Bulgaria Cards and Payments – Opportunities and Risks to 2025

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

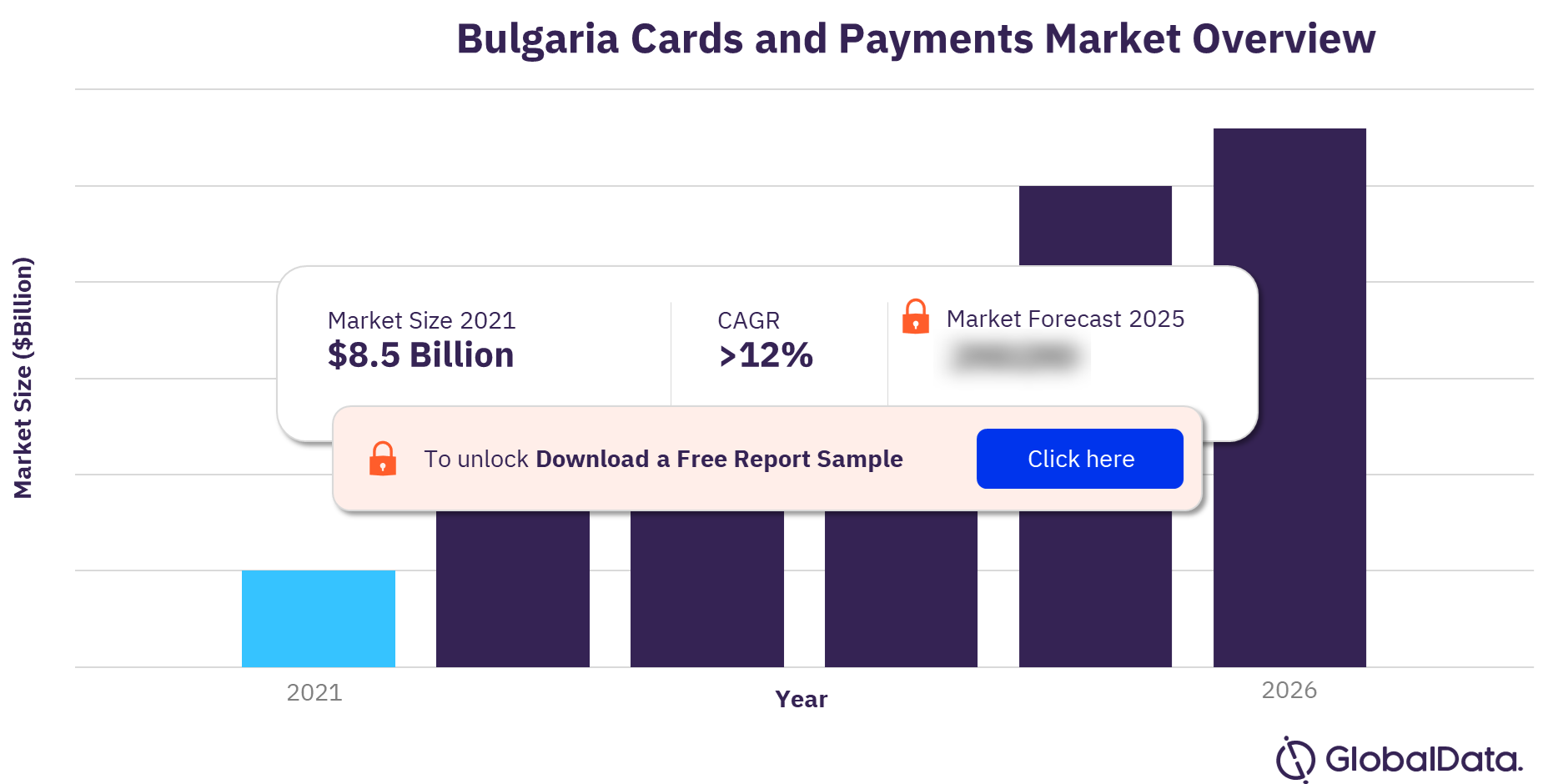

The annual value of card transactions in the Bulgaria cards and payments market was $8.5 billion in 2021. The market is expected to grow at a CAGR of more than 12% during the forecast period.

The Bulgaria cards and payments market research report provides detailed analysis of market trends in the Bulgarian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including cash, cards, credit transfers, direct debits, and cheques during the review-period.

Bulgaria cards and payments market outlook

For more insights on this report, download a free sample

What are the market dynamics in the Bulgaria cards and payments industry?

The extension of payment card use for transport payments will support the growth of the card payment space. In May 2021, the public transport system in Sofia enabled the use of contactless debit and credit cards to make payments across 1,110 buses, trolleybuses, and trams operating in the city. In August 2021, Bulgaria’s DSK Bank partnered with payment solutions provider O-CITY to launch contactless payment cards that can be used across 3,900 validators installed on public transport including buses, trams, and trolleybuses.

To increase card penetration in the country, banks are introducing more convenient methods for consumers to access personal banking services. UBB offers debit card issuance via its mobile banking app. Customers can apply for a debit card directly within the app and choose which branch they want to collect the card from. The app also enables users to repay credit card dues in three to 12 installments. On a similar note, UBB launched web platform UBB Digital Portal for business customers in March 2021, which allows customers to open new accounts and apply for debit and credit cards digitally.

Which are the key payment instruments in the Bulgaria cards and payments market?

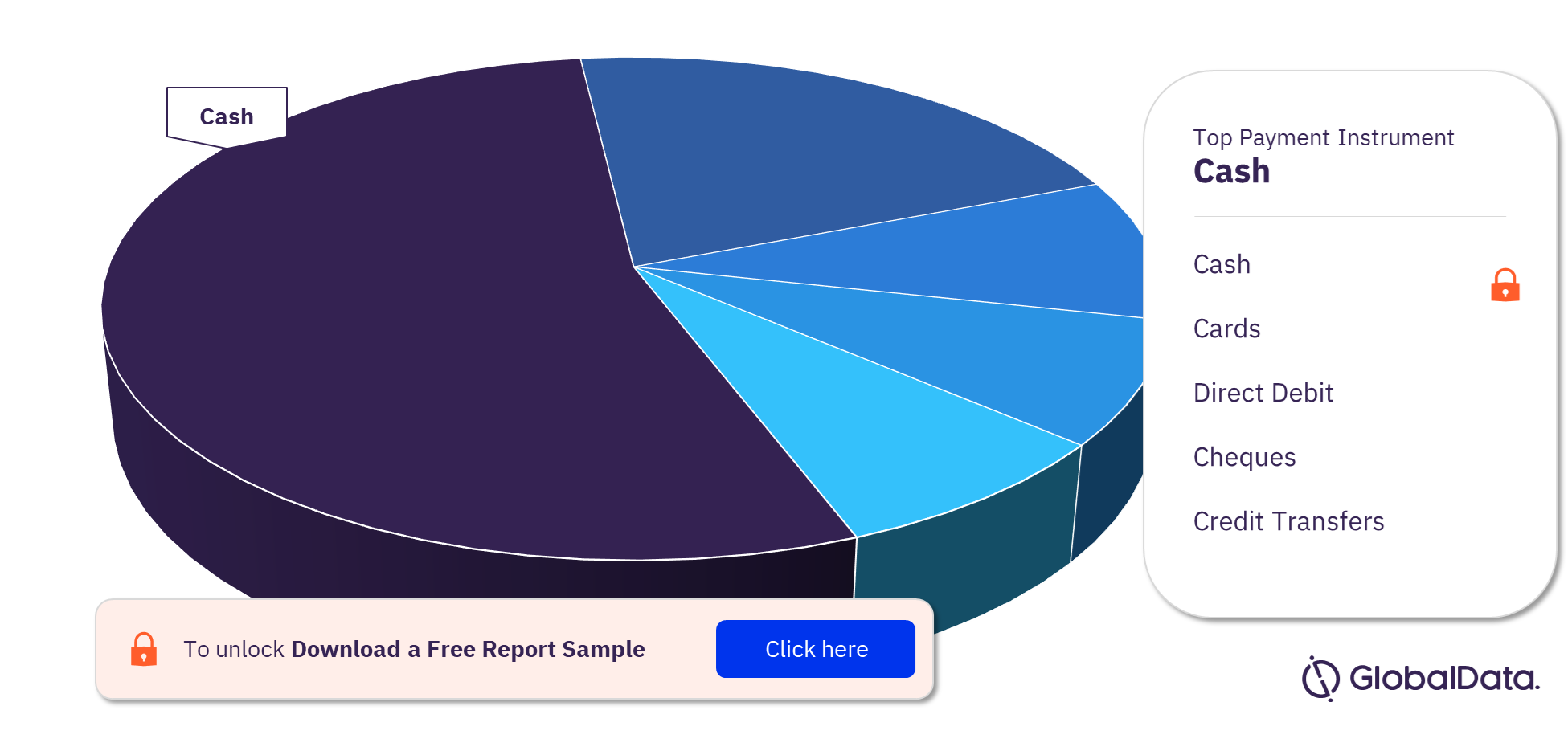

The key payment instruments in the Bulgaria cards and payments market are cash, cards, credit transfers, direct debit and cheques. Cash is the largest segment in the cards and payments market in Bulgaria.

Bulgaria cards and payments market, by payment instruments

For more payment instrument insights, download a free sample

For more payment instrument insights, download a free sample

What are the key segments in the Bulgaria cards and payments market?

The key segments in the Bulgaria cards and payments market include card-based payments, e-commerce payments, and alternative payments.

Card-based payment market in Bulgaria

Debit cards dominate the Bulgarian payment card market. In line with EU regulations relating to citizens’ right to a basic bank account, banks in Bulgaria offer payment accounts with basic features. Central Cooperative Bank, UBB, Tokuda Bank, and Raiffeisen Bank all offer basic bank accounts with a debit card. These basic accounts are mostly offered free of charge, but some banks charge a minimal annual fee for the service.

E-commerce payments market in Bulgaria

The Bulgarian ecommerce market is currently in a growth phase, in 2021e. This can be attributed to the country’s widespread smartphone penetration and internet connectivity, coupled with enhanced security of online transactions. This has resulted in high consumer confidence and participation in ecommerce.

Alternative payments market in Bulgaria

Alternative payments in the cards and payments market in Bulgaria include PayPal, Apple Pay, Google Pay, ONE Wallet, phyre, and paysafecard.

Which are the key companies in the Bulgaria cards and payments market?

The key companies in the Bulgaria cards and payments market are OTP Bank, KBC Bank, UniCredit Bank, Access Finance, Eurobank, Raiffeisen Bank, Central Cooperative Bank, Fibank, BORICA, Visa, and Mastercard.

Market report scope

| Market size | $8.5 billion |

| CAGR% | >12% |

| Forecast period | 2021-2025 |

| Key segments | Card-Based Payments, E-Commerce Payments, and Alternative Payments |

| Key payment instruments | Cash, Cards, Credit Transfers, Direct Debit and Cheques |

| Key companies | OTP Bank, KBC Bank, UniCredit Bank, Access Finance, Eurobank, Raiffeisen Bank, Central Cooperative Bank, Fibank, BORICA, Visa, and Mastercard. |

Scope

The report provides top-level market analysis, information and insights into the Bulgarian cards and payments industry, including –

- Current and forecast values for each market in the Bulgarian cards and payments industry, including debit and credit cards

- Detailed insights into payment instruments including cash, credit transfers, cards, direct debits, and cheque. It also, includes an overview of the country’s key alternative payment instruments.

- Ecommerce market analysis.

- Analysis of various market drivers and regulations governing the Bulgarian cards and payments industry.

- Detailed analysis of strategies adopted by banks and other institutions to market debit and credit cards.

- Comprehensive analysis of consumer attitudes and buying preferences for cards.

- The competitive landscape of the Bulgarian cards and payments industry.

Reasons to Buy

- Make strategic business decisions, using top-level historic and forecast market data, related to the Bulgarian cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the Bulgarian cards and payments industry.

- Assess the competitive dynamics in the Bulgarian cards and payments industry.

- Gain insights into marketing strategies used for various card types in Bulgaria.

- Gain insights into key regulations governing the Bulgarian cards and payments industry.

KBC Bank

UniCredit Bank

Access Finance

Eurobank

Raiffeisen Bank

Central Cooperative Bank

Fibank

BORICA

Visa

Mastercard.

Table of Contents

Frequently asked questions

-

What was the Bulgaria cards and payments market size in the year 2021?

The cards and payments market size in Bulgaria was valued at $8.5 billion in the year 2021.

-

What was the Bulgaria cards and payments market growth rate?

The cards and payments market in Bulgaria is projected to grow at a CAGR of more than 12% during the forecast period.

-

What are the key segments in the Bulgaria cards and payments market?

Card-based payments, e-commerce payments, and alternative payments are the key segments in the Bulgarian cards and payments market.

-

Which are the key payment instruments in the Bulgaria cards and payments market?

Cash, cards, credit transfers, direct debit and cheques are the key payment instruments in the Bulgarian cards and payments market.

-

Which are the key companies in the Bulgaria cards and payments market?

OTP Bank, KBC Bank, UniCredit Bank, Access Finance, Eurobank, Raiffeisen Bank, Central Cooperative Bank, Fibank, BORICA, Visa, and Mastercard are the key companies in the Bulgarian cards and payments market.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports