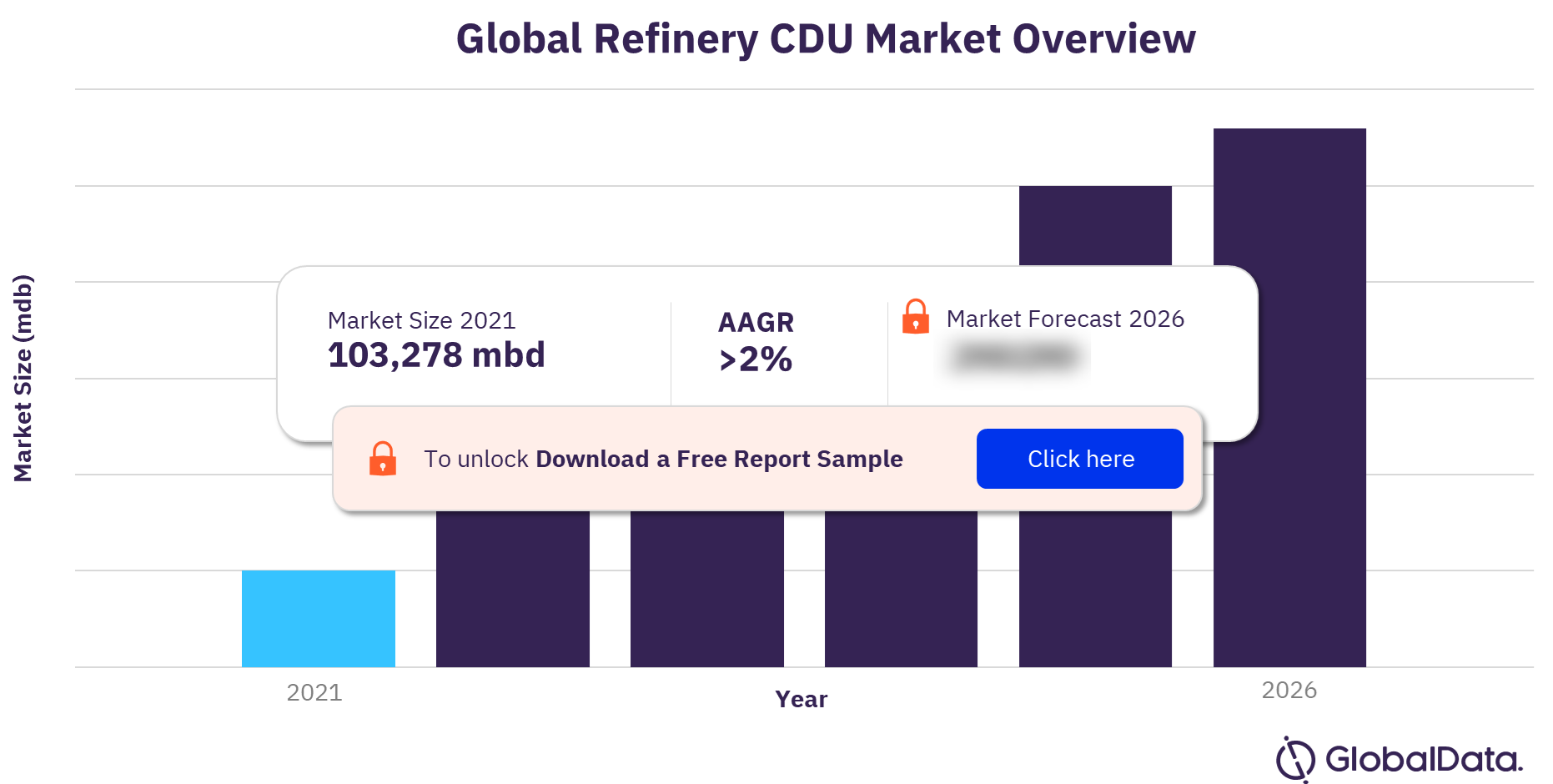

Table 1: Refinery CDU, Global, key statistics, 2021 16

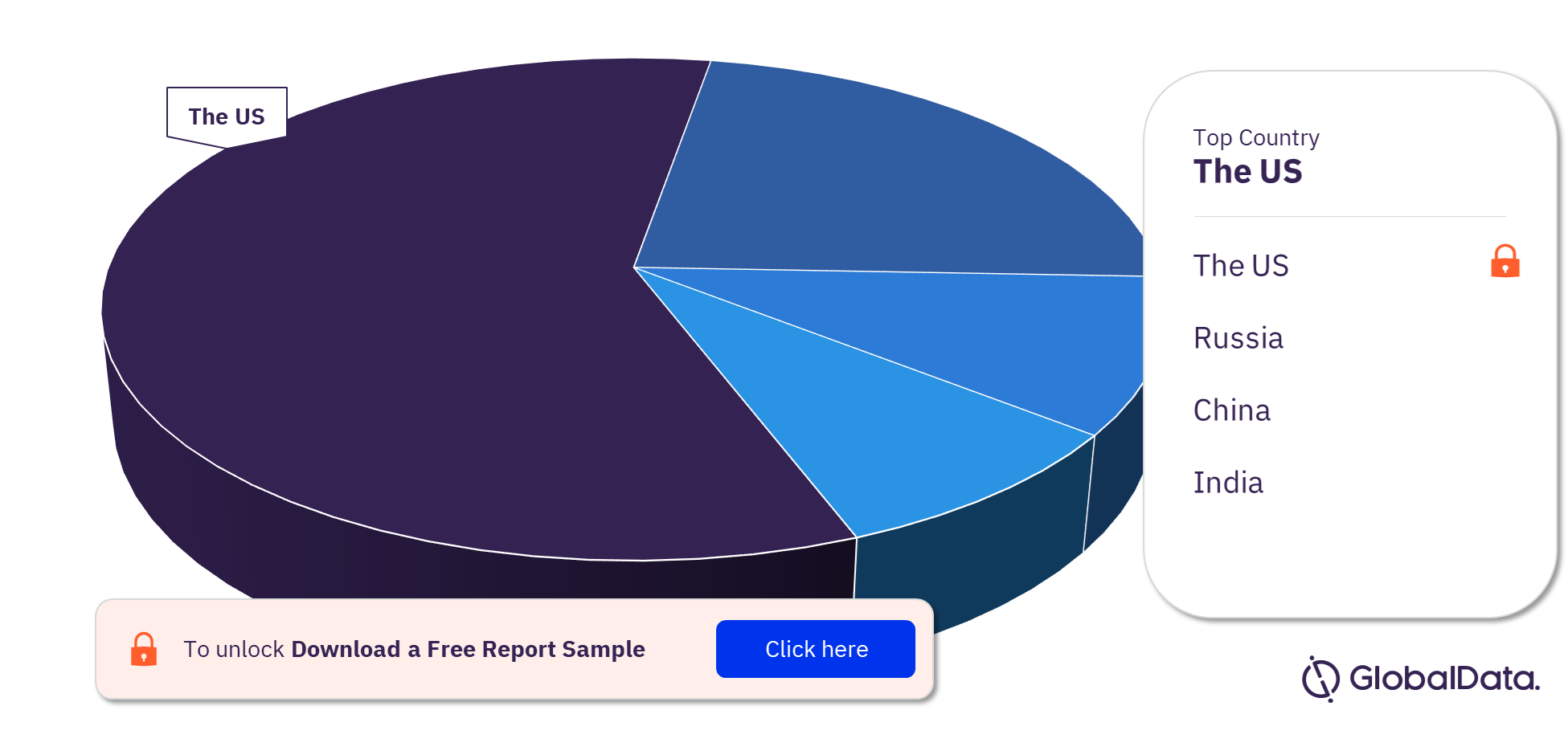

Table 2: Refinery CDU, Global, capacity by key countries (mbd), 2016–2026 16

Table 3: Refinery CDU, Global, Top 10 planned and announced CDUs details, 2022–2026 18

Table 4: Global, annual new build and expansion capital expenditure for CDUs ($B), 2022–2026 19

Table 5: Refinery CDU, Global, annual new build and expansion capital expenditure outlook for CDUs by key countries ($M), 2022–2026 20

Table 6: Refinery CDU, Global, CDU capacity additions through new and existing refinery expansions by region (mbd), 2022–2026 21

Table 7: Refinery CDU, Global, CDU capacity additions through new refineries by region (mbd), 2022–2026 21

Table 8: Refinery CDU, Global, CDU capacity additions through existing refinery expansions by region (mbd), 2022–2026 22

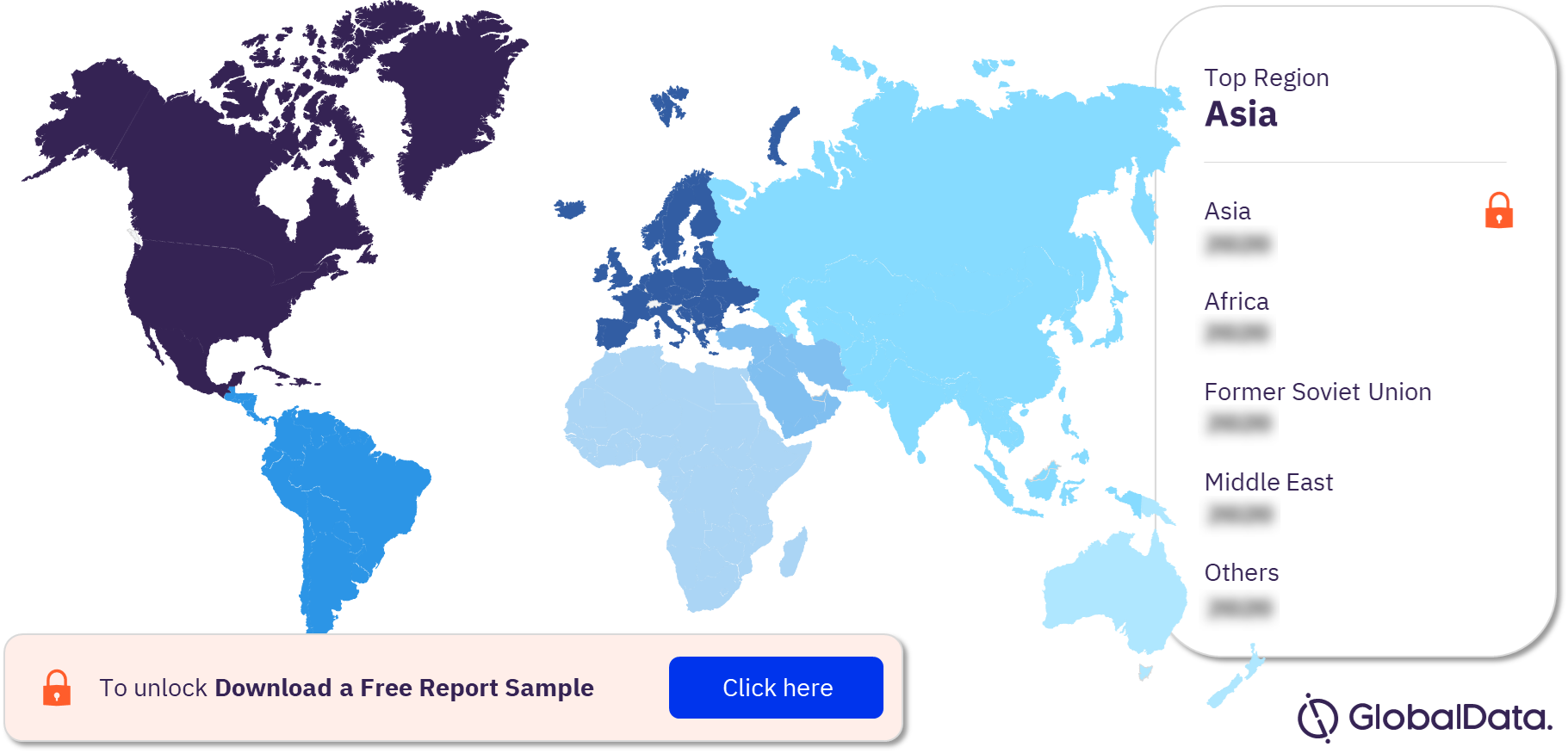

Table 9: Refinery CDU, regional comparison, contribution (%) to Global CDUs capacity, 2016–2026 23

Table 10: Refinery CDU, Africa, key statistics, 2021 24

Table 11: Refinery CDU, Africa, capacity by key countries (mbd), 2016–2026 25

Table 12: Refinery CDU, Africa, planned and announced CDUs details, 2022–2026 26

Table 13: Refinery CDU, Africa, annual new build and expansion capital expenditure for CDUs ($M), 2022–2026 29

Table 14: Africa, annual new build and expansion capital expenditure outlook for CDUs by key countries ($M), 2022–2026 30

Table 15: Refinery CDU, Africa, CDU capacity additions through new and existing refinery expansions by key countries (mbd), 2022–2026 31

Table 16: Refinery CDU, Africa, CDU capacity additions through new refineries by key countries (mbd), 2022–2026 31

Table 17: Refinery CDU, Africa, CDU capacity additions through existing refinery expansions by country (mbd), 2022–2026 32

Table 18: Refinery CDU, Egypt, crude distillation unit capacity (mbd), 2016–2026 33

Table 19: Refinery CDU, Algeria, crude distillation unit capacity (mbd), 2016–2026 34

Table 20: Refinery CDU, South Africa, crude distillation unit capacity (mbd), 2016–2026 35

Table 21: Refinery CDU, Nigeria, crude distillation unit capacity (mbd), 2016–2026 36

Table 22: Refinery CDU, Libya, crude distillation unit capacity (mbd), 2016–2026 39

Table 23: Refinery CDU, Morocco, crude distillation unit capacity (mbd), 2016–2026 40

Table 24: Refinery CDU, Sudan, crude distillation unit capacity (mbd), 2016–2026 40

Table 25: Refinery CDU, Angola, crude distillation unit capacity (mbd), 2016–2026 41

Table 26: Refinery CDU, Cote d’Ivoire, crude distillation unit capacity (mbd), 2016–2026 42

Table 27: Refinery CDU, Ghana, crude distillation unit capacity (mbd), 2016–2026 42

Table 28: Refinery CDU, Cameroon, crude distillation unit capacity (mbd), 2016–2026 43

Table 29: Refinery CDU, Djibouti, crude distillation unit capacity (mbd), 2016–2026 44

Table 30: Refinery CDU, Tunisia, crude distillation unit capacity (mbd), 2016–2026 45

Table 31: Refinery CDU, Senegal, crude distillation unit capacity (mbd), 2016–2026 45

Table 32: Refinery CDU, Zambia, crude distillation unit capacity (mbd), 2016–2026 46

Table 33: Refinery CDU, Gabon, crude distillation unit capacity (mbd), 2016–2026 46

Table 34: Refinery CDU, Chad, crude distillation unit capacity (mbd), 2016–2026 47

Table 35: Refinery CDU, Congo Republic, crude distillation unit capacity (mbd), 2016–2026 48

Table 36: Refinery CDU, Niger, crude distillation unit capacity (mbd), 2016–2026 49

Table 37: Refinery CDU, South Sudan, crude distillation unit capacity (mbd), 2016–2026 49

Table 38: Refinery CDU, Liberia, crude distillation unit capacity (mbd), 2016–2026 50

Table 39: Refinery CDU, Ethiopia, crude distillation unit capacity (mbd), 2016–2026 50

Table 40: Refinery CDU, Sierra Leone, crude distillation unit capacity (mbd), 2016–2026 50

Table 41: Refinery CDU, Equatorial Guinea, crude distillation unit capacity (mbd), 2016–2026 51

Table 42: Refinery CDU, Zimbabwe, crude distillation unit capacity (mbd), 2016–2026 51

Table 43: Refinery CDU, Guinea, crude distillation unit capacity (mbd), 2016–2026 52

Table 44: Refinery CDU, Asia, key statistics, 2021 53

Table 45: Refinery CDU, Asia, capacity by key countries (mbd), 2016–2026 54

Table 46: Refinery CDU, Asia, planned and announced CDUs details, 2022–2026 55

Table 47: Refinery CDU, Asia, annual new build and expansion capital expenditure outlook for CDUs ($M), 2022–2026 58

Table 48: Asia, annual new build and expansion capital expenditure outlook for CDUs by key countries ($M), 2022–2026 59

Table 49: Refinery CDU, Asia, CDU capacity additions through new and existing refinery expansions by key countries (mbd), 2022–2026 60

Table 50: Refinery CDU, Asia, CDU capacity additions through new refineries by key countries (mbd), 2022–2026 60

Table 51: Refinery CDU, Asia, cdu capacity additions through existing refinery expansions by country (mbd), 2022–2026 61

Table 52: Refinery CDU, China, crude distillation unit capacity (mbd), 2016–2026 62

Table 53: Refinery CDU, India, crude distillation unit capacity (mbd), 2016–2026 78

Table 54: Refinery CDU, Japan, crude distillation unit capacity (mbd), 2016–2026 80

Table 55: Refinery CDU, South Korea, crude distillation unit capacity (mbd), 2016–2026 82

Table 56: Refinery CDU, Singapore, crude distillation unit capacity (mbd), 2016–2026 83

Table 57: Refinery CDU, Thailand, crude distillation unit capacity (mbd), 2016–2026 84

Table 58: Refinery CDU, Taiwan, crude distillation unit capacity (mbd), 2016–2026 85

Table 59: Refinery CDU, Indonesia, crude distillation unit capacity (mbd), 2016–2026 86

Table 60: Refinery CDU, Malaysia, crude distillation unit capacity (mbd), 2016–2026 87

Table 61: Refinery CDU, Pakistan, crude distillation unit capacity (mbd), 2016–2026 88

Table 62: Refinery CDU, Vietnam, crude distillation unit capacity (mbd), 2016–2026 89

Table 63: Refinery CDU, Philippines, crude distillation unit capacity (mbd), 2016–2026 90

Table 64: Refinery CDU, Brunei, crude distillation unit capacity (mbd), 2016–2026 91

Table 65: Refinery CDU, North Korea, crude distillation unit capacity (mbd), 2016–2026 92

Table 66: Refinery CDU, Myanmar, crude distillation unit capacity (mbd), 2016–2026 93

Table 67: Refinery CDU, Sri Lanka, crude distillation unit capacity (mbd), 2016–2026 94

Table 68: Refinery CDU, Bangladesh, crude distillation unit capacity (mbd), 2016–2026 95

Table 69: Refinery CDU, Laos, crude distillation unit capacity (mbd), 2016–2026 96

Table 70: Refinery CDU, Afghanistan, crude distillation unit capacity (mbd), 2016–2026 97

Table 71: Refinery CDU, Mongolia, crude distillation unit capacity (mbd), 2016–2026 97

Table 72: Refinery CDU, Caribbean, key statistics, 2021 98

Table 73: Refinery CDU, Caribbean, capacity by key countries (mbd), 2016–2026 99

Table 74: Refinery CDU, Curacao, crude distillation unit capacity (mbd), 2016–2026 100

Table 75: Refinery CDU, Aruba, crude distillation unit capacity (mbd), 2016–2026 101

Table 76: Refinery CDU, U.S. Virgin Islands, crude distillation unit capacity (mbd), 2016–2026 102

Table 77: Refinery CDU, Trinidad and Tobago, crude distillation unit capacity (mbd), 2016–2026 103

Table 78: Refinery CDU, Cuba, crude distillation unit capacity (mbd), 2016–2026 104

Table 79: Refinery CDU, Dominican Republic, crude distillation unit capacity (mbd), 2016–2026 105

Table 80: Refinery CDU, Jamaica, crude distillation unit capacity (mbd), 2016–2026 106

Table 81: Refinery CDU, Martinique, crude distillation unit capacity (mbd), 2016–2026 107

Table 82: Refinery CDU, Central America, key statistics, 2021 108

Table 83: Refinery CDU, Central America, capacity by country (mbd), 2016–2026 109

Table 84: Refinery CDU, Costa Rica, crude distillation unit capacity (mbd), 2016–2026 110

Table 85: Refinery CDU, Nicaragua, crude distillation unit capacity (mbd), 2016–2026 111

Table 86: Refinery CDU, Guatemala, crude distillation unit capacity (mbd), 2016–2026 112

Table 87: Refinery CDU, Europe, key statistics, 2021 113

Table 88: Refinery CDU, Europe, capacity by key countries (mbd), 2016–2026 114

Table 89: Refinery CDU, Germany, crude distillation unit capacity (mbd), 2016–2026 115

Table 90: Refinery CDU, Italy, crude distillation unit capacity (mbd), 2016–2026 116

Table 91: Refinery CDU, Spain, crude distillation unit capacity (mbd), 2016–2026 117

Table 92: Refinery CDU, United Kingdom, crude distillation unit capacity (mbd), 2016–2026 118

Table 93: Refinery CDU, Netherlands, crude distillation unit capacity (mbd), 2016–2026 119

Table 94: Refinery CDU, France, crude distillation unit capacity (mbd), 2016–2026 120

Table 95: Refinery CDU, Belgium, crude distillation unit capacity (mbd), 2016–2026 121

Table 96: Refinery CDU, Poland, crude distillation unit capacity (mbd), 2016–2026 122

Table 97: Refinery CDU, Greece, crude distillation unit capacity (mbd), 2016–2026 123

Table 98: Refinery CDU, Sweden, crude distillation unit capacity (mbd), 2016–2026 124

Table 99: Refinery CDU, Romania, crude distillation unit capacity (mbd), 2016–2026 125

Table 100: Refinery CDU, Bulgaria, crude distillation unit capacity (mbd), 2016–2026 125

Table 101: Refinery CDU, Norway, crude distillation unit capacity (mbd), 2016–2026 126

Table 102: Refinery CDU, Portugal, crude distillation unit capacity (mbd), 2016–2026 127

Table 103: Refinery CDU, Finland, crude distillation unit capacity (mbd), 2016–2026 128

Table 104: Refinery CDU, Austria, crude distillation unit capacity (mbd), 2016–2026 128

Table 105: Refinery CDU, Czech Republic, crude distillation unit capacity (mbd), 2016–2026 129

Table 106: Refinery CDU, Hungary, crude distillation unit capacity (mbd), 2016–2026 129

Table 107: Refinery CDU, Denmark, crude distillation unit capacity (mbd), 2016–2026 130

Table 108: Refinery CDU, Serbia, crude distillation unit capacity (mbd), 2016–2026 130

Table 109: Refinery CDU, Slovakia, crude distillation unit capacity (mbd), 2016–2026 131

Table 110: Refinery CDU, Croatia, crude distillation unit capacity (mbd), 2016–2026 131

Table 111: Refinery CDU, Ireland, crude distillation unit capacity (mbd), 2016–2026 132

Table 112: Refinery CDU, Switzerland, crude distillation unit capacity (mbd), 2016–2026 132

Table 113: Refinery CDU, Albania, crude distillation unit capacity (mbd), 2016–2026 133

Table 114: Refinery CDU, Bosnia and Herzegovina, crude distillation unit capacity (mbd), 2016–2026 134

Table 115: Refinery CDU, Former Soviet Union, key statistics, 2021 135

Table 116: Refinery CDU, Former Soviet Union, capacity by key countries (mbd), 2016–2026 136

Table 117: Refinery CDU, Former Soviet Union, planned and announced CDUs details, 2022–2026 137

Table 118: Refinery CDU, Former Soviet Union, annual new build and expansion capital expenditure outlook for CDUs ($M), 2022–2026 138

Table 119: Former Soviet Union, annual new build and expansion capital expenditure outlook for CDUs by key countries ($M), 2022–2026 139

Table 120: Refinery CDU, Former Soviet Union, CDU capacity additions through new and existing refinery expansions by key countries (mbd), 2022–2026 140

Table 121: Refinery CDU, Former Soviet Union, CDU capacity additions through new refineries by key countries (mbd), 2022–2026 140

Table 122: Refinery CDU, Former Soviet Union, CDU capacity additions through existing refinery expansions by country (mbd), 2022–2026 141

Table 123: Refinery CDU, Russia, crude distillation unit capacity (mbd), 2016–2026 142

Table 124: Refinery CDU, Belarus, crude distillation unit capacity (mbd), 2016–2026 145

Table 125: Refinery CDU, Ukraine, crude distillation unit capacity (mbd), 2016–2026 146

Table 126: Refinery CDU, Turkmenistan, crude distillation unit capacity (mbd), 2016–2026 146

Table 127: Refinery CDU, Kazakhstan, crude distillation unit capacity (mbd), 2016–2026 147

Table 128: Refinery CDU, Lithuania, crude distillation unit capacity (mbd), 2016–2026 148

Table 129: Refinery CDU, Uzbekistan, crude distillation unit capacity (mbd), 2016–2026 148

Table 130: Refinery CDU, Azerbaijan, crude distillation unit capacity (mbd), 2016–2026 149

Table 131: Refinery CDU, Kyrgyzstan, crude distillation unit capacity (mbd), 2016–2026 149

Table 132: Refinery CDU, Tajikistan, crude distillation unit capacity (mbd), 2016–2026 150

Table 133: Refinery CDU, Georgia, crude distillation unit capacity (mbd), 2016–2026 151

Table 134: Refinery CDU, Moldova, crude distillation unit capacity (mbd), 2016–2026 151

Table 135: Refinery CDU, Middle East, key statistics, 2021 152

Table 136: Refinery CDU, Middle East, capacity by key countries (mbd), 2016–2026 153

Table 137: Refinery CDU, Middle East, planned and announced CDUs details, 2022–2026 154

Table 138: Refinery CDU, Middle East, annual new build and expansion capital expenditure outlook for CDUs ($M), 2022–2026 156

Table 139: Middle East, annual new build and expansion capital expenditure outlook for CDUs by country ($M), 2022–2026 157

Table 140: Refinery CDU, Middle East, CDU capacity additions through new and existing refinery expansions by key countries (mbd), 2022–2026 158

Table 141: Refinery CDU, Middle East, CDU capacity additions through new refineries by key countries (mbd), 2022–2026 158

Table 142: Refinery CDU, Middle East, CDU capacity additions through existing refinery expansions by key countries (mbd), 2022–2026 159

Table 143: Refinery CDU, Saudi Arabia, crude distillation unit capacity (mbd), 2016–2026 160

Table 144: Refinery CDU, Iran, crude distillation unit capacity (mbd), 2016–2026 161

Table 145: Refinery CDU, Iraq, crude distillation unit capacity (mbd), 2016–2026 163

Table 146: Refinery CDU, United Arab Emirates, crude distillation unit capacity (mbd), 2016–2026 165

Table 147: Refinery CDU, Turkey, crude distillation unit capacity (mbd), 2016–2026 166

Table 148: Refinery CDU, Kuwait, crude distillation unit capacity (mbd), 2016–2026 167

Table 149: Refinery CDU, Oman, crude distillation unit capacity (mbd), 2016–2026 168

Table 150: Refinery CDU, Israel, crude distillation unit capacity (mbd), 2016–2026 169

Table 151: Refinery CDU, Bahrain, crude distillation unit capacity (mbd), 2016–2026 169

Table 152: Refinery CDU, Syria, crude distillation unit capacity (mbd), 2016–2026 170

Table 153: Refinery CDU, Yemen, crude distillation unit capacity (mbd), 2016–2026 170

Table 154: Refinery CDU, Jordan, crude distillation unit capacity (mbd), 2016–2026 171

Table 155: Refinery CDU, Qatar, crude distillation unit capacity (mbd), 2016–2026 171

Table 156: Refinery CDU, North America, key statistics, 2021 172

Table 157: Refinery CDU, North America, capacity by US PADD regions, Canada and Mexico (mbd), 2016–2026 173

Table 158: Refinery CDU, North America, planned and announced CDUs details, 2022–2026 174

Table 159: Refinery CDU, North America, annual new build and expansion capital expenditure outlook for CDUs ($M), 2022–2026 175

Table 160: North America, annual new build and expansion capital expenditure outlook for CDUs by key countries ($M), 2022–2026 176

Table 161: Refinery CDU, North America, CDU capacity additions through new and existing refinery expansions by country (mbd), 2022–2026 177

Table 162: Refinery CDU, North America, CDU capacity additions through new refineries by country (mbd), 2022–2026 177

Table 163: Refinery CDU, North America, CDU capacity additions through existing refinery expansions by country (mbd), 2022–2026 177

Table 164: Refinery CDU, Gulf Coast, crude distillation unit capacity (mbd), 2016–2026 178

Table 165: Refinery CDU, Midwest, crude distillation unit capacity (mbd), 2016–2026 182

Table 166: Refinery CDU, West Coast, crude distillation unit capacity (mbd), 2016–2026 184

Table 167: Refinery CDU, East Coast, crude distillation unit capacity (mbd), 2016–2026 186

Table 168: Refinery CDU, Rocky Mountain, crude distillation unit capacity (mbd), 2016–2026 187

Table 169: Refinery CDU, Canada, crude distillation unit capacity (mbd), 2016–2026 188

Table 170: Refinery CDU, Mexico, crude distillation unit capacity (mbd), 2016–2026 190

Table 171: Refinery CDU, Oceania, key statistics, 2021 191

Table 172: Refinery CDU, Oceania, capacity by country (mbd), 2016–2026 191

Table 173: Refinery CDU, Australia, crude distillation unit capacity (mbd), 2016–2026 193

Table 174: Refinery CDU, New Zealand, crude distillation unit capacity (mbd), 2016–2026 194

Table 175: Refinery CDU, Papua New Guinea, crude distillation unit capacity (mbd), 2016–2026 195

Table 176: Refinery CDU, South America, key statistics, 2021 196

Table 177: Refinery CDU, South America, capacity by key countries (mbd), 2016–2026 197

Table 178: Refinery CDU, South America, planned and announced CDUs details, 2022–2026 198

Table 179: Refinery CDU, South America, annual new build and expansion capital expenditure outlook for CDUs ($M), 2022–2026 199

Table 180: South America, annual new build and expansion capital expenditure outlook for CDUs by key countries ($M), 2022–2026 200

Table 181: Refinery CDU, South America, CDU capacity additions through new and existing refinery expansions by country (mbd), 2022–2026 201

Table 182: Refinery CDU, South America, CDU capacity additions through new refineries by country (mbd), 2022–2026 201

Table 183: Refinery CDU, South America, CDU capacity additions through existing refinery expansions by country (mbd), 2022–2026 201

Table 184: Refinery CDU, Brazil, crude distillation unit capacity (mbd), 2016–2026 202

Table 185: Refinery CDU, Venezuela, crude distillation unit capacity (mbd), 2016–2026 204

Table 186: Refinery CDU, Argentina, crude distillation unit capacity (mbd), 2016–2026 205

Table 187: Refinery CDU, Colombia, crude distillation unit capacity (mbd), 2016–2026 206

Table 188: Refinery CDU, Chile, crude distillation unit capacity (mbd), 2016–2026 207

Table 189: Refinery CDU, Peru, crude distillation unit capacity (mbd), 2016–2026 208

Table 190: Refinery CDU, Ecuador, crude distillation unit capacity (mbd), 2016–2026 209

Table 191: Refinery CDU, Bolivia, crude distillation unit capacity (mbd), 2016–2026 210

Table 192: Refinery CDU, Uruguay, crude distillation unit capacity (mbd), 2016–2026 211

Table 193: Refinery CDU, Suriname, crude distillation unit capacity (mbd), 2016–2026 211

Table 194: Refinery CDU, Paraguay, crude distillation unit capacity (mbd), 2016–2026 212

Table 195: Refinery CDU, Guyana, crude distillation unit capacity (mbd), 2016–2026 213

![]()