Finland Fuel Cards Market Size, Share, Key Players, Competitor Card Analysis and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Finland Fuel Cards Market Report Overview

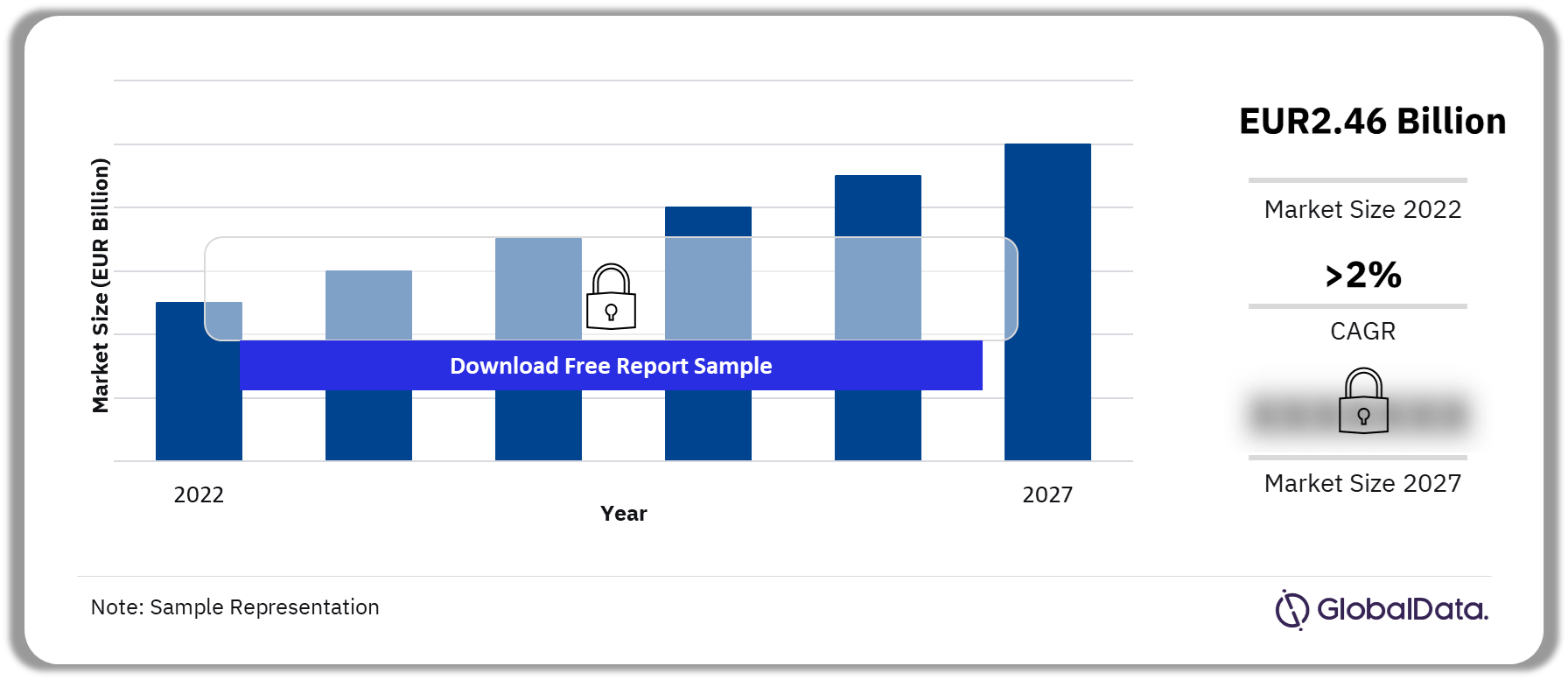

The Finland fuel cards market value was EUR2.46 billion in 2022. The market is expected to register a CAGR of more than 2% during the period 2023-2027. The main factors behind the growth will be rising fuel prices and growing volumes of fuel sold through fuel cards.

Finland Fuel Cards Market Outlook 2022-2027 (EUR Billion)

Buy Full Report for More Insights into the Finland Fuel Cards Market Forecast

The Finland fuel cards market research report provides invaluable comprehensive data insights for issuers of fleet cards, fuel retailers, fleet leasing companies, and other suppliers to the sector. The report also provides commercial (B2B) fuel card volume (split by fleet and CRT), value and market share forecasts for 2027, and key data on independent and oil company card issuers. It analyzes fuel card competition in Finland.

| Market Size (2022) | EUR2.46 Billion |

| CAGR (2023-2027) | >2% |

| Historical Period | 2015-2022 |

| Forecast Period | 2023-2027 |

| Key Channels | · CRT Cards

· Fleet Cards |

| Leading Fuel Card Operators | · Neste

· Shell · St1 · Teboil · ABC |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Finland Fuel Cards Market Trends

The rising demand for electric vehicles is one of the key trends shaping the Finland fuel cards market. Over the next five years, the number of EVs in Northern Europe will increase dramatically owing to domestic fleets investment in EVs to reduce transport costs. This will also assist them in competing against low-cost Eastern competitors.

The Northern European countries’ governments are planning to ban the sale of fossil fuel vehicles from as early as 2025. As a result, commercial transport companies will be forced to invest in electric vehicles over the next 10 years. Falling electric vehicle prices, government incentives, and expanding recharge networks across Northern Europe will make electric vehicles a feasible option for commercial use moving towards 2027. Thus, operators need to invest in services for this new vehicle type to compete with forward-thinking competitors.

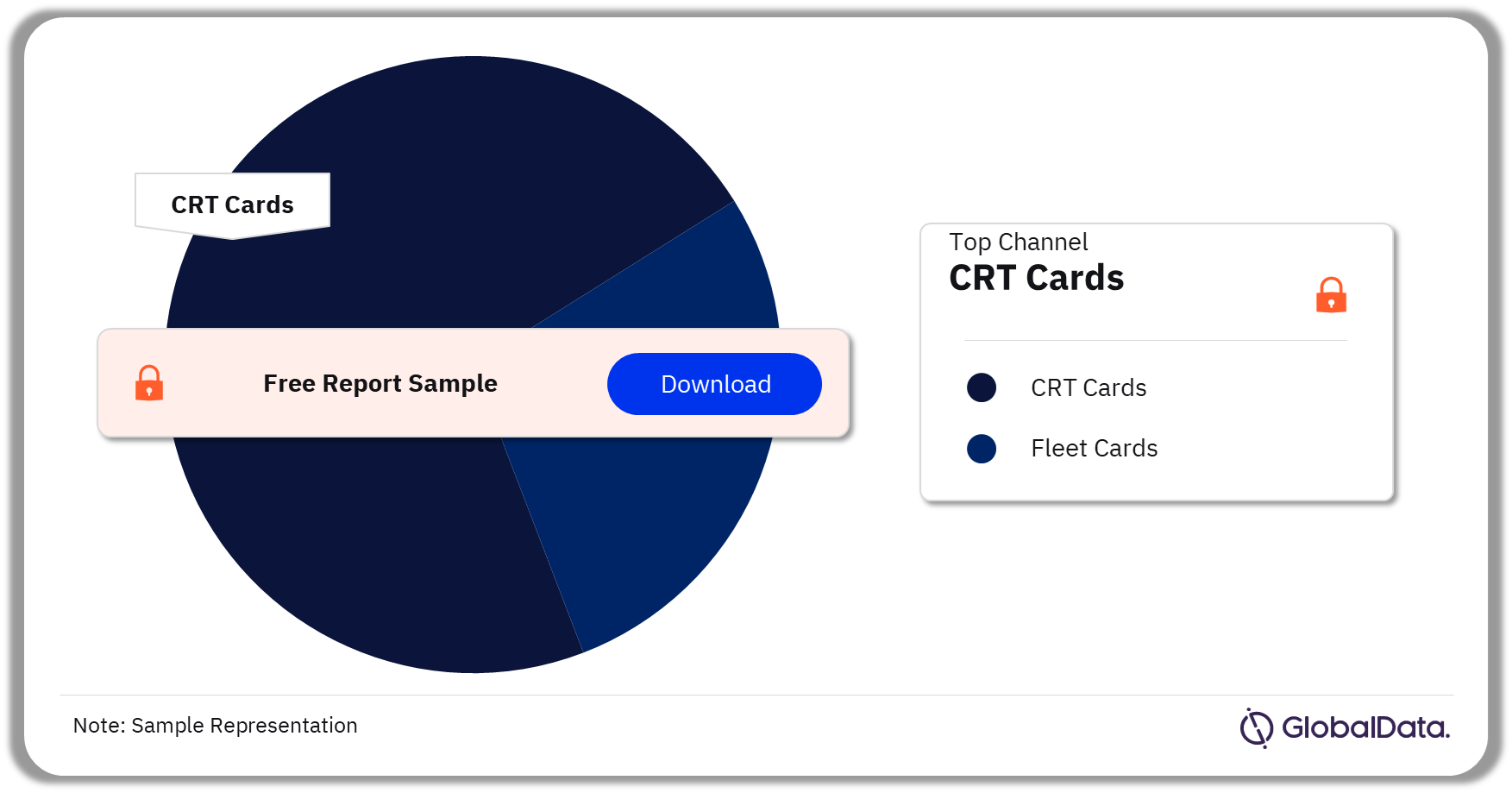

Finland Fuel Cards Market Segmentation by Channels

The key channels in the Finland fuel cards market are fleet cards and CRT cards. CRT card channels led the market in 2022. Due to international and domestic trade, CRT vehicles remained busier as they were involved in transporting essential supplies. Many international transport and logistics companies use the additional services offered by fuel card operators. However, there is immense competition in the CRT card market in Finland, with many card operators offering similar services. Thus, fuel card operators should appeal to drivers as well as fleet managers, to ensure that their card is preferred over that of their competitors.

Finland Fuel Cards Market Analysis by Channels, 2022 (%)

Buy the Full Report for More Insights on Channels in the Finland Fuel Cards Market

Finland Fuel Cards Market – Competitive Landscape

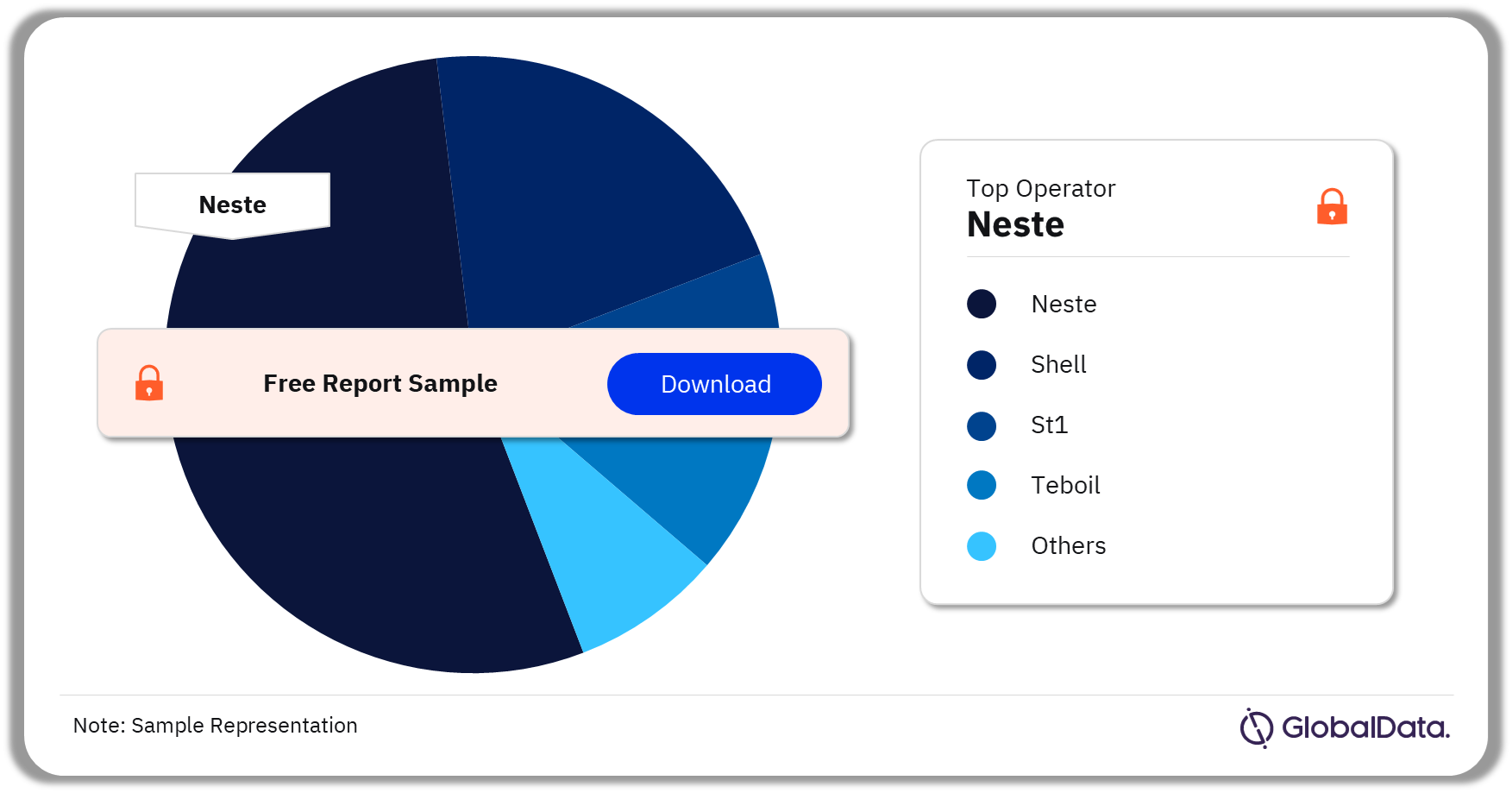

Some of the leading fuel card operators in Finland are:

- Neste

- Shell

- St1

- Teboil

- ABC

In 2022, Neste led the market leader in Finland. Its market share increased owing to its large site acceptance network that appealed to domestic and foreign CRT vehicle companies.

Finland Fuel Cards Market Analysis by Fuel Card Operators, 2022 (%)

Buy the Full Report for More Insights on Companies in the Finland Fuel Cards Market

Segments Covered Finland Fuel Cards Market Report

Finland Fuel Cards Channels Outlook (Value, EUR Billion, 2015-2027)

- Fleet card

- CRT card

Scope

Fuel Cards in Finland 2022 is invaluable for issuers of fleet cards, fuel retailers, fleet leasing companies, and other suppliers to the sector. Based on research with issuers and fuel retailers it provides commercial (B2B) fuel card volume (split by fleet and CRT), value and market share forecasts to 2027, key data on independent and oil company card issuers, and an analysis of fuel card competition in Finland.

Key Highlights

The total number of service stations in Finland declined by 2.7% from 2,204 in 2021 to 2,263 in 2022. More than 21,000 new fuel cards will be issued over 2023-27, resulting in a total of 753,342 cards in the market. Out of the total active cards in the market, 58.3% will be held by fleet vehicles and 41.7% by CRT vehicles. Fuel card volumes will rise by a CAGR of 0.9% over 2023-27, reaching 1.2 billion liters.

Reasons to Buy

Plan effective market entry strategies by uncovering current and future volumes and values of the Finnish fuel card market. Assess whether you should increase network acceptance of your card and identify potential new merchants by uncovering the position of competitors. Whether you are an issuer, a processor, a leasing company, or a fuel retailer, make informed pitches to partners by understanding their business. Enhance fuel sales at your service stations by identifying which fuel cards you should accept based on their market shares and network acceptance. Plan your regional strategy by understanding the Northern European markets, Finland, Denmark, Sweden, and Norway.

Teboil

ABC

St1

Shell

UTA

DKV

SEO

Table of Contents

Frequently asked questions

-

What was the Finland fuel cards market size in 2022?

The fuel card market size in Finland was valued at EUR2.46 billion in 2022.

-

What is the market growth rate of the Finland fuel card market?

The Finland fuel cards market is expected to register a CAGR of more than 2% during the period 2023-2027.

-

Which channel led the Finland fuel cards market?

CRT cards channel led the Finland fuel cards market in 2022.

-

Which are the leading fuel card operators in Finland fuel cards market?

Some of the leading fuel card operators in Finland are Neste, Shell, St1, Teboil, ABC, and others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.