Automotive Steering Systems Market Trends, Sector Overview and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Automotive Steering Systems Market Report Overview

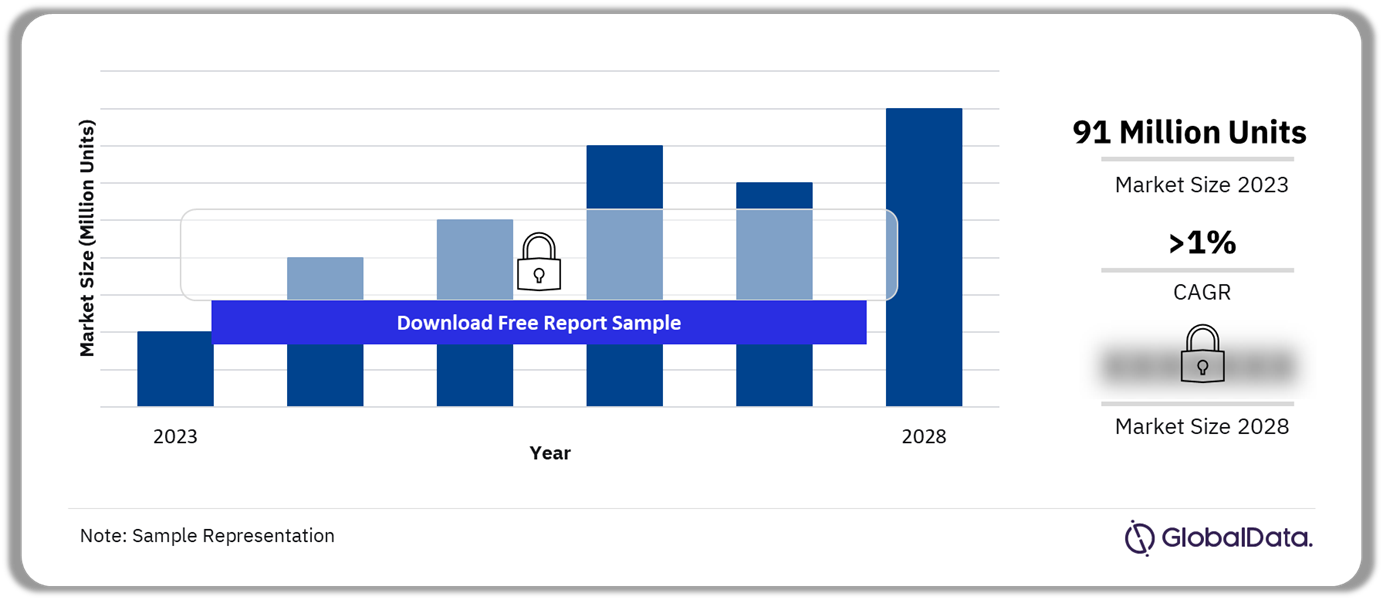

The steering systems market size was 91 million units in 2023. The market will grow at a CAGR of more than 1% during 2023-2028. Continuous advancements in technology, such as improvements in electric power steering (EPS), sensors, and control algorithms drive the innovation of steering systems. In 2023, Asia-Pacific accounted for a significant share of the automotive steering systems market.

Automotive Steering Systems Market Outlook, 2023-2028 (Million Units)

Buy the Full Report for More Insights on the Automotive Steering Systems Market Report Forecast

The automotive steering systems market research report provides a comprehensive overview of the market trends and drivers. The automotive steering systems market also provides a detailed overview of technological developments and PESTER analysis. Furthermore, evaluate strategic initiatives by market players and their recent product innovations to identify growth opportunities. The report also provides an overview of patent filings across sectors, regions, countries, and top applicants.

| Market Size (2023) | 91 million units |

| CAGR (2023-2028) | >1% |

| Historical Period | 2018-2022 |

| Forecast Period | 2023-2028 |

| Key Regions | Asia-Pacific, Europe, North America, South America, and MEA |

| Key Companies | JTEKT, Nexteer Automotive, ZF Friedrichshafen, Robert Bosch, and NSK |

| Key Sectors | Steering – Power Hydraulic, Steering – Power Electrical, and Steering – Manual |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Automotive Steering Systems Market Trends

The key trends shaping the automotive steering systems market are electric power steering (EPS) dominance and the implementation of steer-by-wire technology.

Electric power steering (EPS): EPS systems exhibit greater energy efficiency compared to traditional hydraulic power steering systems as they only utilize power when assistance is required. This results in improved fuel efficiency and a decrease in CO2 emissions.

Buy the Full Report for More Trend Insights into the Automotive Steering Systems Market

Automotive Steering Systems Market Segmentation by Regions

In 2023, Asia-Pacific accounted for the highest automotive steering systems market share among all the regions

The key regions in the automotive steering systems market are Asia-Pacific, Europe, North America, South America, and MEA. EVs require specialized steering systems that are designed to handle the unique torque and performance characteristics of electric motors. Hence, a growing demand for EVs is a major opportunity for the APAC steering systems market. The increasing adoption of ADAS also drives the APAC steering systems market.

Automotive Steering Systems Market Analysis by Regions, 2023 (%)

Buy the Full Report for More Regional Insights into the Automotive Steering Systems Market

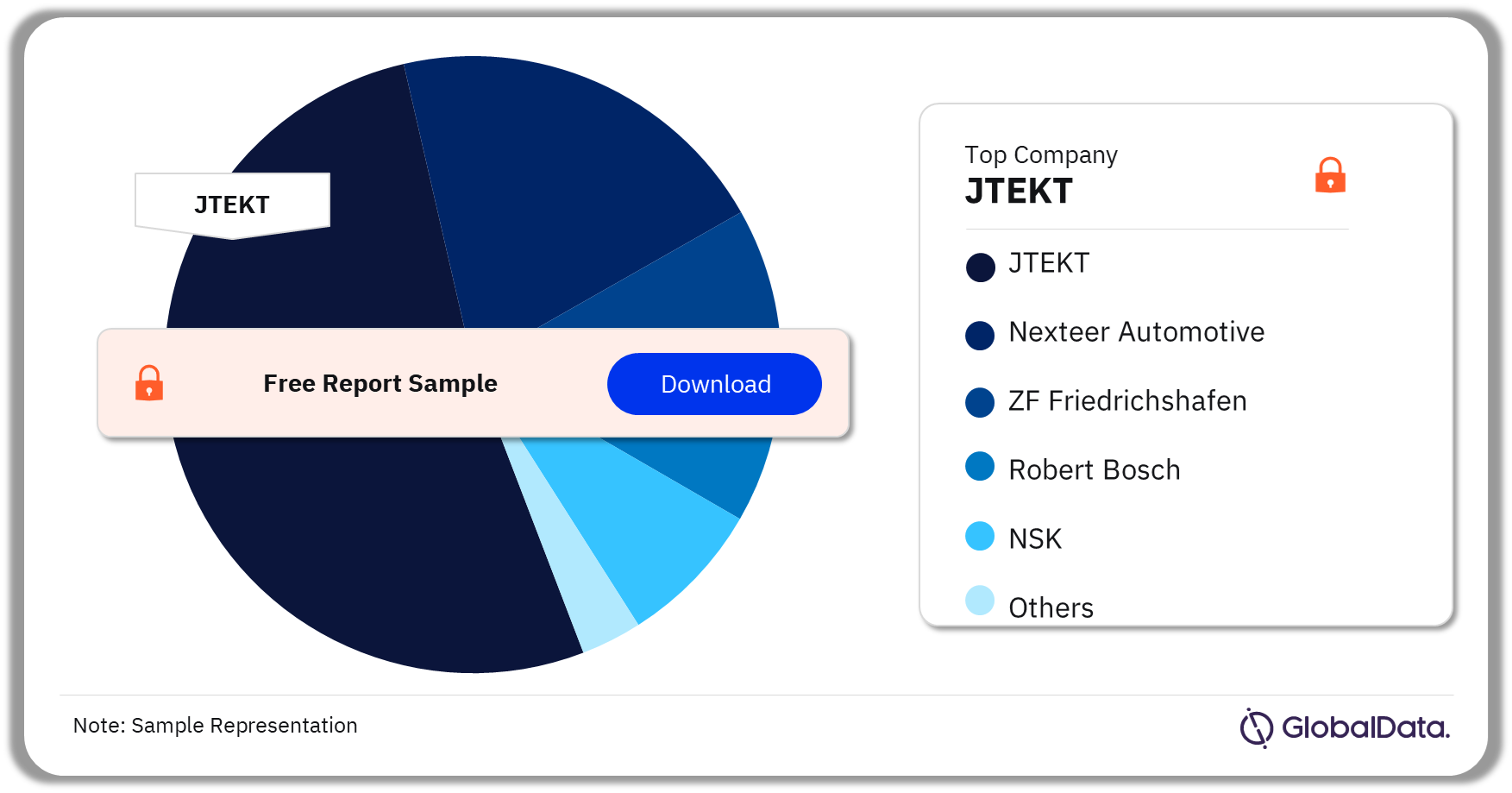

Automotive Steering Systems Market – Competitive Landscape

JTEKT Corporation led the electronically powered steering market in 2022

A few of the top companies operating in the market are:

- JTEKT

- Nexteer Automotive

- ZF Friedrichshafen

- Robert Bosch

- NSK

CNXMotion is a joint venture between Nexteer Automotive and Continental Automotive. In July 2022, the Brake-to-Steer (BtS) technology was expanded under this joint venture. Nexteer Automotive claims that these two new software functions provide backup safety layers for all variations of Electric Power Steering (EPS) and Steer-by-Wire (SbW) systems as well as across all SAE levels of driving automation.

Nexteer Automotive is also taking strategic actions to aid the automotive steering systems market growth. In August 2021, the company increased the output capabilities of its pinion EPS systems to accommodate the demands of heavier EVs in segments B through D.

Electronically Powered Steering Market Analysis by Companies, 2022 (%)

Buy the Full Report to Know More about Major Developments and Strategic Actions of Automotive Steering Systems Market Companies

Automotive Steering Systems Market Segmentation by Sectors

In 2023, steering-power electrical accounted for the highest share of the automotive steering systems market

The key sectors in the automotive steering systems market are steering – power hydraulic, steering – power electrical, and steering – manual. The growing concern for fuel efficiency is one of the major driving forces behind the EPS sector’s market volume growth. EPS is only active when steering input is detected, thus offering improved fuel efficiency. Furthermore, the system is less complex and requires minimal maintenance, making it an economically beneficial option.

Automotive Steering Systems Market Analysis by Sectors, 2023 (%)

Buy the Full Report for More Sector Insights into the Automotive Steering Systems Market Download a Free Report Sample

Automotive Steering Systems Market – Latest Developments

A few of the latest developments in the automotive steering systems market are as follows:

- 7th February 2024: SAF-HOLLAND SE, a primary supplier of trailer and truck components globally, announced its acquisition of Tecma Srl (Assali Tecma) located in Verona, Italy. Tecma Srl focuses on creating customer-specific axle systems and suspensions for special vehicles and heavy-duty applications.

- 14th September 2023: Kentucky International Holdings, Inc. has completed the acquisition of high-pressure light metal castings production specialist Rane Light Metal Casting Inc.

Buy the Full Report to Know More about the Latest Developments in the Automotive Steering Systems Market

Segments Covered in this Report

Automotive Steering Systems Regional Outlook (Value, Million Units, 2018-2028)

- Asia-Pacific

- Europe

- North America

- South America

- MEA

Automotive Steering Systems Sector Outlook (Value, Million Units, 2018-2028)

- Steering – Power Hydraulic

- Steering – Power Electrical

- Steering – Manual

Scope

- Trends & Drivers: Provides an overview of the current key trends and drivers that will influence the sector’s growth in the future.

- Technological Developments: Provides a detailed overview of technological developments and innovations in the sector.

- PESTER Analysis: Provides a detailed understanding of political, economic, social, technological, environmental, and regulatory factors impacting the sector.

- Sector Forecast: Provides deep-dive analysis of the global market covering volume growth during 2018-2028, and spot estimates for 2030 and 2036. The analysis also covers a regional overview across four regions highlighting sector size and growth drivers for the region.

- Competitive Landscape: Provides an overview of leading component suppliers at a global and regional level, besides analyzing the companies’ recent product innovations and key strategic initiatives. taken by the companies.

- Patent Analysis: Provides an overview of patent filings in the sector across regions, countries, and top applicants.

Reasons to Buy

- The report provides OEMs and component suppliers’ latest information on market evolution to help formulate sales and marketing strategies.

- The report provides authentic market data with a high level of detail to help gain a competitive edge.

- The report provides its readers with up-to-date information and analysis to uncover emerging opportunities for growth within the sector.

- The report analyzes regions and competitive landscape that can help companies gain insight into the region-specific nuances.

- The report assesses the key trends that drive customer choice and the future opportunities that can be explored in the region. Actionable insights on trends can help companies in revenue expansion.

- The report helps gain competitive intelligence about leading component suppliers in the region with information about their market share and growth rates.

,Steering systems

,Steering - CD EPS

,Steering - DPD EPS

,Steering - EPHS

,Steering - MR&P

,Steering - PR&P

,Steering -RCB

,Steering - RD EPS

Steering - SPD EPS

,JTEKT, Nexteer Automotive

,ZF

,Robert Bosch

,NSK and Hitachi Astemo.

Table of Contents

Frequently asked questions

-

What was the automotive steering systems market size in 2023?

The automotive steering systems market size was 91 million units in 2023.

-

What will the steering systems market growth rate be during the forecast period?

The steering systems market will grow at a CAGR of more than 1% during 2023-2028.

-

Which was the leading region in the automotive steering systems market in 2023?

Asia-Pacific was leading the automotive steering systems market in 2023.

-

Which was the leading sector of the automotive steering systems market in 2023?

In 2023, steering-power electrical accounted for the highest share of the automotive steering systems market.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.