Duty-Free Retail Market Trends and Analysis by Region, Sector, Tourism Landscape, Retail Innovations, Key Players and Forecast to 2026

Powered by ![]()

Access in-depth insight and stay ahead of the market

Access and explore the following trends, opportunities, and market analysis in our ‘Duty-Free Retailing Market’ report:

- Analyze the global duty-free retailing market by region (Americas, APAC, Europe, and MEA) and country.

- Identify the key drivers and trends impacting the market.

- Detailed data on duty-free sales across major countries by sector (cosmetics and toiletries, drinks, jewelry and watches, food, tobacco, accessories, womenswear, communications equipment, menswear, printed media, and others).

- Explores the tourism and competitive landscape and highlights the key innovations in the duty-free retail market.

- In-depth analysis of key duty-free retailers such as Lotte Duty Free, Shinsegae DF, Dufry, DFS, Dubai Duty Free, and King Power.

How is the ‘Duty-Free Retailing Market’ report different from other reports in the market?

- Gain a comprehensive knowledge of global duty-free market and develop a competitive advantage.

- Investigate current trends in the global duty-free market to identify the best opportunities to exploit.

- Analysis of key duty-free players operating globally.

- Explore novel opportunities that will allow you to align your product offerings and strategies to meet demand by analyzing the key consumer and technology trends influencing the duty-free market globally.

- Analyze the recommended actions to align your marketing strategies with the crucial trends influencing consumer behavior.

- Analysis of key international players operating in the global duty-free retail market – including store counts and revenues that give you a competitive edge and identify opportunities to improve your market share.

We recommend this valuable source of information to anyone involved in:

- Startups/Suppliers/White-label manufacturers

- Cosmetics and Toiletries Companies

- Luxury Store Suppliers/Retailers

- Strategy/Innovation and Business Development

- Market Intelligence and Portfolio Managers

- Government Agencies/Health Associations

To get a snapshot of the duty-free retailing market report, download a free report sample

Duty Free Retailing Market Overview

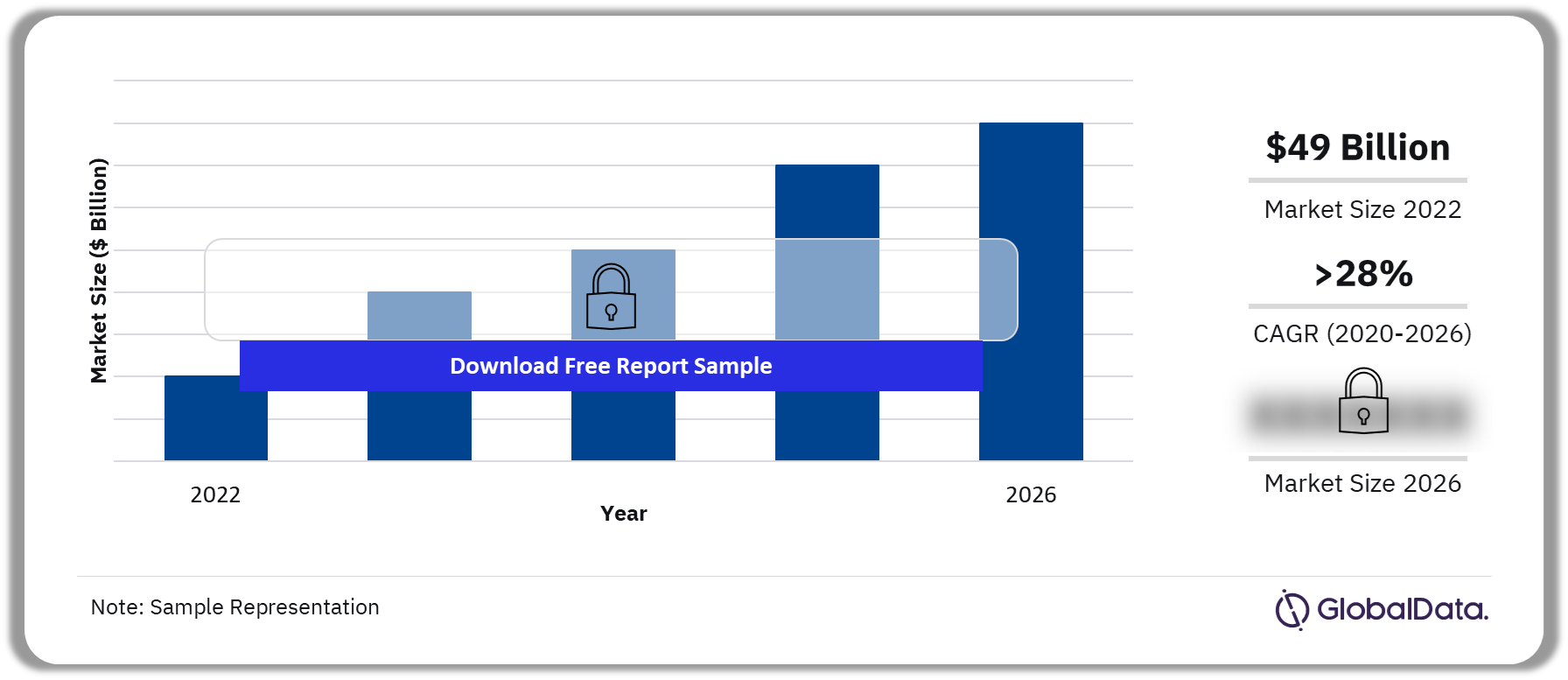

The duty-free retailing market size was $49.0 billion in 2022. The market will grow at a CAGR of more than 28% during the period 2020-2026. Government initiatives, rising passenger numbers, major global events (for instance global sporting tournaments), and the renewed popularity of cruise trips will drive the growth of the duty-free retailing market. Infrastructure investments will also play an important role, particularly airport expansion and space refurbishment, and investments in arrivals duty-free formats. However, growth will be held in check in the years ahead by the permanent erosion of disposable income from the heightened cost of living impacting demand for air travel.

Duty-Free Retailing Market Outlook (2022-2026)

Buy the Full Report for More Insights into the Duty-Free Retailing Market, Download Free Report Sample

The global duty-free retailing market research report provides an overview of global duty-free retailing which includes Market & Category Expenditure and Forecasts, Trends, and Competitive Landscape.

| Market size (Year – 2022) | $49.0 billion |

| CAGR (2020-2026) | >28% |

| Historical Period | 2016-2022 |

| Forecast Period | 2023-2026 |

| Key sectors | · Cosmetics and Toiletries

· Drinks · Jewelry and Watches · Food · Tobacco · Accessories · Womenswear · Communications Equipment · Menswear · Printed Media · Others |

| Key Regions | · Asia-Pacific

· Americas · Europe · MEA |

| Key Retailers | · Lotte Duty Free

· Shinsegae DF · DUFRY · DFS · Dubai Duty Free · King Power · Duty Free Americas · Heinemann · James Richardson · Travel Retail Norway |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Duty-Free Retailing Market Drivers

Luxury goods, digital advances, and personalization are a few of the key drivers of the duty-free retail market. Digital innovation in bricks & mortar stores and omnichannel capabilities in airports are being introduced to enhance customers’ shopping experiences, reduce crowding, and strengthen communication with customers.

Additionally, tapping into the growth for luxury goods will be a key sales driver for duty-free retailers over the forecast period. A major part of this expansion will come from duty-free retail as shoppers respond positively to the growing presence of luxury brands in international airports.

Duty-Free Retailing Market Trends

A few of the duty-free retailing market trends are:

- Changing consumer tastes and preferences are influencing duty-free retailers to change their offerings.

- Low- and no-alcohol categories will gain momentum in duty-free liquor sales, especially after the pandemic, as consumers around the world are more health-conscious.

- Players in the travel industry, such as hotels, restaurants, and tour operators, are embracing this trend by offering more alcohol-free beverages.

- In line with this trend, low- and no-alcohol categories will make up a higher proportion of offerings in duty-free liquor stores in the coming years.

- Furthermore, duty-free retail brands are focusing on bringing more sustainability into their ecosystems.

Duty-Free Retailing Market Segmentation by Sectors

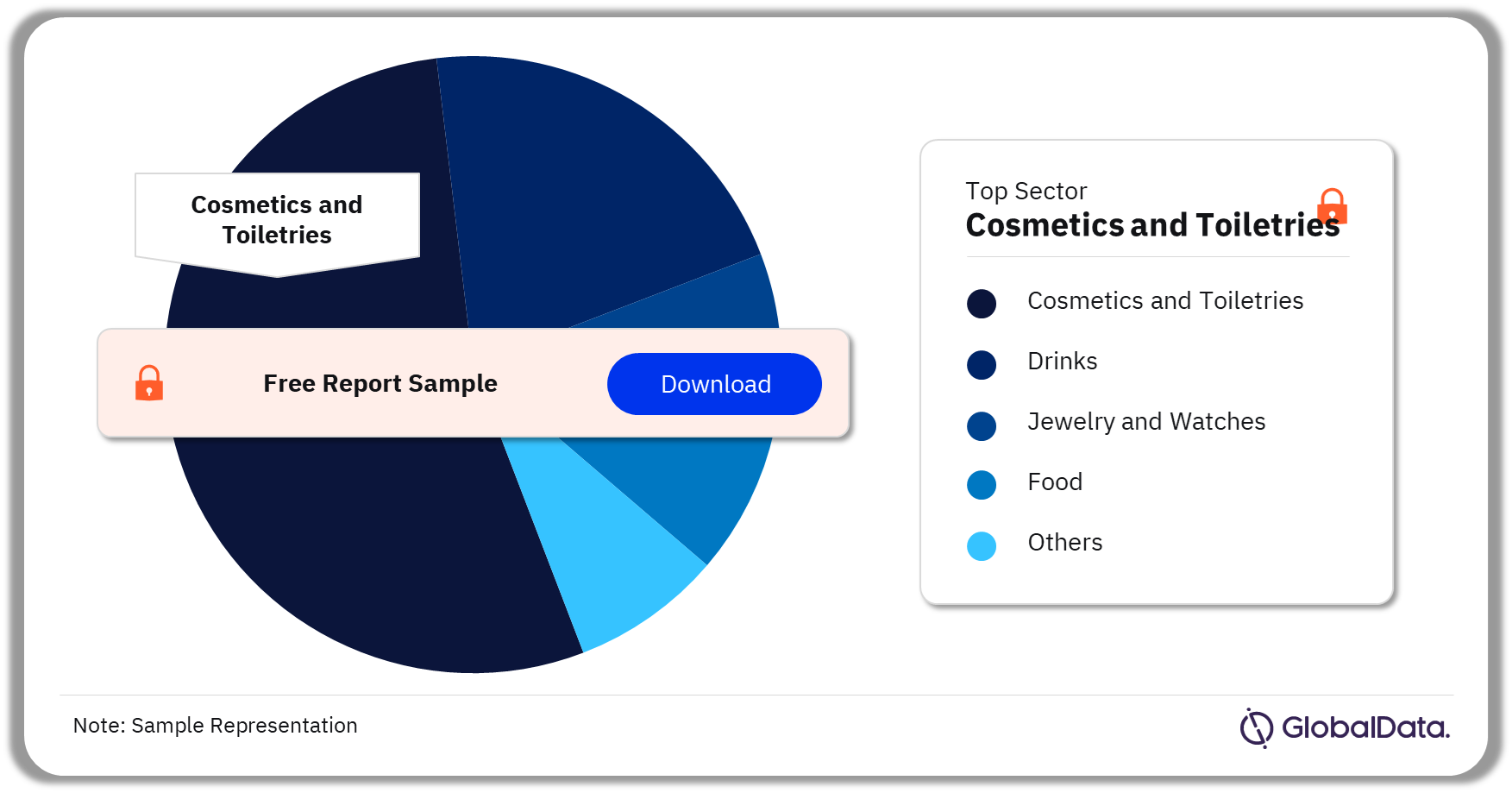

Cosmetics and toiletries had the highest share in the duty-free retailing market in 2021

The key sectors in the duty-free retailing market are cosmetics and toiletries, drinks, jewelry and watches, food, tobacco, accessories, womenswear, communications equipment, menswear, printed media, and others.

Duty-Free Retailing Market Sector Analysis 2021 (%)

Buy the Full Report for More Sector Insights into the Duty-Free Retailing Market, Download Free Report Sample

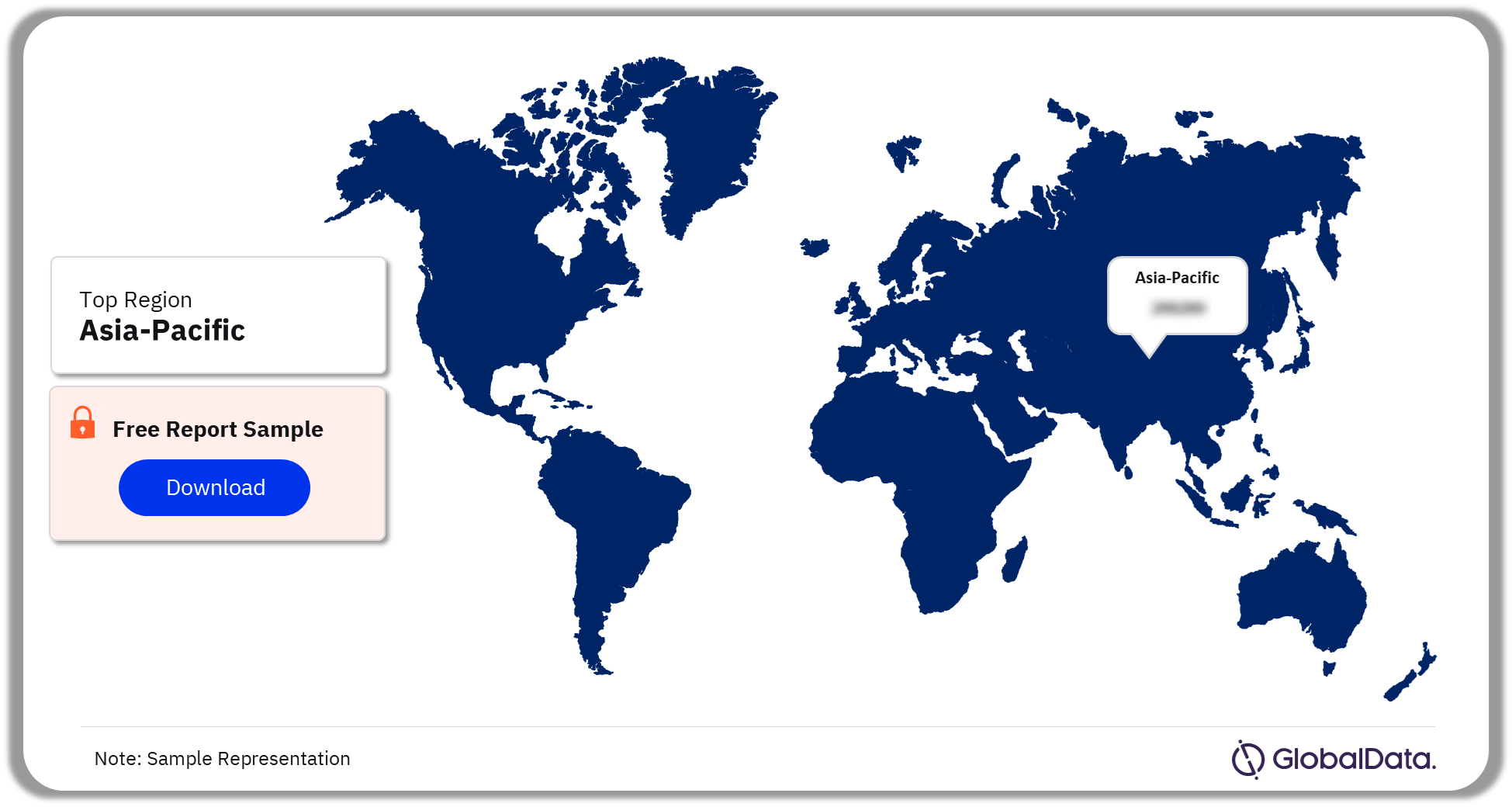

Duty-Free Retailing Market Segmentation by Regions

APAC had the highest share in the duty-free retailing market in2022

Americas, APAC, Europe, MEA, and others are the key regions in the duty-free retailing market.

Asia Pacific: APAC market is expected to grow as key players extend their operations in the region. An increase in the number of will underpin this growth. Improving performances of economies such as India after the pandemic, resuming business travel in the region, and continued investment in airport infrastructure will support a rise in passenger numbers and duty-free channel growth. In the APAC region, there has been a big increase in the sale of cosmetics and perfumes.

Duty-Free Retailing Market Regional Analysis, 2021 (%)

Buy the Full Report for More Regional Insights into the Duty-Free Retailing Market, Download Free Report Sample

Duty-Free Retailing Market Segmentation by Retailers

Lotte Duty Free had the largest market share in 2020.

The key retailers in the duty-free retailing market are:

- Lotte Duty Free

- Shinsegae DF

- DUFRY

- DFS

- Dubai Duty Free

- Others

Duty-Free Retailing Market Retailer Analysis, 2021 (%)

Buy the Full Report for More Competitor Insights into the Duty-Free Retailing Market, Download Free Report Sample

Segments Covered in the Report

Duty-Free Retailing Market Outlook by Region (Value, $ Billion, 2016-2026)

- APAC

- Europe

- MEA

- Americas

Duty-Free Retailing Market Outlook by Sectors (Value, $ Billion, 2016-2026)

- Cosmetics and Toiletries

- Drinks

- Jewelry and Watches

- Food

- Tobacco

- Accessories

- Womenswear

- Communications Equipment

- Menswear

- Printed Media

Key Players

Lotte Duty FreeShinsegae DF

DUFRY

DFS

Dubai Duty Free

King Power

Duty Free Americas

Heinemann

James Richardson

Travel Retail Norway

Table of Contents

Frequently asked questions

-

What was the duty-free retailing market size in 2022?

The duty-free retailing market size was valued at $49.0 billion in 2022.

-

What is the growth rate of the duty-free retailing market?

The duty-free retailing market is projected to grow at a CAGR of more than 28% during the period 2020-2026.

-

Which is the leading sector in the duty-free retailing market?

Cosmetics and toiletries had the highest share in 2021 in the duty-free retailing market.

-

Who are the key retailers in the duty-free retailing market?

The key retailers in the duty-free retailing market are Lotte Duty Free, Shinsegae DF, DUFRY, DFS, Dubai Duty Free, King Power, Duty Free Americas, Heinemann, James Richardson, and Travel Retail Norway.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.