Artificial Intelligence (AI) in Banking – Thematic Research

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

AI in Banking Market Overview

In banking, AI use cases range from enhancing client interactions through chatbots to providing better loan terms through data-driven risk assessments, and the automation of laborious back-end processes. Banks can realize the benefits of AI in cost savings, quality improvements, an expansion of their services, and increased personalization in these product offerings. AI can galvanize waning banks and provide them with new income sources while increasing the value they derive from current sources.

The AI in banking thematic research report highlights the impact of AI in the banking industry and discusses banking challenges, case studies, AI timelines, and value chains.

AI in Banking – Industry Analysis

The AI platform revenue in the retail banking industry was worth $1.8 billion in 2019 and is expected to achieve a CAGR of more than 21% during 2019-2024. The digital revolution in banking is driving incumbent banks to defensively adopt leading technologies to combat the nascent threat posed by disruptive fintech firms. Many of these technologies are complementary and reinforce one another. Therefore, spending across the board will increase.

The AI in the banking industry analysis also covers:

- Mergers and acquisitions

- AI Timeline

AI Platform Revenue in Retail Banking Industry, 2019-2024

To gain more information about AI platform revenue in the banking industry, download a free report sample

AI in Banking - Value Chain Analysis

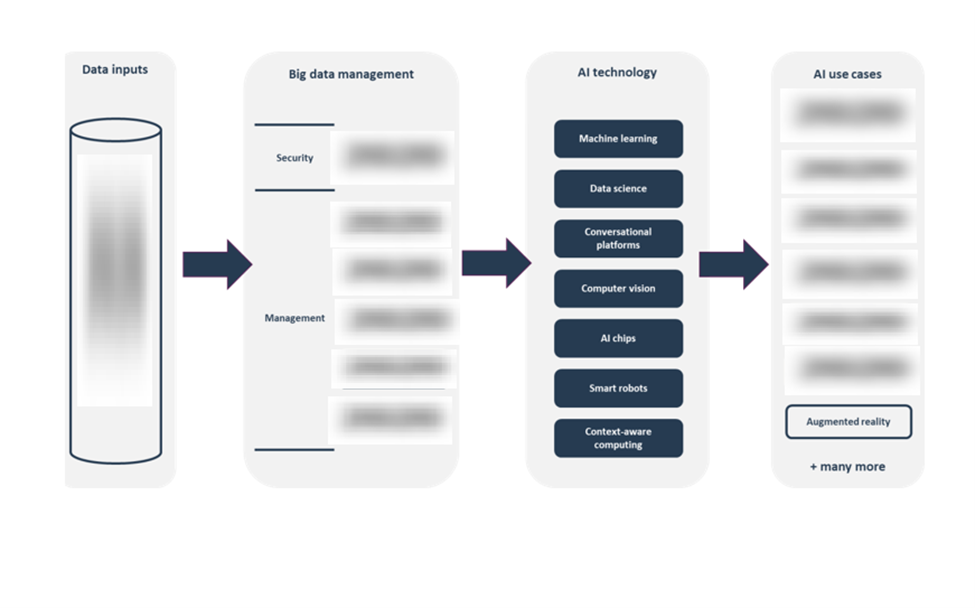

GlobalData’s AI value chain consists of four segments: data inputs, big data management, AI technology, and AI use cases. It provides an overview of seven main AI technologies such as machine learning (ML), data science, conversational platforms, computer vision, AI chips, smart robots, and context-aware computing.

Machine Learning: Many companies use ML as part of predictive data models or software platforms that analyze behavioral data. Businesses have also taken ML and applied it to specific industry use cases, such as detecting bank fraud, assessing a person’s creditworthiness, preventing cyberattacks, and delivering personalized ads to consumers.

AI Value Chain Analysis

For more insights into the AI value chain, download a free report sample

Leading AI Adopters in the Banking Industry

Some of the leading banking companies that are currently deploying AI:

- Ant Group

- Bank of America

- BBVA

Leading AI Vendors in the Banking Industry

Some of the leading vendors associated with the AI theme:

- Alibaba

- Alphabet

- Amazon

Specialist AI Vendors in the Banking Industry

Some of the specialist AI vendors in the banking industry:

- Fiserv

- FiVerity

- Kasisto

To know more about the leading AI adopters, vendors and specialist AI vendors in the banking industry, download a free report sample

Banking Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our banking sector scorecard has two screens: a thematic screen and a valuation screen.

- The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

- The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

Banking Sector Scorecard – Thematic Screen

To know more about the banking sector scorecards, download a free report sample

AI in Banking Market Overview

| Report Pages | 42 |

| Regions Covered | Global |

| Market Size (2019) | $1.8 billion |

| CAGR (2019-2024) | >21% |

| Value Chains | Data Inputs, Big Data Management, AI Technology, and AI Use Cases |

| Leading AI Adopters | Ant Group, Bank of America, and BBVA |

| Leading AI Vendors | Alibaba, Alphabet, and Amazon |

| Specialist AI Vendors | Fiserv, FiVerity, and Kasisto |

Scope

This report provides:

- Forecast data of the estimated evolution in banking spend on AI services globally.

- A breakdown of the AI value chain and its intersection with the banking stack, including investment recommendations for each technology in each section of the banking value chain.

- An explanation of how AI can help to solve each of the challenges faced by the banking industry including cybersecurity risks, the threat posed by digitally native fintechs, and falling profitability driven by macroeconomic conditions such as perennially low-interest rates and COVID-19.

- Analysis of the key AI technology vendors in banking, including their specialisms, their location in the AI value chain, and details of some existing partnerships.

- Summaries of the incumbent and disruptive banks adopting AI and transforming their businesses. These detail the specific AI technologies they use, the partnerships they have, as well as placing them in the context of the AI value chain.

- Key best practice case studies of AI adoption in banking, supported by executive interviews with the companies involved.

- GlobalData’s thematic sector scorecard for retail banking ranks the leadership of 37 banking companies in AI and other themes disrupting their industry. This is informed by GlobalData’s comprehensive tracking of AI-related deals, job openings, patents ownership, company news, and financial and marketing statements.

Reasons to Buy

- Identify leading artificial intelligence vendors in banking and shortlist potential partners based on their areas of expertise and historic partnerships.

- Benchmark your company against 37 other banks in terms of how prepared each business is for AI disruption. Use this as a roadmap for where to target your AI investment and to focus on areas of the market that are underserved.

- Develop marketing messages and value propositions for your AI services that will resonate with prospective clients in the banking industry, by uncovering the business challenges they face in areas such as falling profitability, cybersecurity, and COVID-19. Pick the right areas to invest in AI-based on our value chain recommendations, paired with case study insight.

- As a technology vendor, identify the areas where banks are most in need of your services and uncover the areas that are lacking specific AI vendors that might prove profitable areas for expansion.

- Support investment cases for AI in banking, both as a vendor and as a bank, by accessing our proprietary market sizing and growth forecast data, specific to AI in financial services.

Amazon

Microsoft

Alibaba

Baidu

Apple

Tencent

IBM

Temenos

FiVerity

Simudyne

Personetics

Fiserv

Kasisto

Tencent

Ant Group

Goldman Sachs

BBVA

OakNorth

DBS Bank

Bank of America

Santander

Samsung

Table of Contents

Frequently asked questions

-

What was the AI platform revenue in the banking industry in 2019?

The AI platform revenue in the retail banking industry was worth $1.8 billion in 2019.

-

What is AI in the banking industry growth rate?

AI in the retail banking industry is expected to achieve a CAGR of more than 21% during 2019-2024.

-

What are the components of the AI value chain?

GlobalData’s AI value chain consists of four segments which are data inputs, big data management, AI technology, and AI use cases.

-

Which are the leading AI adopters in the banking industry?

Some of the leading AI adopters in the banking industry are Ant Group, Bank of America, and BBVA.

-

Which leading vendors are associated with the AI theme?

Some of the leading vendors associated with the AI theme are Alibaba, Alphabet, and Amazon.

-

Who are the specialist AI vendors in the banking industry?

Some of the specialist AI vendors in the banking industry are Fiserv, FiVerity, and Kasisto.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Financial Services reports