CaixaBank – Digital Transformation Strategies

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

CaixaBank has been focusing on leveraging disruptive technologies as a part of its digital transformation strategies. The annual ICT spending of CaixaBank was estimated at $809.6 million in 2021. A major share of this spending is earmarked for acquiring software, hardware, and consulting from vendors. CaixaBank is a provider of banking, asset management, insurance, and investment solutions to individuals, SMEs, and corporate customers.

The CaixaBank digital transformation strategies report will act as a reference point to understand a company/competitor’s digital strategy. It will also help in understanding the digital preparedness of the company against its peers. Information included in these reports are sourced from a mix of our very own internal database and authentic secondary research links such as company’s annual report, presentations, press releases etc. The report covers overview of the company, its digital transformation strategies, technology focus areas, technology initiatives, technology introductions, ICT spending among others.

Digital Transformation Strategies

CaixaBank is exploring the use of advanced technologies such as blockchain, artificial intelligence, big data, and robotics to increase its operational flexibility and efficiency. Its technology initiatives include leveraging blockchain technology to simplify trade transactions; establishing big data infrastructure; deploying smart PCs for enterprise mobility and implementing an open banking business model to offer innovative solutions.

To gain more insights on digital transformation strategies and initiatives of CaixaBank, download a free report sample

CaixaBank Technology Theme Focus

CaixaBank is utilizing number of emerging technologies including big data, cloud, and blockchain to improve operational efficiency, diversify product portfolio, and enhance customer experience.

CaixaBank Technology Theme Focus

To know about other technology themes under focus for the company, download a free report sample

CaixaBank Technology Initiatives

CaixaBank has been involved in several strategic technology partnerships and collaborations, technology developments and roll outs over the past few years.

For instance, CaixaBank Partnered with Revelock to develop AI based solution for digital security. The solution developed as a result of this partnership is integrated into CaixaBank’s online banking platform. It detects changes in customers’ normal patterns of behavior during online transactions that could indicate an attempt at fraud. The technology monitors users’ online interactions and compares them to risk patterns in real time, ensuring enhanced security for all CaixaBank online banking customers.

For more insights on other technology initiatives of CaixaBank, download a free report sample

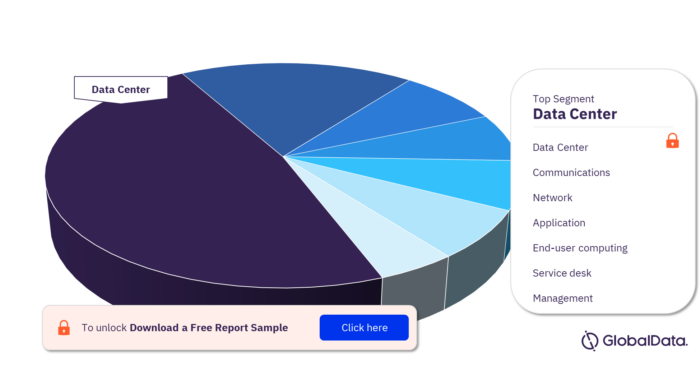

CaixaBank ICT Spend by Function

- Communications

- Data center

- Network

- Application

- End-user computing

- Service desk

- Management

CaixaBank ICT Spend by Function

For more insights on ICT spending by function, download a free report sample

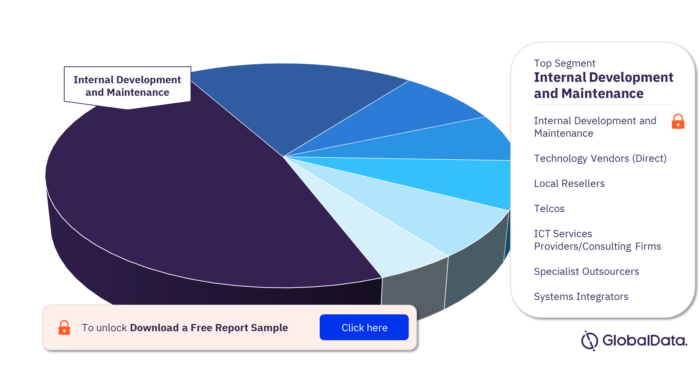

CaixaBank ICT Spend by Channel

- Internal development and maintenance

- Technology vendors (direct)

- Local resellers

- Telcos

- ICT services providers/Consulting firms

- Specialist outsourcers

- Systems integrators

CaixaBank ICT Spend by Channel

For more insights on ICT spending by channel, download a free report sample

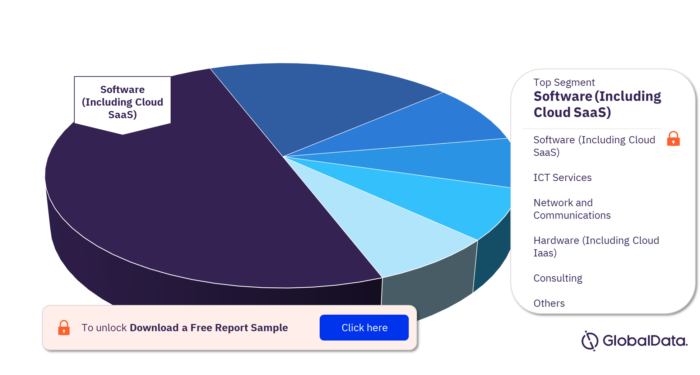

CaixaBank External ICT Spend by Segment

- ICT services

- Software (including Cloud SaaS)

- Hardware (including Cloud Iaas)

- Network and communications

- Consulting

- Others

CaixaBank External ICT Spend by Segment

For more insights on external ICT spending by segment, download a free report sample

CaixaBank Digital Transformation Strategies Overview

| Total ICT Spending 2021 | $809.6 million |

| ICT Spend by Function | Communications, Data Center, Network, Application, End-User Computing, Service Desk, and Management |

| ICT Spend by Channel | Internal Development and Maintenance, Technology Vendors (Direct), Local Resellers, Telcos, ICT Services Providers/Consulting Firms, Specialist Outsourcers, and Systems integrators |

| External ICT Spend by Segment | ICT services, Software (including Cloud SaaS), Hardware (including Cloud Iaas), Network and communications, Consulting, and Others |

| Technology Theme Focus | Big Data, Cloud, and Blockchain |

This report provides:

- Insight into CaixaBank’s technology activities.

- Insights of its digital transformation strategies and technology center & innovation program.

- Overview of technology initiatives covering product launches and partnerships.

- Insights on each technology initiative including technology theme, objective, and benefits.

- Details of estimated ICT budgets and major ICT contracts.

Reasons to Buy

- Gain insights into CaixaBank’s technology operations.

- Gain insights into its technology strategies and innovation initiatives.

- Gain insights into its technology themes under focus.

- Gain insights into its various product launches and partnerships.

Revelock

Booking.com

D-Wave

Qualys

Devo Technology

Samsung Pay

Social Pay

Global Payments

Garmin

Visa

Apple

Telefónica

SEAT

Aigües de Barcelona

Naturgy

Table of Contents

Frequently asked questions

-

What was the total ICT spending of CaixaBank in 2021?

The annual ICT spending of CaixaBank was estimated at $809.6 million in 2021.

-

What are the key ICT spending categories by function for CaixaBank?

The key ICT spending categories by function for CaixaBank are communications, data center, network, application, end-user computing, service desk, and management.

-

What are the key ICT spending categories by channel for CaixaBank?

The key ICT spending categories by channel for CaixaBank are internal development and maintenance, technology vendors (direct), local resellers, telcos, ICT services providers/consulting firms, specialist outsourcers, and systems integrators.

-

What are the key external ICT spending categories by segment for CaixaBank?

The key external ICT spending categories by segment for CaixaBank are ICT services, software (including cloud SaaS), hardware (including cloud IaaS), network and communications, consulting, and others.

-

What are the key technology themes in focus for CaixaBank?

The key technological theme in focus for CaixaBank are big data, cloud, and blockchain.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Retail Banking and Lending reports