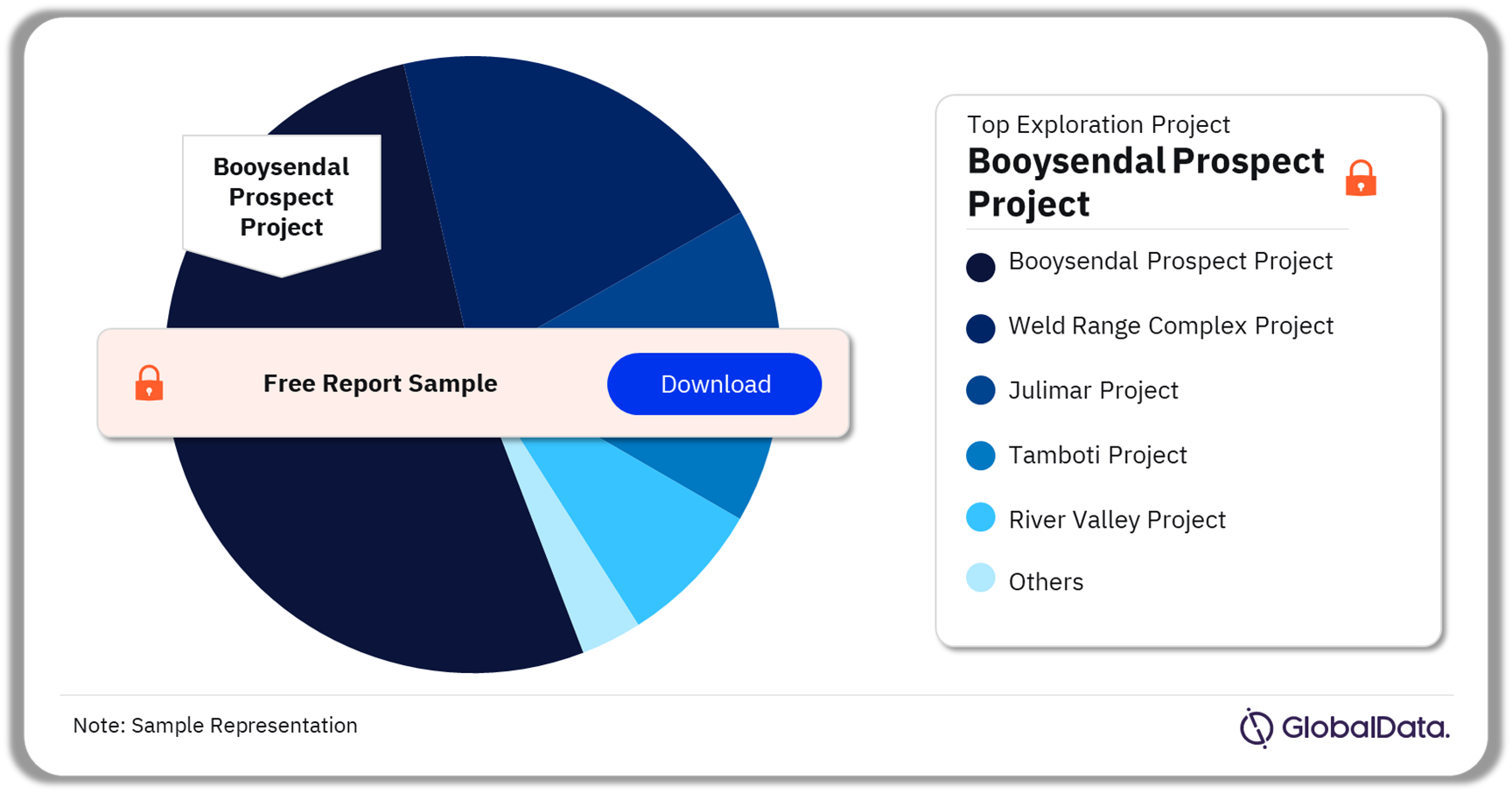

Platinum Mining Market - Exploration Projects

A few of the major platinum exploration projects are the Booysendal Prospect Project, Weld Range Complex Project, Julimar Project, Tamboti Project, River Valley Project, and Kruidfontein Project among others. Booysendal Prospect Project is wholly owned by Northam Platinum Holdings Ltd. It started operations in 2023.

Platinum Mining Market Analysis by Exploration Projects, 2024 (%)

Buy Full Report for More Insights on Exploration Projects in the Platinum Mining Market, Download a Free Report Sample

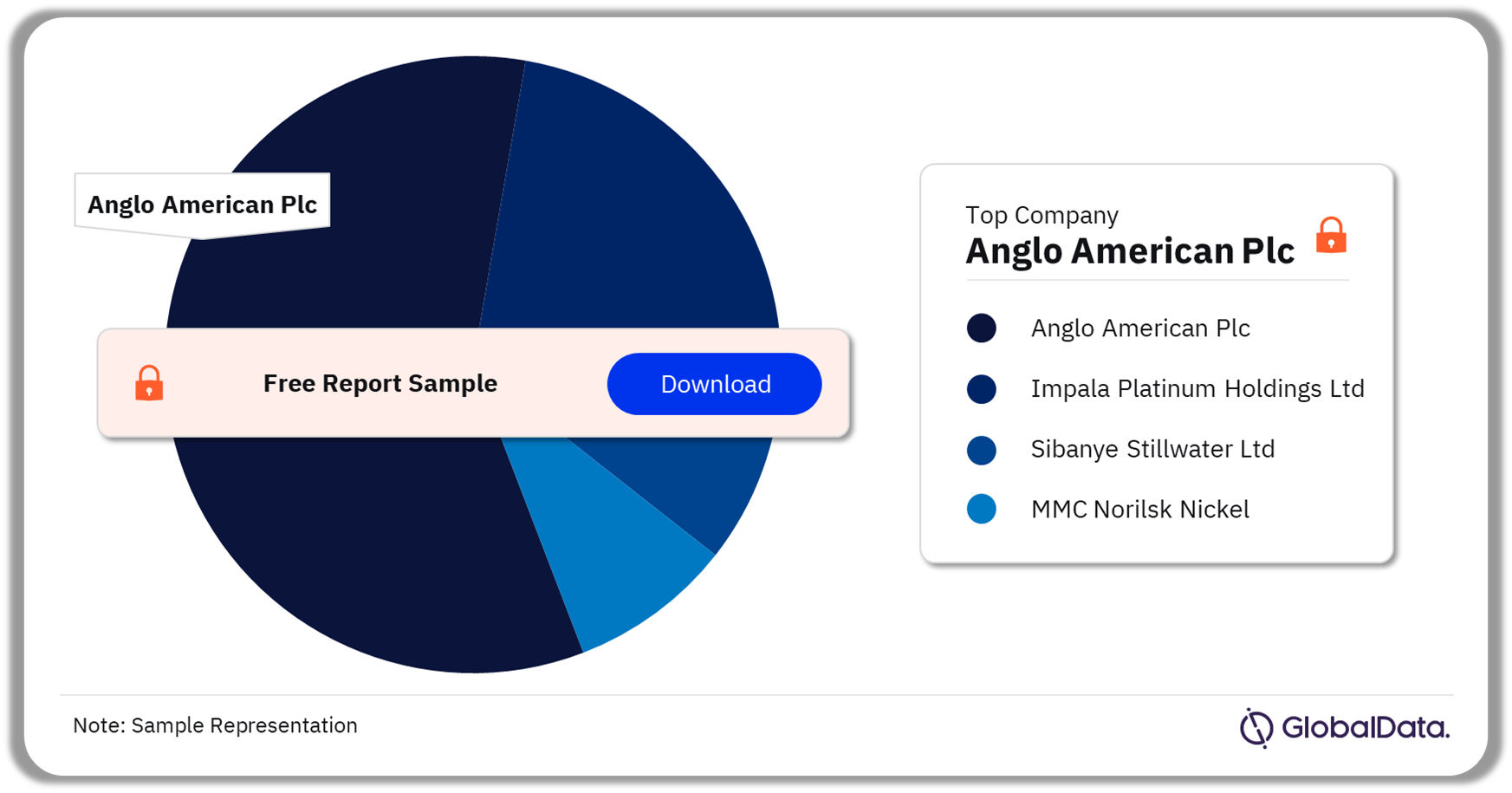

Platinum Mining Market - Competitive Landscape

Anglo American Plc, Impala Platinum Holdings Ltd, Sibanye Stillwater Ltd, and MMC Norilsk Nickel are among the key platinum-producing companies in the world, accounting for majority of global platinum production in 2023.

Leading Platinum Mining Companies, 2023 (%)

Buy the Full Report for More Insights on Companies in the Platinum Mining Market, Download a Free Report Sample

Segments Covered in the Report

Platinum Mining Market Countries Outlook (Value, 2011-2030)

- South Africa

- Russia

- Zimbabwe

- Canada

- US

- Others

Scope

- The report contains an overview of the global platinum mining industry, including key demand driving factors affecting the global platinum mining industry.

- It provides detailed information on reserves by country, global production, production by country, production by company, major operating mines, competitive landscape, and major exploration and development projects.

Reasons to Buy

- Get actionable insights on global coal mining trends, and relevant driving factors.

- Track the latest developments in the global coal mining industry.

- Identify major active, exploration, and development projects.

- Analyze upcoming project developments in the mining industry.

- Understand historical and forecast trends on global coal production.

- Identify key players in the global coal mining industry.

Table of Contents

Table

Figures

Frequently asked questions

-

Which country had the largest platinum reserves in 2023?

South Africa remained the world’s largest platinum producer in 2023.

-

Which are the major active platinum mines in the market?

A few of the major active platinum mines are Impala Mine, Marikana Mine (Lonmin), Mogalakwena Mine, Rustenburg Complex, and Kola MMC Mine among others.

-

Which are the major development projects in the platinum mining market?

A few of the major platinum mining projects that are in the development phase include the Garatau Project, South Africa, the Waterberg Project, South Africa, the Platreef Project, South Africa, the Marathon Project, Canada, Karo Platinum Project, Zimbabwe, and Tjate Project, South Africa among others.

-

Which are the major exploration projects in the platinum mining market?

A few of the major platinum exploration projects are the Booysendal Prospect Project, Weld Range Complex Project, Julimar Project, Tamboti Project, River Valley Project, and Kruidfontein Project among others.

-

Which are the leading companies in the Platinum mining market?

A few of the leading platinum-producing companies are Anglo American Plc, Impala Platinum Holdings Ltd, Sibanye Stillwater Ltd, and MMC Norilsk Nickel, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.