Argentina Life Insurance Market Size and Trends by Line of Business, Distribution, Competitive Landscape and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Argentina Life Insurance Market Report Overview

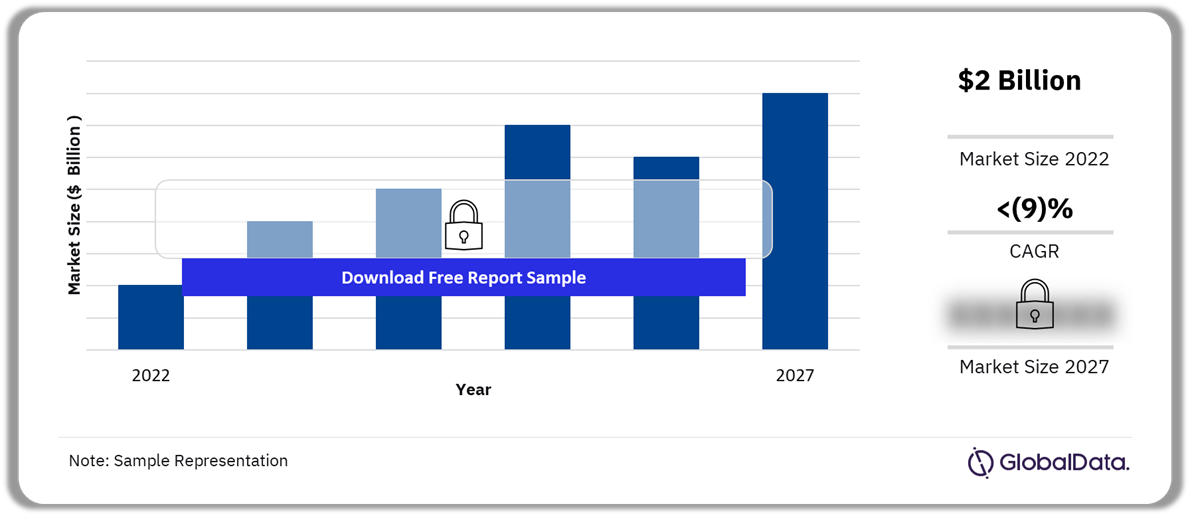

The gross written premium of the Argentina life insurance market was $2 billion in 2022 and it is expected to register a negative CAGR of more than 9% during 2023-2027. The Argentine economy is expected to contract in 2023, with fear of a move towards recession. This will impact consumer spending and thus life insurance sector growth.

The Argentina life insurance market research report provides in-depth market analysis, information, insights, and a detailed outlook by product category for Argentina’s life insurance segment. It also provides values for key performance indicators such as gross written premium, penetration, and premium ceded and cession rates during the review period and forecast period.

Argentina Life Insurance Market Outlook, 2022-2027 ($ Billion)

Buy Full Report to Gain More Information about the Argentina Life Insurance Market Forecast

The report analyzes distribution channels operating in the segment, gives a comprehensive overview of Argentina’s economy and demographics, and provides detailed information on the competitive landscape in the country. It also gives insurers access to information on segment dynamics competitive advantages, and profiles of insurers operating in the country. Moreover, it includes details of insurance regulations and recent changes in the regulatory structure.

| Market Size (2022) | $2 billion |

| CAGR (2023-2027) | <(9)% |

| Forecast Period | 2023-2027 |

| Historical Period | 2018-2022 |

| Key Trends | · Focus on ESG

· Rising Inflation · Increasing Digital Initiatives |

| Key Lines of Business | · Life PA&H

· Pension · Term life · Other Life Insurance |

| Key Distribution Channels | · Direct Marketing

· Insurance Broker · Financial Advisor · Bank · Online Aggregator |

| Leading Companies | · Sancor Cooperativa

· Nacion Seguros · Prudential Seguros · La Estrella De Seguros de Retiro · Zurich International |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Argentina Life Insurance Market Trends

Focus on ESG, rising inflation, demographic shift, and ongoing digital initiatives are some of the key trends impacting the Argentina life insurance market. For instance, inflation is a trending topic in Argentina for insurers as consumer spending has decreased due to increased prices. Persistent high inflation rates in Argentina might lead to a fall in investor confidence in the economy and reduce future investments. The coronavirus (COVID-19) pandemic and spillovers from the Russia-Ukraine war further supported it, leading to high energy and food prices. To tame high inflationary pressure, the Central Bank of Argentina increased the interest rate from 69.5% in August 2022 to 75% in September 2022. In 2022, the interest rate increased seven times. High-interest rates will discourage investment in the economy.

Furthermore, Argentina’s rising old-age population is expected to affect the economy by pressurizing the working-age population over the next few decades. Furthermore, the sustainability of the public pension system, life insurance products that offer retirement planning, and income annuities have gained traction. Traditional life insurance plans are preferred by customers owing to their pessimistic outlook.

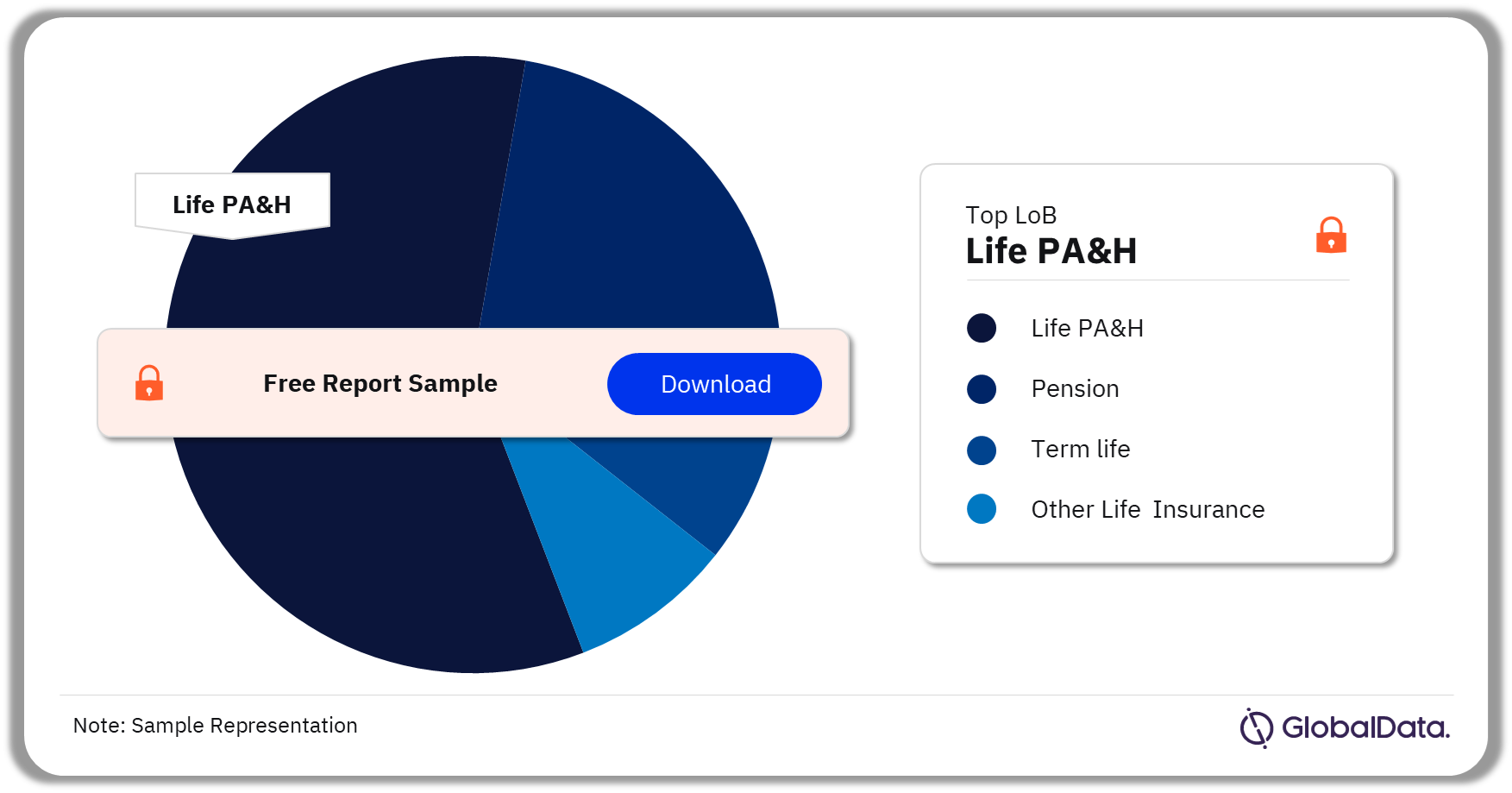

Argentina Life Insurance Market Segmentation by Lines of Business

The key lines of business in the Argentina life insurance industry are life PA&H, pension, term life, and other life insurance. Life PA&H was the leading life insurance line of business in 2022. However, term life is expected to emerge as the fastest-growing life insurance line, among all lines of business. This is supported by rising awareness of protection insurance due to the COVID-19 pandemic.

Argentina Life Insurance Market Analysis by Lines of Business, 2022 (%)

Buy the Full Report for more Lines of Business Insights into the Argentina Life Insurance Market

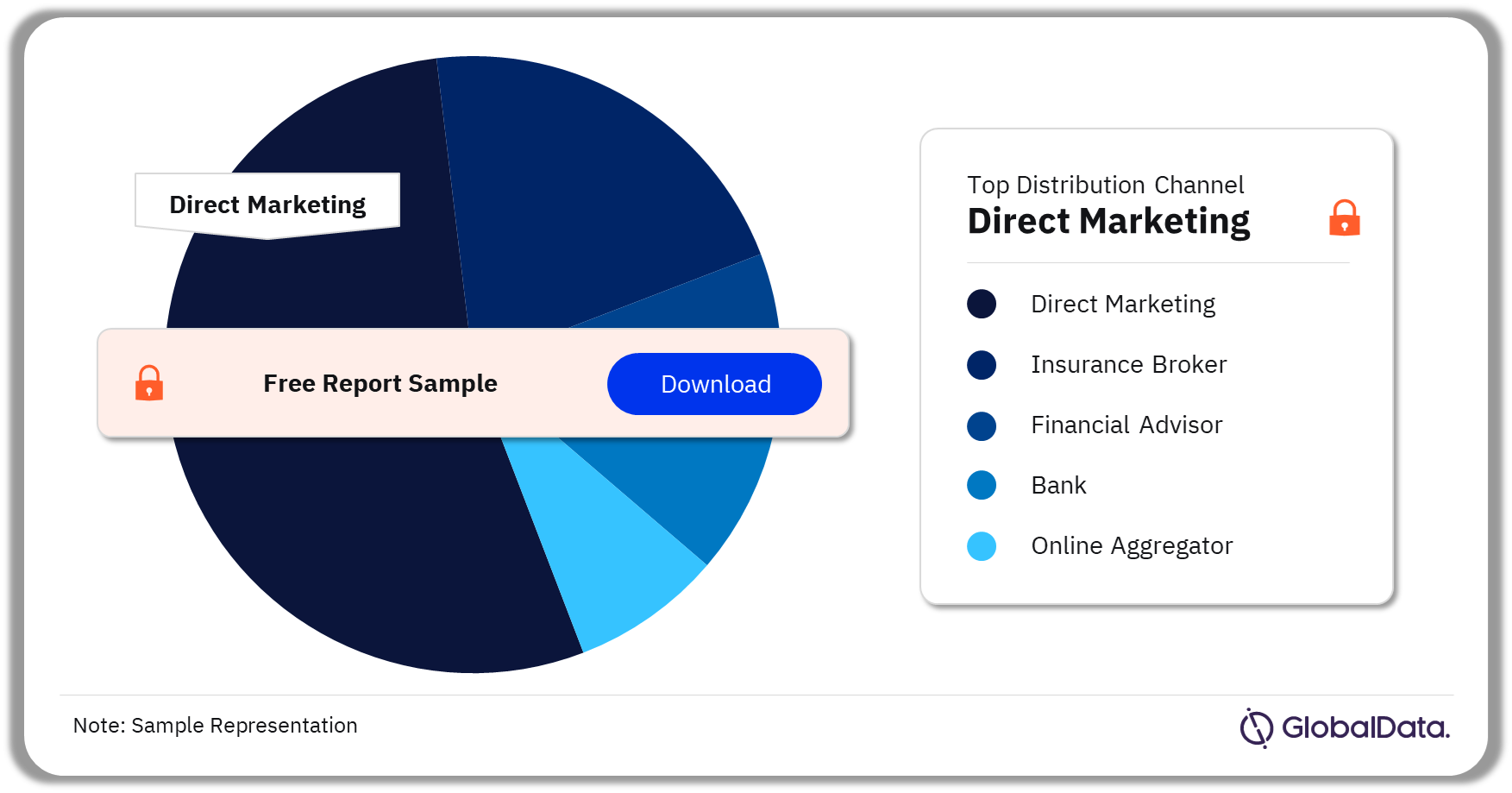

Argentina Life Insurance Market Segmentation by Distribution Channels

The key distribution channels in the Argentina life insurance industry are direct marketing, insurance broker, financial advisor, bank, and online aggregator, among others. Direct marketing held the largest share in life insurance distribution in 2022. It was followed by insurance brokers as customers preferred face-to-face interactions with insurance brokers, highlighting the low prevalence of digital usage and the dependability on advisory services in buying life insurance.

Argentina Life Insurance Market Analysis by Distribution Channels, 2022 (%)

Buy the Full Report for more Distribution Channel Insights into the Argentina Life Insurance Market

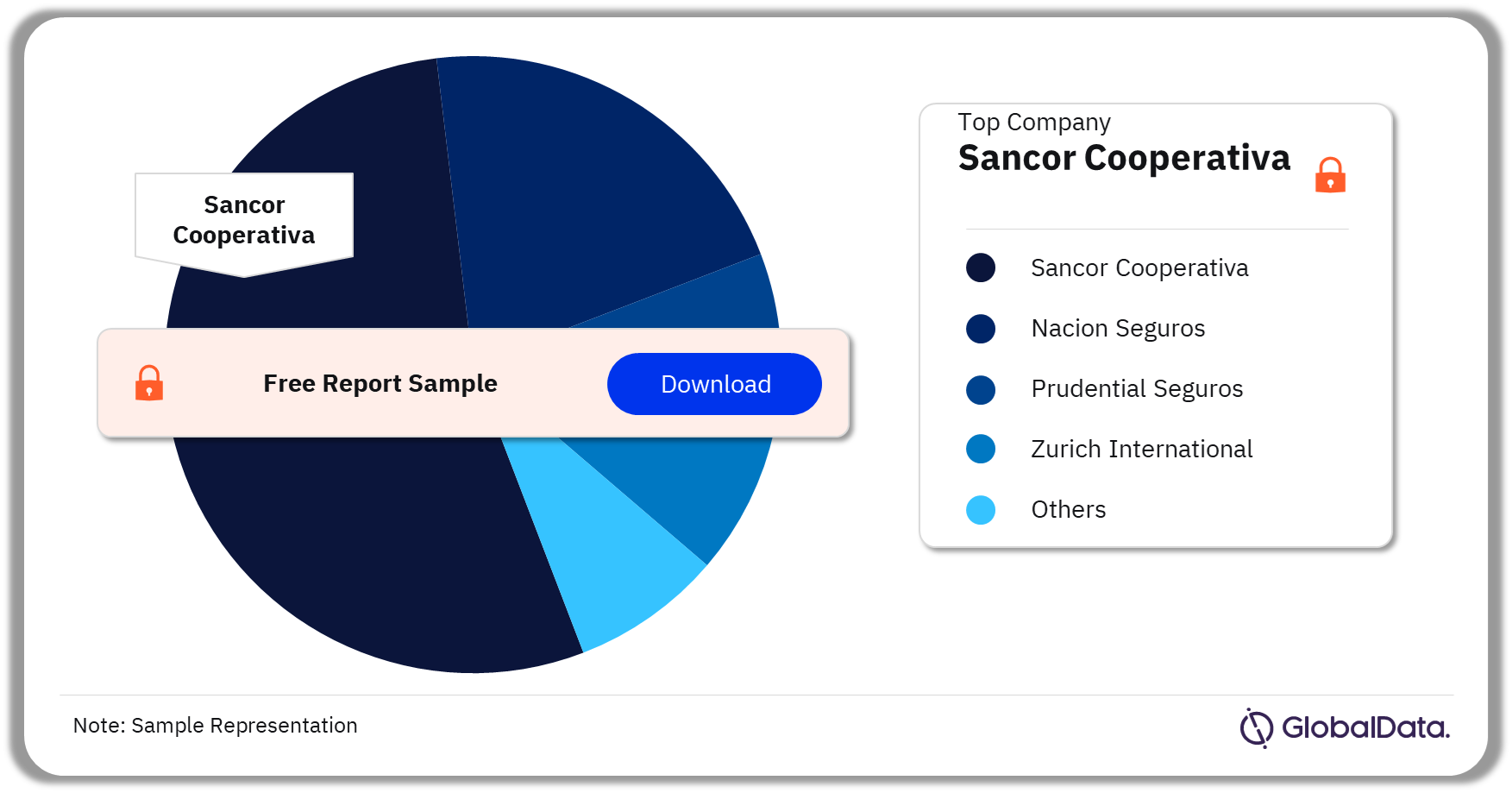

Argentina Life Insurance Market - Competitive Landscape

Some of the leading life insurance companies in Argentina are Sancor Cooperativa, Nacion Seguros, Prudential Seguros, La Estrella De Seguros de Retiro, and Zurich International among others. The Sancor Cooperativa was the largest life insurer in 2022. The company leads due to its improved distribution channel and use of technology providing ease to customers with the use of a mobile app.

Argentina Life Insurance Market Analysis by Companies, 2022 (%)

Buy the Full Report to Know More about the Life Insurance Companies in Argentina Life Insurance Market

Segments Covered in the Report

Argentina Life Insurance Lines of Business Outlook (Value, $ Billion, 2018-2027)

- Life PA&H

- Pension

- Term life

- Other Life Insurance

Argentina Life Insurance Distribution Channel Outlook (Value, $ Billion, 2018-2027)

- Direct marketing

- Insurance Broker

- Financial Advisor

- Bank

- Online Aggregator

Scope

This report provides:

- A comprehensive analysis of the life insurance segment in Argentina

- Historical values for the Argentina life insurance segment for the report’s review period and projected figures for the forecast period

- Profiles of the top life insurance companies in Argentina and outlines the key regulations affecting them.

Key Highlights

- Key insights and dynamics of Argentina’s life insurance segment.

- A comprehensive overview of Argentina’s economy, government initiatives and investment opportunities.

- Argentina’s insurance regulatory framework’s evolution, key facts, taxation regime, licensing and capital requirements.

- Argentina’s life insurance segment’s market structure giving details of lines of business.

- Argentina’s life reinsurance business’ market structure giving details of premium ceded along with cession rates.

- Distribution channels deployed by Argentina’s life insurers.

- Details of the competitive landscape and competitors’ profiles.

Reasons to Buy

- Make strategic business decisions using in-depth historical and forecast market data related to the Argentina life insurance segment.

- Understand the demand-side dynamics, key market trends, and growth opportunities in the Argentina life insurance segment.

- Assess the competitive dynamics in the life insurance segment.

- Identify growth opportunities and market dynamics in key product categories.

Nacion Seguros

Prudential Seguros

La Estrella De Seguros de Retiro

Zurich International

Caja De Seguros

MetLife Seguros

Provincia Seguros

Table of Contents

Frequently asked questions

-

What was the Argentina life insurance market gross written premium in 2022?

The gross written premium of the Argentina life insurance market is $2 billion in 2022.

-

What is the growth rate of the Argentina life insurance market?

The life insurance market in Argentina is expected to register a negative CAGR of more than 9% during 2023-2027.

-

Which line of business held the largest share of the Argentina life insurance market?

The life PA&H was the leading life insurance line of business in 2022.

-

Which distribution channel held the highest share in the Argentina life insurance market?

Direct marketing was the leading channel in 2022 in the Argentina life insurance market.

-

Who are the key companies operating in the Argentina life insurance market?

Some of the leading life insurance companies in Argentina are Sancor Cooperativa, Nacion Seguros, Prudential Seguros, La Estrella De Seguros de Retiro, and Zurich International among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Life Insurance reports