China Fuel Cards Market Size, Share, Key Players, Competitor Card Analysis and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

China Fuel Cards Market Report Overview

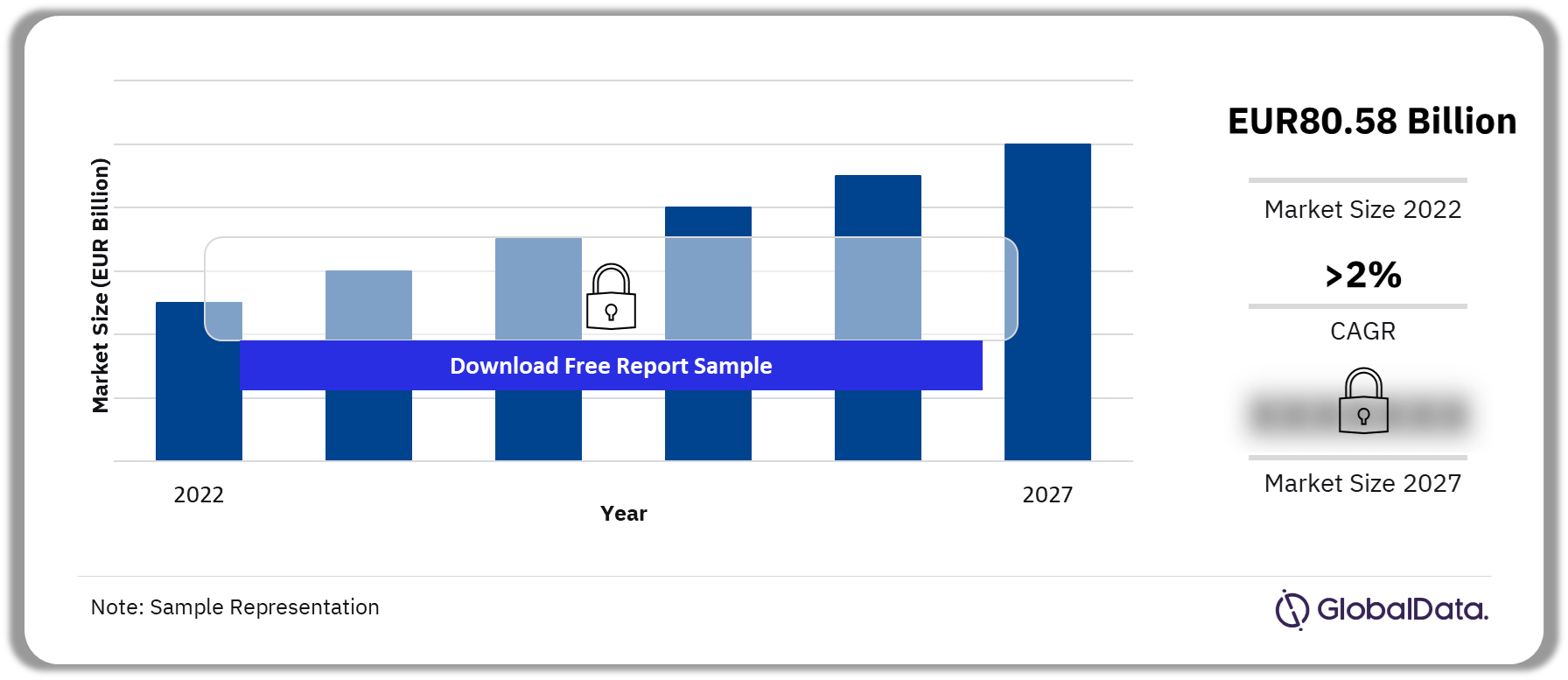

The China fuel cards market value was EUR80.58 billion in 2022. The market is expected to register a CAGR of more than 2% during the period 2023-2027. Elevating fuel prices and growing volumes of fuel sold through fuel cards will propel fuel card market growth in the coming years.

China Fuel Cards Market Outlook 2022-2027 (EUR Billion)

Buy Full Report for More Insights into the China Fuel Cards Market Forecast

The China fuel cards market research report provides invaluable comprehensive data insights for issuers of fleet cards, fuel retailers, fleet leasing companies, and other suppliers to the sector. The report also provides commercial (B2B) fuel card volume (split by fleet and CRT), value and market share forecasts for 2027, and key data on independent and oil company card issuers. It analyzes fuel card competition in China.

| Market Size (2022) | EUR80.58 Billion |

| CAGR (2023-2027) | >2% |

| Historical Period | 2015-2022 |

| Forecast Period | 2023-2027 |

| Key Channels | · Fleet Cards

· CRT Cards |

| Leading Fuel Card Operators | · Sinopec

· Shell · PetroChina · BP |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

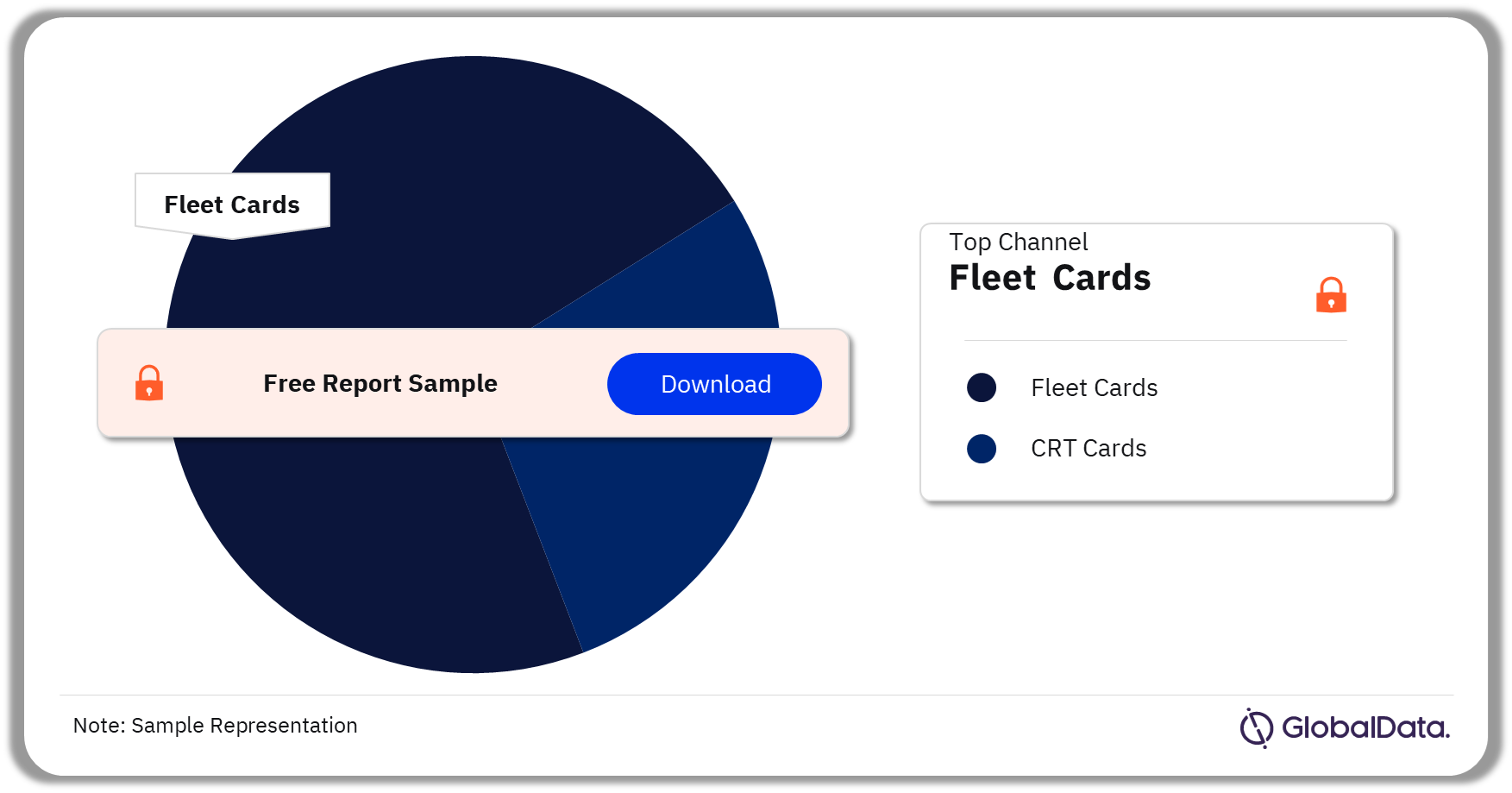

China Fuel Cards Market Segmentation by Channels

The key channels in the China fuel cards market are fleet cards and CRT cards. Fleet card channels led the market in 2022. During the forecast period, a large proportion of new fuel cards in China will be issued to small domestic fleets, as they take on new business in foreign markets owing to increasing trade between neighboring countries.

Furthermore, as card operators introduce lower volume limits to target this growing market segment, there will likely be an influx of small to medium-sized fleets in the fuel card market. This will add more fuel cards to be sold to fleet vehicles during 2023-2027. As a result, fleet volumes will rise significantly during the forecast period.

China Fuel Cards Market Analysis by Channels, 2022 (%)

Buy the Full Report for More Insights on Channels in the China Fuel Cards Market

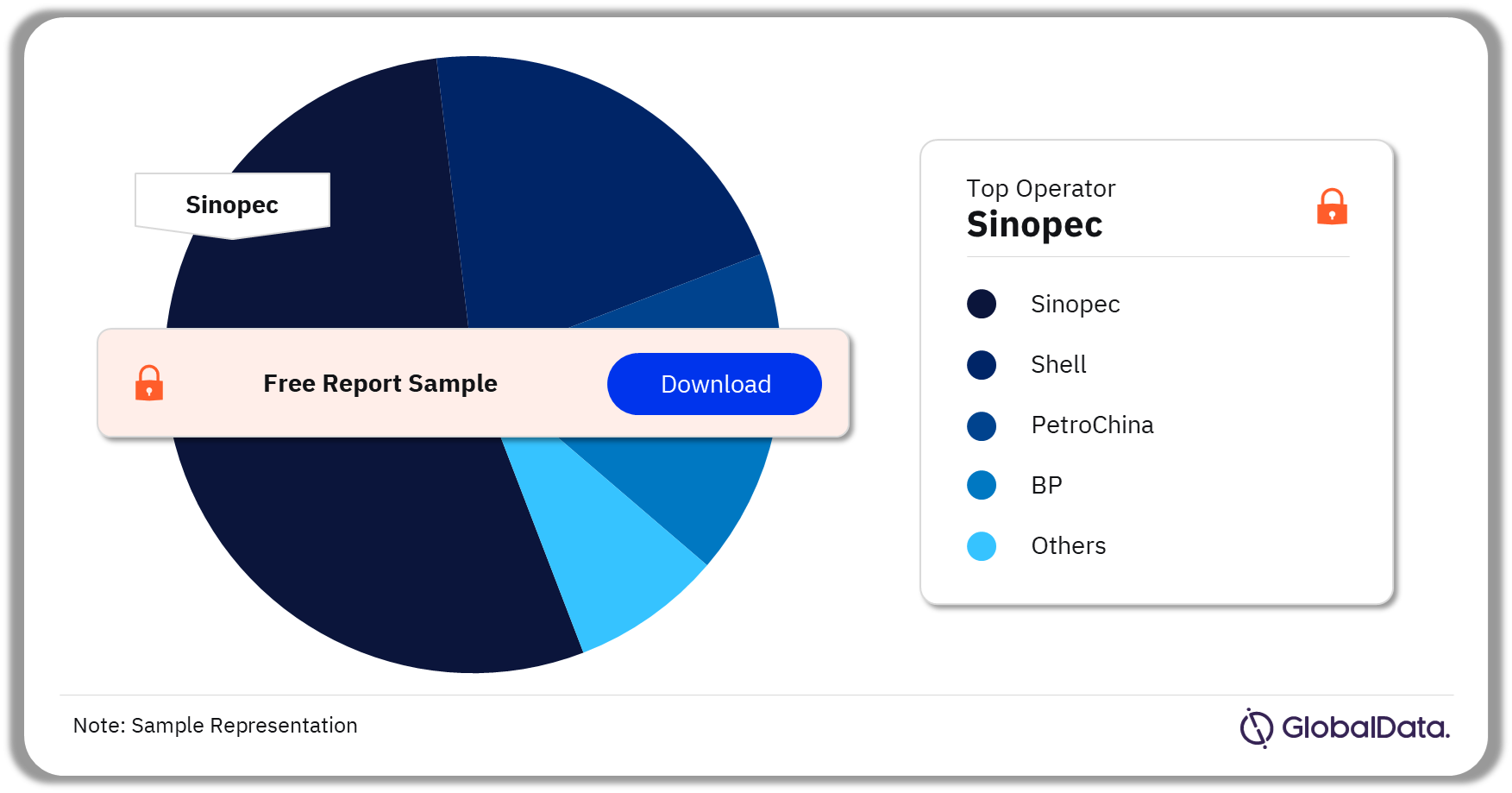

China Fuel Cards Market – Competitive Landscape

Some of the leading fuel card operators in China are:

- Sinopec

- Shell

- PetroChina

- BP

In 2022, Sinopec led the market leader in China. Commercial CRT fleets are drawn to their large international card-acceptance networks and range of services aimed at CRT vehicles.

China Fuel Cards Market Analysis by Fuel Card Operators, 2022 (%)

Buy the Full Report for More Insights on Companies in the China Fuel Cards Market

Segments Covered China Fuel Cards Market Report

China Fuel Cards Channels Outlook (Value, EUR Billion, 2015-2027)

- Fleet card

- CRT card

Scope

Fuel Cards in China 2022 is invaluable for issuers of fleet cards, fuel retailers, fleet leasing companies, and other suppliers to the sector. Based on research with issuers and fuel retailers it provides commercial (B2B) fuel card volume (split by fleet and CRT), value and market share forecasts to 2027, key data on independent and oil company card issuers, and an analysis of fuel card competition in China.

Key Highlights

The total number of service stations in China increased by 7.8%, from 116,104 in 2021 to 125,200 in 2022. More than 295,200 new fuel cards will be issued during 2023-27, resulting in a total of 6.96 million cards in the market. Out of the total active cards in the market, 69.6% will be held by fleet vehicles and 30.4% by CRT vehicles. Fuel card volumes will rise by a CAGR of 3.1% from 2023 to 2027, reaching 91.6 billion liters in 2027.

Reasons to Buy

Plan effective market entry strategies by uncovering current and future volumes and values of the Chinese fuel card market. Assess whether you should increase network acceptance of your card and identify potential new merchants by uncovering the position of competitors. Whether you are an issuer, a processor, a leasing company, or a fuel retailer, make informed pitches to partners by understanding their business. Enhance fuel sales at your service stations by identifying which fuel cards you should accept based on their market shares and network acceptance.

PetroChina

BP

Shell

Table of Contents

Frequently asked questions

-

What was the China fuel cards market size in 2022?

The fuel card market size in China was valued at EUR80.58 billion in 2022.

-

What is the market growth rate of the China fuel card market?

The China fuel cards market is expected to register a CAGR of more than 2% during the period 2023-2027.

-

Which channel led the China fuel cards market?

Fleet cards channel led the China fuel cards market in 2022.

-

Which are the leading fuel card operators in China fuel cards market?

Some of the leading fuel card operators in China are Sinopec, Shell, PetroChina, BP, and others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.