Canada General Insurance Market Size and Trends by Line of Business, Distribution, Competitive Landscape and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Canada General Insurance Market Report Overview

The gross written premium of the Canadian general insurance market was CAD77.6 billion ($59.6 billion) in 2022 and is expected to achieve a CAGR of more than 6% during 2023-2027. The Canada general insurance market research report provides in-depth market analysis, information, insights, and a detailed outlook by product category for the Canadian general insurance segment. It also provides values for key performance indicators such as gross written premium, penetration, and premium ceded and cession rates during the review period and forecast period.

Canada General Insurance Market Outlook, 2022-2027 (CAD Billion)

Buy Full Report to Gain More Information about the Canada General Insurance Market Forecast

The report analyzes distribution channels operating in the segment, gives a comprehensive overview of Canada’s economy and demographics, and provides detailed information on the competitive landscape in the country. The report also gives insurers access to information on segment dynamics and competitive advantages, and profiles of insurers operating in the country. Moreover, it includes details of insurance regulations and recent changes in the regulatory structure.

| Market Size (2022) | CAD77.6 billion ($59.6 billion) |

| CAGR (2023-2027) | >6% |

| Forecast Period | 2023-2027 |

| Historical Period | 2018-2022 |

| Key Lines of Business | · Property

· Motor · Liability · Financial Lines · MAT · General Insurance PA&H |

| Key Distribution Channels | · Insurance Broker

· Direct from Insurance · Bank · Financial Advisor · Online Aggregator |

| Leading Companies | · Intact

· Aviva Canada · Lloyd’s · Security National · Co-operators General |

| Enquire &Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Canada General Insurance Market Trends

- ESG has been a major theme for all large businesses and around 60% of insurers in Canada implement ESG principles in their underwriting and new product development practices.

- The growth in the EV insurance market will be driven by advancements in technology, regulatory pressures, rising oil prices, and growing consumer acceptance of EVs.

- Embedded insurance is the bundling of insurance or protection within the purchase of a third-party good or service. Open insurance is a key driver behind this trend in insurance distribution. Opening the industry up to widespread collaboration and data-sharing with third parties will ultimately be the driving force behind the next generation of insurance. This will create new business and revenue opportunities, as well as strengthen insurers’ relationships with their customers.

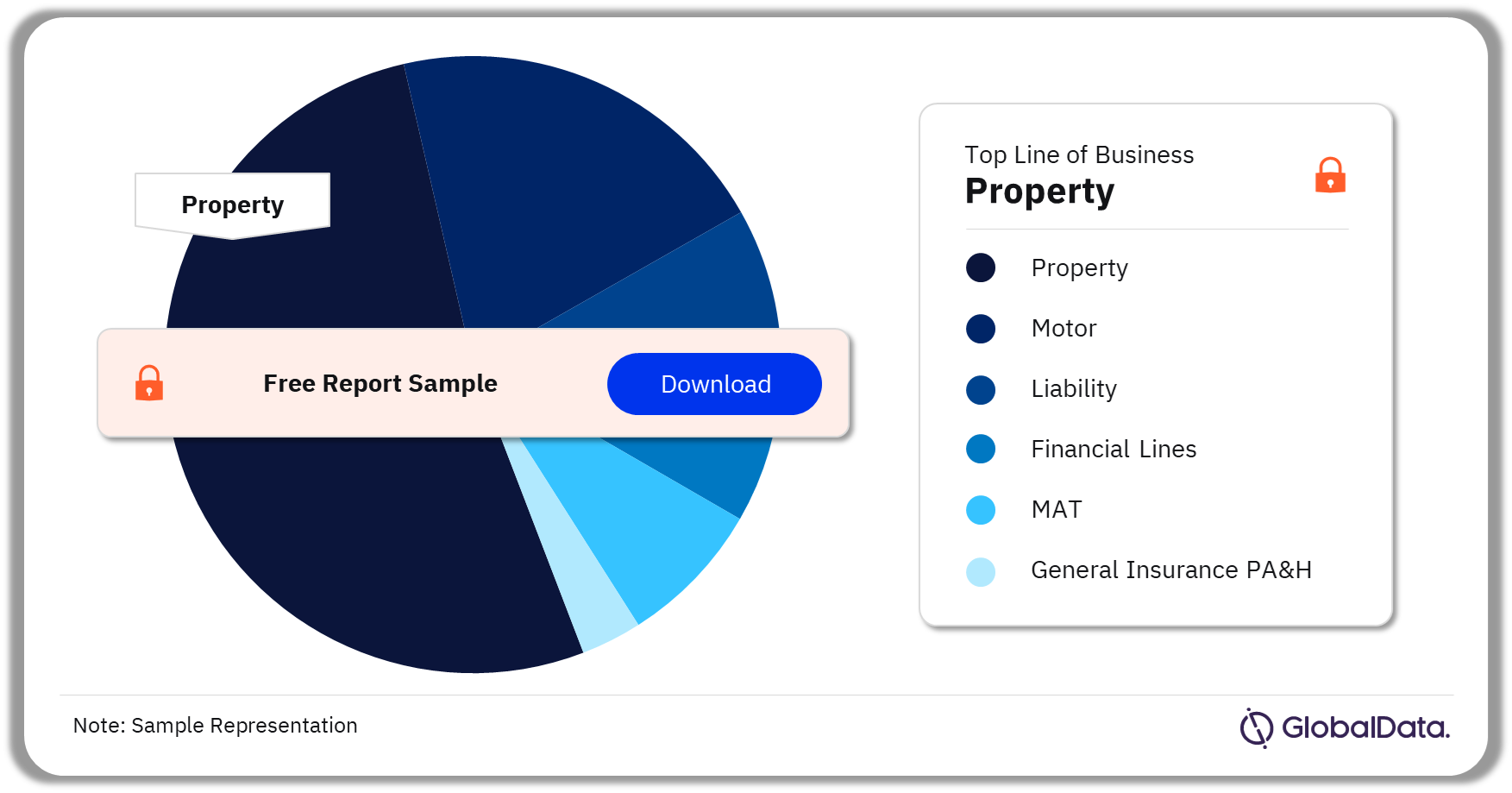

Canada General Insurance Market Segmentation by Line of Business

Property insurance had the highest market share in the Canadian general insurance market in 2022.

The key lines of business in the Canadian general insurance market are property, motor, liability, financial lines, MAT, and general insurance PA&H. The growth of property insurance by 2023 was driven by an increase in premium prices. Within this LOB, premiums continue to increase and are now more dependent on the risk profile of the property. However, high inflation will negatively impact the property insurance business. The recent renewal of reinsurance treaties was challenging and led to increased reinsurance rates. These increases affected the entire Canadian property market and added extra strain on primary insurers both in terms of pricing and capacity.

Canada General Insurance Market Analysis by Lines of Business, 2022 (%)

Buy Full Report for More Lines of Business Insights into the Canada General Insurance Market

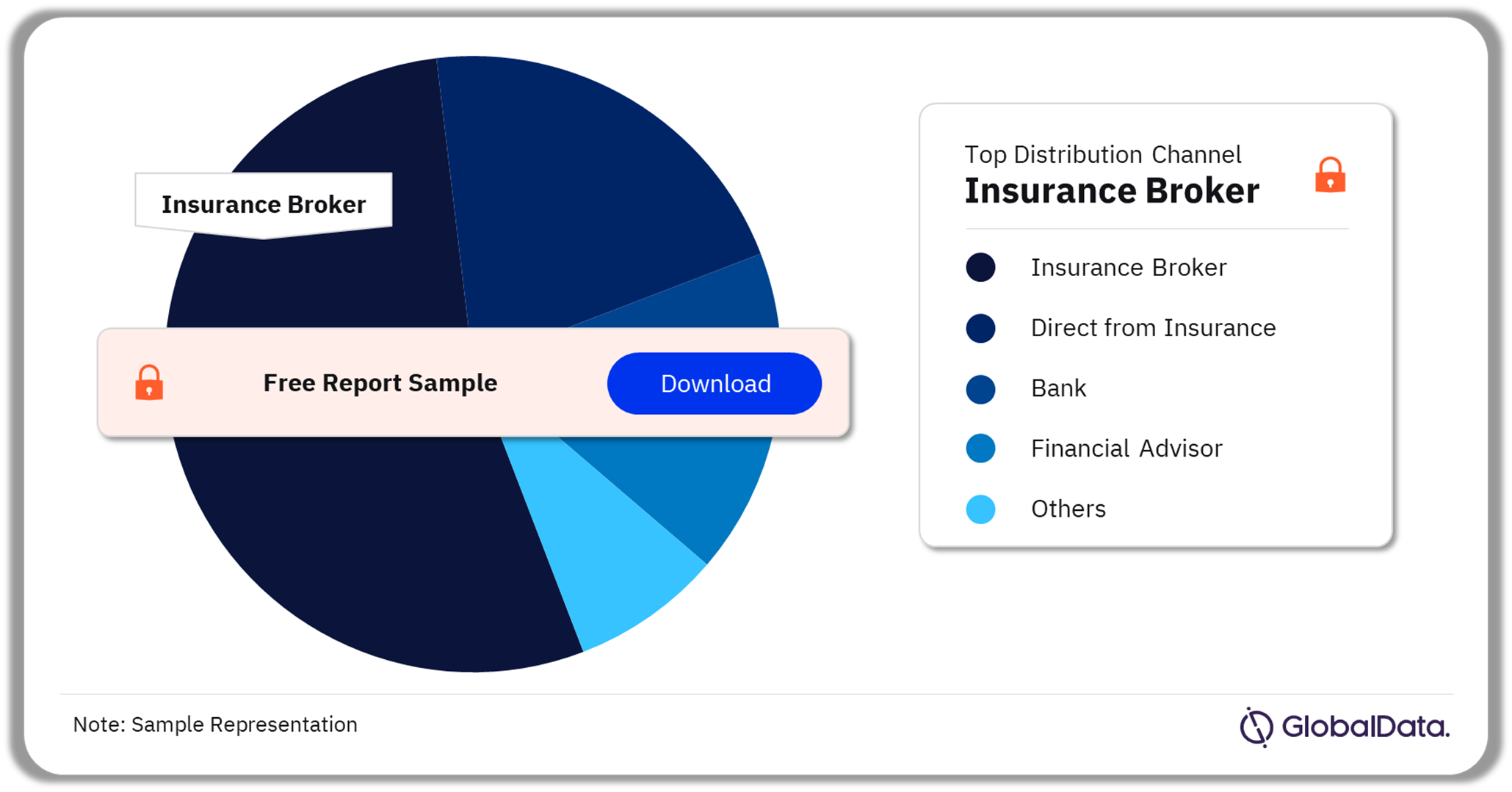

Canada General Insurance Market Segmentation by Distribution Channels

Customers in the Canadian general insurance market have a strong preference for the direct channel.

The key distribution channels in the Canadian general insurance market are insurance brokers, direct from insurance, banks, financial advisors, and online aggregators, among others. Insurance brokers was the most preferred distribution channel in Canada.

The population aged 65–74 years is mostly dependent on insurers and insurance brokers for home insurance policies and motor insurance. Purchasing through face-to-face interaction was the most preferred method for buying all types of insurance, followed by purchasing via telephone.

Canada General Insurance Market Analysis by Distribution Channels, 2022 (%)

Buy Full Report for More Distribution Channel Insights into the Canada General Insurance Market

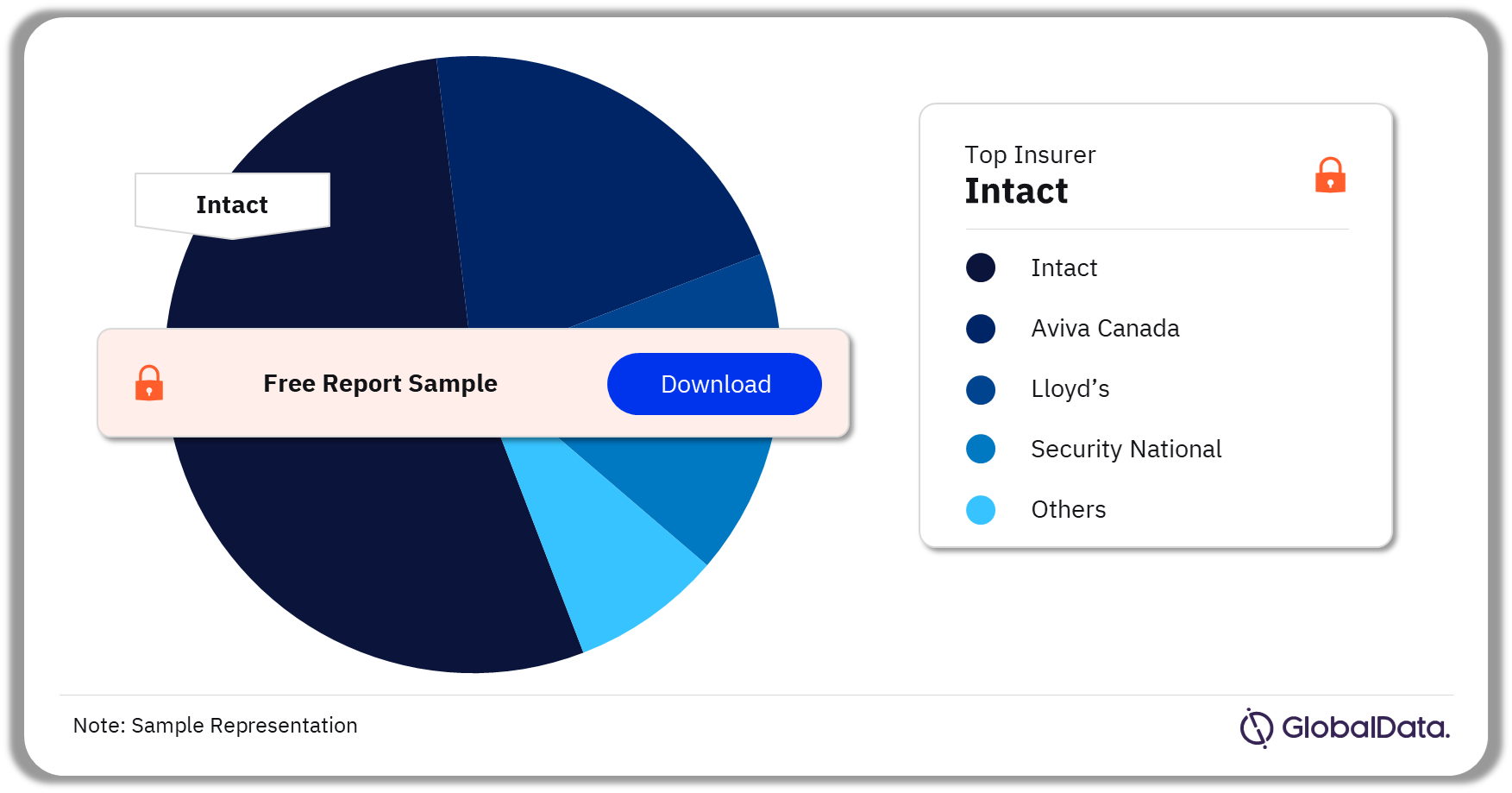

Canada General Insurance Market - Competitive Landscape

Intact was the leading insurer in 2022, followed by Aviva Canada and Lloyd’s.

Some of the leading insurers in Canada are:

- Intact

- Aviva Canada

- Lloyd’s

- Security National

- Co-operators General

Among the top five insurers, Aviva Canada recorded the highest CAGR during the review period driven by improved underwriting income. In addition, both the commercial and personal lines registered strong growth in 2022. M&A activities were strong in the Canadian insurance market during the review period. This trend is expected to continue in the coming years, driven by investments in digital technology and product innovations.

Canada General Insurance Market Analysis by Insurers, 2022 (%)

Buy Full Report to Know More about the Insurers in the Canada General Insurance Market

Canada General Insurance Market - Latest Developments

- In March 2023, OFSI released new guidelines on climate risk management, which include requirements for banks and insurance companies to manage and disclose climate-related risks. From 2024, major banks and insurance companies must submit climate-related reports for the fiscal year, whereas smaller organizations must submit climate reports by 2025.

- Aviva entered into a partnership with Earth Day Canada under a program named Charged for Change, which will fund public EV charging installations in underserved communities across Canada. Over the next three years, Aviva will invest a certain budget every year to help communities get access to EV charging infrastructure.

Segments Covered in the Report

Canada General Insurance Market Lines of Business Outlook (Value, CAD Billion, 2018-2027)

- Property

- Motor

- Liability

- Financial Lines

- MAT

- General Insurance PA&H

Canada General Insurance Distribution Channel Outlook (Value, CAD Billion, 2018-2027)

- Insurance Broker

- Direct from Insurance

- Bank

- Financial Advisor

- Online Aggregator

Scope

This report provides:

- A comprehensive analysis of the general insurance segment in Canada.

- Historical values for the Canada general insurance segment for the report’s review period and projected figures for the forecast period.

- Profiles of the top general insurance companies in Canada and outlines the key regulations affecting them.

Key Highlights

- Key insights and dynamics of the Canadian general insurance segment.

- A comprehensive overview of the Canadian economy, government initiatives, and investment opportunities.

- The Canadian insurance regulatory framework’s evolution, key facts, taxation regime, licensing, and capital requirements.

- The Canadian general insurance industry’s market structure gives details of lines of business.

- The Canadian general reinsurance business’ market structure gives details of premium ceded along with cession rates.

- Distribution channels deployed by the Canadian general insurers.

- Details of the competitive landscape and competitors’ profiles.

Reasons to Buy

- Make strategic business decisions using in-depth historical and forecast market data related to the Canadian general insurance segment.

- Understand the demand-side dynamics, key market trends, and growth opportunities in the Canadian general insurance segment.

- Assess the competitive dynamics in the general insurance segment.

- Identify growth opportunities and market dynamics in key product categories.

Lloyd's Underwriters

Aviva Insurance Company Of Canada

Co-operators General Insurance Company

Security National Insurance Company

The Wawanesa Mutual Insurance Company

Certas Home and Auto Insurance Company

Definity Insurance Company

Table of Contents

Frequently asked questions

-

What was the Canada general insurance market gross written premium in 2022?

The gross written premium of the Canada general insurance market was CAD77.6 billion ($59.6 billion) in 2022.

-

What is the Canada general insurance market growth rate?

The general insurance market in Canada is expected to achieve a CAGR of more than 6% during 2023-2027.

-

Which line of business held the largest share of the Canadian general insurance market in 2022?

Property insurance was the leading general insurance line in the Canadian general insurance market in 2022.

-

Which are the key companies operating in the Canadian general insurance market?

Some of the leading insurers in the Canadian general insurance market are Intact, Aviva Canada, Lloyd’s, Security National, and Co-operators General.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Financial Services reports