Finland General Insurance Market Size and Trends by Line of Business, Distribution, Competitive Landscape and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Finland General Insurance Market Report Overview

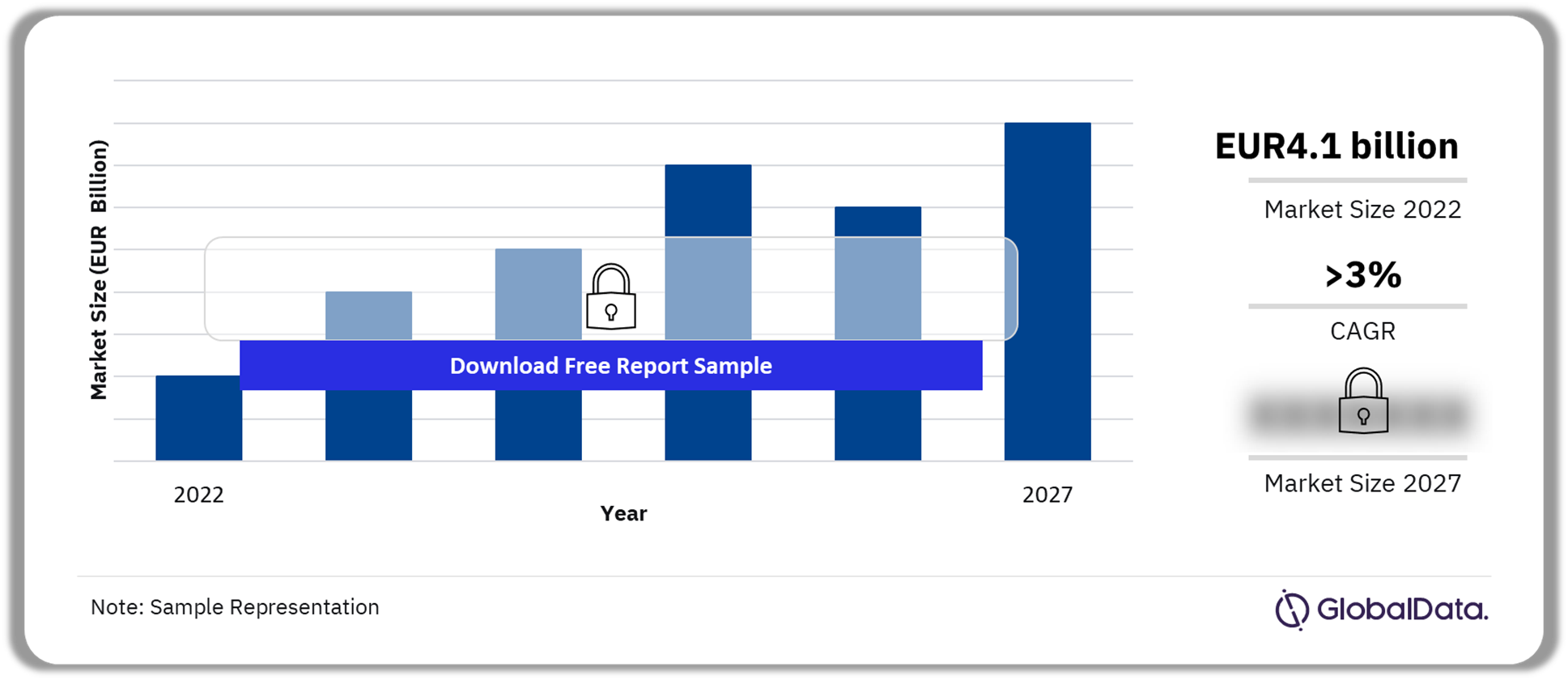

The gross written premium of the Finland general insurance market was EUR4.1 billion ($362.8 million) in 2022. The market is expected to achieve a CAGR of more than 3% during 2023-2027. The Finland General Insurance market research report provides an in-depth analysis of various product categories in the Finnish GI market. The report gives an overview of the country’s economic outlook and the general insurance regulatory and compliance framework. In addition, the report covers the emerging trends in the market segments, key performance indicators, and growth prospects for the Finland GI industry for the forecast period.

Finland General Insurance Market Outlook, 2022-2027 (EUR Billion)

Buy the Full Report to Gain More Information about Finland’s General Insurance Market Forecast

Download a Free Report Sample

The report also gives an insight into the distribution channels, the key players, and the competitive landscape in the Finland GI market.

| Market Size (2022) | EUR4.1 billion ($362.8 million) |

| CAGR (2023-2027) | >3% |

| Forecast Period | 2023-2027 |

| Historical Period | 2018-2022 |

| Key Trends | • Pet Insurance

• ESG • Electric Vehicles (EVs) • Smart Home and Telematics • Digital Initiatives |

| Key Lines of Business | • Motor

• Property • Liability • Non-Life PA&H • Financial Lines • MAT |

| Key Distribution Channels | • Direct from Insurer

• Online Aggregator • Bank • Insurance Broker • Financial Advisor |

| Leading Companies | • Pohjola Vakuutus Oy

• Keskinainen Vakuutusyhtio Fennia • LahiTapiola Paakaupunkiseutu Keskinainen • Keskinainen Vakuutusyhtio Turva • Pohjantahti Keskinainen Vakuutusyhtio |

| Enquire &Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Finland General Insurance Market Trends

Some of the trends that will shape the Finland general insurance market during the projected period are the growing popularity of pet insurance, the rise in connected devices due to smart homes, and telematics, surging demand for EVs, and increasing digital initiatives in the insurance industry.

Digital Initiatives: Finland’s insurance industry ranks among the top globally in terms of insurtech innovation. Insurers and other industry stakeholders have implemented insurtech in the insurance value chain to improve product innovation, competitiveness, and the overall process. Fennia and Nordea are examples of insurers that provide online support to customers in selecting their preferred insurance package, along with AI-enabled chatbots for customer service. Wellmo is an insurtech startup that provides mobile platforms based on cloud services for insurers. Meanwhile, Vakuutuslaskuri is a subsidiary of the insurtech startup Little Buck. It uses AI to assist customers in comparing the best policies as per their specifications.

Buy the Full Report for Additional Insights on the Key Finland General Insurance Market Trends,

Download a Free Sample Report

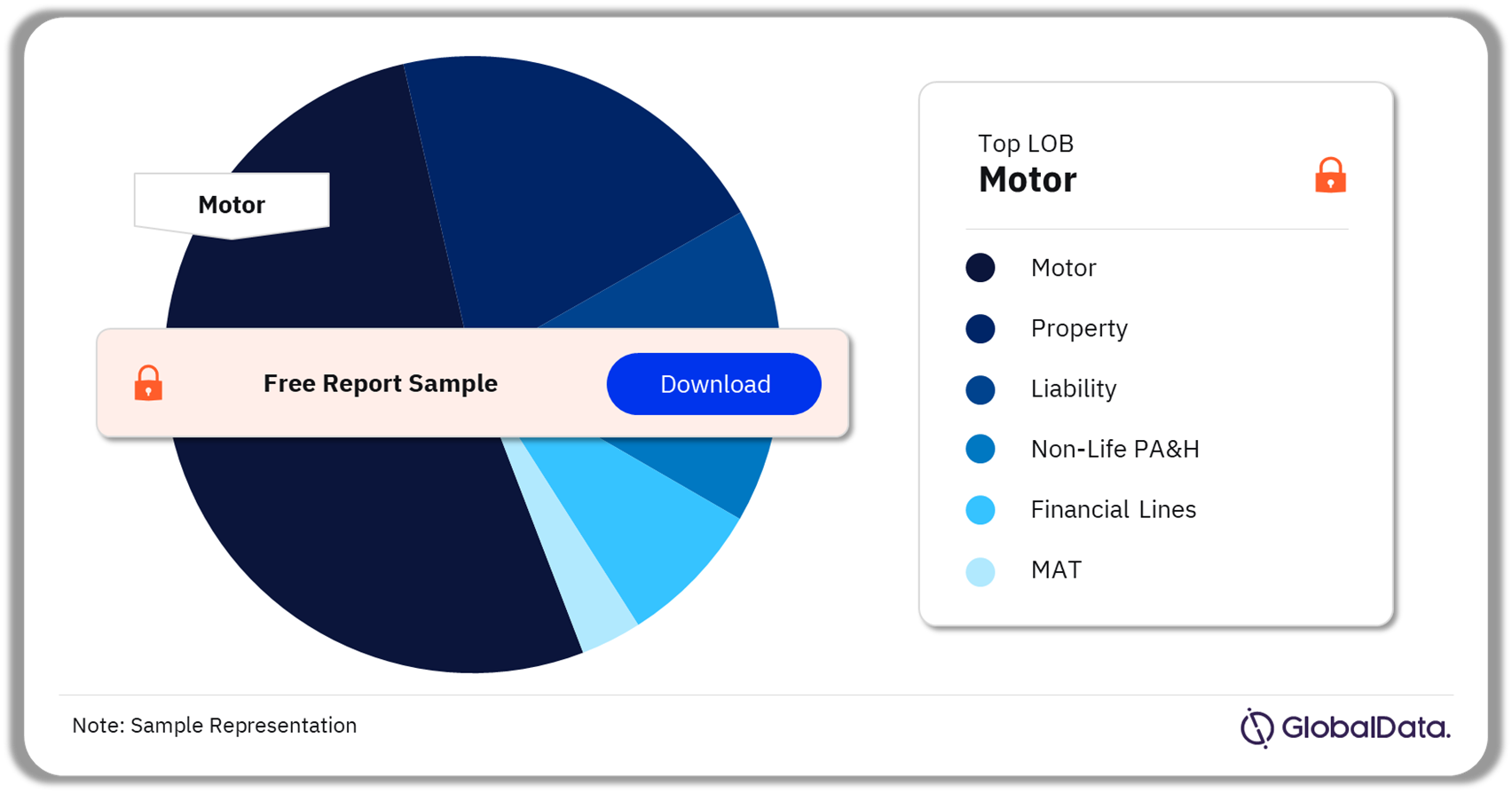

Finland General Insurance Market Segmentation by Lines of Business

The key lines of business in the Finland general insurance market are motor, property, liability, non-life PA&H, financial lines, and MAT. Motor insurance was the leading LoB accounting for the highest Finland general insurance market share in 2022, followed by property, and liability. Increasing use of new technologies such as the Internet of Things (IoT) and telematics will improve the profitability of motor insurance over 2023–27. Concurrently, Finnish property insurance will grow in the coming years as Finland is vulnerable to natural hazards, such as floods, snowstorms, and windstorms.

Finland General Insurance Market Analysis by Lines of Business, 2022 (%)

Buy the Full Report for More Lines of Business Insights into Finland’s General Insurance Market Download a Free Report Sample

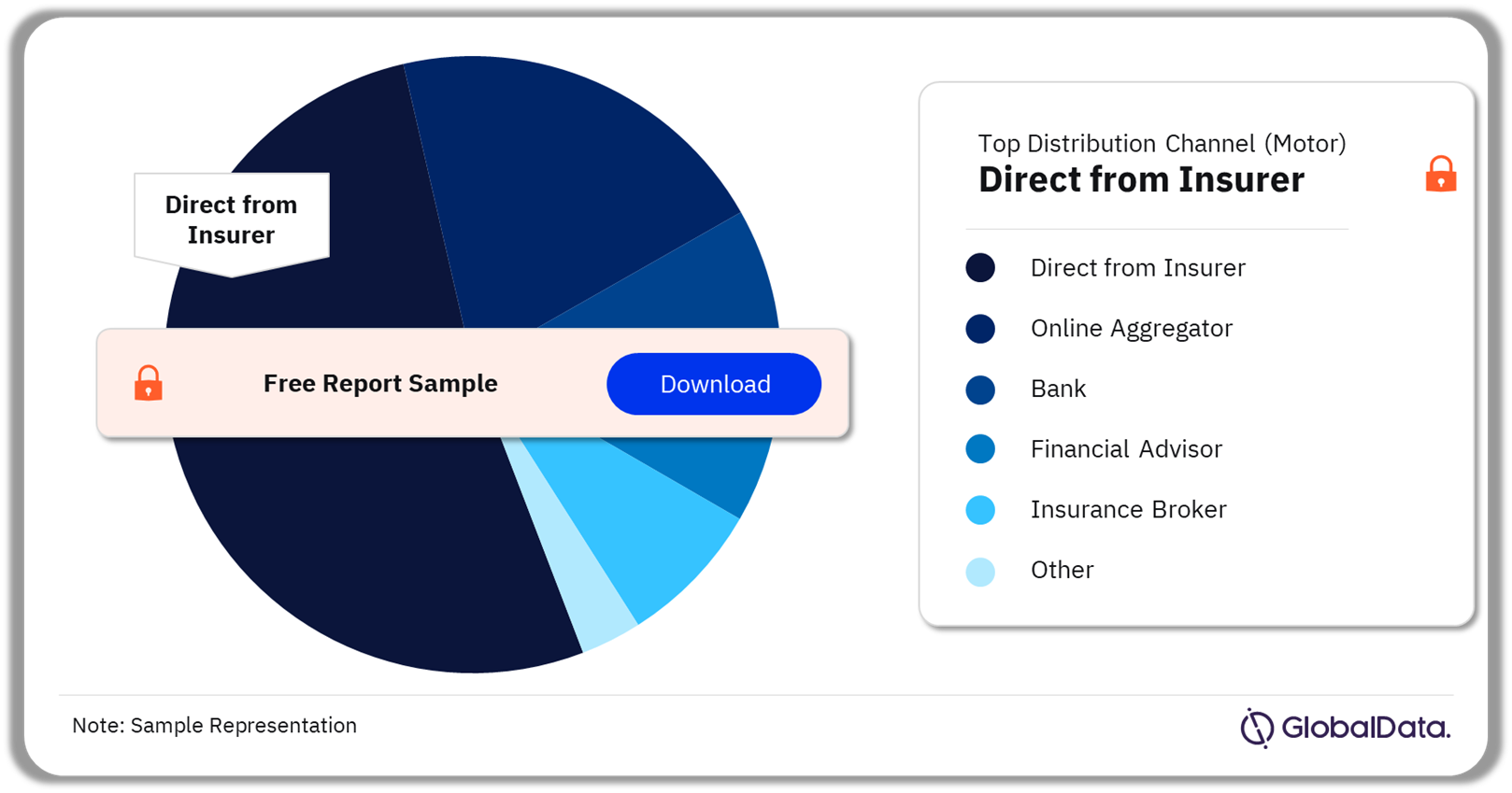

Finland General Insurance Market Segmentation by Distribution Channels

The key distribution channels in the Finland general insurance market are direct from insurers, online aggregators, banks, insurance brokers, and financial advisors among others. Direct from insurer was the leading distribution channel for consumers in the country who preferred to purchase motor insurance and home building insurance.

Finland Motor General Insurance Market Analysis by Distribution Channels, 2023 (%)

Buy Full Report for More Distribution Channel Insights into Finland’s General Insurance Market

Download a Free Report Sample

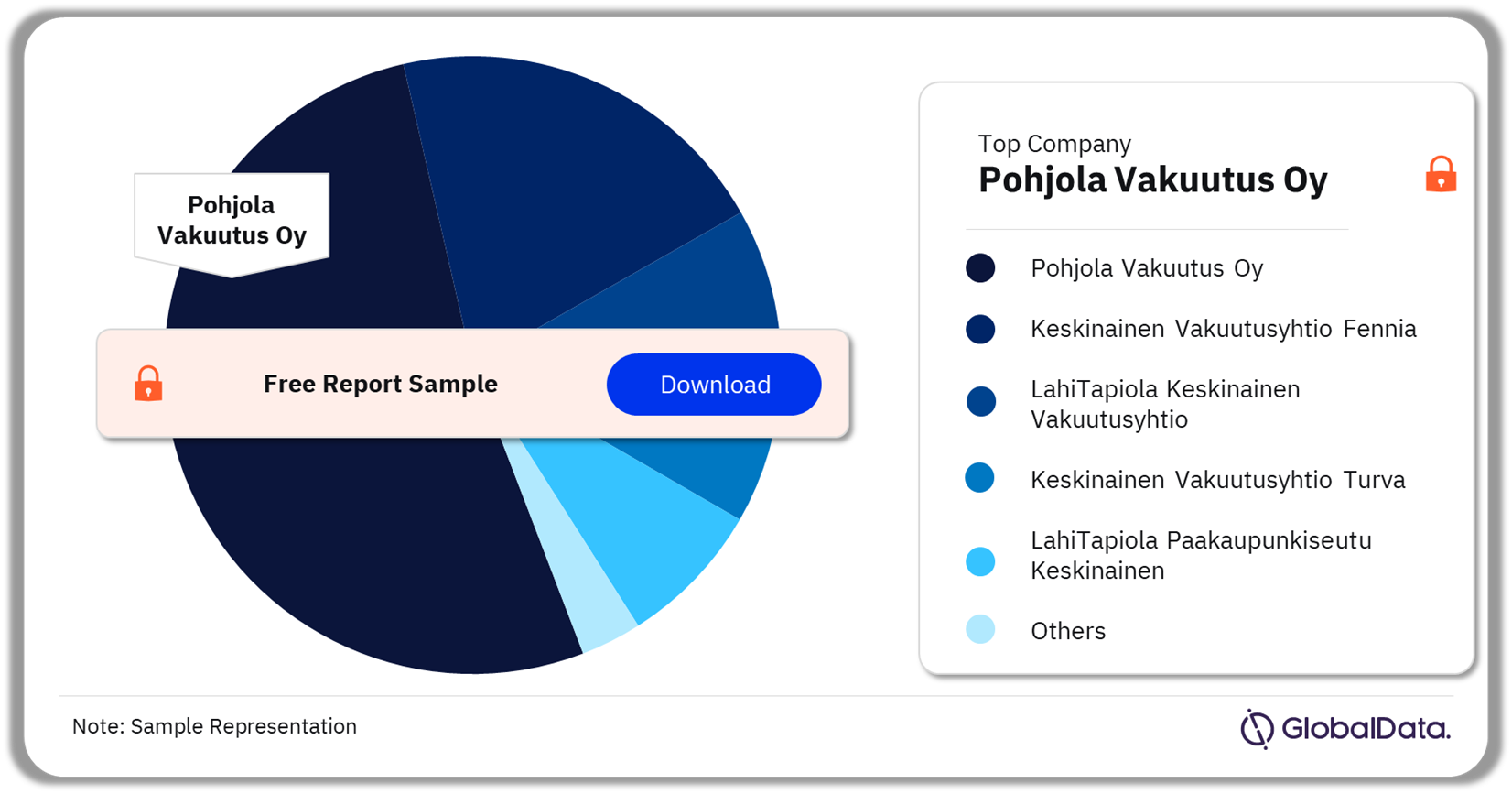

Finland General Insurance Market - Competitive Landscape

The general insurance sector was concentrated in 2022, with domestic financial groups dominating the competitive landscape with their multiple subsidiaries. The key insurers in the Finland general insurance market are Pohjola Vakuutus Oy, Keskinainen Vakuutusyhtio Fennia, LahiTapiola Keskinainen Vakuutusyhtio, Keskinainen Vakuutusyhtio Turva, and LahiTapiola Paakaupunkiseutu Keskinainen among others. Pohjola Vakuutus Oy held the largest share in 2022. It was followed by Keskinainen Vakuutusyhtio Fennia and LahiTapiola Keskinainen Vakuutusyhtio.

Pohjola Vakuutus Oy is part of the domestic financial group OP in Finland. In January 2023, OP created an independent model for assessing its AI, to tackle the lack of transparency within it. The model will help OP to improve transparency, along with the governance of its AI. In March 2022, OP introduced Google Pay as a payment method for buying insurance; thereby expanding the range of payment options available to its customers.

Finland General Insurance Market Analysis, by Companies, 2022 (%)

Buy the Full Report to learn more about the Companies in the Finland General Insurance Market

Download a Free Report Sample

Segments Covered in the Report

Finland General Insurance Market Lines of Business Outlook (Value, EUR Billion, 2018-2027)

- Motor

- Property

- Liability

- Non-Life PA&H

- Financial Lines

- MAT

Finland General Insurance Distribution Channel Outlook (Value, EUR Billion, 2018-2027)

- Insurance Broker

- Direct From Insurer

- Bank

- Financial Advisor

- Online Aggregators

Scope

This report provides:

- A comprehensive analysis of the general insurance segment in Finland.

- Historical values for the Finland general insurance segment for the report’s review period and projected figures for the forecast period.

- Profiles of the top general insurance companies in Finland and outlines the key regulations affecting them.

Key Highlights

- Key insights and dynamics of Finland’s general insurance segment.

- A comprehensive overview of Finland’s economy, government initiatives, and investment opportunities.

- Finland’s insurance regulatory framework’s evolution, key facts, taxation regime, licensing, and capital requirements.

- Finland’s general insurance industry’s market structure gives details of lines of business.

- Finland’s general reinsurance business market structure gives details of premium ceded along with cession rates.

- Distribution channels deployed by Finland’s general insurers.

- Details of the competitive landscape and competitors’ profiles.

Reasons to Buy

- Make strategic business decisions using in-depth historical and forecast market data related to Finland’s general insurance segment.

- Understand the demand-side dynamics, key market trends, and growth opportunities in Finland’s general insurance segment.

- Assess the competitive dynamics in the general insurance segment.

- Identify growth opportunities and market dynamics in key product categories.

Keskinainen Vakuutusyhtio Fennia

LahiTapiola Keskinainen Vakuutusyhtio

Keskinainen Vakuutusyhtio Turva

Pohjantahti Keskinainen Vakuutusyhtio

Forsakringsaktiebolaget Alandia

LahiTapiola Paakaupunkiseutu Keskinainen Vakuutusyhtio

LahiTapiola Vellamo Keskinainen Vakuutusyhtio

Table of Contents

Frequently asked questions

-

What was the Finland general insurance market gross written premium in 2022?

The gross written premium of Finland general insurance market was EUR4.1 billion ($362.8 million) in 2022.

-

What is the Finland general insurance market growth rate?

The general insurance market in Finland is expected to achieve a CAGR of more than 3% during 2023-2027.

-

Which line of business held the largest share of the Finland general insurance market?

Motor was the leading general insurance line of business in the Finland general insurance market in 2022.

-

Which are the key companies operating in the Finland general insurance market?

The leading companies in Finland are Pohjola Vakuutus Oy, Keskinainen Vakuutusyhtio Fennia, LahiTapiola Keskinainen Vakuutusyhtio, Keskinainen Vakuutusyhtio Turva, and LahiTapiola Paakaupunkiseutu Keskinainen among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Non-Life Insurance reports