Canada Cards and Payments – Opportunities and Risks to 2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

How will the ‘Canada Cards and Payments Market’ help you achieve your business goals? The report’s in-depth analysis and market insights will enable you to:

- Make strategic business decisions, using top-level historical and forecast market data, related to the Canada cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the Canada cards and payments industry.

- Assess the competitive dynamics in the Canada cards and payments industry.

- Gain insights into marketing strategies used for various card types in Canada.

- Gain insights into key regulations governing the Canada cards and payments industry.

How is the ‘ Canada Cards and Payments Market’ report different from other reports in the market?

Businesses need to have a deeper understanding of the market dynamics to gain a competitive edge in the coming decade. Anticipate market changes and develop risk management strategies with the following data:

- Current and forecast values for each market in the Canada cards and payments industry, including debit, credit, and charge cards.

- Detailed insights into payment instruments including cards, cash, direct debits, credit transfers, cheques, and mobile wallets. It also includes an overview of the country’s key alternative payment instruments.

- E-commerce market analysis.

- Analysis of various market drivers and regulations governing the Canada cards and payments industry.

- Detailed analysis of strategies adopted by banks and other institutions to market debit, credit, and charge cards.

- Comprehensive analysis of consumer attitudes and buying preferences for cards.

- Competitive landscape of the Canada cards and payments industry.

We recommend this valuable source of information to anyone involved in:

- Regulatory Agency/Procurement Managers/ M&A and Investment Consultants

- Strategy, Marketing, and Business Development

- Digital payment companies/Insurance Companies

- Technology Leaders and Startups

- Cyber Security Managers for Banks

- Product Development Directors

- Professional Services /Sales & Marketing Director

- Banks – Industry/Commercial/Retail/Private/Government/International

- E-commerce Firms, PE/VC Firms

To Get a Snapshot of the Canada Cards and Payments Market Report

Canada Cards and Payments Market Report Overview

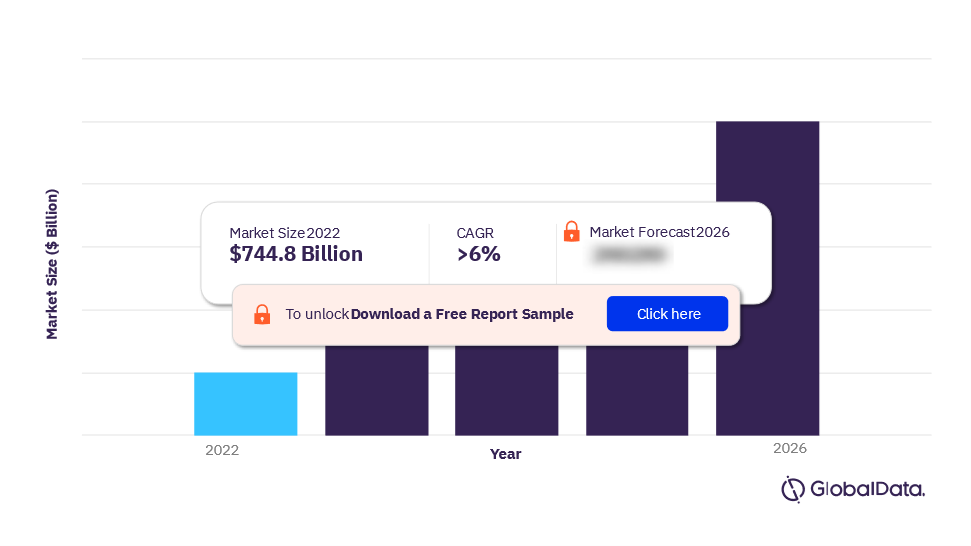

The Canada cards and payments market was valued at $744.8 billion in 2022 and is expected to achieve a CAGR of more than 6% from 2022-2026. The proliferation of digital-only banks has helped drive competition in the banking space, thus boosting debit card holding. Furthermore, contactless technology is gaining prominence in Canada, with banks and scheme providers increasingly promoting this technology.

Canada Cards and Payments Market Outlook, 2022-2026 ($ Billion)

To gain more information on the Canada cards and payments market forecast, download a free sample report

The Canada cards and payments market research report provides a detailed analysis of market trends in Canada’s cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry including cash, cards, credit transfers, direct debits, and cheques during the review-period. The report also analyzes various payment card markets operating in the industry and provides detailed information on the number of cards in circulation, transaction values, and volumes during the review period and over the forecast period. It also offers information on the country’s competitive landscape, including market shares of issuers and schemes.

| Market Size (2023) | $744.8 billion |

| CAGR | >6% |

| Forecast Period | 2022-2026 |

| Historical Period | 2018-2022 |

| Key Payment Instruments | · Cash

· Cards · Credit Transfers · Direct Debits · Mobile Wallets · Cheques |

| Key Segments | · Card-Based Payments

· Merchant Acquiring · E-commerce Payments · In-store Payments · Buy Now Pay Later · Mobile Payments · P2P Payments · Bill Payments · Alternative Payments |

| Key Card-based Payment Segments | · Debit Cards

· Credit Cards · Charge Cards |

| Leading Players | · RBC Royal Bank

· Canada Trust · Desjardins · Scotiabank · CIBC · BMO |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Canada Cards and Payments Market Dynamics

Canada’s payment card market is mature, with each individual holding 2.8 cards in 2022e. This is due to near-100% banking penetration, as well as the combined efforts of the government and banks to promote card payments. These measures include offering low-cost bank accounts and expanding payment infrastructure. Besides cards, the growing preference for contactless card payments and instant payments; the rising ecommerce market; payment innovations such as cashier-less stores and payment accessories; and alternative payment solutions such as PayPal, Google Pay, and Apple Pay have boosted the preference for cashless payment methods. The Canadian economy rebounded from the initial impact of COVID-19 but is expected to slow down again in 2023 amid rising inflation and ongoing geopolitical uncertainty.

For additional Canada cards and payments market dynamics, download a free report sample

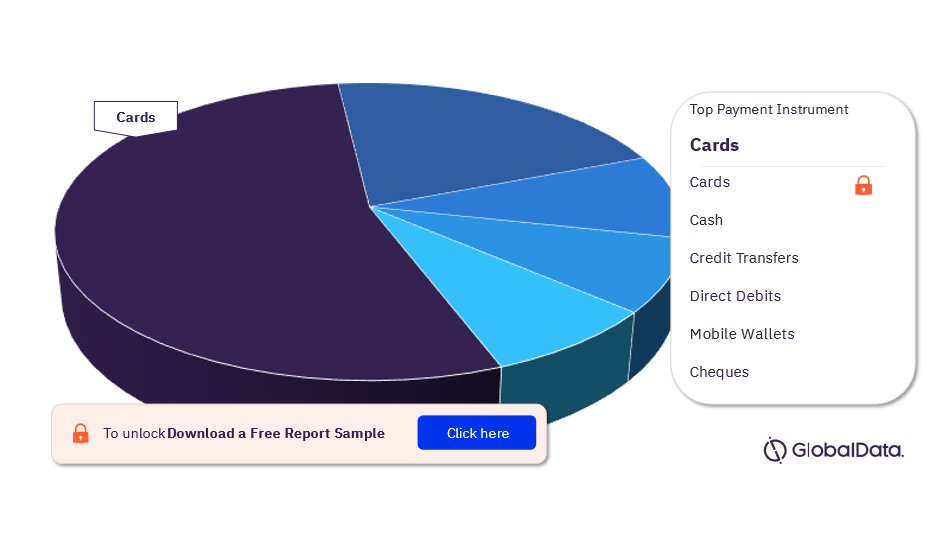

Canada Cards and Payments Market Segmentation by Payment Instruments

The key payment instruments in the Canada cards and payments market are cash, cards, credit transfers, direct debits, mobile wallets, and cheques. In 2022, cards accounted for over 70% of total transaction volume in the Canadian cards and payment market. This growth can be attributed to the country’s well-developed payment infrastructure, high consumer awareness, and wide card acceptance network. In addition, the emergence of digital-only banks and the country’s strong e-commerce market will further support growth.

Canada Cards and Payments Market Analysis by Payment Instruments, 2022 (%)

For more payment instrument insights into the Canada cards and payments market, download a free sample report

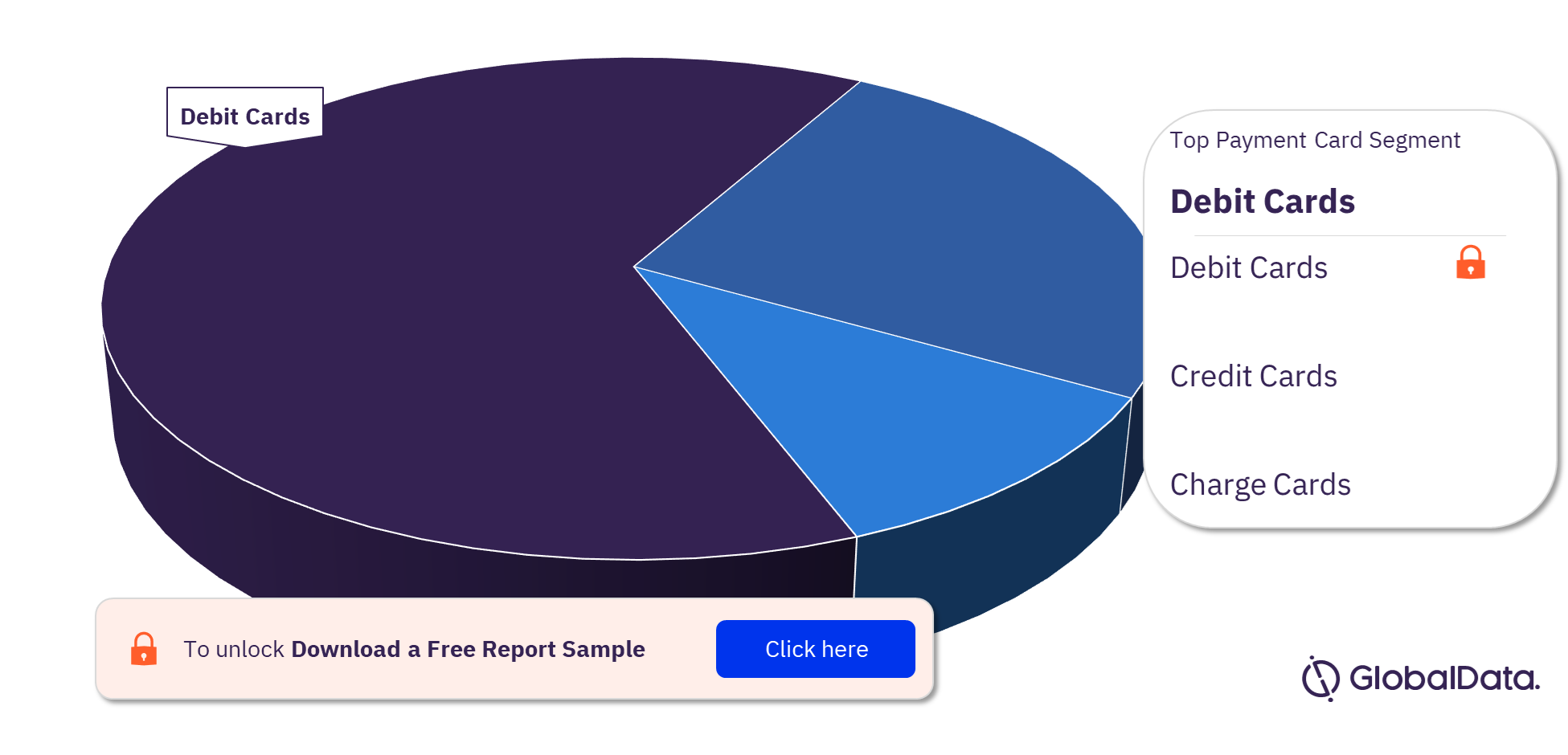

Canada Cards and Payments Market Segments

The key segments in the Canada cards and payments market are card-based payments, merchant acquiring, e-commerce payments, in-store payments, buy now pay later, and alternative payments among others.

The high payment card frequency of use (including both ATM cash withdrawals and payments) was supported by the growing adoption of contactless payments (especially since the outbreak of COVID 19). The launch of digital-only banks and alternative payment solutions as well as ecommerce growth will boost the Canadian payment card market going forward.

Payment Cards Analysis by Segments, 2023 (%)

For more insights on the Canada payment card segments, download a free report sample

Canada Cards and Payments Market - Competitive Landscape

Some of the leading players in the Canada cards and payments market are RBC Royal Bank, Canada Trust, Desjardins, Scotiabank, CIBC, and BMO among others.

Segments Covered in the Report

Canada Cards and Payments Instruments Outlook (Value, $ Billion, 2018-2026)

- Cash

- Cards

- Credit Transfers

- Direct Debits

- Cheques

Canada Cards and Payments Market Segments Outlook (Value, $ Billion, 2018-2026)

- Card-Based Payments

- E-commerce Payments

- Alternative Payments

TD Canada Trust

Desjardins

Scotiabank

CIBC

BMO

Interac

Visa

Mastercard

American Express

Moneris

Global Payments

Chase Paymentech

TD Merchant Solutions

PayPal

Apple Pay

Google Pay

Samsung Pay

Click to Pay

paysafecard

Klarna

Afterpay

Table of Contents

Frequently asked questions

-

What was the Canada cards and payments market size in 2023?

The cards and payments market size in Canada was valued at $744.8 billion in 2023.

-

What is the Canada cards and payments market growth rate?

The cards and payments market in Canada is expected to achieve a CAGR of more than 6% during 2022-2026.

-

Which is the leading payment instrument in the Canada cards and payments market in 2023?

Card payments is the leading payment instrument in terms of volume transactions in the Canadian cards and payments market.

-

Who are the leading players in the Canada cards and payments market?

Some of the leading players in the Canada cards and payments market are RBC Royal Bank, Canada Trust, Desjardins, Scotiabank, CIBC, and BMO.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Financial Services reports