High-Performance Computing – Thematic Research

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

The ability to run high-performance computing (HPC) in the cloud has made the technology more readily available. The COVID-19 pandemic has put the spotlight back on HPC as a research resource. HPC helped scientists understand how the virus interacts with the human body and how it passes from human to human. It had a role in genomic sequencing and, importantly, it enabled advancements in therapeutics and the production of life-saving vaccines.

The high-performance computing thematic research report highlights key technology trends, macroeconomic trends, and regulatory trends impacting the high-performance computing theme. Furthermore, it discusses HPC value chains, mergers & acquisitions activities, and major milestones in the journey of the high-performance computing theme.

High-Performance Computing: Key Trends

The key trends that are associated with the high-performance computing theme can be classified into two categories: technology trends and macroeconomic trends.

- Technology trends – Some of the key technology trends impacting the high-performance computing theme include AI, flexibility, exascale computing, and microarchitectural improvements.

- Macroeconomic trends – The key macroeconomic trends that will shape the high-performance computing theme are COVID-19, China, and sustainability.

For more insights on key trends shaping the high-performance computing theme, download a free report sample

High-Performance Computing – Industry Analysis

Like cloud computing, cybersecurity, and augmented reality (AR), HPC has benefitted from increased visibility throughout the pandemic. HPC technology is involved in research on how the virus spreads and vaccine development. The impact of HPC’s greater visibility is likely to continue to positively impact the market in the coming years.

The high-performance computing industry analysis also covers:

- Patent trends

- Mergers & acquisitions

- Timeline

High-Performance Computing - Value Chain Analysis

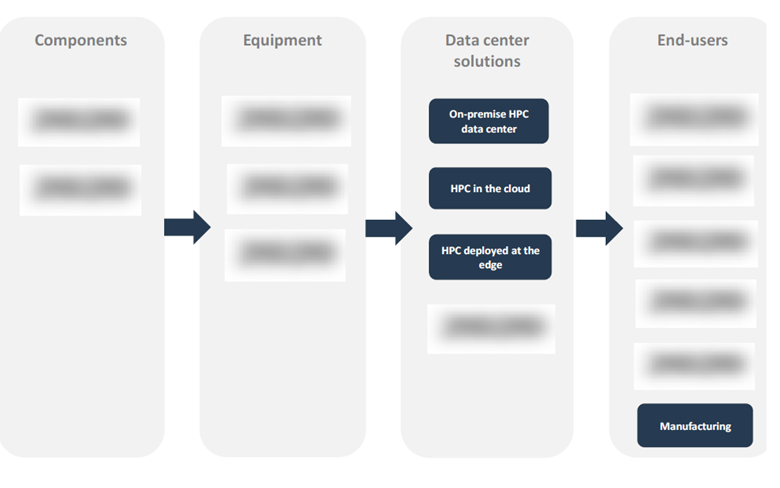

GlobalData’s HPC value chain consists of four segments: components, equipment, data center solutions, and end-users.

Data Center Solutions: Traditional HPC data centers are on-premise data centers, but this model started being challenged by emerging solutions in the last decade. Among the new solutions, HPC in the cloud is the more developed, whereas it’s still early days for HPC deployed at the edge. A fourth way, which combines on-premise with the cloud, has also recently emerged.

High-Performance Computing Value Chain Analysis

For more insights on the high-performance computing value chains, download a free report sample

Leading Companies Associated with the High-Performance Computing Theme

Some of the leading companies that are making their mark within the HPC theme are Alphabet, Amazon, AMD, Dell, Fujitsu, HPE, and Huawei.

To know more about the leading companies associated with the HPC theme, download a free report sample

IT Infrastructure Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our sector scorecards have three screens: a thematic screen, a valuation screen, and a risk screen. The IT infrastructure sector scorecard has three screens:

- The thematic screen tells us who are the overall leaders in the 10 themes that matter most, based on our thematic engine.

- The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

- Our risk screen ranks companies within a sector based on overall investment risk.

IT Infrastructure Sector Scorecard – Thematic Screen

To know more about the sector scorecards, download a free report sample

High-Performance Computing Market Overview

| Report Pages | 46 |

| Regions Covered | Global |

| Key Trends | Technology Trends and Macroeconomic Trends |

| Value Chains | Components, Equipment, Data Center Solutions, and End-Users |

| Leading Companies | Alphabet, Amazon, AMD, Dell, Fujitsu, HPE, and Huawei |

Scope

- This report provides an overview of the high-performance computing (HPC) theme.

- It identifies the key trends impacting the growth of the theme over the next 12 to 24 months, split into two categories: technology trends and macroeconomic trends.

- It includes comprehensive industry analysis, including data on HPC patent filings, M&A deals, and a timeline showing key events in the development of HPC.

- The detailed value chain shows comprise four segments: components, equipment, data center solutions, and end-users.

Reasons to Buy

- In the last decade, HPC’s commercial use cases have grown, and the technology has become more accessible. This report is an invaluable guide to a theme that is increasing in importance, including identifying components, equipment, and data center solutions.

- This report includes a comprehensive technology briefing, which not only explains what HPC is but also describes the evolution of supercomputers to computing clusters, analyzes the growing importance of the cloud to HPC, and evaluates the future role of quantum computers.

- The value chain identifies leading vendors and notable challengers across all segments, including components, equipment, and data center solutions.

- It also includes an analysis of prominent use cases in markets such as government, financial services, entertainment retail, and academia.

Adtran

AMD

Analog Devices

Arista

ASM

Baidu

Bitmain

Cambricon

Centec Networks

Cerebras

Ciena

Cisco

Citrix Systems

Companies

Dell

Ericsson

Extreme Networks

Fujitsu

Horizon Robotics

HPE

Huawei

IBM

Infineon

Inspur

Intel

Juniper

Knowles

Lenovo

Micron

Microsoft

Nokia

NoviFlow

Nutanix

Nvidia

NXP

Omron

Oracle

Phytium

Pluribus

Pure Storage

QCT

Qualcomm

Quanergy

Quanta

Samsung Electronics

Scality

Seagate

SK Hynix

Sony

STMicroelectronics

Sugon

Supermicro

TDK

Texas Instruments

TidalScale

Toshiba

Velodyne

Virtuozzo

VMware

Western Digital

ZTE

Table of Contents

Frequently asked questions

-

What key technology trends are impacting the high-performance computing theme?

Some of the key technology trends impacting the high-performance computing theme include AI, flexibility, exascale computing, and microarchitectural improvements.

-

What key macroeconomic trends are impacting the high-performance computing theme?

The key macroeconomic trends that will shape the high-performance computing theme are COVID-19, China, and sustainability.

-

What are the components of the high-performance computing value chain?

GlobalData’s HPC value chain consists of four segments: components, equipment, data center solutions, and end-users.

-

Which leading companies are associated with the HPC theme?

Some of the leading companies associated with the HPC theme are Alphabet, Amazon, AMD, Dell, Fujitsu, HPE, and Huawei.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Technology reports