Mexico Foodservice Market Size and Trends by Profit and Cost Sector Channels, Players and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Mexico Foodservice Market Report Overview

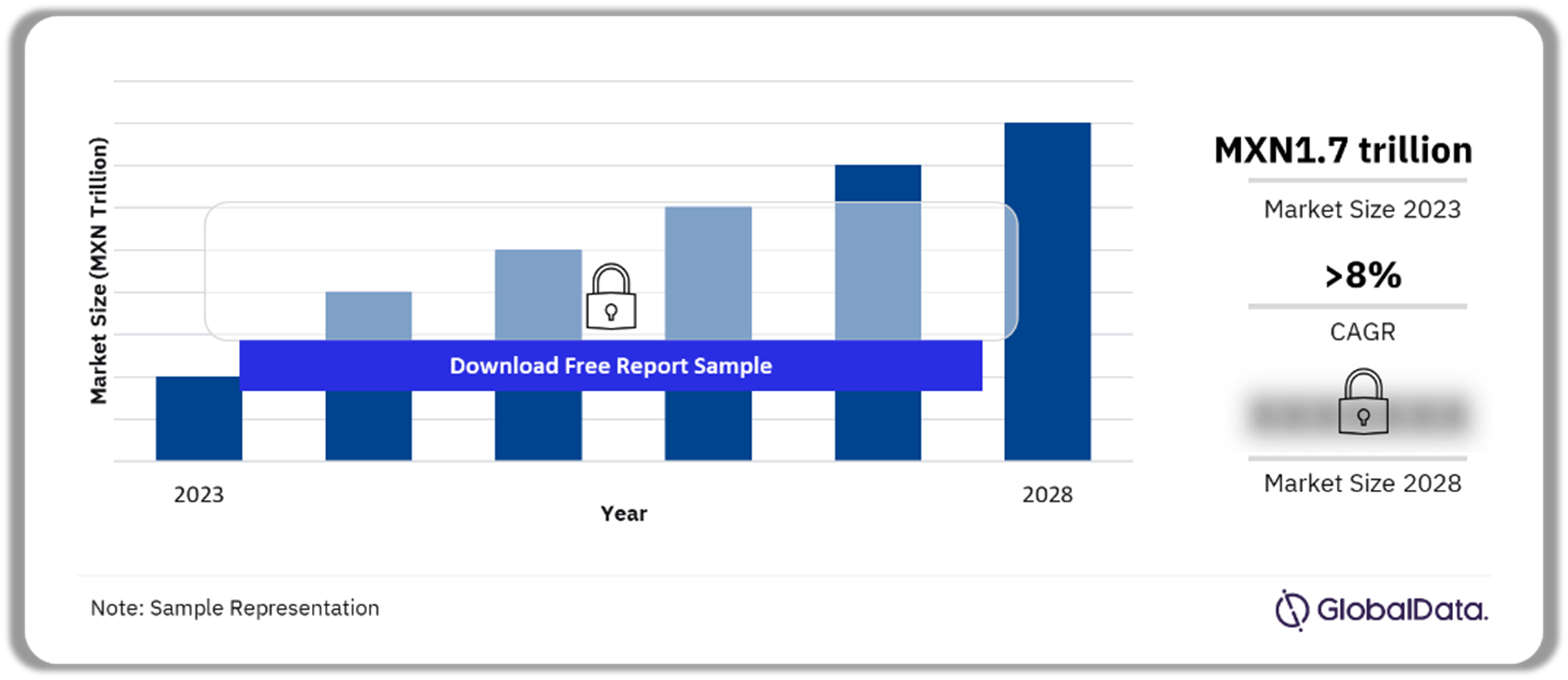

The Mexico foodservice profit sector recorded sales of MXN1.7 trillion ($84 billion) in 2023. The number of transactions decreased due to operational restrictions on restaurants and travel bans in 2020 and 2021 during the COVID-19 pandemic. However, in 2023, the number of international tourist arrivals gradually increased, driving the market growth positively. The Mexican foodservice market will register a relatively strong CAGR of over 8% for 2023-2028.

Mexico Foodservice Profit Sector Outlook 2023-2028, (MXN Trillion)

Buy the Full Report for More Insights on the Mexico Foodservice Market Forecast

Download A Free Sample Report

The Mexico foodservice market research report provides an in-depth evaluation of the foodservice market in the country, including an analysis of the key issues impacting the market, and the opportunities this presents for the sector participants. The report includes data and forecast of key channels (QSR, FSR, coffee & tea shop, and pub, club & bar) within the Mexico foodservice market and gives an overview of market leaders within the four major channels.

| Market Size (2023) | MXN1.7 trillion ($84 billion) |

| CAGR (2023-2028) | >8% |

| Historical Period | 2018-2023 |

| Forecast Period | 2023-2028 |

| Key Profit Sector Channels | · Quick-service Restaurant (QSR)

· Full-service Restaurant (FSR) · Workplace · Pub, Club & Bar · Accommodation |

| Key Outlet Type | · Dine-in

· Takeout |

| Key Owner Type | · Independent Operators

· Chain Operators |

| Key Cost Sector Channels | · Education

· Healthcare · Military & Civil Defense · Welfare & Services · Complimentary Services |

| Key Companies | · McDonald’s

· Yum! Brands · Little Caesars Pizza · Domino’s Pizza |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Mexico Foodservice Market Trends

- Value for money: Consumers remain highly price-conscious. Therefore, operators need to constantly innovate their menus and offer value-for-money options.

- Healthier Lifestyles: Rising health awareness among consumers is driving the need for healthy offerings. Therefore, operators must focus on including more nutritious food options.

Buy the Full Report for more Insights into the Mexico Foodservice Market Trends

Download A Free Sample Report

Mexico Foodservice Market Segmentation by Profit Sector Channels

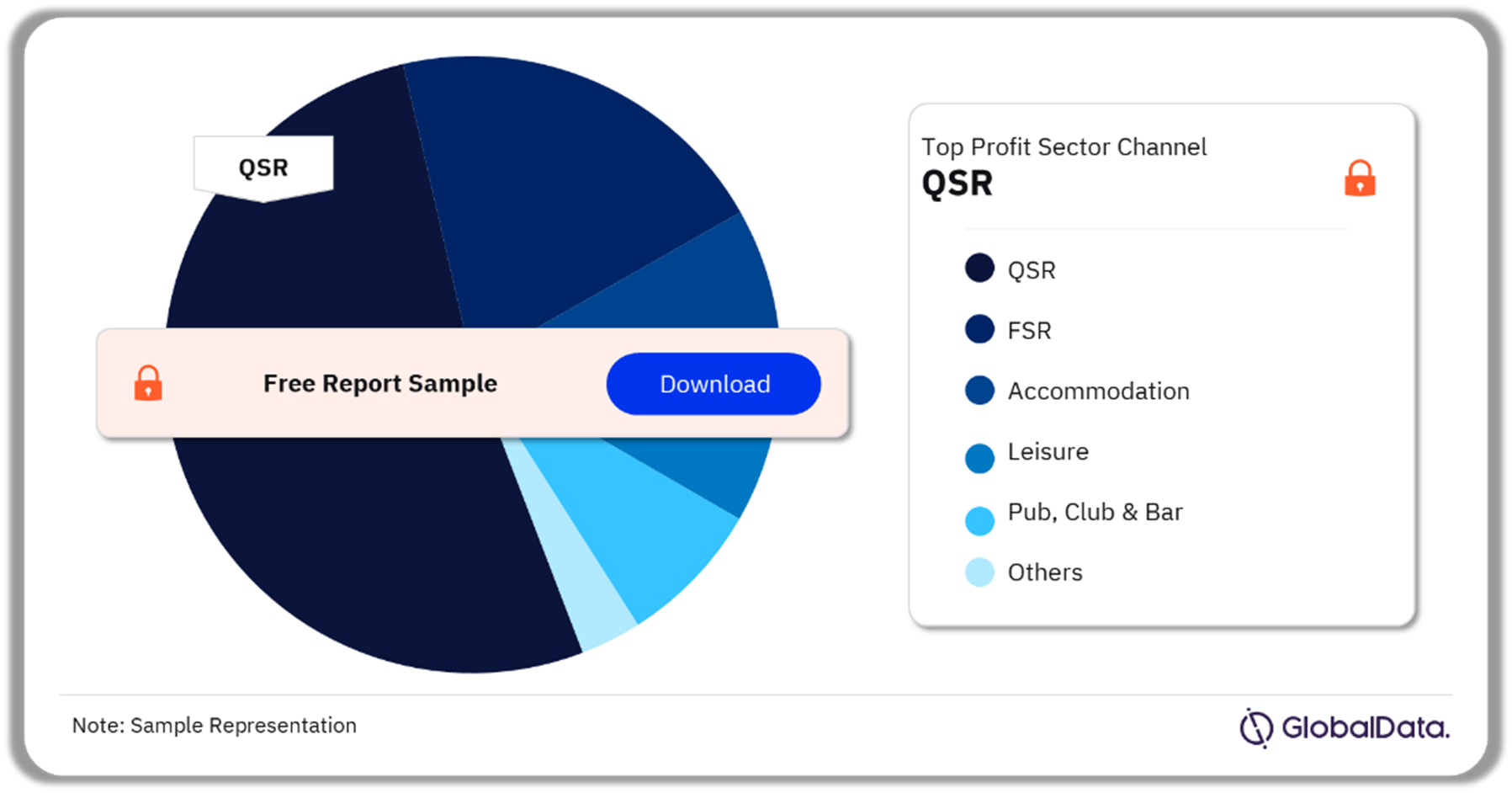

The QSR was the largest profit sector channel in 2023 by value sales

The key profit sector channels in the Mexican foodservice market are FSR; QSR; accommodation; leisure; pub, club & bar; and retail. The QSR channel was the leading profit sector channel, accounting for more than 30% of revenue share in 2023. Takeouts in the channel recorded a significant CAGR during 2018–23, as the demand for convenient and quick food options remained popular among consumers, especially during the pandemic. Key operators in the channel focused on improving their sales and generating consumer interest by launching new items.

Mexico Foodservice Market Analysis by Profit Sector Channels, 2023 (%)

Buy the Full Report for More Channel Insights into the Mexico Foodservice Market

Download A Free Sample Report

Mexico Foodservice Market Segmentation by Cost Sector Channels

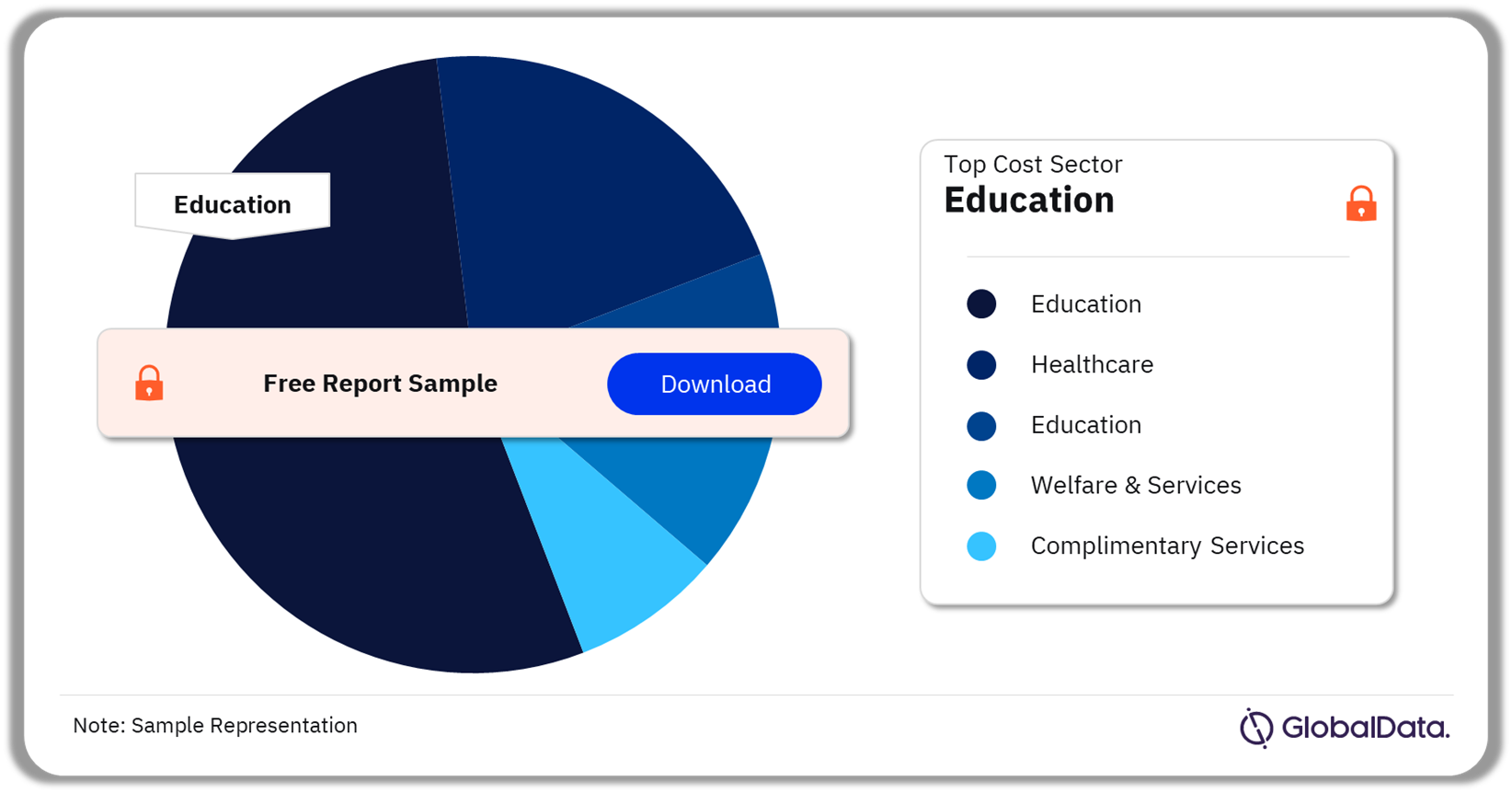

The key cost sector channels in the Mexico foodservice market are military & civil defense, healthcare, education, welfare & services, and complimentary services. In 2023, education was the largest cost sector, followed by healthcare, and military & civil defense.

Mexico Foodservice Market Analysis by Cost Sector Channels, 2023 (%)

Buy the Full Report for More Information on the Cost Sectors in the Mexico Foodservice Market

Download A Free Sample Report

Mexico Foodservice Market – Competitive Landscape

McDonald’s was the largest QSR operator in the country in 2023

The key foodservice companies in Mexico are:

- McDonald’s

- Yum! Brands

- Little Caesars Pizza

- Domino’s Pizza

In 2023, McDonald’s was the largest QSR operator in Mexico. McDonald’s Mexico features three categories in its menu which include competitively priced combo options such as McTrio 3×3; core options such as Big Mac, Quarter Pounder, and Happy Meals; and premium options such as the Signature collection and chicken burgers. The operator also runs discount offers on its combo meals to attract more customers.

Mexico Foodservice Market Analysis by Competitors, QSR (%)

Buy the Full Report for Additional Information on Mexico Foodservice Market Players

Download A Free Sample Report

Segments Covered in the Report

Mexico Foodservice Market Outlook by Profit Sector Channel (Value MXN Trillion, 2017-2028)

- Full-service Restaurants (FSR)

- Quick-service Restaurants (QSR)

- Pub, Club & Bar

- Retail

- Accommodation

Mexico Foodservice Market Outlook by Cost Sector Channels (Value, MXN Trillion, 2017-2028)

- Military & Civil Defense

- Healthcare

- Education

- Welfare & Services

- Complimentary Services

Scope

The report includes:

- Overview of Mexico’s macroeconomic landscape: Detailed analysis of current macroeconomic factors and their impact on the Mexico foodservice market, including GDP per capita, consumer price index, population growth, and annual household income distribution.

- Growth dynamics: In-depth data and forecasts of key channels (QSR; FSR; coffee & tea shop; and pub, club & bar) within the Mexico foodservice market, including the value of the market, number of transactions, number of outlets and average transaction price.

- Customer segmentation: Identify the most important demographic groups, buying habits, and motivating factors that drive out-of-home meal occasions among segments of the Mexico population.

- Key players: Overview of market leaders within the four major channels, including business descriptions and number of outlets.

Reasons to Buy

- Identify emerging/declining markets and understand specific forecasts of the foodservice market over the next five years to make informed business decisions.

- Understand the target audience and changing consumer behavior through a detailed analysis of the consumer segmentation, which elaborates on the desires of known consumers among all major foodservice channels (QSR; FSR; coffee & tea shop; and pub, club & bar).

Yum! Brands (KFC)

Little Caesar Enterprises

Domino’s Pizza

Alsea

Yum! Brands (Pizza Hut)

Grupo Gigante

and Brinker International

Starbucks

Krispy Kreme Doughnuts

Tim Hortons (Restaurant Brands International)

and The Italian Coffee Company

Café Punta del Cielo

Table of Contents

Frequently asked questions

-

What was the Mexico profit sector market size in 2023?

The Mexico profit sector market size was MXN1.7 trillion ($84 billion) in 2023.

-

What will the Mexico profit sector growth rate be during the forecast period?

The profit sector in Mexico will grow at a CAGR of over 8% during 2023-2028.

-

Which was the leading profit sector channel in the Mexican foodservice market in 2023?

QSR was the leading profit sector channel in the Mexican foodservice market in 2023.

-

What cost sector channel had the highest share in the Mexico foodservice market in 2023?

The education sector had the highest share in the Mexico foodservice market in 2023.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.