Confectionery Market Opportunities, Trends, Growth Analysis and Forecast to 2027

Powered by ![]()

Access in-depth insight and stay ahead of the market

Confectionery Market Overview

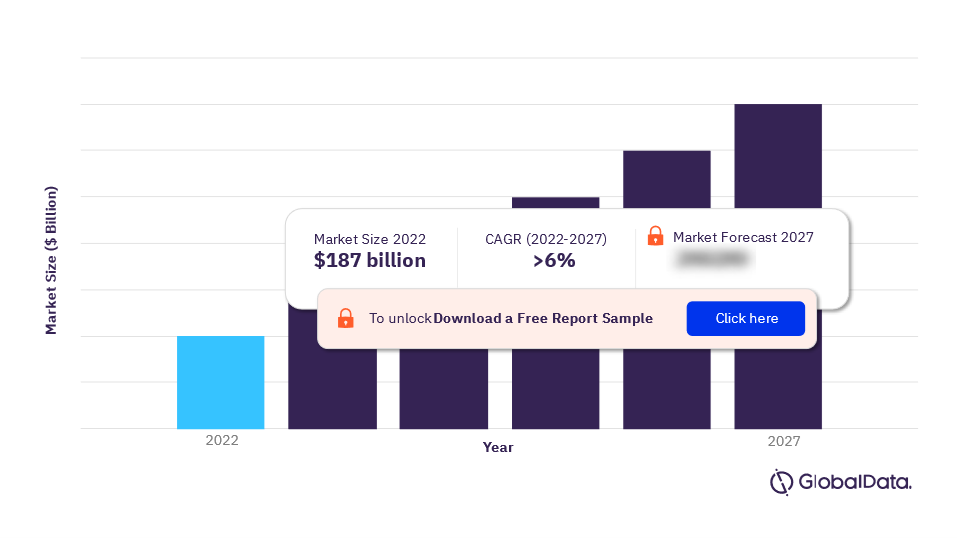

The confectionery market size was $187 billion in 2022. The market is expected to record a CAGR of more than 6% during 2022-2027. Healthy confectionery has become more popular as consumers are seeking guilt-free indulgence. This has pushed companies to innovate and reformulate their products to suit these consumers’ needs. Furthermore, consumers’ interest in the use of healthier ingredients has led to the launch of products with no trans fats and low/zero-sugar claims along with healthy/nutritional ingredients.

Confectionery Market Outlook 2022-2027 ($ Billion)

The confectionery market report comprises a comprehensive overview of the global confectionery sector. It includes an overall sector overview, insights on changes in consumption patterns, a list of high-potential countries, and a competitive landscape. The report also provides an overview of the current meat substitute scenario regarding the outlook in terms of ingredients, product claims, labeling, distribution, and packaging. The analysis also covers a regional overview across five regions including Asia-Pacific, Middle East & Africa, Americas, Western Europe, and Eastern Europe highlighting industry size, growth drivers, latest developments, and future inhibitors for the regions.

| Market Size (2022) | $187 billion |

| CAGR (2022-2027) | >6% |

| Key Categories | Chocolate, Sugar Confectionery, and Gum |

| Key Regions | Asia-Pacific, Western Europe, Eastern Europe, Americas, Middle East and Africa |

| High-potential Countries | Canada, Germany, the UK, Japan, China, Brazil, Romania, South Africa, the UAE, and the Czech Republic |

| Key Distribution Channels | Hypermarkets & Supermarkets, Convenience Stores, E-retailers, Food & drink specialists, and Others |

| Key Packaging Materials | Flexible Packaging, Rigid Plastics, Paper & Board, Rigid Metal, and Glass |

| Leading Players | Mars, Incorporated, Mondelēz International, Ferrero, The Hershey Company, Nestle’, and Private Label |

For more insights on the confectionery market forecast, download a free sample report

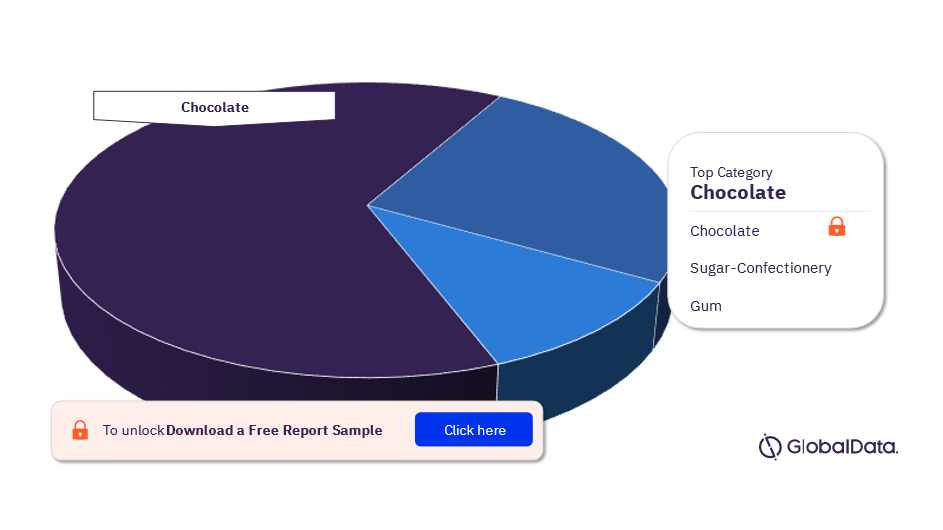

Confectionery Market Segmentation by Category

The key categories in the confectionery market are chocolate, sugar confectionery, and gum. In 2022, the chocolate category dominated the confectionery market share and is expected to continue doing so during the forecast period. Leading companies such as Mars, Mondelēz, and Ferrero have launched new products with innovative formulations with low-sugar or nutritional attributes in attractive packaging globally to generate demand among consumers.

Confectionery Market Analysis by Category, 2022 (%)

For more insights on the categories in the confectionery market, download a free sample report

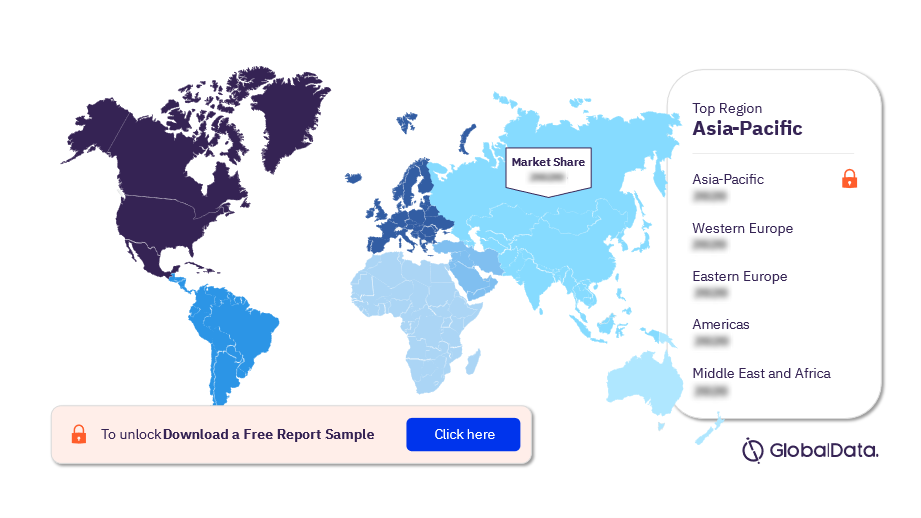

Confectionery Market Segmentation by Region

The key regions in the confectionery market are Asia-Pacific, Western Europe, Eastern Europe, the Americas, and the Middle East and Africa. In 2022, the Americas segment accounted for the largest revenues in the confectionery market. The sector’s growth is primarily attributed to household consumption among consumers in the US increasing by 9.76% in 2022. This motivated consumers to opt for confectionery products that generally have novel ingredients and flavors and premium prices.

Consumers younger than 24, who make up the largest market in the US, demonstrate a strong willingness to try new and exotic flavors in search of an indulgent and decadent experience. Young consumers in Canada, one of the high-potential countries, also seek guilt-free indulgences.

The key high-potential countries in the confectionery market are Canada, Germany, the UK, Japan, China, Brazil, Romania, South Africa, the UAE, and the Czech Republic.

Confectionery Market Analysis by Region, 2022 (%)

For more insights on the country-wise regional insights in the confectionery market, download a free sample report

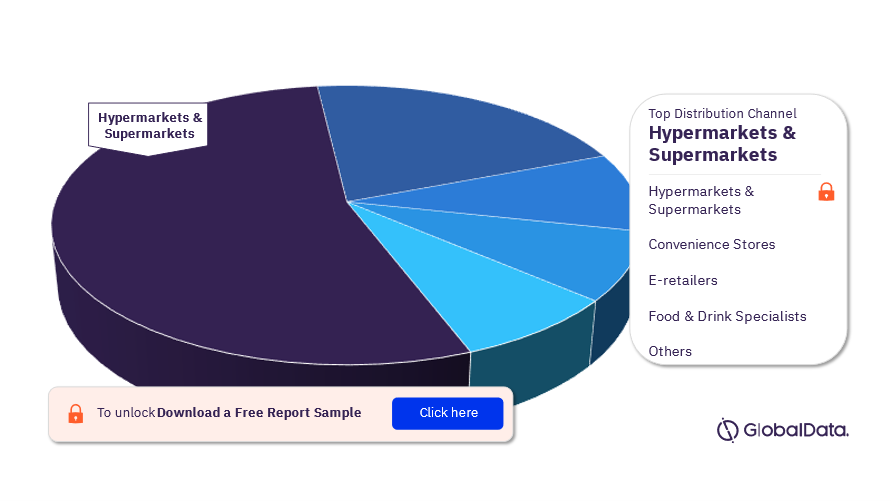

Confectionery Market Segmentation by Distribution Channel

The key distribution channels in the confectionery market are hypermarkets & supermarkets, convenience stores, e-retailers, and food & drink specialists, and among others. In 2022, the hypermarkets & supermarkets emerged as the leaders with the highest confectionery market value.

Confectionery Market Analysis by Distribution Channel, 2022 (%)

For more distribution channel insights in the confectionery market, download a free sample report

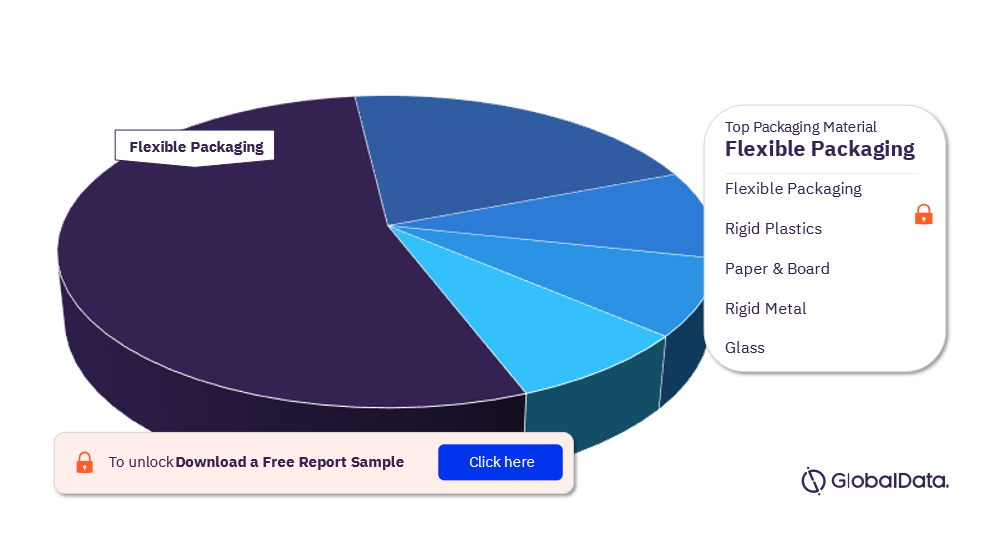

Confectionery Market Segmentation by Packaging Material

The key packaging materials used in the confectionery market are flexible packaging, rigid plastics, paper & board, rigid metal, and glass. In 2022, the flexible packaging was the most used packaging material in the confectionery market.

Confectionery Market Analysis by Packaging Material, 2022 (%)

For more packaging material insights in the confectionery market, download a free sample report

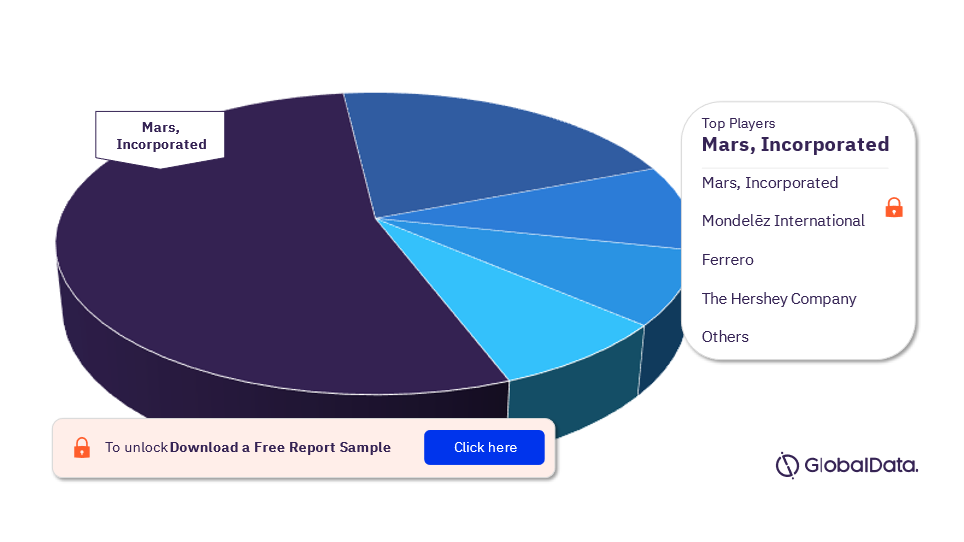

Confectionery Market - Competitive Landscape

The key leading players in the confectionery market are Mars, Incorporated, Mondelēz International, Ferrero, The Hershey Company, Nestle’, and Private Label among others. In 2022, Mars, Incorporated led the confectionery market with the highest contribution share by value.

Confectionery Market Analysis by Leading Players, 2022 (%)

For more information on the leading players in the confectionery market, download a free sample report

Reasons to Buy

- Manufacturing and retailers seek the latest information on how the market is evolving to formulate their sales and marketing strategies. There is also a demand for authentic market data with a high level of detail. This report has been created to provide its readers with up-to-date information and analysis to uncover emerging opportunities for growth within the sector in the region

- The report provides a detailed analysis of the countries in the region, covering the key challenges, competitive landscape, and demographic analysis, that can help companies gain insight into the country-specific nuances

- The analysts have also placed a significant emphasis on the key trends that drive consumer choice and the future opportunities that can be explored in the region, which can help companies in revenue expansion

- To gain competitive intelligence about leading brands in the sector in the region with information about their market share and growth rates.

Key Players

Mondelēz InternationalMars

Ferrero

The Hershey Company

Nestlé

Perfetti Van Melle

Lotte

Colian

Sweetco Foods Ltd

Chocoladefabriken Lindt & Sprüngli

Yildiz Holding

Table of Contents

Table

Figures

Frequently asked questions

-

What was the confectionery market size in 2022?

The confectionery market size was valued at $187 billion in 2022.

-

What will be the confectionery market CAGR during 2022-2027?

The confectionery market will grow at a CAGR of more than 6% during 2022-2027.

-

Which was the leading category in the confectionery market?

The leading category in the confectionery market was chocolates in 2022.

-

Which distribution channel dominated the confectionery market?

Hypermarkets & supermarkets were the largest contributing distribution channel in the confectionery market.

-

Which packaging material was mostly used in the confectionery market?

Flexible packaging was mostly used in the confectionery market in 2022.

-

Who are the leading confectionery market players?

Mars, Incorporated, Mondelēz International, Ferrero, The Hershey Company, Nestle’, and Private Label are some of the leading players in the confectionery market.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.