Automotive Roof Systems Market Trends, Sector Overview and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Automotive Roof Systems Market Report Overview

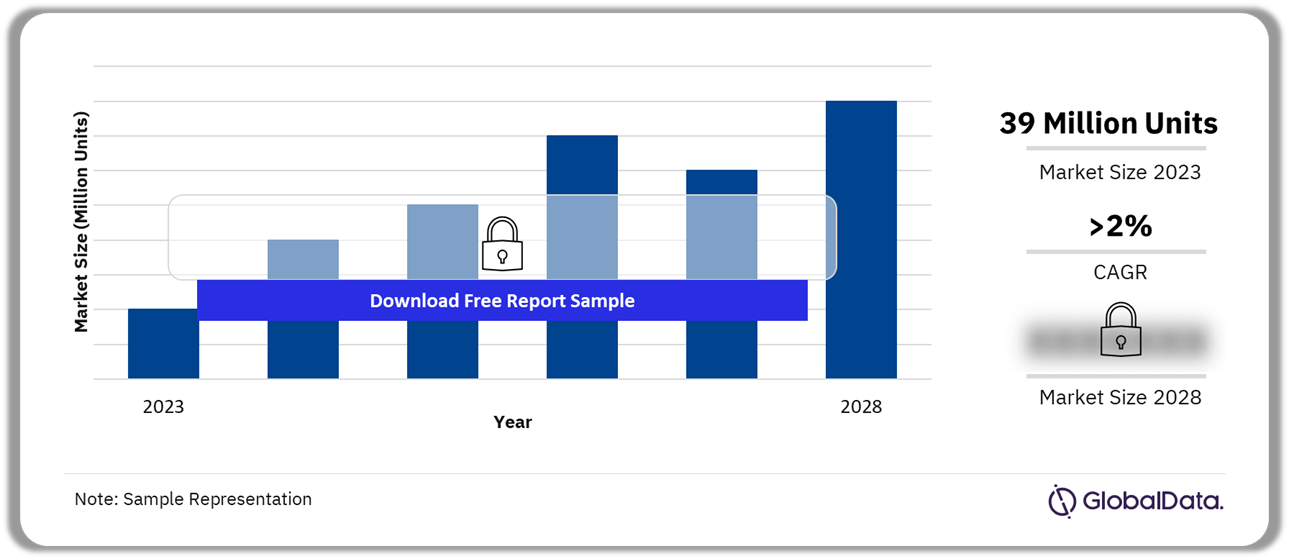

The automotive roof systems market size was 39 million units in 2023. The market will grow at a CAGR of more than 2% during 2023-2028. Solar roofs, which are being used in electric vehicles, lead the roof systems sector. In 2023, Asia-Pacific accounted for a significant share of the market.

Automotive Roof Systems Market Outlook, 2023-2028 (Million Units)

Buy the Full Report for More Insights on the Automotive Roof Systems Market Report Forecast

The automotive roof systems market research report provides a comprehensive overview of the automotive roof system market trends and drivers. The report also provides a detailed overview of technological developments and PESTER analysis. Furthermore, evaluate strategic initiatives by market players and their recent product innovations to identify growth opportunities. The report also provides an overview of patent filings across sectors, regions, countries, and top applicants.

| Market Size (2023) | 39 million units |

| CAGR (2023-2028) | >2% |

| Historical Period | 2018-2022 |

| Forecast Period | 2023-2028 |

| Key Regions | Asia-Pacific, Europe, North America, South America, and MEA |

| Key Companies | Webasto, Inalfa Roof Systems, CIE Automotive (Inteva Products), Aisin Corp, and Magna |

| Key Sectors | Roof-Conventional Sunroofs, Roof-Large Sunroofs, Roof–RHT, and Roof–RST |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Automotive Roof Systems Market Trends

A few of the key trends shaping the automotive roof systems market are the integration of solar technology in cars and the use of a panoramic roof as a design feature of the car.

The use of a panoramic roof: The automobile industry is moving towards modular design as car companies continue to diversify. High-end sunroofs, such as retractable and bigger panoramic models and sunroofs with heating and cooling systems, are becoming more popular in China. Webasto made the largest all-in-one openable panorama roof.

Buy the Full Report for More Trend Insights into the Automotive Roof Systems Market

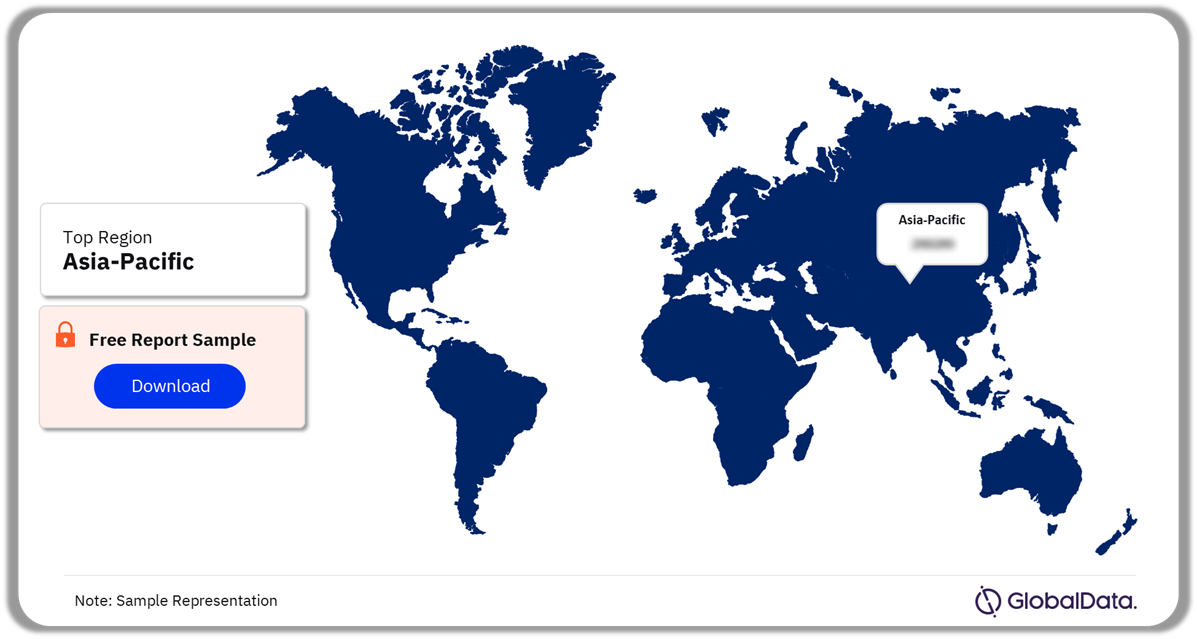

Automotive Roof Systems Market Segmentation by Regions

In 2023, Asia-Pacific accounted for the highest share among all the regions

The key regions in the automotive roof systems market are Asia-Pacific, Europe, North America, South America, and MEA. Convertible cars with hardtop roofs are more advanced and offer greater protection against harsh weather and potential damage compared to those with softtop roofs. In Asia-Pacific, India currently boasts the largest number of hardtop convertible cars.

Automotive Roof Systems Market Analysis by Regions, 2023 (%)

Buy the Full Report for More Regional Insights into the Automotive Roof Systems Market

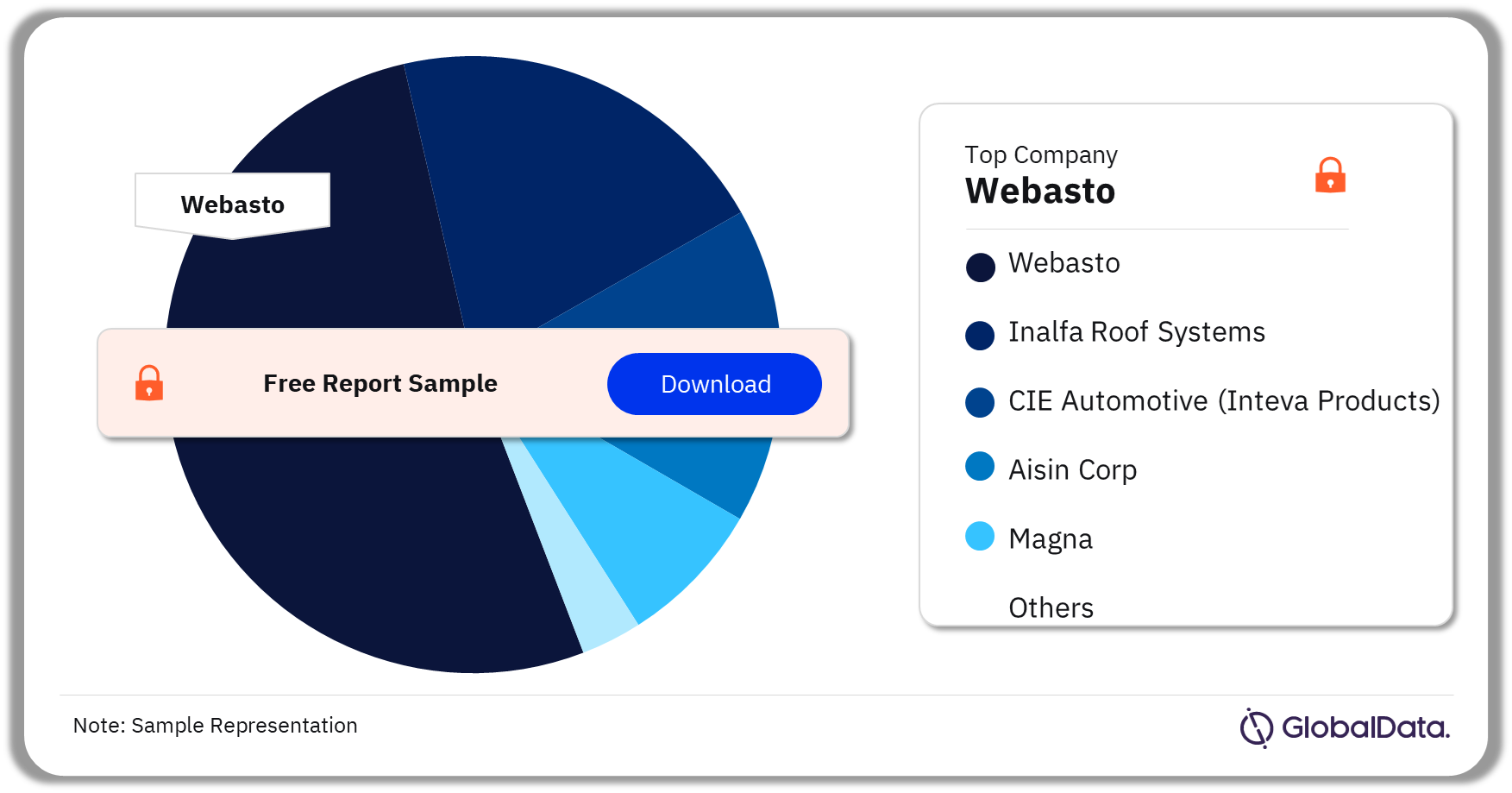

Automotive Roof Systems Market – Competitive Landscape

Webasto accounted for the highest market share in 2022

A few of the top companies operating in the market are:

- Webasto

- Inalfa Roof Systems

- CIE Automotive (Inteva Products)

- Aisin Corp

- Magna

The Webasto vehicle on display at IAA showcases the company’s diverse product line, including its cutting-edge roof for autonomous driving.

Moreover, the company is taking strategic actions to aid the automotive roof system market growth. In May 2023, Webasto launched a second roof production facility in India. The Indian roof system market is experiencing extremely rapid growth and openable panoramic roofs are in particularly high demand. Therefore, they have a highly innovative production facility in Chennai besides their existing plant in Pune.

Automotive Roof Systems Analysis by Companies, 2022 (%)

Buy the Full Report to Know More about Major Developments and Strategic Actions of Automotive Roof Systems Market Companies

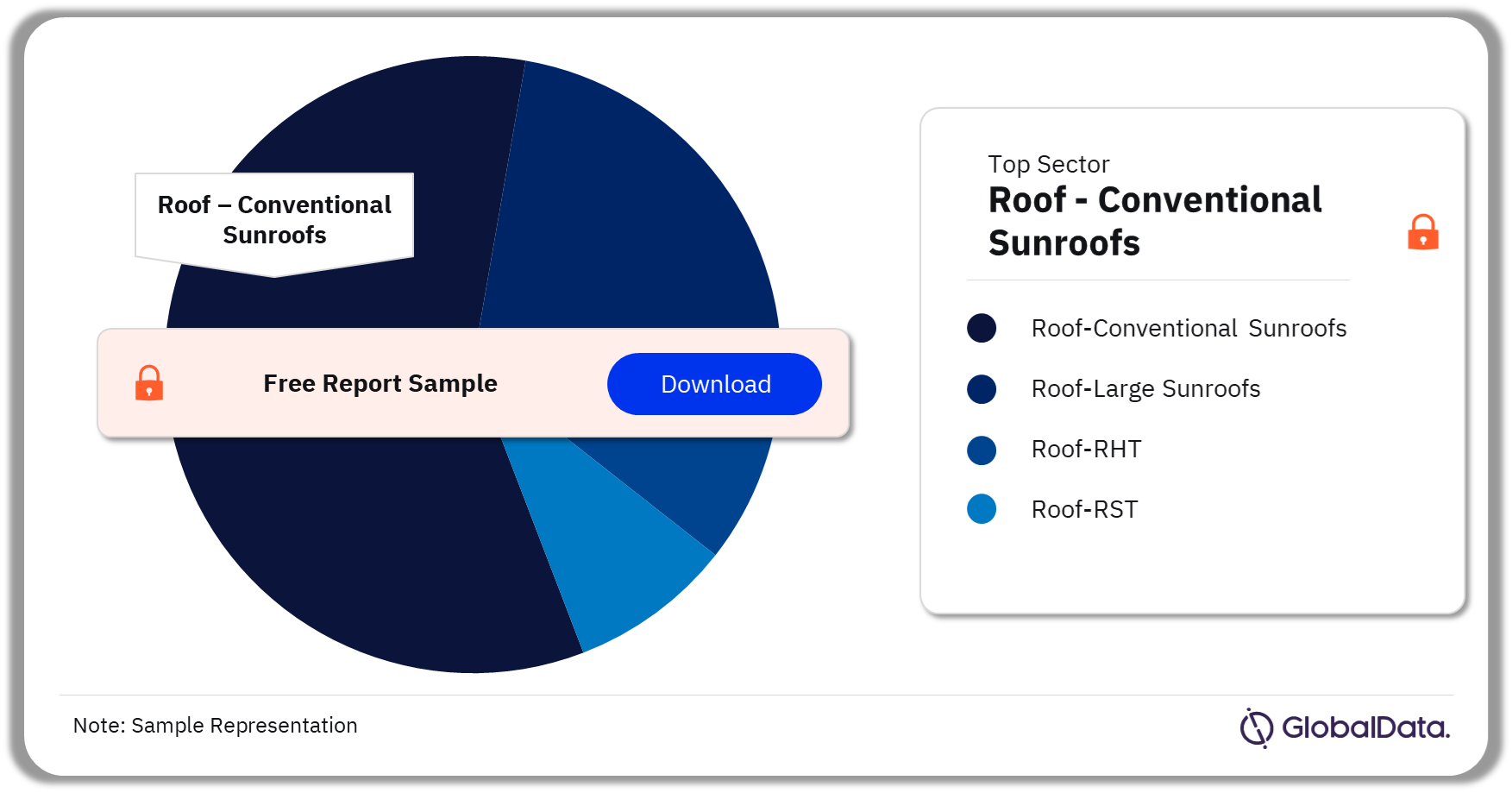

Automotive Roof Systems Market Segmentation by Sectors

The key sectors in the automotive roof systems market are roof-conventional sunroofs, roof-large sunroofs, roof-RHT, and roof-RST. In 2023, roof-conventional sunroofs accounted for the highest share of the automotive roof systems market.

Automotive Roof Systems Market Analysis by Sectors, 2023 (%)

Buy the Full Report for More Sector Insights into the Automotive Roof Systems Market

Automotive Roof Systems Market – Latest Deals

A few of the latest deals in the automotive roof systems market are as follows:

- 2nd August 2023: Webasto introduced a prototype roof sensor module. It combines cameras and lidar sensors and can be integrated into a car’s panoramic sunroof. The module understands traffic signals, traffic lights, and lane markings.

- 9th May 2023: Gabriel and Inalfa Roof Systems collaborated to produce sunroofs locally in Chennai. Gabriel India plans to invest in technical collaboration over the next three years.

Buy the Full Report to Know More about the Latest Deals in the Automotive Roof Systems Market

Segments Covered in this Report

Automotive Roof Systems Sector Outlook (Value, Million Units, 2018-2028)

- Roof-Conventional Sunroofs

- Roof-Large Sunroofs

- Roof–RHT

- Roof–RST

Automotive Roof Systems Regional Outlook (Value, Million Units, 2018-2028)

- Asia-Pacific

- Europe

- North America

- South America

- MEA

Scope

- Trends & Drivers: Provides an overview of the current key trends and drivers that will influence the sector’s growth in the future.

- Technological Developments: Provides a detailed overview of technological developments and innovations in the sector.

- PESTER Analysis: Provides a detailed understanding of political, economic, social, technological, environmental, and regulatory factors impacting the sector.

- Sector Forecast: Provides deep-dive analysis of the global market covering volume growth during 2018-2028, and spot estimates for 2030 and 2036. The analysis also covers a regional overview across four regions highlighting sector size and growth drivers.

- Competitive Landscape: Provides an overview of leading component suppliers at a global and regional level, besides analyzing the recent product innovations and key strategic initiatives taken by the companies.

- Patent Analysis: Provides an overview of patent filings in the sector across regions, countries, and top applicants.

Reasons to Buy

- The report provides OEMs and component suppliers’ latest information on market evolution to help formulate sales and marketing strategies.

- The report provides authentic market data with a high level of detail to help gain a competitive edge.

- The report provides its readers with up-to-date information and analysis to uncover emerging opportunities for growth within the sector.

- The report analyzes regions and competitive landscape that can help companies gain insight into the region-specific nuances.

- The report assesses the key trends that drive customer choice and the future opportunities that can be explored in the region. Actionable insights on trends can help companies in revenue expansion.

- The report helps gain competitive intelligence about leading component suppliers in the region with information about their market share and growth rates.

Table of Contents

Frequently asked questions

-

What was the automotive roof systems market size in 2023?

The automotive roof systems market size was 39 million units in 2023.

-

What will the automotive roof systems market growth rate be during the forecast period?

The automotive roof systems market will grow at a CAGR of more than 2% during 2023-2028.

-

Which was the leading sector of the automotive roof systems market in 2023?

In 2023, roof-conventional sunroofs accounted for the highest share of the automotive roof systems market.

-

Which was the leading region in the automotive roof systems market in 2023?

Asia-Pacific was leading the automotive roof systems market in 2023.

-

Which are the key companies in the automotive roof systems market?

The key companies operating in the automotive roof system market are Webasto, Inalfa Roof Systems, CIE Automotive (Inteva Products), Aisin Corp, and Magna, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.