Egypt Projects, H1 2022 – Outlook of Major Projects in Egypt – MEED Insights

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Egypt Projects Market Report Overview

The project market size in Egypt was valued at $18.4 billion in 2021. Egypt was the fourth largest projects market in the MENA region. The largest single sector has historically been construction followed by transport and power.

Egypt’s macroeconomic environment has remained resilient in the aftermath of the Covid-19 shock, although long-standing issues remain. In recent years, macroeconomic reforms have helped to stabilize the economy, allowing the government to enter the Covid-19 crisis and recovery phase with improved fiscal accounts and significant foreign reserves.

The Egypt projects market report offers opportunities and challenges in Egypt’s projects market and offers an analysis of the pipeline of planned projects and contract awards. The report also provides insights on key policies and drivers shaping the outlook for projects in Egypt.

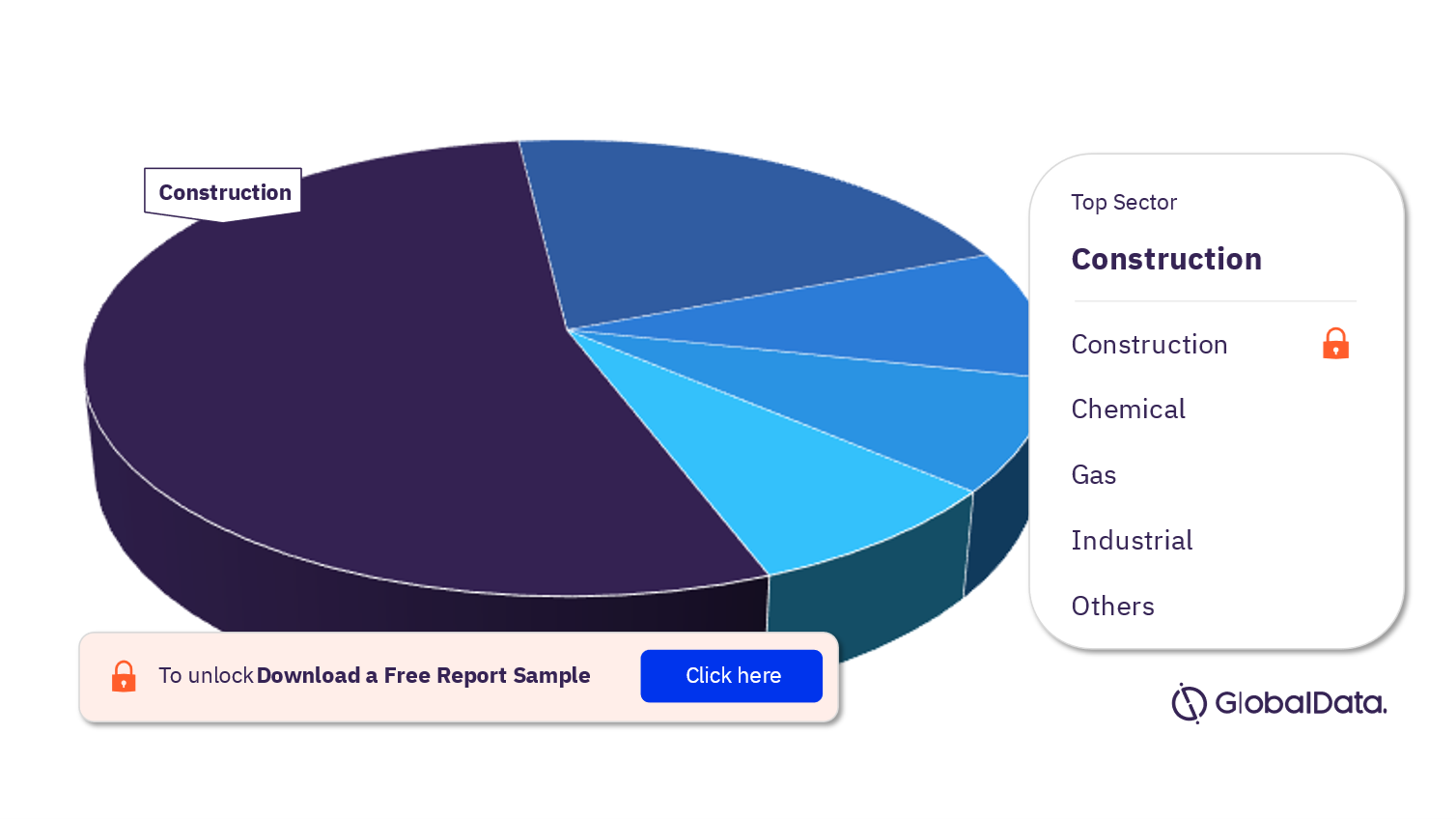

Egypt Projects Market Segmentation by Sectors

The key sectors in the Egypt Projects Market are chemical, construction, gas, industrial, oil, power, transport, and water. The construction sector led the projects market in Egypt.

Egypt Projects Market Analysis, by Sectors

For more sector insights on the Egypt Projects market, download a free report sample

For more sector insights on the Egypt Projects market, download a free report sample

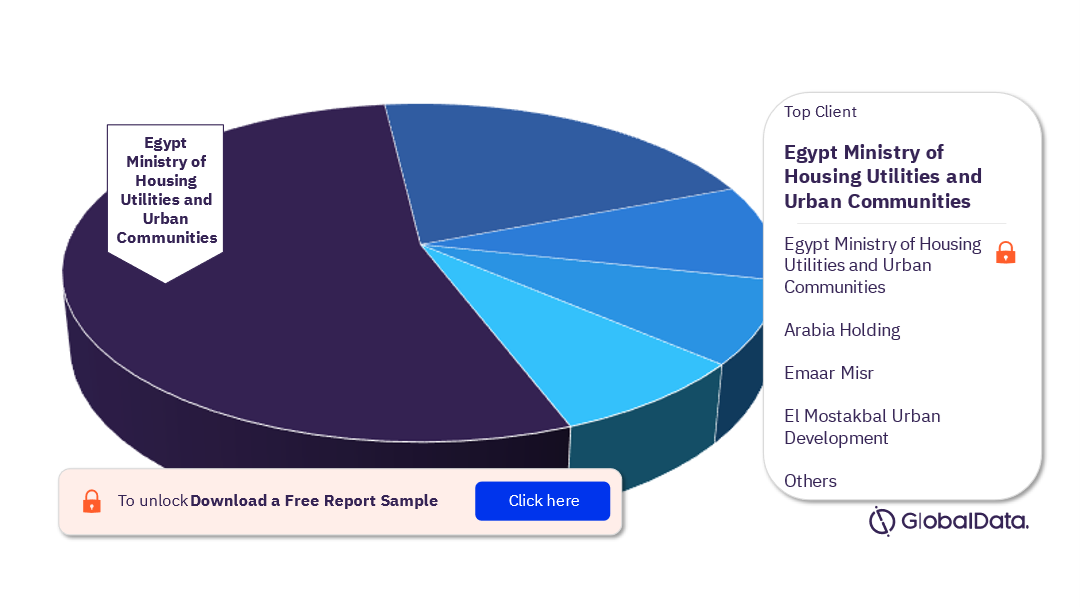

Egypt Projects Market Clients

Some of the key clients associated with the Egypt Projects Market are the Egypt Ministry of Housing Utilities and Urban Communities, Arabia Holding, Emaar Misr, El Mostakbal Urban Development, Egypt Ministry of Transport, Egypt Ministry of Petroleum, Citystars, The African Union Commission, United Nations Economic Commission for Africa, Palm Hills Developments, New Urban Communities Authority, Administrative Capital for Urban Development, Qatari Diar, and National Authority for Tunnels (NAT). Egypt Ministry of Housing Utilities & Urban Communities is the largest client by value.

Egypt Projects Market Analysis, by Clients

For more insights on clients in the Egypt Projects market, download a free report sample

For more insights on clients in the Egypt Projects market, download a free report sample

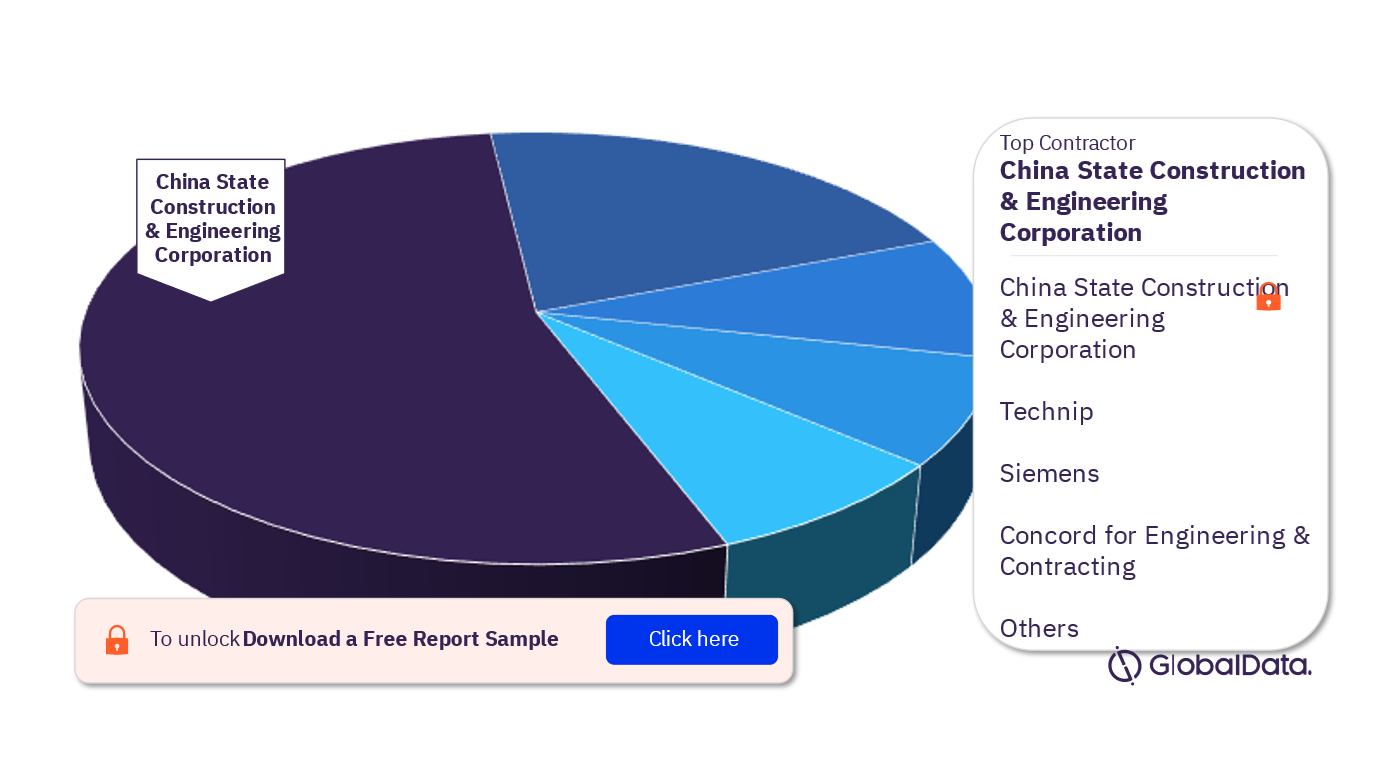

Egypt Projects Market Contractors

Some of the key contractors associated with Egypt Projects Market are China State Construction & Engineering Corporation, Technip, Siemens, Concord for Engineering & Contracting, Sinohydro, Enppi, Hassan Allam Construction, Petrojet, The Arab Contractors, and Orascom Construction. China State Construction & Engineering Corporation has the highest value of projects.

Egypt Projects Market Analysis, by Contractors

For more insights on the contractors in the Egypt Projects market, download a free report sample

For more insights on the contractors in the Egypt Projects market, download a free report sample

Egypt Projects Market Report Overview

| Market Size (2021) | $18.4 Billion |

| Key Sectors | Chemical, Construction, Gas, Industrial, Oil, Power, Transport, and Water |

| Key Clients | Egypt Ministry of Housing Utilities and Urban Communities, Arabia Holding, Emaar Misr, El Mostakbal Urban Development, Egypt Ministry of Transport, Egypt Ministry of Petroleum, Citystars, The African Union Commission, United Nations Economic Commission for Africa, Palm Hills Developments, New Urban Communities Authority, Administrative Capital for Urban Development, Qatari Diar, and National Authority for Tunnels (NAT) |

| Key Contractors | China State Construction & Engineering Corporation, Technip, Siemens, Concord for Engineering & Contracting, Sinohydro, Enppi, Hassan Allam Construction, Petrojet, The Arab Contractors, and Orascom Construction |

Key Highlights

- Despite the lingering aftereffects of the bruising currency devaluation of 2016 on its socio-economic fabric, the impact of the Covid pandemic on key sectors of the economy, and a weak public health response by the government, the country appears to have weathered the pandemic with remarkable ease. Despite the Covid-19 impact, economic slowdown, and few project delays, contract awards grew in 2020. The same level of growth continued in 2021 as well, with the contract awards activity totaling $18.4bn.

- As a key market for projects and infrastructure development, the value of project contract awards in the construction and transport sectors has risen for the past eight years running.

- While Egypt’s oil and gas sector now suffers from underinvestment in upstream projects following the completion of development work at the Zohr gas field, exploration activities continue.

Reasons to Buy

- Opportunities and challenges in Egypt’s projects market

- Analysis of the pipeline of planned projects and contract awards

- Key policies and drivers shaping the outlook for projects in Egypt

- Political and economic background

- The barriers and challenges that may arise

- Sector-by-sector breakdown of future project plans

- Key drivers of projects in each sector

- Egypt’s most valuable key projects and major project sponsors

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Egypt Projects market size in 2021?

The projects market of Egypt was valued at $18.4 billion in 2021.

-

What are the key sectors in Egypt Projects market?

The key sectors among the Egypt Projects market are chemical, construction, gas, industrial, oil, power, transport, and water.

-

Who are the key clients associated with Egypt Projects market?

Some of the key clients associated with Egypt Projects market are the Egypt Ministry of Housing Utilities and Urban Communities, Arabia Holding, Emaar Misr, El Mostakbal Urban Development, Egypt Ministry of Transport, Egypt Ministry of Petroleum, Citystars, The African Union Commission, United Nations Economic Commission for Africa, Palm Hills Developments, New Urban Communities Authority, Administrative Capital for Urban Development, Qatari Diar, and National Authority for Tunnels (NAT).

-

Who are the key contractors associated with Egypt Projects market?

Some of the key contractors associated with the Egypt Projects market are China State Construction & Engineering Corporation, Technip, Siemens, Concord for Engineering & Contracting, Sinohydro, Enppi, Hassan Allam Construction, Petrojet, The Arab Contractors, and Orascom Construction.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.