Future of Construction in Europe – Report Bundle (5 Reports)

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Future of Construction in Europe Bundle Overview

The European construction market is expected to grow in the coming quarters owing to increasing demand for housing in non-rural areas and infrastructural development activities. Moreover, the usage of advanced technologies like construction robotics and BIM is not only boosting market growth but also enhancing the efficiency of construction activities in Europe.

Each report within the bundle allows you to access in-depth analysis of the construction industry of the respective countries. The reports provide –

- Historical (2018-2022) and forecast (2023-2027) valuations of the construction industry, featuring details of key growth drivers.

- Segmentation by sector (commercial, industrial, infrastructure, energy & utilities, institutional and residential) and by sub-sector.

- Analysis of the mega-project pipeline, including breakdowns by development stage across all sectors, and projected spending on projects in the existing pipeline.

- Listings of major projects, in addition to details of leading contractors and consultants.

You can get access to a wealth of information and insights with this cost-effective bundle, as it provides access to multiple reports at a discounted price, compared to buying individual reports.

The Future of Construction in Europe report bundle worth $7,475 can now be purchased just for $4,400

- France Construction Market (Single User $1,495)

- Germany Construction Market (Single User $1,495)

- Russia Construction Market (Single User $1,495)

- Turkey Construction Market (Single User $1,495)

- United Kingdom (UK) Construction Market (Single User $1,495)

Each report will allow you to –

- Identify and evaluate market opportunities using GlobalData’s standardized valuation and forecasting methodologies.

- Assess market growth potential at a micro-level with historical and forecast data.

- Understand the latest industry and market trends.

- Formulate and validate strategy using GlobalData’s critical and actionable insight.

- Assess business risks, including cost, regulatory and competitive pressures.

- Evaluate competitive risk and success factors.

We recommend this valuable source of information to anyone involved in:

- Contractors Including Civil Works, Electrical, HVAC, and Others

- Consultants/Designers

- Building Material Merchants/Players

- Management Consultants and Investment Banks

- Portfolio Managers/Buy-Side Firms

- Strategy & Business Development

- Investment Banking

Currently working in the construction industry or those looking to enter this market as contractors, SoC & hardware suppliers, consulting firms, venture capitalists, and construction technology firms.

Report 1: France Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast

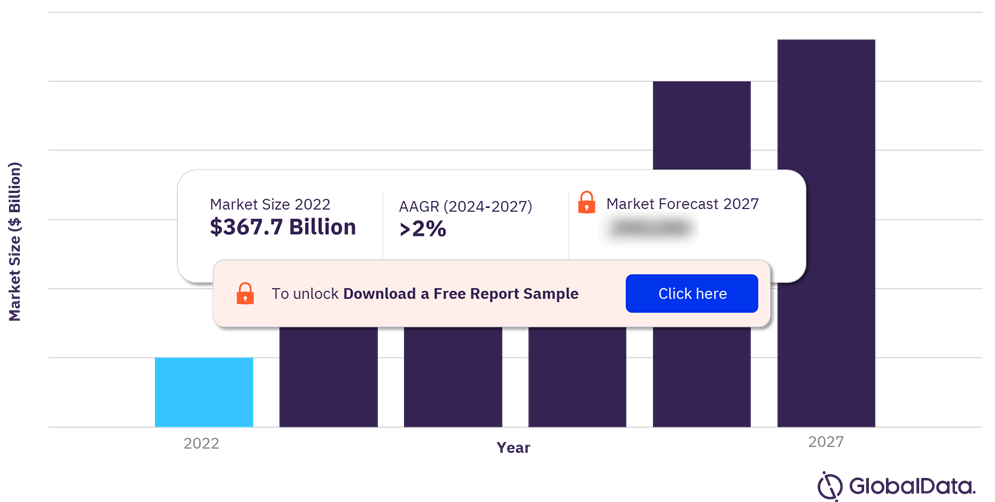

The France construction market size was valued at $367.7 billion in 2022. The market is expected to achieve an AAGR of more than 2% during 2024-27. Industry activities from 2024 to 2027 will be supported by investments in transport and renewable energy infrastructure projects. Residential construction was the largest sector in the France construction market in 2022. The sector’s output in 2023 will be affected by headwinds such as rising inflation, interest rates, and construction material prices. However, from 2024 to 2027, the growth of the sector will be supported by the government’s effort to supply affordable houses across the country as well as the renovation of homes to improve the energy efficiency of buildings.

France Construction Market Outlook, 2022-2027 ($ Billion)

For more insights on the France construction market, download a free report sample

Report 2: Germany Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast

The Germany construction market size was valued at $493.3 billion in 2022. The market is expected to achieve an AAGR of more than 2% during 2024-27. The construction industry is expected to start regaining growth momentum from 2024, supported by investment in transport, renewable energy, housing, and manufacturing projects. Residential construction was the largest sector in the Germany construction market in 2022 and its growth during the forecast period will be supported by an improvement in housing demand and economic conditions as well as the government’s focus on tackling the country’s housing shortages by investing in social housing projects.

Germany Construction Market Outlook, 2022-2027 ($ Billion)

For more insights on the Germany construction market, download a free report sample

Report 3: Russia Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast

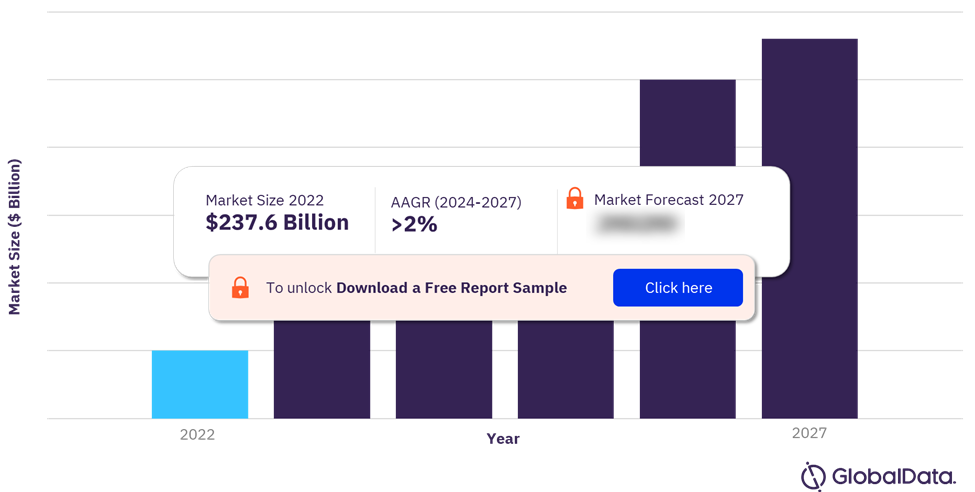

The Russia construction market size was valued at $237.6 billion in 2022. The market is expected to achieve an AAGR of more than 2% during 2024-27. The construction industry is expected to suffer from material shortages in the short-term owing to trade sanctions, while in the medium term restricted access to Western technology and human capital is likely to weigh on productivity in the sector, limiting its ability to mount a strong recovery and maintain a sustainable trend rate of growth. However, from 2025 to 2027, if the military conflict remains short-lived, there will be growth in the sector supported by government investment in infrastructure, and residential and renewable energy projects. Residential construction was the largest sector in the Russia construction market in 2022 and its growth was supported by the government’s focus to develop affordable housing.

Russia Construction Market Outlook, 2022-2027 ($ Billion)

For more insights on the Russia construction market, download a free report sample

Report 4: Turkey Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast

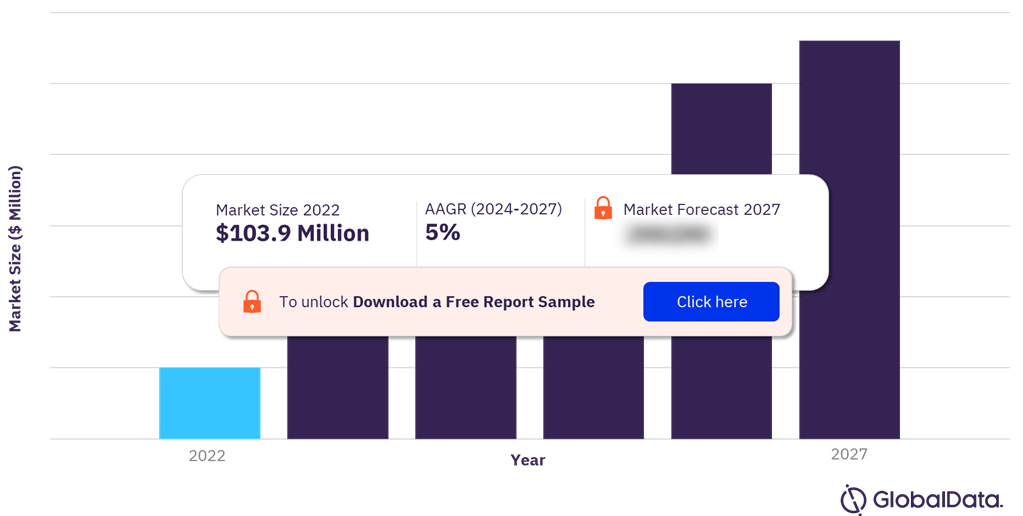

The Turkey construction market size was valued at $103.9 million in 2022. The market is expected to achieve an AAGR of 5% during 2024-27. The growth of the industry from 2024-27 will be supported by investments in transport and renewable energy infrastructure projects. Residential construction was the largest sector in the Turkey construction market in 2022 and its output is expected to be boosted by a recovery in housing demand, together with the government’s plan to build several social housing units by 2028.

Turkey Construction Market Outlook, 2022-2027 ($ Million)

For more insights on the Turkey construction market, download a free report sample

Report 5: United Kingdom (UK) Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast

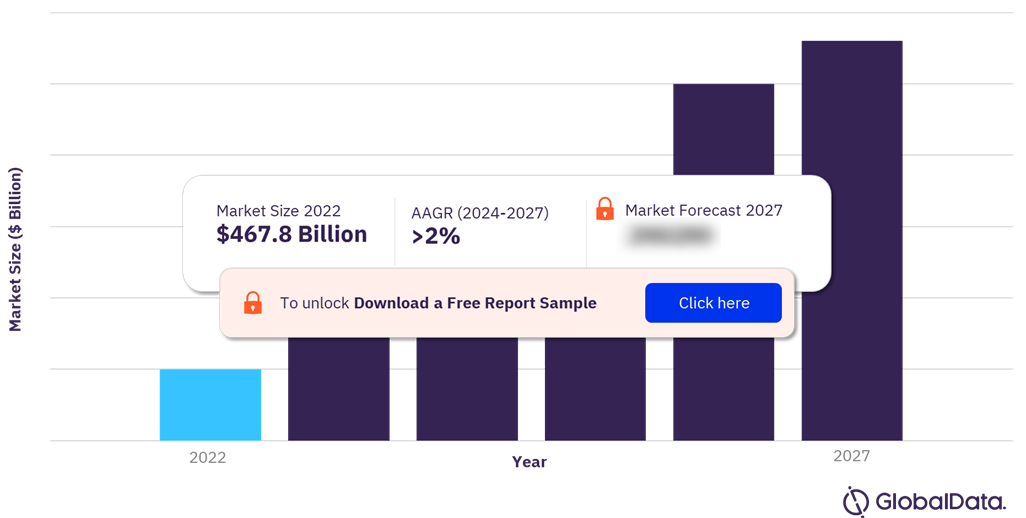

The UK construction market size was valued at $467.8 billion in 2022. The market is expected to achieve an AAGR of more than 2% during 2024-27. The construction industry in the UK is expected to grow between 2024 and 2027, supported by investments in transport, energy, housing, health, education, and telecommunication infrastructure projects. The residential construction sector led the market in 2022 driven by the government investment in affordable housing projects, coupled with investments to improve energy efficiency in residential buildings.

UK Construction Market Outlook, 2022-2027 ($ Billion)

For more insights on the UK construction market, download a free report sample

Report 1: France Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast

Report 2: Germany Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast

Report 3: Russia Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast

Report 4: Turkey Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast

Report 5: United Kingdom (UK) Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast

Table of Contents

Frequently asked questions

-

Report 1: France Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast

-

What was the France construction market size in 2022?

The construction market in France was valued at $367.7 billion in 2022.

-

Report 2: Germany Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast

-

What was the Germany construction market size in 2022?

The construction market in Germany was valued at $493.3 billion in 2022.

-

Report 3: Russia Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast

-

What was the Russia construction market size in 2022?

The construction market in Russia was valued at $237.6 billion in 2022.

-

Report 4: Turkey Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast

-

What was the Turkey construction market size in 2022?

The construction market in Turkey was valued at $103.9 million in 2022.

-

Report 5: United Kingdom (UK) Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast

-

What was the UK construction market size in 2022?

The construction market in the UK was valued at $467.8 billion in 2022.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.