Thailand General Insurance Market Size, Trends by Line of Business, Distribution, Competitive Landscape and Forecast to 2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Thailand General Insurance Market Overview

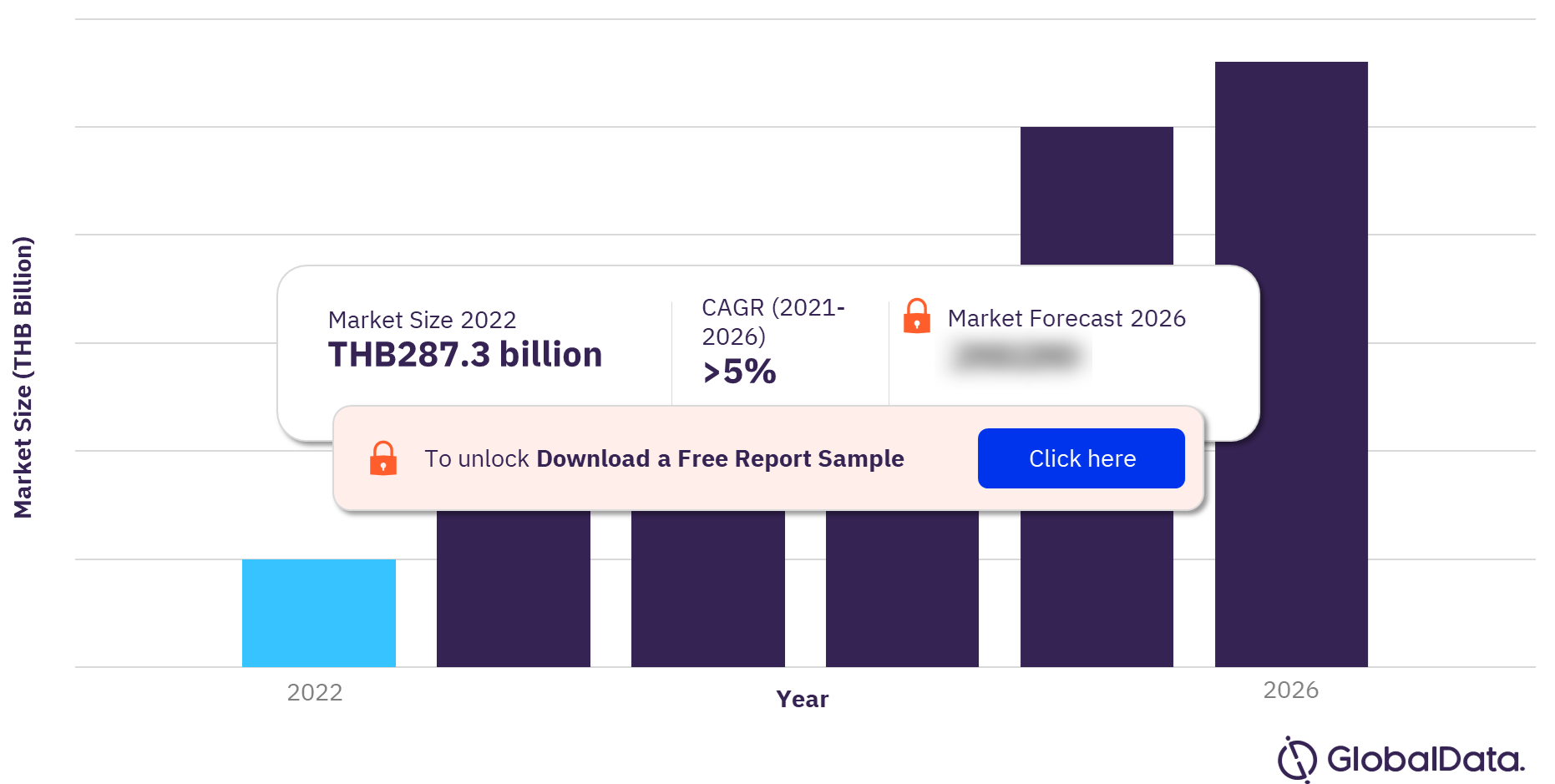

The gross return premium of the Thailand general insurance market was THB287.3 billion ($9.1 billion) in 2022 and is expected to achieve a CAGR of more than 5% during 2021-2026. The Thailand general insurance market research report provides in-depth market analysis, information, and insights into the Thailand’s general insurance sector.

Thailand General Insurance Market Outlook, 2022-2026 (THB Billion)

For more insights into the Thailand general insurance market, download a free report sample

The report provides a detailed outlook by product category for the Thailand’s General insurance sector. It provides values for key performance indicators such as gross written premium, penetration, and premium ceded and cession rates during the review period (2017-21) and forecast period (2021-26). The report also analyzes distribution channels operating in the sector, gives a comprehensive overview of Thailand’s economy and demographics, and provides detailed information on the competitive landscape in the country.

| Market Size (2022) | THB287.3 billion ($9.1 billion) |

| CAGR | >5% |

| Forecast Period | 2021-2026 |

| Key Lines of Business | · Property

· Motor · Liability · Miscellaneous · MAT · Non-Life PA&H |

| Key Distribution Channel | · Insurance Brokers

· Direct Marketing · Bancassurance · Agencies · E-Commerce · Other Distribution Channels |

| Leading Companies | · Viriyah Insurance

· Bangkok Insurance · Tokio Marine Safety Insurance · Muang Thai Insurance · Syn Mun Kong Insurance |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Thailand General Insurance Market Trends

Embedded insurance, inflation, ESG and insurance for COVID-19 vaccine side effects, are some of the key trends driving the Thailand GI market.

Non-insurance and other non-financial companies, especially in retail, telecommunication, and e-commerce sectors, are embedding insurance into the suite of their existing services. Along with the non-financial services and products, these companies are selling customized and instant insurance at their points of sale, making the traditional insurance companies risk losing their customers and revenues.

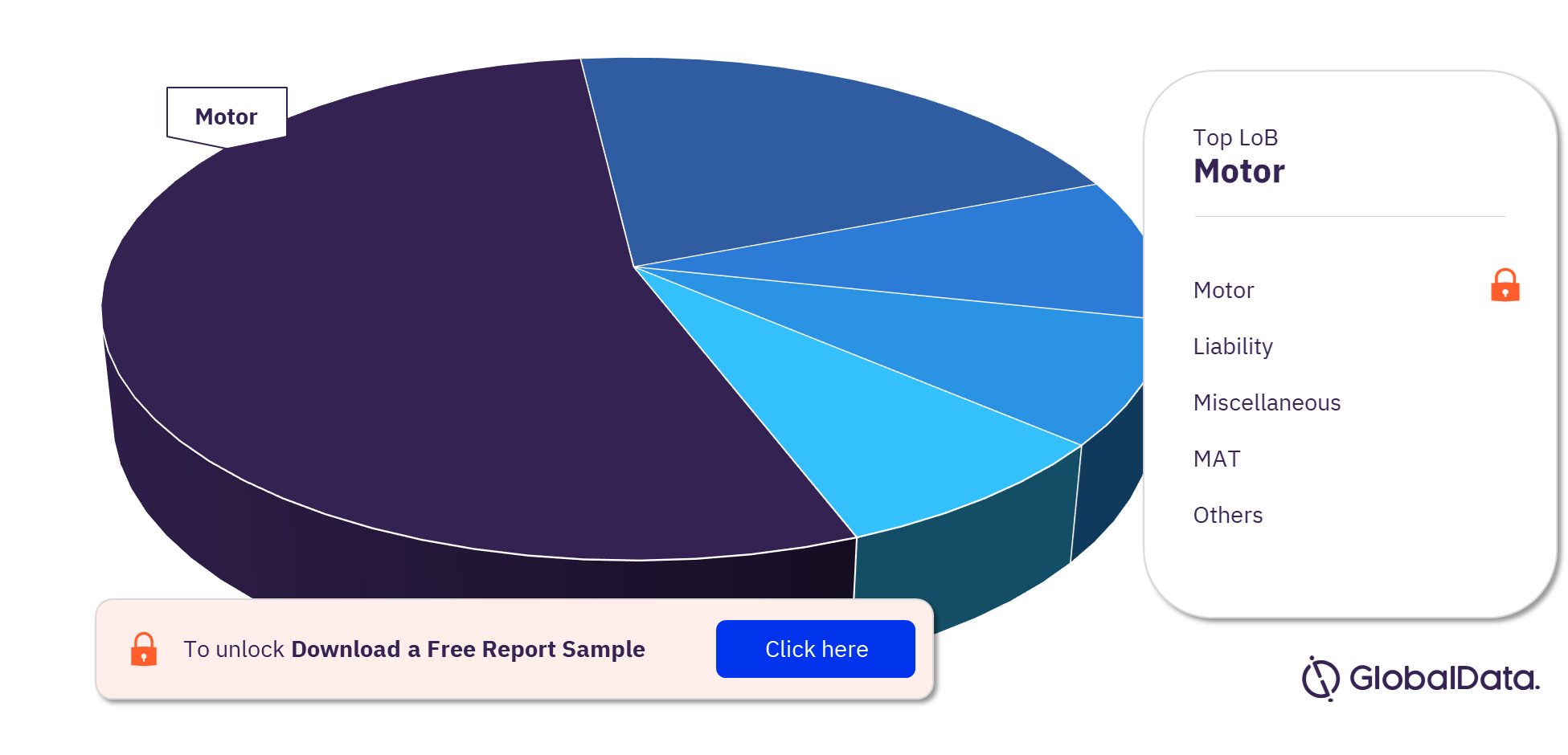

Thailand General Insurance Market Segmentation by Lines of Business

The key lines of business in the Thailand general insurance market are property, motor, liability, miscellaneous, MAT, and non-life PA&H. In 2021, motor segment held the highest share.

Thailand General Insurance Market Analysis by Lines of Business, 2021 (%)

For more lines of business insights into the Thailand general insurance market, download a free report sample

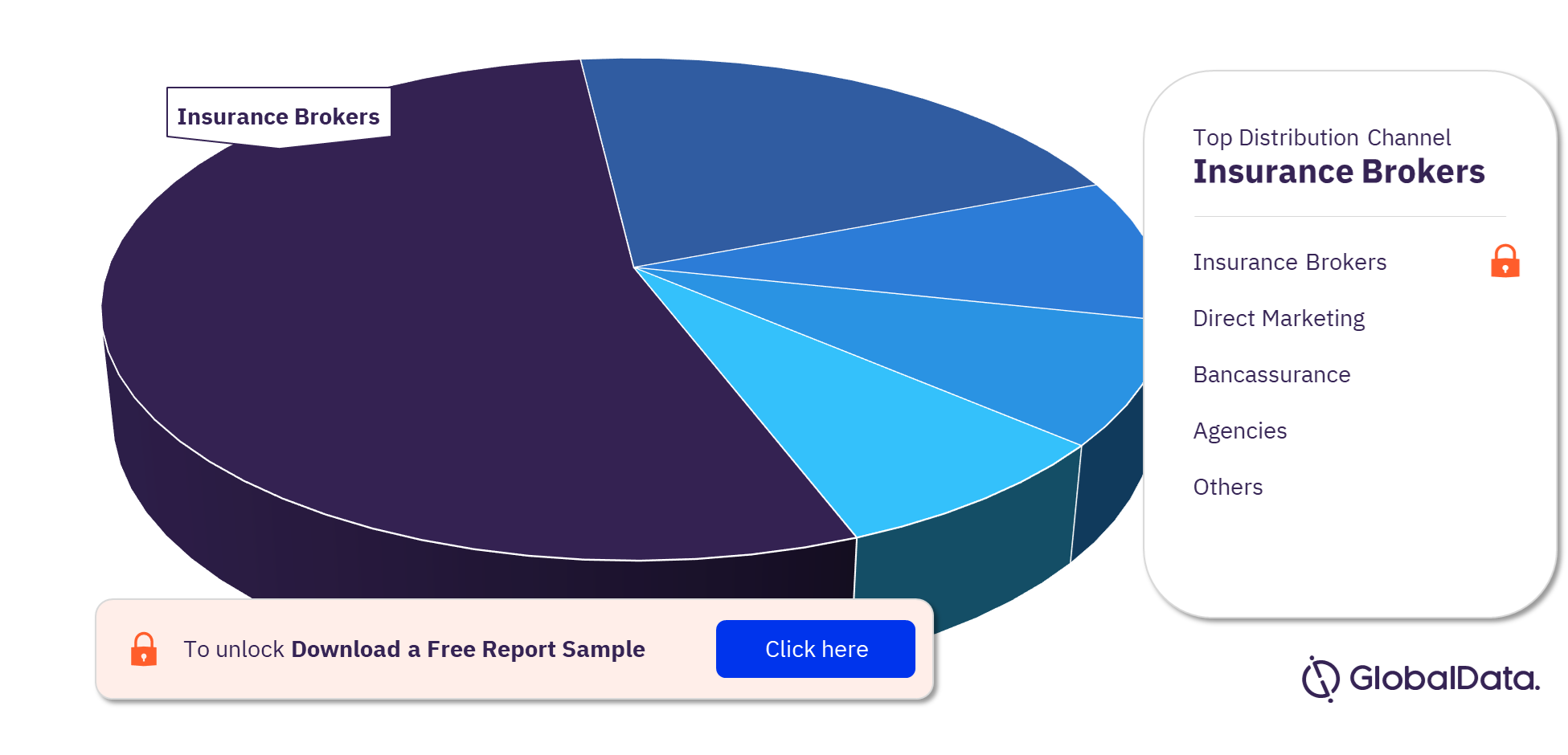

Thailand Life Insurance Market Segmentation by Distribution Channel

The key distribution channels in the Thailand life insurance industry are insurance brokers, direct marketing, bancassurance, agencies, e-commerce, and other distribution channels. Insurance brokers are the most popular distribution channel, with a share of more than 72% in terms of DWP in 2021 for bringing in new business in general insurance.

Thailand Life Insurance Market Analysis by Distribution Channel, 2021 (%)

For more distribution channel insights into the Thailand life insurance market, download a free report sample

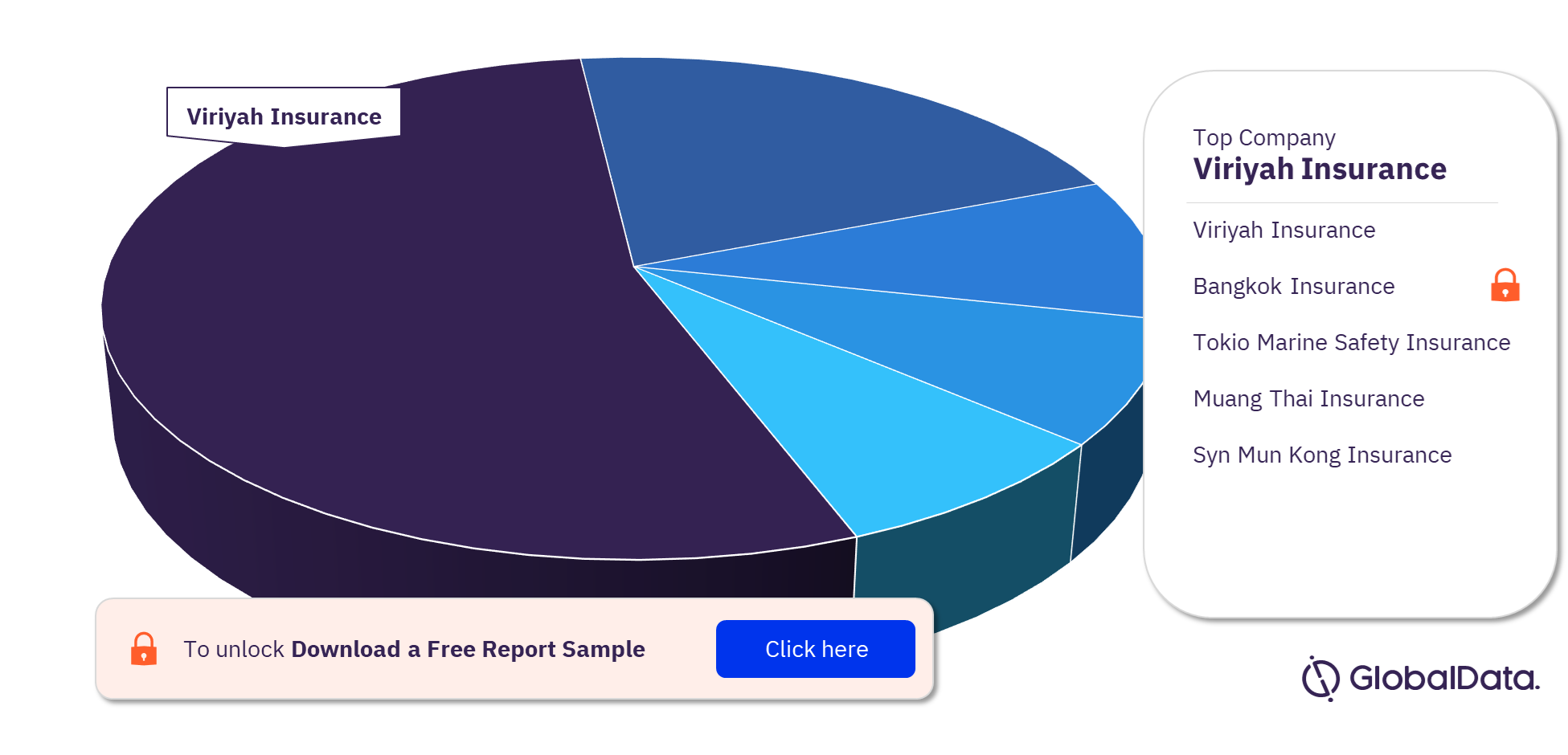

Thailand General Insurance Market - Competitive Landscape

Some of the leading general insurance companies in Thailand are Viriyah Insurance, Bangkok Insurance, Tokio Marine Safety Insurance, Muang Thai Insurance, and Syn Mun Kong Insurance, and Others. In 2021, Viriyah Insurance was the leading insurer.

Thailand General Insurance Market Analysis by Companies, 2021 (%)

To know more about the leading companies in the Thailand general insurance market, download a free report sample

Segments Covered in the Report

Thailand General Insurance Market Lines of Business Outlook (Value, THB Billion, 2017-2026)

- Property

- Motor

- Liability

- Miscellaneous

- MAT

- Non-Life PA&H

- Thailand

General Insurance Market Distribution Channel Outlook (Value, THB Billion, 2017-2026)

- Insurance Brokers

- Direct Marketing

- Bancassurance

- Agencies

- E-Commerce

- Other Distribution Channels

Scope

This report provides a comprehensive analysis of the general insurance sector in Thailand –

- It provides historical values for the Thailand’s general insurance sector for the report’s 2017-21 review period, and projected figures for the 2021-26 forecast period.

- It profiles the top general insurance companies in Thailand and outlines the key regulations affecting them.

Key Highlights

• Key insights and dynamics of the Thailand’s general insurance sector.

• A comprehensive overview of the Thailand’s economy, government initiatives and investment opportunities.

• The Thailand’s insurance regulatory framework’s evolution, key facts, taxation regime, licensing and capital requirements.

• The Thailand’s general insurance industry’s market structure giving details of lines of business.

• The Thailand’s general insurance reinsurance business’s market structure giving details of premium ceded along with cession rates.

• Distribution channels deployed by Thailand’s general insurers.

• Details of the competitive landscape and competitors’ profiles.

Reasons to Buy

- Make strategic business decisions using in-depth historic and forecast market data related to the Thailand’s general insurance sector.

- Understand the demand-side dynamics, key market trends and growth opportunities in the Thailand’s general insurance sector.

- Assess the competitive dynamics in the general insurance sector.

- Identify growth opportunities and market dynamics in key product categories.

Bangkok Insurance

Tokio Marine Safety Insurance (Thailand)

Muang Thai Insurance

Syn Mun Kong Insurance

Generali Insurance (Thailand)

LMG Insurance

Thanachart Insurance

Discovery Insure Limited

Table of Contents

Frequently asked questions

-

What was the Thailand general insurance market net earned premium in 2022?

The net earned premium of the Thailand general insurance market was THB287.3 billion ($9.1 billion) in 2022.

-

What is the Thailand general insurance market growth rate?

The general insurance market in Thailand is expected to achieve a CAGR of more than 5% during 2021-2026.

-

Which LoB held the highest share of the Thailand general insurance market?

In 2021, motor segment held the highest share in the Thailand general insurance market.

-

Which was the most preferred distribution channel in the Thailand life insurance market?

Insurance brokers were the most preferred distribution channel in the Thailand life insurance market.

-

Which are the leading companies in the Thailand general insurance industry?

Some of the leading general insurance companies in Thailand are Viriyah Insurance, Bangkok Insurance, Tokio Marine Safety Insurance, Muang Thai Insurance, and Syn Mun Kong Insurance, and others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Non-Life Insurance reports