China General Insurance Market Size, Trends by Line of Business, Distribution, Competitive Landscape and Forecast to 2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

China General Insurance Market Report Overview

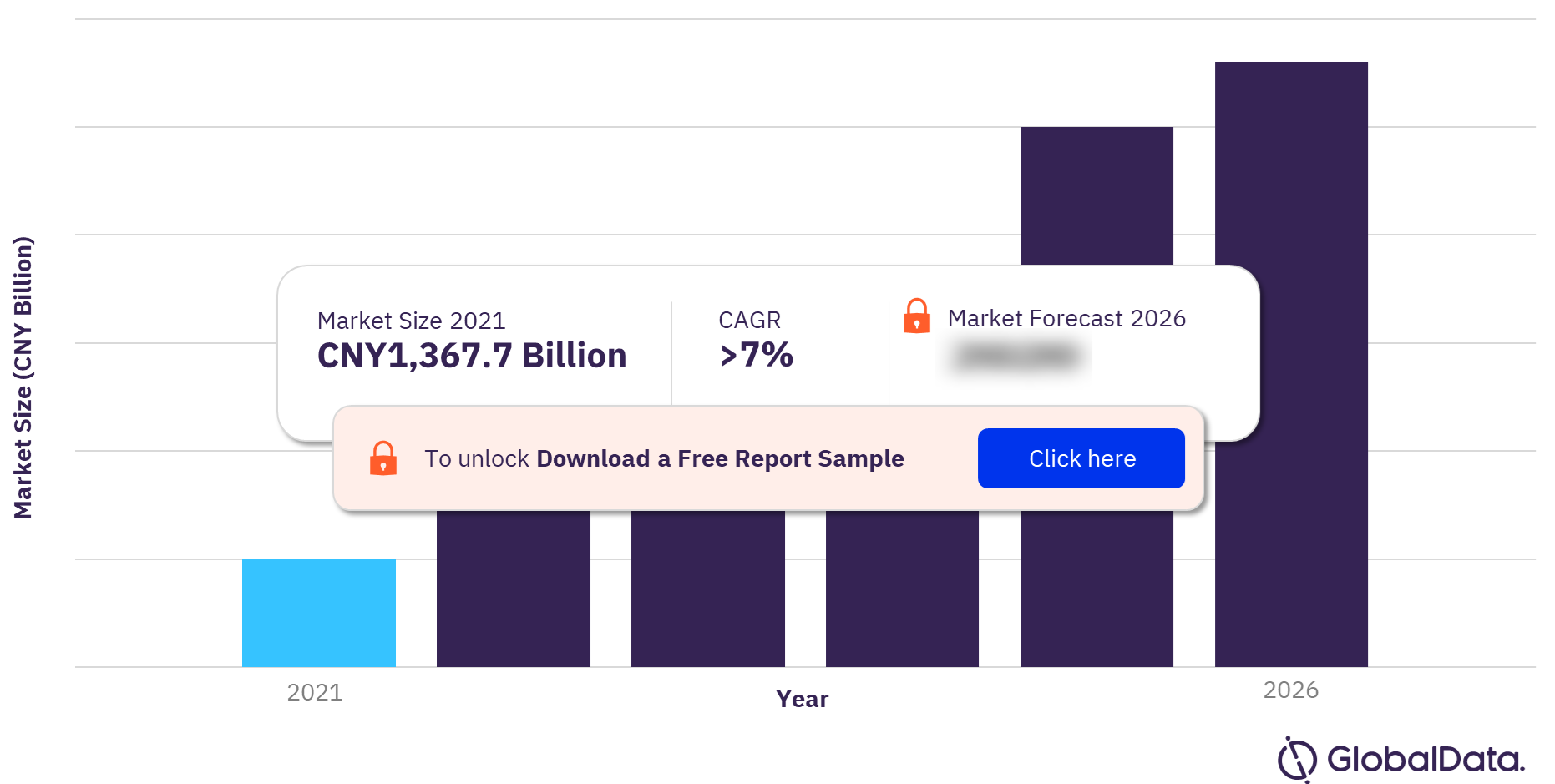

The gross written premium of the China general insurance market was CNY1,367.7 billion ($212.1 billion) in 2021 and is expected to achieve a CAGR of more than 7% during 2021-2026. The China general insurance market research report provides in-depth market analysis, information, and insights into the Chinese general insurance segment. It also provides values for key performance indicators such as gross written premium, penetration, and premium ceded and cession rates during the review period and forecast period.

The report analyzes distribution channels operating in the segment, gives a comprehensive overview of the Chinese economy and demographics, and provides detailed information on the competitive landscape in the country. The report also gives insurers access to information on segment dynamics and competitive advantages, and profiles of insurers operating in the country. Moreover, it includes details of insurance regulations and recent changes in the regulatory structure.

China General Insurance Market Outlook, 2021-2026 (CNY Billion)

To gain more information about China general insurance market forecast, download a free report sample

China General Insurance Market Trends

Demography challenges, ecosystem development, changing market dynamics, and agriculture – grain insurance are some of the key trends driving the Chinese general insurance market.

China’s aging population and rising life expectancy have created a demand for protection and PA&H insurance products to cover morbidity risks. Hybrid insurance products, combining both savings and protection elements, have also gained prominence. The growing middle class and the increasing number of older people are the key consumer segments for these products.

Furthermore, digitalization, coupled with ecosystem developments, is expected to fuel steady growth in the Chinese general insurance segment over the forecast period. In response to the demand for online-oriented insurance products, digital transformation is being leveraged by general insurers in China, with a focus on value-driven transformations across multiple dimensions, including distribution channels, customer segmentation, product proposition, and service delivery.

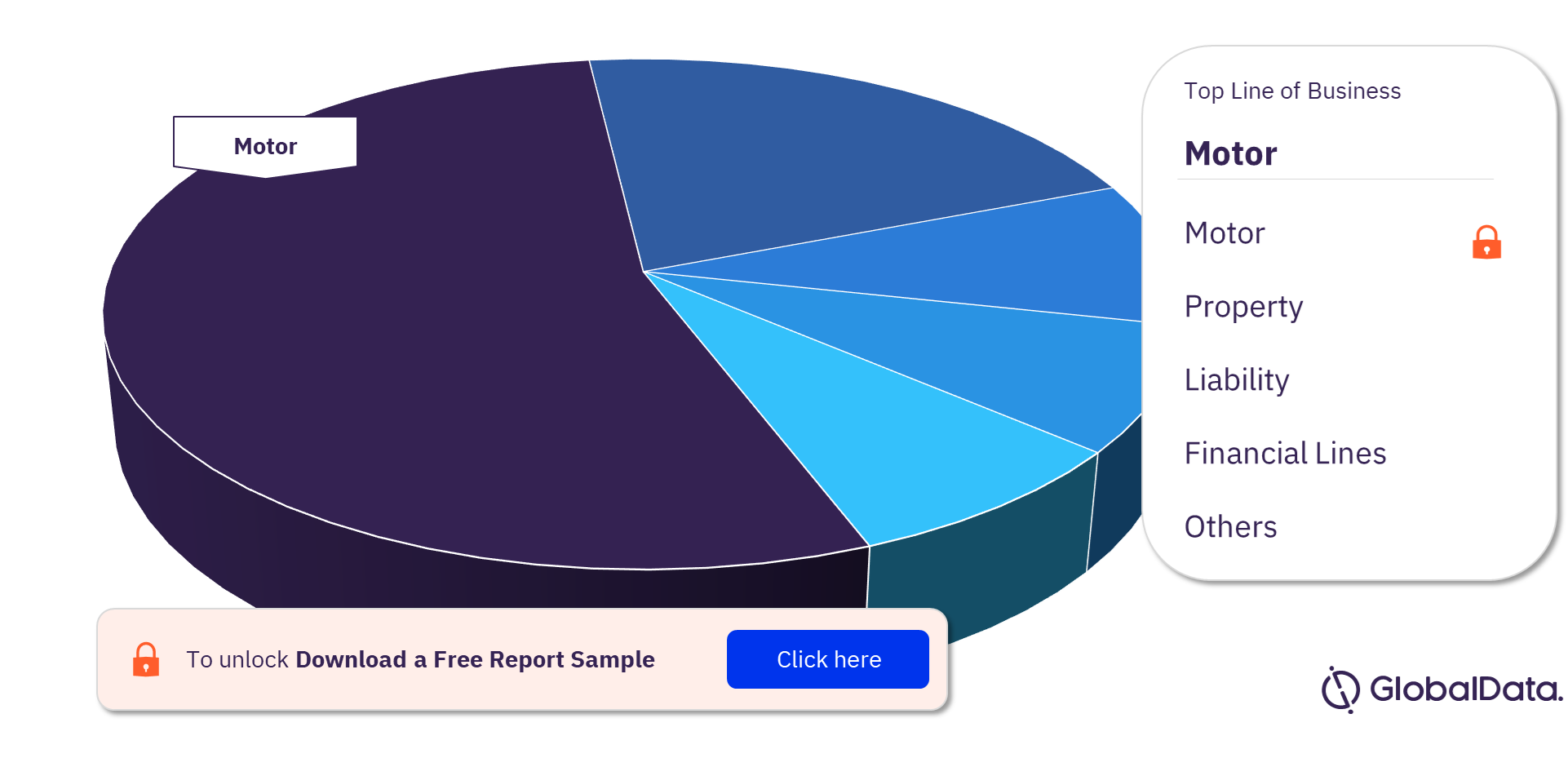

China General Insurance Market Segmentation by Lines of Business

The key lines of business in the China general insurance market are property, motor, liability, financial lines, MAT, PA&H, and miscellaneous. Motor insurance had the highest market share in the China general insurance market in 2021.

Motor Insurance: Lower vehicle sales had caused a decline in motor insurance uptake in 2021. However, the segment is expected to recover over the forecast period, as automobile sales are likely to rise by the proposed extension of EV subsidies until 2023. Moreover, the promotion of greener alternatives to cut pollution has prompted electric car makers such as Nio, BYD, and Xpeng to expand manufacturing capacity in China. This is expected to support the growth of motor insurance in the country over the forecast period.

Property Insurance: Property insurance is expected to grow during 2021–26, driven by the Chinese government’s plans to invest considerably in infrastructure projects. These projects, which include high-speed rail networks, renewable energy projects, and water tunnels, are expected to be completed by 2030 and will provide a boost to the segment.

China General Insurance Market Analysis, by Lines of Business, 2021 (%)

For more lines of business insights into the China general insurance market, download a free report sample

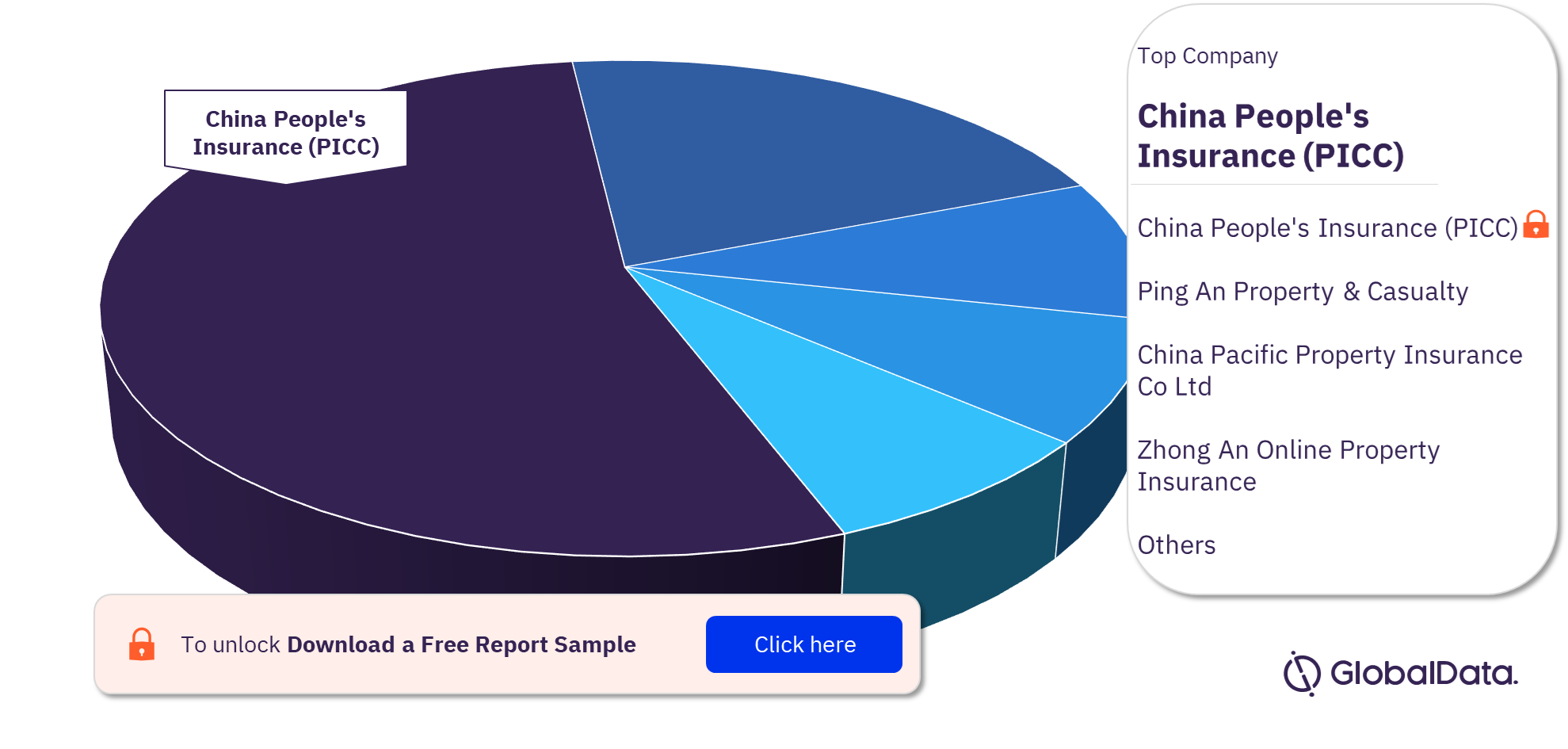

China General Insurance Market - Competitive Landscape

Some of the leading general insurance companies in China are China People’s Insurance (PICC), Ping An Property & Casualty, China Pacific Property Insurance Co Ltd, China Life Property And Casualty Insurance Co Ltd, China United Property Insurance Co Ltd, China Continent Property & Casualty Insurance Co Ltd, Sunshine Property and Casualty Insurance Co Ltd, Taiping General Insurance Co Ltd, Zhong An Online Property Insurance, and Sinosafe General Insurance Co Ltd. China People’s Insurance (PICC)was the leading general insurer in 2021.

China People’s Insurance (PICC) It is a subsidiary of China’s People’s Insurance Company (Group). It distributes its insurance products through an extensive network of bancassurance, individual insurance agents, and group sales channels. The group provides insurance products for accident, property, travel, auto, health, personal credit loan guarantee, and performance guarantee. It also offers cargo insurance, credit guarantee insurance, special risk insurance, engineering performance guarantee insurance, employer liability insurance, export product liability insurance, safety production liability insurance, and technological equipment insurance.

China General Insurance Market Analysis, by Companies, 2021 (%)

To know more about the leading companies in the China general insurance market, download a free report sample

China General Insurance Market Report Overview

| Market Size (2021) | CNY1,367.7 billion ($212.1 billion) (GWP) |

| CAGR (2021-2026) | >7% |

| Forecast Period | 2021-2026 |

| Historical Period | 2017-2020 |

| Key Lines of Business | Property, Motor, Liability, Financial Lines, MAT, PA&H, and Miscellaneous |

| Leading Companies | China People’s Insurance (PICC), Ping An Property & Casualty, China Pacific Property Insurance Co Ltd, China Life Property And Casualty Insurance Co Ltd, China United Property Insurance Co Ltd, China Continent Property & Casualty Insurance Co Ltd, Sunshine Property and Casualty Insurance Co Ltd, Taiping General Insurance Co Ltd, Zhong An Online Property Insurance, and Sinosafe General Insurance Co Ltd |

Segments Covered in the Report

China General Insurance Market Lines of Business Outlook (Value, CNY Billion, 2017-2026)

- Property Insurance

- Motor Insurance

- Liability Insurance

- Financial Lines Insurance

- MAT Insurance

- PA&H Insurance

- Miscellaneous

Scope

- This report provides a comprehensive analysis of the general insurance segment in China.

- It provides historical values for the Chinese general insurance segment for the report’s review period and projected figures for the forecast period.

- It profiles the top general insurance companies in China and outlines the key regulations affecting them.

Reasons to Buy

- Make strategic business decisions using in-depth historic and forecast market data related to the Chinese general insurance segment, and each category within it.

- Understand the demand-side dynamics, key market trends, and growth opportunities in the Chinese general insurance segment.

- Assess the competitive dynamics in the general insurance segment.

- Identify growth opportunities and market dynamics in key product categories.

Ping An Property & Casualty

China Pacific Property Insurance Co

China Life Property And Casualty Insurance Co

China United Property Insurance Co

China Continent Property & Casualty Insurance Co

Sunshine Property and Casualty Insurance Co

Taiping General Insurance Co

Table of Contents

Frequently asked questions

-

What was the China general insurance market gross written premium in 2021?

The gross written premium of the China general insurance market was CNY1,367.7 billion ($212.1 billion) in 2021.

-

What is the China general insurance market growth rate?

The general insurance market in China is expected to achieve a CAGR of more than 7% during 2021-2026.

-

What are the key lines of business in the China general insurance market?

The key lines of business in the China general insurance market are property, motor, liability, financial lines, MAT, PA&H, and miscellaneous.

-

Which are the leading companies in the China general insurance industry?

The leading insurance companies in the China general insurance industry are China People’s Insurance (PICC), Ping An Property & Casualty, China Pacific Property Insurance Co Ltd, China Life Property And Casualty Insurance Co Ltd, China United Property Insurance Co Ltd, China Continent Property & Casualty Insurance Co Ltd, Sunshine Property and Casualty Insurance Co Ltd, Taiping General Insurance Co Ltd, Zhong An Online Property Insurance, and Sinosafe General Insurance Co Ltd.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Financial Services reports