Automotive Exhaust Systems Market Trends, Sector Overview and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Automotive Exhaust Systems Market Report Overview

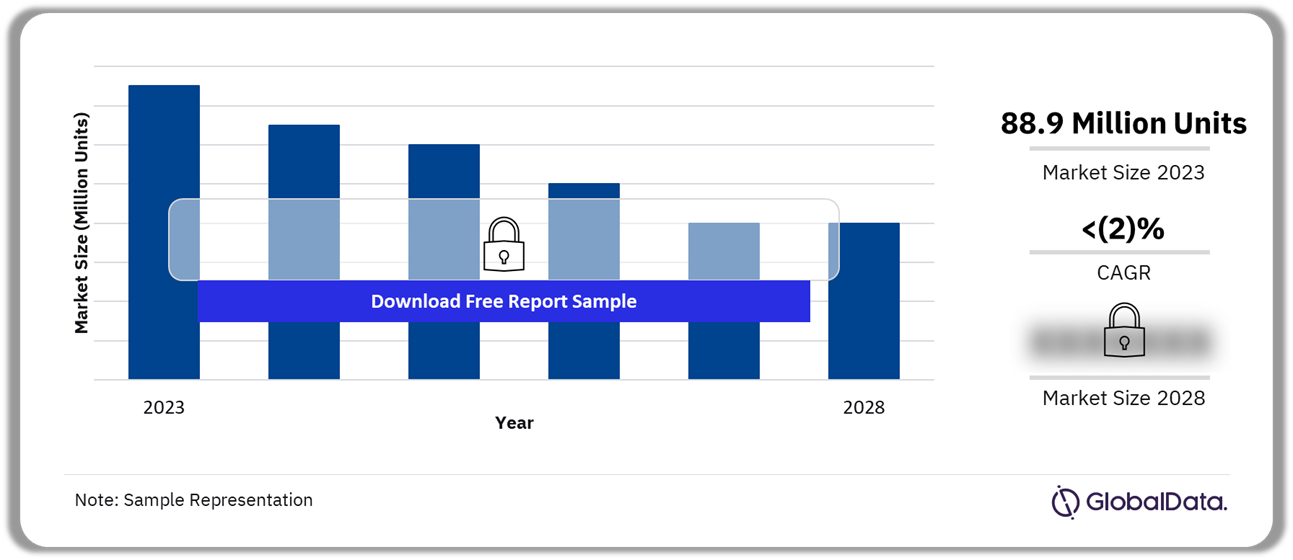

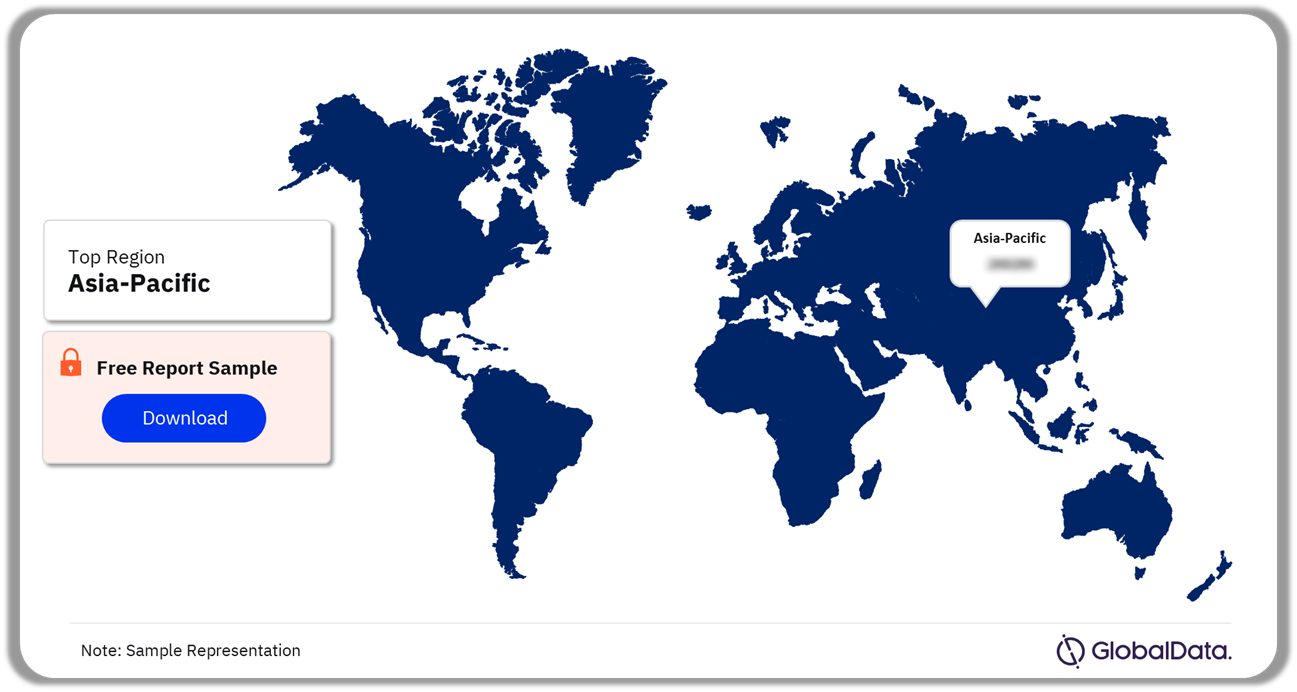

The exhaust systems market size was 88.9 million units in 2023. The market declined over the historical period, primarily owing to the prolonged impact of COVID-19. Although the market is in a recovery phase it will post at a negative CAGR of more than 2% during 2023-2028. Innovations in exhaust system technology, such as exhaust after-treatment systems, automotive catalysts, and exhaust gas recirculation (EGR) systems, will increase demand for automotive exhaust systems, thereby driving market growth in the coming years. In 2023, Asia-Pacific accounted for a significant share of the automotive exhaust systems market.

Automotive Exhaust Systems Market Outlook, 2023-2028 (Million Units)

Buy the Full Report for More Insights on the Automotive Exhaust Systems Market Report Forecast

The automotive exhaust systems market research report provides a comprehensive overview of the market trends and drivers. The automotive exhaust systems market also provides a detailed overview of technological developments and PESTER analysis. Furthermore, evaluate strategic initiatives by market players and their recent product innovations to identify growth opportunities. The report also provides an overview of patent filings across sectors, regions, countries, and top applicants.

| Market Size (2023) | 88.9 million units |

| CAGR (2023-2028) | <(2)% |

| Historical Period | 2018-2022 |

| Forecast Period | 2023-2028 |

| Key Regions | Asia-Pacific, Europe, North America, South America, and MEA |

| Key Companies | Forvia Faurecia, Tenneco, Marelli Corp, Eberspacher Gruppe, and Futaba Industrial |

| Key Sectors | Exhaust-DEF, Exhaust-Diesel, and Exhaust-Petrol |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Automotive Exhaust Systems Market Trends

The main trend shaping the automotive exhaust systems market is the rising demand for zero-emission automobiles.

The government has imposed rigorous regulations to restrict pollutant gas emissions from cars due to the combustion of fuels such as diesel fuel, fuel oil, gasoline, biodiesel, and others. The development of the vehicle exhaust system is accelerating due to the government’s severe rules limiting automobile emissions.

Buy the Full Report for More Trend Insights into the Automotive Exhaust Systems Market

Automotive Exhaust Systems Market Segmentation by Regions

In 2023, Asia-Pacific accounted for the highest automotive exhaust systems market share among all the regions

The key regions in the automotive exhaust systems market are Asia-Pacific, Europe, North America, South America, and MEA. Increasing vehicle production and sales, strict emission regulations, and changing consumer preferences will drive APAC’s exhaust systems market growth. Technological advancements and the presence of key market players also contribute to the region’s market expansion.

Automotive Exhaust Systems Market Analysis by Regions, 2023 (%)

Buy the Full Report for More Regional Insights into the Automotive Exhaust Systems Market

Automotive Exhaust Systems Market – Competitive Landscape

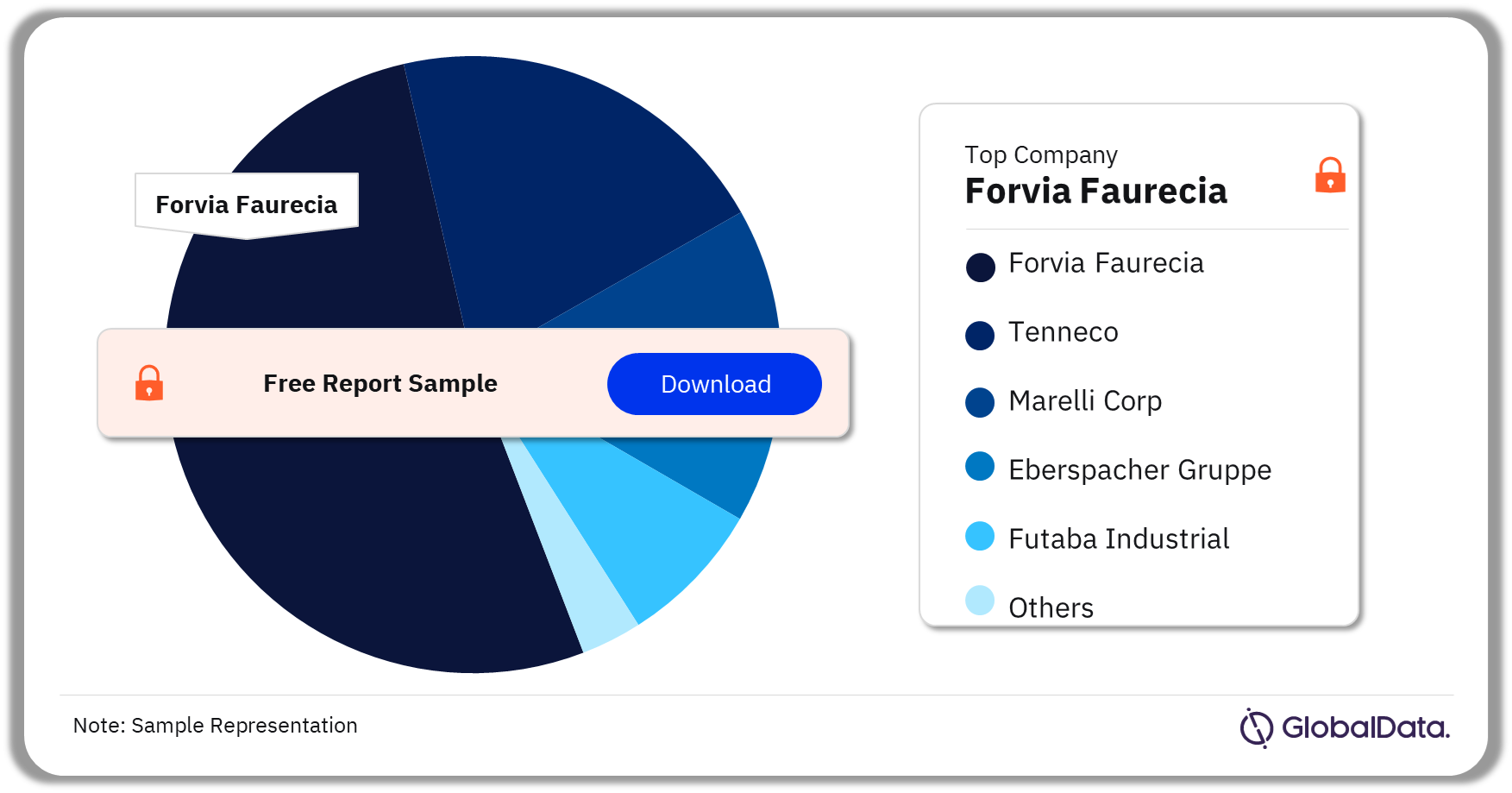

Forvia Faurecia led the emission control systems market in 2022

A few of the top companies operating in the market are:

- Forvia Faurecia

- Tenneco

- Marelli Corp

- Eberspacher Gruppe

- Futaba Industrial

Faurecia created the Electrically Heated Catalyst to enhance air quality and prepare for future emissions regulations. Within the first twenty seconds of an engine running, eighty percent of pollutants are released. To heat exhaust gases and ceramic catalyst cells to their maximum efficiency temperature in the shortest time, the electrically heated catalyst, which is activated in low-temperature phases, uses electric energy.

Forvia Faurecia is also taking strategic actions to aid the automotive exhaust systems market growth. In February 2023, Faurecia began exclusive talks with Cummins regarding the possible sale of a specific portion of its commercial vehicle exhaust after-treatment business in Europe and the US.

Emission Control Systems Market Analysis by Companies, 2022 (%)

Buy the Full Report to Know More about Major Developments and Strategic Actions of Automotive Exhaust Systems Market Companies

Automotive Exhaust Systems Market Segmentation by Sectors

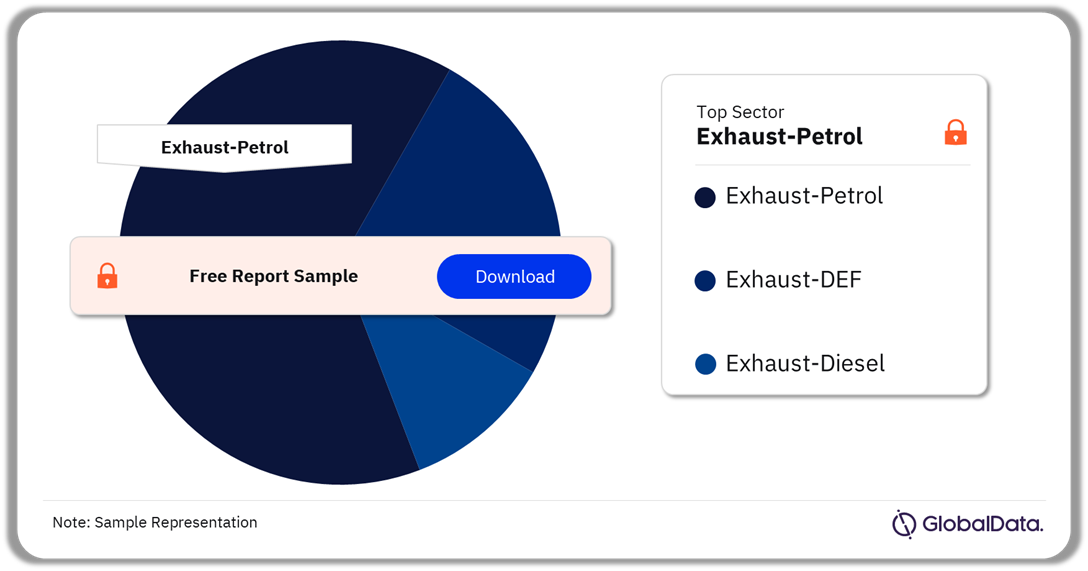

In 2023, exhaust-petrol accounted for the highest share of the automotive exhaust systems market

The key sectors in the automotive exhaust systems market are exhaust-DEF, exhaust-diesel, and exhaust-petrol. Government initiatives, increasing consumer awareness regarding sustainability, and concerns such as range anxiety are driving the popularity of electric vehicles. Hence the growth of the exhaust system market will be negatively impacted in the future. The shift towards electric vehicles is likely to lead to a decline in demand for exhaust systems, which will have implications for businesses operating in the exhaust system market.

Automotive Exhaust Systems Market Analysis by Sectors, 2023 (%)

Buy the Full Report for More Sector Insights into the Automotive Exhaust Systems Market Download a Free Report Sample

Automotive Exhaust Systems Market – Latest Developments

A few of the latest developments in the automotive exhaust systems market are as follows:

- 7th November 2023: Milltek Sport, based in the UK, is a leading manufacturer of performance exhaust systems for a wide range of vehicles. The company became one of the first to introduce an enhanced high-performance exhaust system for BMW’s exciting M2 Coupé, unlocking even more potential from the new baby M car.

- 4th October 2023: Scientists at the Fraunhofer Institute for Solar Energy Systems (ISE) have created the CatVap technology to lower emissions from internal combustion engines. The technology works with diesel fuel as well as fuels based on electricity (e-fuels) and biofuels.

Buy the Full Report to Know More about the Latest Developments in the Automotive Exhaust Systems Market

Segments Covered in this Report

Automotive Exhaust Systems Regional Outlook (Value, Million Units, 2018-2028)

- Asia-Pacific

- Europe

- North America

- South America

- MEA

Automotive Exhaust Systems Sector Outlook (Value, Million Units, 2018-2028)

- Exhaust-DEF

- Exhaust-Diesel

- Exhaust-Petrol

Scope

- Trends & Drivers: Provides an overview of the current key trends and drivers that will influence the sector’s growth in the future.

- Technological Developments: Provides a detailed overview of technological developments and innovations in the sector.

- PESTER Analysis: Provides a detailed understanding of political, economic, social, technological, environmental, and regulatory factors impacting the sector.

- Sector Forecast: Provides deep-dive analysis of the global market covering volume growth during 2018-2028, and spot estimates for 2030 and 2036. The analysis also covers a regional overview across four regions highlighting sector size and growth drivers for the region.

- Competitive Landscape: Provides an overview of leading component suppliers at a global and regional level, besides analyzing the companies’ recent product innovations and key strategic initiatives. taken by the companies.

- Patent Analysis: Provides an overview of patent filings in the sector across regions, countries, and top applicants.

Reasons to Buy

- The report provides OEMs and component suppliers’ latest information on market evolution to help formulate sales and marketing strategies.

- The report provides authentic market data with a high level of detail to help gain a competitive edge.

- The report provides its readers with up-to-date information and analysis to uncover emerging opportunities for growth within the sector.

- The report analyzes regions and competitive landscape that can help companies gain insight into the region-specific nuances.

- The report assesses the key trends that drive customer choice and the future opportunities that can be explored in the region. Actionable insights on trends can help companies in revenue expansion.

- The report helps gain competitive intelligence about leading component suppliers in the region with information about their market share and growth rates.

Tenneco

Marelli

Futaba Industrial

Bosal

Eberspächer.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the automotive exhaust systems market size in 2023?

The automotive exhaust systems market size was 88.9 million units in 2023.

-

What will the exhaust systems market growth rate be during the forecast period?

The exhaust systems market will decline at a negative CAGR of more than 2% during 2023-2028.

-

Which was the leading region in the automotive exhaust systems market in 2023?

Asia-Pacific was the leading revenue contributor for the automotive exhaust systems market in 2023.

-

Which was the leading sector of the automotive exhaust systems market in 2023?

In 2023, exhaust-petrol accounted for the highest share of the automotive exhaust systems market.

-

Which are the key companies in the automotive exhaust systems market?

The top companies operating in the automotive exhaust systems market are Forvia Faurecia, Tenneco, Marelli Corp, Eberspacher Gruppe, and Futaba Industrial, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.